Source: CoinDesk; Compiled by: Deng Tong, Golden Finance

Summary

Strategy Chairman Michael Saylor expects Bitcoin to become a $200 trillion asset class by 2045, transforming it into a global settlement layer for the AI-driven Internet age. He believes that the U.S. adoption of a strategic reserve of Bitcoin will consolidate its dominance, forcing its adoption around the world.

Strategy (formerly MicroStrategy) has used $33 billion to accumulate more than 500,000 Bitcoins, using innovative financial instruments such as convertible bonds and preferred stocks to fund its corporate Bitcoin vault and financially engineered a self-sustaining price increase cycle.

Saylor says destroying his Bitcoin holdings will bring "economic immortality."

It's 2045. Digital assets flow at the speed of light. AI agents interact millions of times per second, using Bitcoin as their base currency. Bitcoin is now a $200 trillion asset class, the settlement layer for the AI age of the internet.

This is the future imagined by Michael Saylor, Bitcoin evangelist and executive chairman of Strategy (MSTR). Saylor pioneered the Bitcoin enterprise treasury system — turning his shaky software company into an $85 billion leveraged Bitcoin behemoth listed on Nasdaq.

CoinDesk recently sat down with Saylor, Bitcoin’s ultimate maximalist, for a two-hour interview to break down his vision for Bitcoin global domination.

Since the election of U.S. President Donald Trump, Bitcoin has been on a tear, rising 26%, peaking at a market cap of $2.1 trillion and hitting an all-time high of $109,000 in January. Strategy, Wall Street’s proxy for Bitcoin, has held strong, gaining about 50%, despite a roughly 30% drop from its November high amid a broad selloff in U.S. stocks, U.S. 10-year Treasury yields and oil prices.

The U.S. went from regulating cryptocurrencies through enforcement and a secretive shutdown of digital asset companies’ banking operations, dubbed “Operation Chokepoint 2.0” by the industry, to declaring the U.S. a Bitcoin superpower and the crypto capital of the world. For Saylor, the sea change means that previously closed doors are opening. Global governments and traditional institutional investors that used to be afraid to get involved in digital assets are now curious.

Saylor said he’s fielding speaking invitations to all the elite gatherings: the 100 richest families in South America, Middle Eastern sovereign wealth funds, Morgan Stanley’s prestigious tech conference, CPAC and the White House. He’s gone from encouraging corporate adoption of Bitcoin Treasury notes to advising nation states to build strategic Bitcoin reserves.

He said that Bitcoin had reached "escape velocity" because once the U.S. government began actively acquiring Bitcoin, the U.S. would be the beneficiary and force every country to adopt Bitcoin as global capital.

"It's already a fait accompli," Saylor said. "It's one of those geopolitical moves where when you embrace the network, you force all your allies to adopt it first, and then all your enemies have to adopt it as well."

US Strategic Bitcoin Reserve

President Trump's executive order establishing the US Strategic Bitcoin Reserve was a milestone in fulfilling Bitcoin's Manifest Destiny. At one point the U.S. held about 400,000 Bitcoins but sold half of them for a profit of $366 million. Trump's cryptocurrency czar David Sachs lamented that the premature sale of those Bitcoins cost U.S. taxpayers $17 billion at current market value.

The executive order instructs the Secretary of the Treasury to never sell U.S. bitcoin and to develop budget-neutral ways to acquire more bitcoin. It further directs the creation of a digital asset reserve, a portfolio of seized crypto assets that can be managed and rebalanced as needed.

At President Trump’s White House Digital Asset Summit on March 7, Saylor proposed that the U.S. acquire 5%-25% of the total bitcoin supply by 2035, which could generate about $100 trillion in economic value by 2045.

When asked about the proposal, Bo Hines, executive director of the President’s Digital Asset Advisory Council, told CoinDesk that the Trump administration wants the U.S. to acquire “as much” bitcoin as possible and is considering a variety of creative approaches, including a proposal from Sen. Cynthia Lummis (R-Wyo) to use federal reserve proceeds and gold certificates to buy bitcoin.

As the U.S. embraces Bitcoin, it’s inevitable that global banks will follow.

“Pandora’s box has been opened,” Saylor said. “When Bitcoin becomes widespread…there will be trillions of dollars of digital capital in the banking system, and it won’t just be in the U.S. This is a virus. So the virus will spread. In this case, what that means is you’ll have hundreds of thousands of banks and trillions of dollars held by a billion people.”

“Thermodynamically Sound” Money

Saylor was born in Lincoln, Nebraska. He grew up on Air Force bases throughout the Midwest, as well as in Japan and New Zealand. An Air Force scholarship sent Saylor to MIT, where he earned a double degree in aeronautics, astronautics, and the history of science. A bona fide rocket scientist, Saylor’s systems thinking drew him to Bitcoin’s “thermodynamically sound” design.

After serving as a captain in the Air Force Reserve, Saylor co-founded MicroStrategy in 1989, a software company that thrived in the dot-com bubble until Saylor and two other MicroStrategy executives were embroiled in an accounting fraud scandal in 2000. They eventually settled with the Securities and Exchange Commission for about $11 million.

