As the US dollar stablecoin gradually attracts market attention, companies inside and outside the currency circle have begun to regard US stocks as the next target.

At the end of May, the US cryptocurrency exchange Kraken announced that it would provide tokenized popular US stocks to non-US customers; on June 18, Paul Grewal, chief legal officer of Coinbase, revealed that the company is seeking SEC approval to launch its "tokenized stock" service.

The tokenization of US stocks has gradually become an explicit business.

Now, this business may have ushered in a new player --- Robinhood, a well-known US Internet brokerage, "retail boxers", and a key force in the movement to bring down Wall Street.

Previously, two people familiar with Robinhood told Bloomberg that they were developing a blockchain-based platform that would allow European retail investors to trade US stocks.

According to people familiar with the matter, the technology selection for this platform may be Arbitrum or Solana, and the specific partners are still being selected, and the agreement has not yet been finalized.

This news can be read at least two layers of meaning.

First, Robinhood directly integrates Arbitrum L2 in this new platform that allows European users to trade US stocks as the base layer of its blockchain transactions;

Second, the more likely scenario is that Robinhood plans to use Arbitrum's Arbitrum Chains function to develop a dedicated L2 chain of its own based on Arbitrum's technology stack (Rollup protocol, EVM compatibility, etc.).

Whichever the final situation is, market sentiment has been driven.

This means that Robinhood may do its own L2 for the tokenization of US stocks, which is more conducive to the on-chain settlement and specialization of the business.

At the upcoming EthCC in Cannes, France on the 30th, Robinhood will also announce an important announcement at 17:00 local time (23:00 Beijing time), which also makes the outside world speculate that it is related to its own L2 and US stock tokenization business.

At the same time, A.J. Warner, chief strategy officer of Offchain Labs, the company behind Arbitrum, will also attend the meeting, which also gives everyone more room for imagination of official announcements at the same time.

ARB, whose price has been slightly dull recently, once exceeded 20% in 24 hours, ranking at the top of the cryptocurrency increase list.

More suggestive is that the X account of Roobinhood Europe replied "Stay tuned" under the netizen's meeting agenda discussion post. Combined with the news reported by Bloomberg that US stock trading will be provided to Europe, the possibility of an official announcement of this function has become higher.

Everything has a trace

Robinhood's idea of tokenizing US stocks is not a sudden whim.

In January this year, the company's CEO Vlad Tenev criticized the current US regulations, believing that the United States has not yet provided a clear framework and rules for the registration of security tokens, hindering the promotion of tokenized products.

In a podcast in March, Tenev said directly: "It is very difficult to invest in an American company if you are overseas now."

This also hits the pain points of most investors who pay attention to the trends of US stocks but are not in the United States. They urgently need a smoother way to trade US stocks.

At the same time, Tenev also said at the time that he was considering tokenizing securities, and pointed out that this would be part of a broader push to integrate digital assets into the financial system.

Now, there are signs of paving the way.

Currently, Robinhood's customers in the EU can only trade cryptocurrencies, and the company obtained a brokerage license in Lithuania last month, allowing it to provide investment services such as stock trading in the EU.

In addition, Robinhood also signed an agreement to acquire the cryptocurrency exchange Bitstamp in June last year. After the transaction is completed, Robinhood will be able to use Bitstamp's MiFID Multilateral Trading Facility (MiFID) license to provide crypto-related derivatives.

With the license obtained and the regulations in compliance, it is time to consider which chain to choose at the implementation level.

Why might it be Arbitrum?

From a technical perspective, Arbitrum is a fully EVM-compatible L2 solution, which means that Robinhood can seamlessly migrate its existing Ethereum smart contracts and development tools without significantly changing its technology stack.

EVM compatibility can be said to be the key to the rapid chaining of large financial technology companies such as Robinhood. If Ethereum's extensive developer community and existing infrastructure can be utilized, who would put it aside?

Looking further, Arbitrum's Optimistic Rollup technology also strikes a balance between transaction confirmation time and cost; in contrast, ZK Rollup has higher cost overhead and relatively slower transaction confirmation time; Robinhood, as a platform that needs to handle large-scale user transactions, is more likely to give priority to Arbitrum's mature technology and lower development threshold.

On the other hand, from a business perspective, this choice is also avoiding Coinbase.

Base is L2 launched by Coinbase. It is also an OP technology stack, but obviously because Roobinhood competes with Coinbase in its main business, it is unlikely to run the US stock tokenization business directly on Base.

Arbitrum provides the option of custom L2 chains (Arbitrum Chains), which allows Robinhood to distinguish itself from Base.

One piece of information you may have overlooked is that Robinhood and Arbitrum actually have experience in cooperation.

As early as ETHDenver in 2024, Robinhood officially announced its cooperation with Arbitrum to simplify the process for users to access Arbitrum through Robinhood Wallet.

This shows that the two parties already have a foundation for technical integration and strategic alliance. Robinhood may choose to continue this cooperation and use Arbitrum's existing technical support and brand effect to further expand its business.

Imitating Base, different from Base

Although the news that Robinhood used Arbitrum to build its own L2 has not been officially confirmed, it has already caused widespread discussion in the crypto community.

The most pointed voice is that this gameplay is a simple imitation of Base.

Base was launched by Coinbase, with an open strategy, inviting external developers to build DApps, thereby expanding the ecosystem and attracting users and assets. Base's success is partly due to this open ecosystem (for example, projects such as Aerodrome and Uniswap migrated or built on it).

If Robinhood also builds an L2 based on Arbitrum, open to external developers to expand the ecosystem, and run more use cases of real assets on the chain, this will be highly similar to Base's business strategy despite the different technology stacks.

In terms of perception, the key to easily creating this "imitation" impression is lag.

Don't forget that Coinbase launched Base as early as the end of 2023, while Robinhood only announced its Arbitrum L2 plan now. This time difference makes Robinhood's actions look like a "follow-the-trend" reaction to Base's success, rather than an original strategy.

In the traditional business field, financial technology companies usually tend to copy proven models, which is indeed a safer strategy; but imitating Base means that Robinhood will compete directly with Coinbase, and Coinbase has established a first-mover advantage through Base. If Robinhood wants to overtake, it needs to invest more resources and effort.

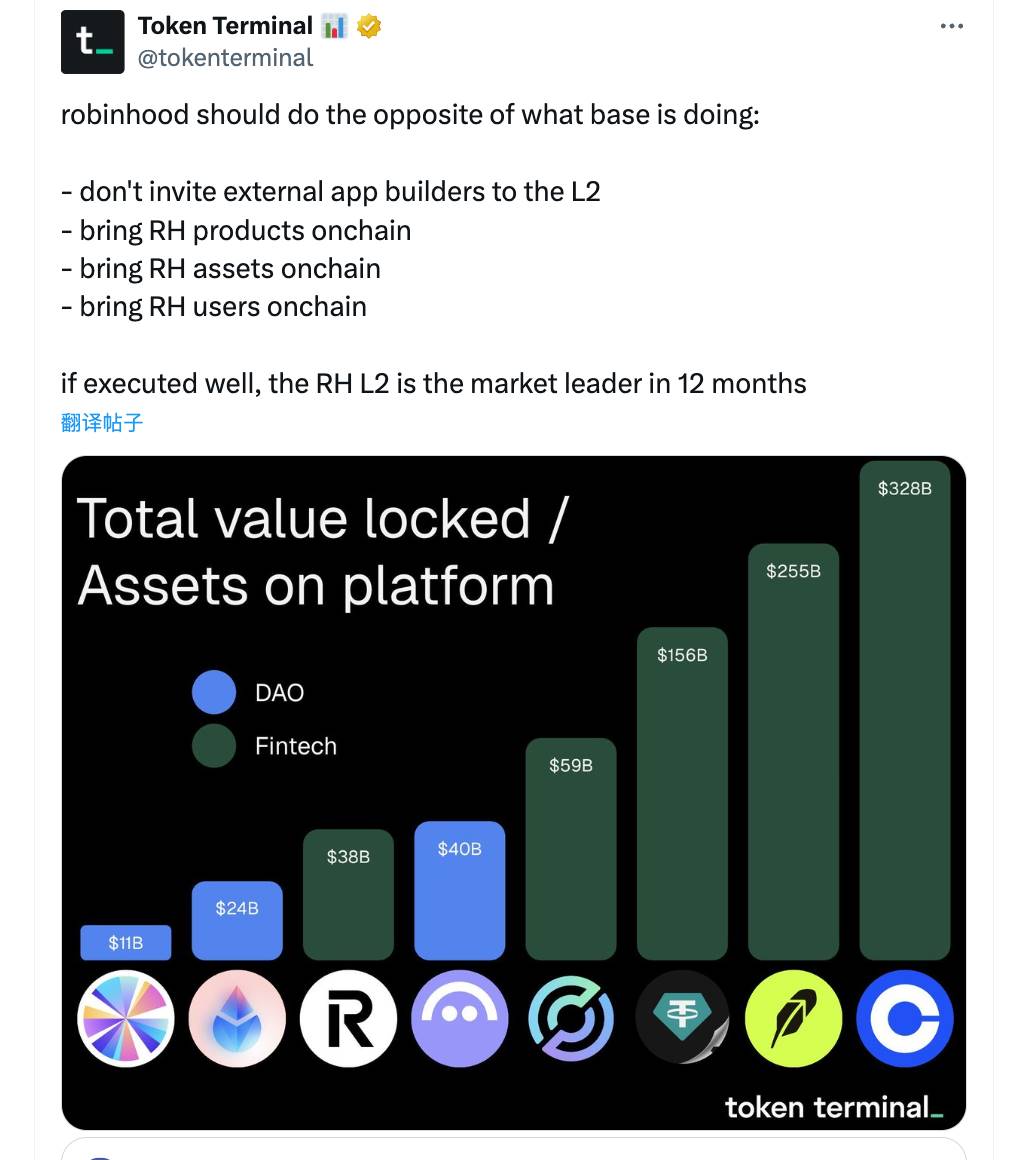

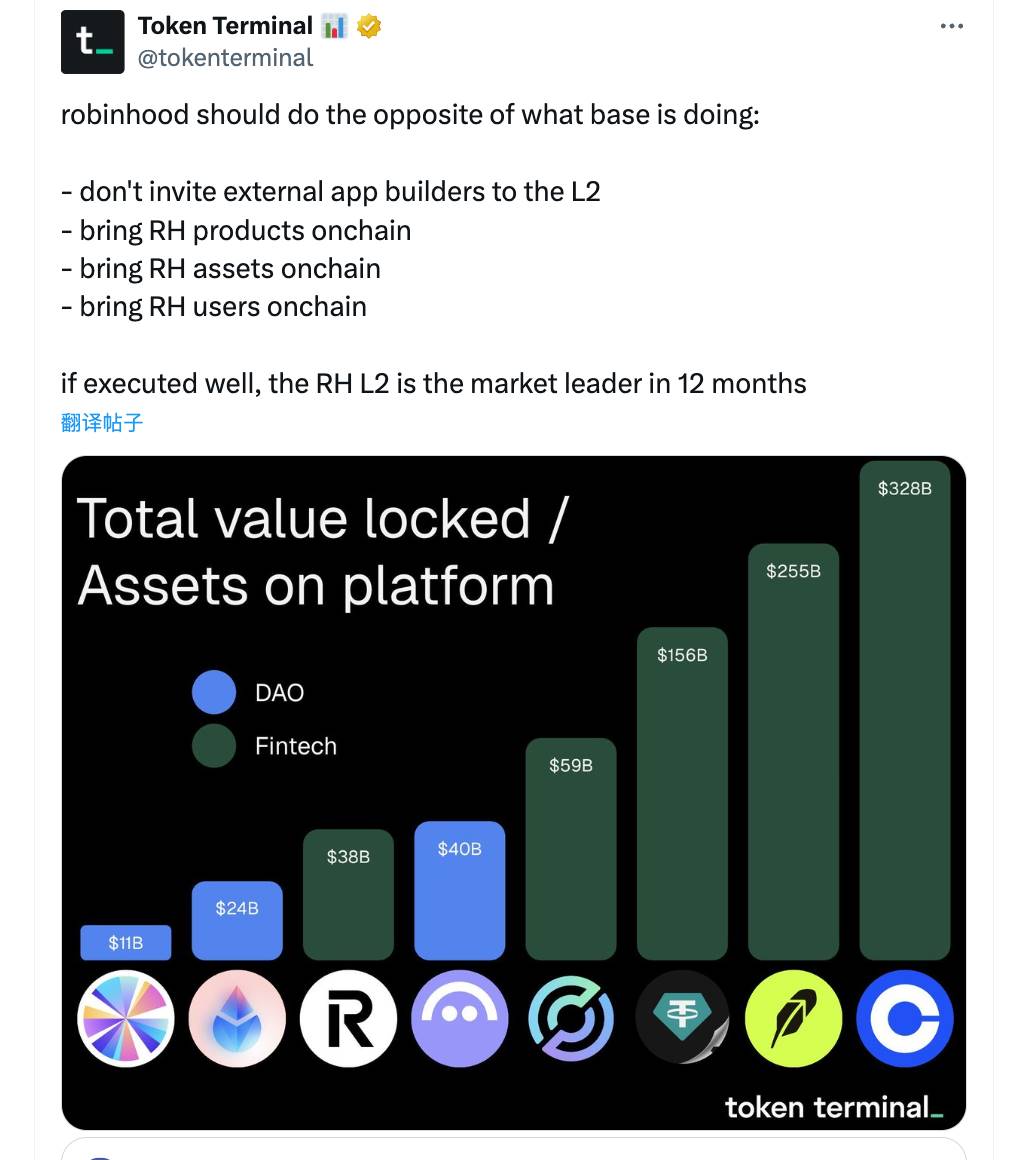

The well-known data platform Token Terminal also pointed out a "bright way" for Roobinhood. The core is to magnify its advantages as an Internet brokerage and take a "closed ecosystem" route that is opposite to Base:

Do not invite external application developers to join its L2, migrate all of Robinhood's existing financial products (such as trading or investment tools), assets and users to the chain, and let users operate directly on the chain instead of relying on traditional centralized systems.

This idea is more Crypto Native, which is to combine Robinhood's existing customer base with pure on-chain gameplay, but a more radical approach also means greater resistance, and Robinhood may not follow this path.

And if you jump out of Robinhood and observe the entire Ethereum ecosystem, some people believe that this will make the split of Ethereum L2 more serious.

Ethereum L1 has lost a lot of initiative in the current ecological status of L2. Whether the performance is good or not is secondary. What is more important is the complete marginalization and pipelineization. It is easy to build a dedicated L2, but it is difficult to revive Ethereum.

What Robinhood will choose in the end, we may get the answer after today's ETHcc.

Catherine

Catherine