Shiboo CSPR Practical Asset Launch How to create this asset in minutes?

The DeFi ecosystem of Casper Network (CSPR) is moving in a sustainable direction, and the launch of the Shiboo token further adds to its appeal.

JinseFinance

JinseFinance

This article explores the trend and development prospects of tokenizing real-world assets (such as real estate, bonds, stocks, etc.) through blockchain technology and integrating them into the decentralized finance (DeFi) ecosystem. The article introduces the historical evolution of RWA, the main tracks and the regulatory challenges it faces, and points out the application potential of this field in the securities, real estate, lending and stablecoin markets as well as the possible investment risks.

1. Tracing the origin of RWA

RWA - Real World Assets

RWA, full name Real World Assets, literally translated as "real world assets", refers to the representation and trading of real-world assets in a digital and tokenized way in the blockchain or Web3 ecosystem. These assets include but are not limited to real estate, commodities, bonds, stocks, artworks, precious metals, intellectual property, etc. The core concept of RWA is to bring traditional financial assets into the decentralized finance (DeFi) ecosystem through blockchain technology, so as to achieve more efficient, transparent and secure asset management and transactions.

The significance of RWA is that it makes assets that are relatively difficult to flow in the real world liquid through blockchain technology, and on this basis can participate in the DeFi ecosystem to carry out operations such as lending, staking, and trading. This way of connecting real assets with the blockchain world is becoming an important development direction in the Web3 ecosystem.

RWA-Special Asset Status

RWA is a digital asset that can generate utility in the blockchain by tokenizing real-world assets. Its essence is a bridge between crypto-native assets and traditional assets. Crypto native assets are generally implemented through smart contracts, and all business logic and asset operations are completed on the chain; following the principle of "Code is Law"; while traditional assets such as bonds, stocks, and real estate operate under the legal framework of the real society and are protected by government laws. The series of tokenization rules proposed by RWA require both the on-chain technical support of smart contracts and the protection of underlying assets such as stocks and real estate by real social laws.

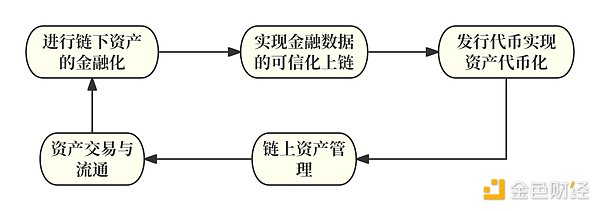

In fact, under the framework of RWA, tokenization does not just refer to the simple process of issuing a token on the blockchain. It includes a whole set of complex processes that involve asset relationships in the real world off-chain. The tokenization process usually includes: the purchase and custody of the underlying assets, the establishment of a legal association framework between the tokens and these assets, and the final issuance of tokens. Through this tokenization process, the laws and regulations off the chain and the relevant product operation procedures are combined, so that token holders have legal claims on the underlying assets.

Figure 1

Figure 2

RWA——Historical Origin

The development history of RWA can be divided into three stages: early exploration, initial development and rapid expansion.

Early Exploration Stage (2017-2019)

2017: RWA Exploration Begins

As the concept of decentralized finance (DeFi) matures, the concept of RWA (Real World Assets) begins to sprout. Some pioneering projects such as Polymath and Harbor began to explore the feasibility of tokenizing securities. Polymath focuses on creating a security token issuance platform and is committed to solving legal compliance issues, while Harbor is committed to providing a compliance framework that enables securities assets to flow on the blockchain.

2018: The Beginning of Commodity Tokenization

In the field of real estate and commodity tokenization, some pilot projects began to emerge. For example, the RealT project attempted to tokenize real estate in the United States, enabling global investors to obtain partial ownership and rental income of US real estate by purchasing tokens.

2019: TAC Alliance Established

The TAC Alliance was established to promote RWA standardization and cross-platform interoperability, and to promote cooperation and development between different projects. In addition, platforms such as Securitize and OpenFinance were also launched during this period, focusing on providing enterprises with compliance solutions for tokenized assets.

Initial Development Stage (2020-2022)

2020: Multiple Projects Introduced RWA

The Centrifuge project has received significant attention. The project enables small and medium-sized enterprises to obtain financing on the blockchain by tokenizing real-world accounts receivable and invoices. In addition, well-known DeFi projects such as Aave and Compound have also begun to try to introduce RWA as collateral to expand the scope of their lending business.