At MicroStrategy, Saylor invented more than 48 patents and deployed dozens of business ideas. Some succeeded, but most failed. Ironically, Saylor said, his biggest success was someone else's idea. Satoshi Namamoto, the anonymous creator of Bitcoin, created "digital gold," and Saylor discovered it while quarantined during the coronavirus pandemic. He grabbed it in desperation, preferring MicroStrategy to die a quick death than a slow death after failure.

In July 2020, MicroStrategy began steadily and consistently buying Bitcoin through cash flow, equity, debt, basically any means it could. It climbed to the highs of the 2021 bull market and weathered the impairment charges of the 2022 crypto winter. By 2024, the Bitcoin corporate finance strategy was battle-tested. It survived the first crypto market cycle, and the Trump shock catapulted MicroStrategy from a $1 billion company to a $100 billion company.

“[Bitcoin] became an opportunity,” Saylor said. “Then it became a strategy, and then all of a sudden in the last 12 months, we realized this is a really good business.”

From MicroStrategy to Strategy

MicroStrategy changed its name to “Strategy” and began doing business as “Strategy.” It has proven to be a highly desirable investment product for institutional investors looking to participate in Bitcoin’s volatility. Last December, Strategy was included in the Nasdaq 100 Index. Currently, the company is considering joining the S&P 500 Index, which would trigger another wave of public market access.

To create positive momentum, Strategy focuses on raising funds through a large number of fixed-income securities to buy more Bitcoin, creating a financial product casino for traders addicted to Bitcoin’s volatility. By constantly weighing market conditions, adjusting yield parameters and conversion factors, Strategy designs “smart levers” designed to attract demand and ensure that each series of securities amplifies each other in an endless positive feedback loop.

“If you say, this sounds like financial engineering, it absolutely is financial engineering,” Saylor said. “That puts more pressure on pushing up the price of Bitcoin, which in turn pushes up the price of MSTR, which pushes up the leverage of MSTR, which pushes up the value of options, which pushes up demand for equity, which pushes up demand and value of [convertible bonds], which pushes up the price and demand for preferred stock.”

Strategy raised about $33 billion through this financial engineering to buy 500 million bitcoins. It has sparked online debate about Strategy’s ability to pay dividends or bond maturities if markets sour or it can’t raise new capital. The money probably won’t come from existing company cash flow: Strategy’s software has negligible profits; in 2020-2023, profits were negative, according to MarketWatch.

All of this keeps Saylor up at night. So Strategy is keeping all its options open.

“We sell equity when the equity capital markets give us a big premium,” Saylor said. “If we’re overleveraged, we’ll deleverage. If we feel like the capital markets are really not right to sell any securities, we’ll stop and wait.”

Last week, Strategy used proceeds from the sale of MSTR common stock to purchase an additional 6,911 Bitcoins for $584 million, bringing its Bitcoin holdings to over 500,000 tokens. They further announced that their new STRF perpetual offering raised $711 million to purchase more Bitcoin, compared to its original goal of raising $500 million.

This latest series of preferred stock differs from the initial STRK offering in that it carries a higher coupon (10% vs. 8%) and has no common stock conversion provision. Risk factors are clearly outlined in both companies’ prospectuses, including no obligation to pay cumulative dividends “for whatever reason.”

The Strategy also eliminates any collateralized debt, eliminating liquidation risk on the company’s Bitcoin assets.

“We’ve built an indestructible balance sheet. Bitcoin can go down 99%. There are no margin calls. The instruments are built with no bitcoin as collateral,” Saylor said.

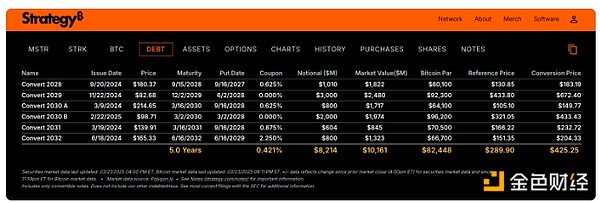

Strategy’s Debt: Convertible Notes and Maturities.

Finally, the dates to watch are the maturities of the loans that Strategy is providing to its bondholders. The first “maturity date” is September 16, 2027. If Strategy fails to incentivize bondholders to convert their bonds into MSTR shares or convince them to wait for the next year to repay the principal, those bondholders could ask Strategy to buy back their $1.8 billion loan for cash. If the market remains hungry for Bitcoin investments, it will be easier to raise funds and repay investors. If the market takes a downturn and the flow of money to Wall Street dries up, Strategy may have to consider selling its Bitcoin or defaulting.

Portrait of Strategy Chairman Michael Saylor AI

"Economic Immortality"

Saylor said that Strategy, like the US government, "will never sell" its bitcoins. He is betting everything on the ever-increasing price of bitcoin and the sovereignty, sound money, freedom and property rights that the community idealizes.

Before he dies, Saylor may burn his bitcoins rather than donate his assets. That would be a "more ethical, more reasonable form of philanthropy" and would grant "economic immortality."

"If I believe in this and burn these keys, then I've made everyone in the Bitcoin network richer and more powerful," Saylor said. "We're all in this together, now and forever. So, yes, that's my legacy."

Alex

Alex

Alex

Alex YouQuan

YouQuan Davin

Davin Catherine

Catherine Hui Xin

Hui Xin Clement

Clement Joy

Joy YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan