Author: 0xLoki, ABCDE Researcher Source: @Loki_Zeng

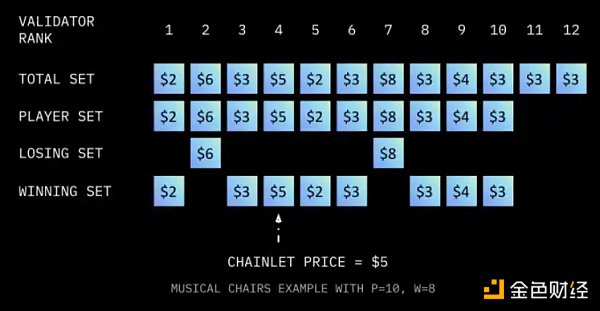

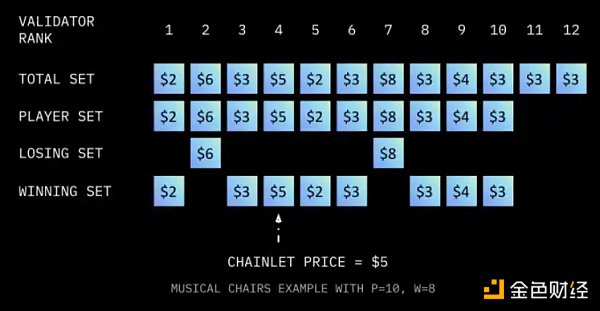

The essence of SAGA's business model is to distribute block space to downstream demand parties. A key issue involved is how to price. SAGA adopts a unique "musical chairs pricing":

(1) Assume that there are a=12 validators in the initial state, and SAGA hopes to select 8 of them for delegated verification;

(2) First, SAGA selects a certain number of validators from the staking rate ranking to enter the bidding stage. For example, if p=10, then the 11th and 12th ranked validators will be eliminated;

(3) The next 10 Validators make bids, and the bids are sorted from low to high. 8 of them are selected as delegated validators. At the same time, the price is determined by the highest price among the 8 validators. Validators No. 2 and No. 7, who bid $6 and $8, are eliminated, and the remaining 8 validators are shortlisted and agree to be priced at $5.

This mechanism looks very complicated, but it can achieve one goal: to provide the cheapest possible block space (or effective pricing) through involution.

Taking the above case as an example, if the validator wants to get rewards, he must ensure that he is in the top 8. The first step is to ensure that his stake is sufficient, which is a bit similar to the super nodes in EOS in the past. There is a significant difference in the rewards between the 21st and 22nd.

The second step is to be shortlisted through quotations. From the perspective of a single node, quoting 0.01 and quoting 5 US dollars, the final order price is 5 US dollars, but 5 US dollars requires the risk of being eliminated, so try to quote as low a price as possible.

But gradually, most validators will find that this is an endless involution, and the price will gradually become cheaper to 0, so if the cost of the validator (including the opportunity cost of the token) is taken into account, a more prudent way is to quote a price slightly higher than your own cost. Therefore, the actual pricing process will be close to [cost + a small amount of profit], and in the long run it will be in a very low range, and high-cost validators will continue to be eliminated in this process.

As can be seen from the table below, after the Cancun upgrade, ETH L2 has become much cheaper, but it is still not cheap enough, especially relative to Solana. From a technical perspective, we need the security of BTC/ETH, but from a commercial perspective, large-scale applications cannot afford a transaction fee of 0.1U/transaction, so "extremely low and stable fees" are very meaningful.

In addition, SAGA's charging model is different from other public chains. Users do not need to pay network fees directly. Applications can decide the charging method by themselves (such as subscription, buyout, advertising or even free), which is more in line with Web2's business model practices and provides more flexibility.

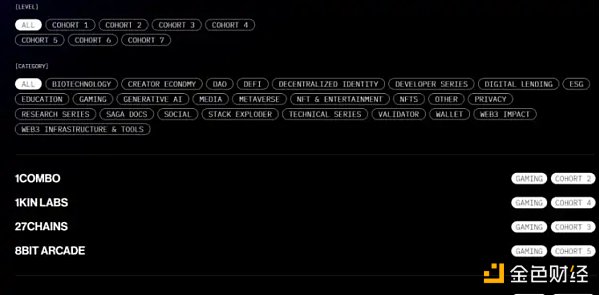

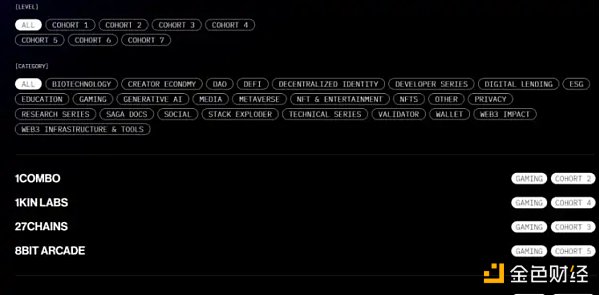

Another interesting thing is that SAGA's incentive test network Saga Pegasus currently has hundreds of protocols, and as of April 1, 2024, the plan includes 350 projects. 80% of these projects are games. About 10% of the projects are NFT and entertainment, and 10% are DeFi. This data is also consistent with the economic model - SAGA is more suitable for scenarios with light assets, high number of users, and high user frequency.

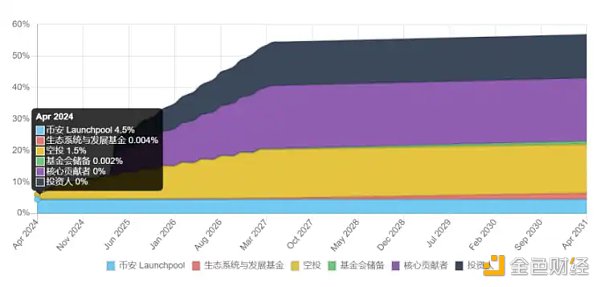

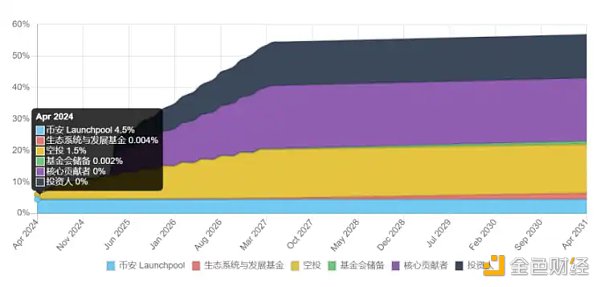

Finally, we need to pay attention to the token distribution. According to the information released by Binance, the initial circulation is only 4.5% of Launchpool and 1.5% of airdrop, while the ecosystem and foundation shares can be basically ignored:

(1) 75% of the chips are Binance Launchpool, and the selling pressure is very limited;

(2) Only 1.5% of the total 15.5% airdrop was issued. It is very likely that there will be many rounds to come. Considering that there are still hundreds of projects on the incentive test network (which may issue coins), SAGA is still worth participating in after the coin issuance (especially staking)

SAGA details: https://binance.com/zh-CN/research/projects/saga

Huang Bo

Huang Bo