2021: Maker DAO joins the RWA market

Centrifuge introduced RWA as collateral to MakerDAO's lending platform, allowing users to obtain stablecoin DAI by holding RWA.

2022: Traditional funds deploy RWA

Large financial institutions such as JPMorgan Chase and Goldman Sachs began to conduct RWA-related research and pilot projects to explore how to digitize traditional assets through blockchain; the RWA Alliance (Real World Asset Alliance) was established to promote the standardized development and global promotion of RWA.

Rapid expansion stage (2023-present)

2023: Government intervention in RWA legal construction

Large asset management companies such as BlackRock and Fidelity began to try to manage part of their asset portfolios through tokenization to improve liquidity and transparency; the U.S. Securities and Exchange Commission (SEC) and the European Securities Markets Authority (ESMA) also began to gradually intervene and try to formulate a regulatory framework related to RWA.

Figure 3

2. RWA track direction

Given the diversity of traditional asset forms, the RWA track has also shined in different fields. From tangible assets such as real estate, commodities and precious metals, artworks and luxury goods, to intangible assets such as bonds and securities, intellectual property, carbon credits, insurance, non-performing assets, legal tender, etc., RWA (real world assets) has demonstrated its application potential in various fields.

Figure 4

Real Estate Industry

In traditional finance, real estate is generally regarded as a relatively stable asset in long-term investment. In a normal market environment, real estate has strong capital appreciation potential. However, the low liquidity and high leverage characteristics of real estate have raised the transaction threshold of real estate and increased the investment risks of individual investors in the real estate sector. In real estate-related RWA projects, the tokenization of real estate will greatly improve asset liquidity and reduce the risks borne by individuals.

Tangible: Focuses on the tokenization of physical assets (such as real estate and precious metals), making these traditionally difficult-to-trade assets liquid on the blockchain.

Landshare: Through tokenization, Landshare enables small investors to participate in the real estate market, especially through its blockchain-based real estate fund model.

PropChain: Provides a blockchain-based global real estate investment platform that enables investors to gain exposure to the global real estate market through tokens without actually purchasing properties.

RealT, RealtyX: Allow investors to own part of U.S. real estate and earn rental income by purchasing tokens.

Fiat to Stablecoin

In the field of stablecoins, there are USDT (Tether), FDUSD, USDC and USDE. These stablecoins provide a low-volatility asset in the crypto market by pegging the value of fiat currencies, and the most famous of them is USDT (Tether). Tether is the stablecoin with the largest market share at present, and its value is pegged to the US dollar at a ratio of 1:1. This means that the value of each USDT corresponds to one US dollar.

In the traditional financial market, fiat currency itself is a real world asset (RWA), which maintains its value through reserves and regulatory mechanisms. When fiat currency enters the blockchain in the form of stablecoins, it is repackaged as a programmable digital asset that can directly participate in various operations in the decentralized finance (DeFi) ecosystem, such as lending, payments, cross-border transfers, etc. Tether directly links the value of USDT to real-world assets denominated in US dollars, which greatly improves the stability of USDT and provides a relatively safe and stable environment for the introduction and use of RWA

USDT operating mechanism

Tether supports the value of USDT by holding a basket of reserve assets. These reserve assets include cash, cash equivalents, short-term government bonds, commercial paper, secured loans, and a small amount of precious metals. When a user deposits fiat currency (such as US dollars) into a Tether account, Tether will issue an equivalent amount of USDT to the user, thereby achieving a 1:1 peg between USDT and the US dollar.

Stability and Risks of USDT

Systemic Risk: Since the value of USDT is directly linked to the US dollar, its users need to bear the systemic risks and market fluctuations associated with the US dollar. For example, if the US dollar depreciates significantly in the global market, the purchasing power of USDT will also decline.

Regulatory Risk: If regulators question or take action on Tether's operating model, it may affect the issuance and use of USDT.

Collateral Risk: Although Tether claims that USDT is fully backed by reserve assets, there have been doubts about the transparency and adequacy of these reserve assets. If Tether fails to maintain sufficient reserves, or the quality of its reserve assets declines, it may cause the price of USDT to de-anchor, that is, USDT will no longer be able to maintain a 1:1 USD value.

Liquidity risk: Under extreme market conditions, Tether may face the problem of insufficient liquidity. If a large number of users simultaneously request to redeem USDT back to USD, Tether may find it difficult to honor these requests in a short period of time, leading to market panic and price fluctuations.

The various difficulties and problems faced by Tether are not unique to the stablecoin market, but to the entire RWA market. The security of RWA is always closely related to the quality of its underlying assets, and is extremely susceptible to the laws and regulations of different countries and regions.

Lending market

The combination of RWA and the credit loan market can bring more collateral options and higher loan amounts. In DeFi protocols such as Maker and AAVE, borrowers need to provide crypto assets that exceed the loan amount as collateral to ensure the safety of the loan. The intervention of RWA has included traditional assets such as real estate and accounts receivable into the category of collateral, expanding the scope of pledgeable assets, so that not only crypto assets, but even assets in the real economy can participate in this system. This move can bring more public funds for the development of small and micro enterprises, and provide more loan channels for large enterprises. At the same time, ordinary investors can also invest in enterprises and obtain future development benefits.

Bonds and Securities

In the traditional financial market, bonds and securities are the most widely used investment methods, and often have a complete financial regulatory system. Therefore, in RWA projects related to bonds and securities, aligning with actual laws and regulations is the most important step.

Maple Finance: Provides a way for businesses and lenders to create and manage loan pools on the chain, making the issuance and trading of bonds more efficient and transparent.

Securitize: Provides issuance, management and trading services for tokenized securities. The platform allows companies to issue bonds, stocks and other securities on the blockchain, and provides a full set of compliance tools to ensure that these tokenized securities comply with the laws and regulatory requirements of various countries.

Ondo Finance: Products provided include tokenized short-term treasury bond funds that provide stable returns, which further blurs the line between DeFi and traditional finance.

3. RWA market size

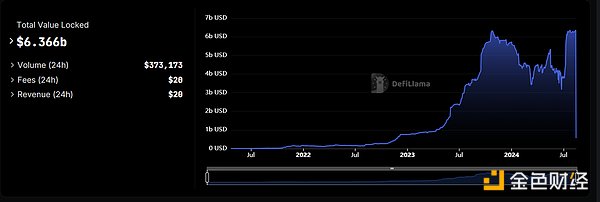

RWA has experienced a big explosion since May 2023. As of the time of writing, according to defillama, RWA-related TVL is still as high as US$6.3 billion, a year-on-year increase of 6000%.

Figure 5

According to the official website of RWA.xyz, there are as many as 62,487 RWA-related asset holders, 99 asset issuers, and a total value of stablecoins of US$169 billion.

Figure 6

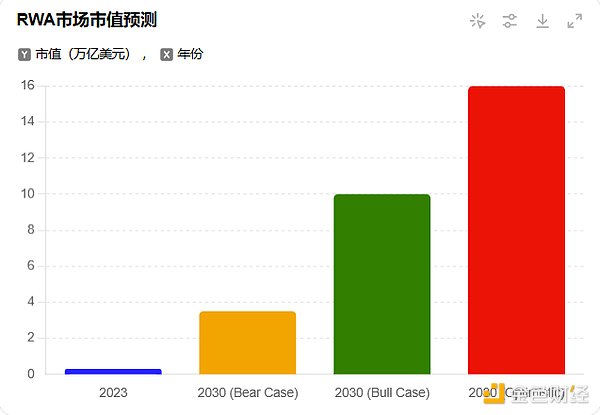

Binance and other well-known Web3 companies are also very optimistic about the future market value of RWA, and even estimate that its total market value can reach 16 trillion US dollars in 2030.

Figure 7

As an emerging track, RWA is changing the DeFi market with unprecedented strength, and its huge potential is worthy of investors' expectations. However, the development of the RWA project is highly related to reality, and different laws and regulations in various countries and regions can easily become a constraint on its development.

4. RWA Ecological Development

With the entry of traditional capital such as Goldman Sachs and SoftBank and well-known Web3 companies such as Binance and OKX, strong projects in the RWA track have gradually emerged; Centrifuge, Maple Finance, Ondo Finance, MakerDAO and other new and old projects have begun to show their edge in this blue ocean, and have become the veritable leaders in RWA in terms of technology and ecological layout.

Centrifuge: Real-world Asset On-Chain Protocol

Concept

Centrifuge is a platform for tokenizing real-world assets on the chain, providing a decentralized asset financing protocol, and uniting well-known DeFi lending protocols in the crypto market such as MakerDAO and Aave, and borrowers with collateral in the real world (generally start-ups) to complete the circulation between DeFi assets and real-world assets.

Financing and Development

Since its inception, Centrifuge has been highly sought after by capital, and has received a total of US$30.8 million in funding support in five rounds of financing from 2018 to 2024. Well-known VCs including ParaFi Capital and IOSG Ventures have all supported it. The Centrifuge project itself has also achieved impressive results. Currently, 1,514 assets have been tokenized, with total financing assets reaching $636M, a 23% year-on-year TVL increase.

Figure 8

Technical architecture

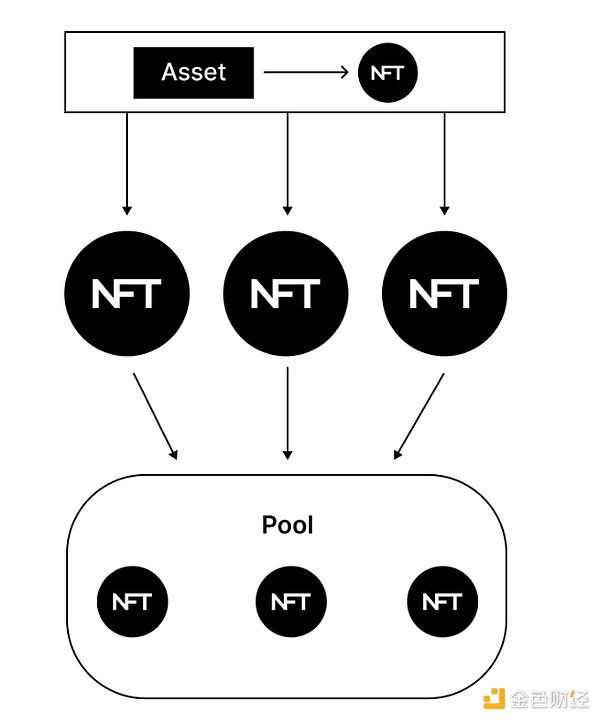

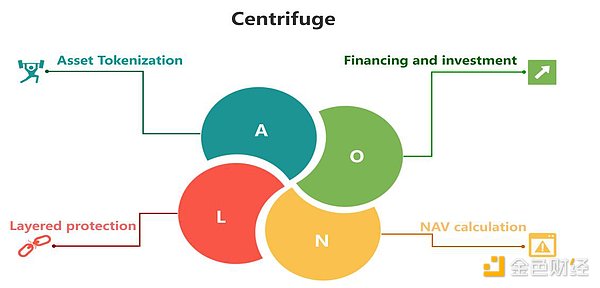

The core architecture of Centrifuge consists of Centrifuge Chain, Tinlake, on-chain net asset value (NAV) calculation and layered investment structure. Among them, Centrifuge Chain is an independent blockchain built on Substrate (part of the Polkadot parachain), which is dedicated to managing the tokenization and privacy protection of assets; Tinlake is a decentralized asset financing protocol that allows issuers to generate NFTs from assets and use these NFTs as collateral to obtain liquidity.

Figure 9

In a complete lending operation process, real-world assets are tokenized into NFTs through the Tinlake protocol, these NFTs are used as collateral, issuers obtain liquidity from the pool, and investors provide funds to the fund pool. At the same time, through the on-chain NAV calculation model, it ensures that investors and issuers can transparently see the pricing and status of assets. The tiered investment structure allows for three different lending tiers: the secondary tranche (high risk, high return), the intermediate tranche, and the senior tranche (low risk, low return).

Figure 10

Development issues

Although the Centrifuge project ranks first in RootData's RWA project attention, core data such as TVL have been declining all the way due to the impact of the bear market in 2022 and the failure of project expectations in 2024, and currently only $497,944.

Figure 11

ONDO Finance: Leader in U.S. Treasury Tokenization

Concept

Different from Centrifuge, which is committed to building a circulation platform for DeFi funds and real assets, Ondo Finance is a decentralized institutional-grade financial protocol (Institutional-Grade Finance) that aims to provide institutional-grade financial products and services and create an open, permissionless, decentralized investment bank. At present, Ondo Finance focuses on creating stable asset options other than stablecoins, introducing risk-free or low-risk, stable value-added and scalable fund products (such as US Treasury bonds, money market funds, etc.) into the blockchain, so that holders can enjoy the benefits of most underlying assets while having relatively stable assets.

Financing Development

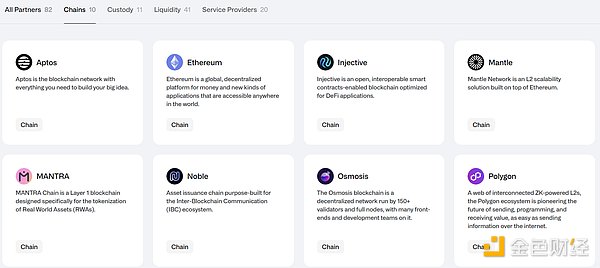

ONDO Finance has completed three rounds of financing in history, with a total of US$34 million in financing. Investors include PanteraCapital, CoinbaseVentures, TigerGlobal, Wintermute and other well-known institutions. In addition, ONDO Finance has as many as 82 partners in the four fields of chain support, asset custody, liquidity support and service facilities.

Figure 12

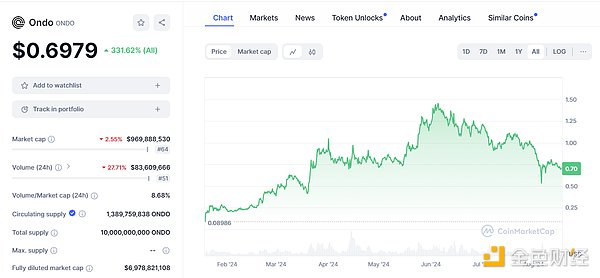

ONDO Finance's market performance is also good. The current project token ONDO price is US$0.6979, compared with the A round financing price of US$0.0285, ICO financing of US$0.055 and opening price of US$0.089, the distribution has increased by 2448%, 1270% and 784%, showing the market's fanatical pursuit of the project.

Figure 13

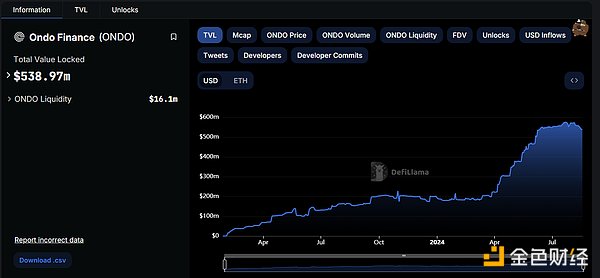

In terms of key data such as TVL, ONDO Finance has seen significant growth since April this year, currently reaching 538.97m US dollars, ranking third in the RWA track.

Figure 14

Product Architecture

ONDO Finance's current main targets are USDY and OUSG.

USDY (US Dollar Yield Token) is a new type of financial instrument issued by Ondo USDY LLC that combines the availability of stablecoins with the yield advantages of US Treasuries. Unlike many other blockchain yield instruments, USDY's architecture is designed to comply with US laws and regulations and is guaranteed by short-term US Treasuries and bank demand deposits.

USDY includes two types: USDY (accumulation) and rUSDY (rebase). The price of USDY (accumulation) tokens will increase with the income of the underlying assets, which is suitable for long-term holders and cash management needs; rUSDY (rebase) maintains a token price of $1.00, and the income is realized by increasing the number of tokens, which is suitable as a settlement or exchange tool.

OUSG (Ondo Short-term US Government Bonds) is an investment tool issued by Ondo Finance that provides liquidity exposure through tokenization, aiming to provide investors with ultra-low-risk and highly liquid investment opportunities. OUSG tokens are linked to US short-term Treasury bonds, and holders can obtain liquidity benefits through instant minting and redemption.

Tokenization structure: OUSG underlying assets are mainly deposited in BlackRock's US Dollar Institutional Digital Liquidity Fund (BUIDL), and the rest are deposited in BlackRock's Federal Fund (TFDXX), bank deposits and USDC to ensure liquidity. Through blockchain technology, OUSG shares have been tokenized and can be transferred and traded 24/7

Minting and redemption mechanism: Investors can obtain OUSG tokens immediately through USDC, or exchange OUSG tokens for USDC.

Token version: Similar to USDY, OUSG is also divided into OUSG (accumulation type) and rOUSG (rebasing type).

Both OUSG and USDY require user KYC support, so Ondo cooperates with the back-end DeFi protocol Flux Finance to provide stablecoin mortgage lending services for tokens such as OUSG that require licensed investment, so as to achieve permissionless participation in the back-end of the protocol.

BlackRock BUIDL: Ethereum's first tokenized fund

Concept

BlackRock BUIDL is an ETF (Exchange Traded Fund) jointly launched by the world-renowned asset management company BlackRock and Securitize. Its full name is "iShares U.S. Infrastructure ETF", and its code is BUIDL. BUIDL is similar to USDY and is essentially a security. When a user invests $100 in BUIDL, he will receive a token with a stable value of $1. At the same time, you can enjoy the financial benefits of this $100.

Regulatory compliance

Underlying assets

Underlying assets

Underlying assets

BlackRock Financial is responsible for the asset management of the fund. The fund invests in cash equivalents, such as short-term U.S. Treasuries and overnight repurchase agreements, to ensure that each BUIDL token maintains a stable value of $1. Securitize LLC is responsible for the tokenization process of the BUIDL fund, including converting the fund's shares into on-chain tokens. On-chain income is automatically generated by smart contracts.

Market Reaction

With the support of BlackRock's own strength and reputation, the BUIDL fund has performed very well in market recognition, TVL and other data. The TVL is stable at $502.41m, and the RWA TVL Ranking is 4th.

Figure 15

Figure 16

In terms of technical architecture, compared with other projects, BUIDL is not very innovative, but BlackRock's long-term reputation in the encryption market is enough to allow the project to occupy a place in the RWA track.

In the RWA ecosystem, in addition to Centrifuge, which integrates traditional lending and DeFi, ONDO Finance and BlackRock BUIDL, which integrate securities and DeFi, have also made breakthroughs in the integration of real estate and DeFi, such as Propbase directly tokenizing real estate assets for circulation, and PARCL allowing the use of mutual tokens to invest in communities or lots.

5. Summary

RWA is essentially a real-world asset. The fundamental purpose of the entire track is to achieve the interoperability of real assets and on-chain assets, allowing more real funds to flow into the blockchain while gradually blurring the boundaries between DeFi and traditional finance.

The main track of RWA includes both tangible assets and intangible assets. Currently, it focuses on three major areas: securities, real estate, credit lending, and stablecoins.

Compared to other tracks, the RWA track is more regulated and has stricter compliance requirements, which gives some well-known companies a greater advantage.

Although the RWA track has a strong narrative and prospects, due to the uncertainty of its compliance, it is still necessary to remain cautious when investing in related projects and be prepared for possible risks at any time.

The DeFi ecosystem of Casper Network (CSPR) is moving in a sustainable direction, and the launch of the Shiboo token further adds to its appeal.

JinseFinance

JinseFinance JinseFinance

JinseFinanceMastercard and MoonPay are looking at ways to make online payments even smoother. They teamed up to pioneer Web3 technologies in experiential marketing & consumer engagement.

YouQuan

YouQuanHuawei has entered into a ‘heavyweight’ partnership with multiple blockchain companies on the launch of its metaverse and Web3 Alliance project.

Finbold

FinboldA private financial document reviewed by CoinDesk shows that Sun, one of the richest figures in crypto, was responsible for the vast majority of a key Valkyrie division’s assets under management.

Coindesk

CoindeskA total of 37 major exploits were monitored, with a total loss of approximately $405 million

The Digital Dollar Project is launching a central bank digital currency (CBDC) Technical Sandbox Program in October. The U.S...

Ledgerinsights

LedgerinsightsBabylon’s founder said several liquidity pools and BABL tokens price were severely impacted, which contributed to the decision.

Coindesk

CoindeskINTERNET CITY, DUBAI, Jul. 18, 2022 – LBank Exchange, a global digital asset trading platform, has listed Qommodity Asset Backed ...

Bitcoinist

BitcoinistOMA3 will focus on proposing standards and facilitating collaboration between various stakeholders of Web3 and other industries.

Cointelegraph

Cointelegraph