Author: Revc, Golden Finance

I. Introduction

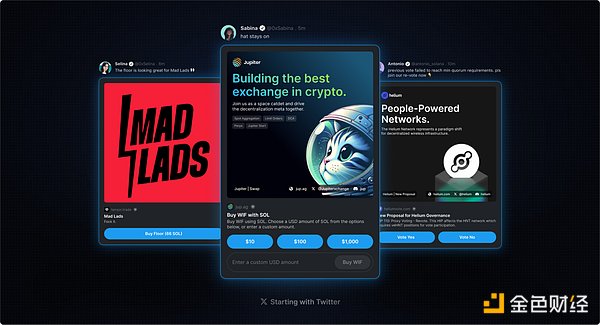

Blink is a platform launched by Dialect and Solana. The name comes from the abbreviation of "Blockchain Links". Blink allows developers to create "actions". Users can convert various Solana interactions (such as voting, donations, minting tokens, exchanging tokens, and payments) into actionable buttons on Platform X through simple URL links. This integration eliminates the need for page jumps and allows people to operate directly on Platform X.

Blink simplifies distribution channels and user workflows. In addition, actions and Blink links can be distributed through links, QR codes, push notifications, messaging applications, and other formats.

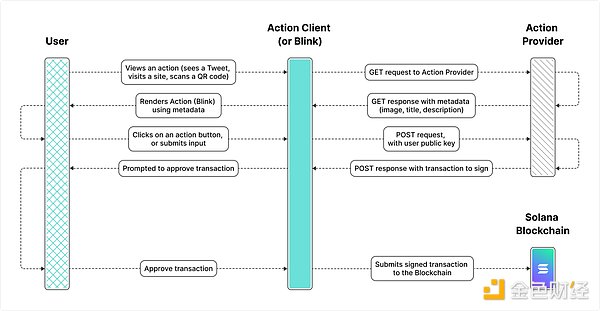

As shown in the figure, with the help of the Actions protocol, developers can encapsulate on-chain operations into a link and present it to users in the form of a Blink page. This logic is similar to the QR code of Web2, but Blink goes a step further and converts on-chain operations into visual front-end pages.

Developers do not need to develop or call API interfaces separately for each page, just create a link to apply it to all pages. When users see the Solana project on Twitter, they do not need to copy the token address and jump to the exchange, they can complete the transaction directly in one interface, which greatly improves the convenience of operation.

The emergence of Blink has brought some breakthroughs to blockchain interaction, but it has also triggered heated discussions in the crypto community. Some users believe that Blink has defects, and the main disputes are concentrated in the following aspects:

● Limited application scenarios: Blink currently only supports Chrome plug-ins and specific wallets and cannot be used on mobile devices, which limits its potential user base.

● Security risks:Users are worried that handing over links to third-party applications may pose security risks, such as phishing attacks or malicious operations.

● Development threshold: While simplifying the development process, it also lowers the audit standards for project teams, which may lead to the emergence of low-quality projects or security vulnerabilities.

Second, typical representatives of Blink scenarios that have emerged

Tip on social media

X account @zen913 has integrated a button with Blink on the GitHub page, so people can tip or sponsor their favorite developers.

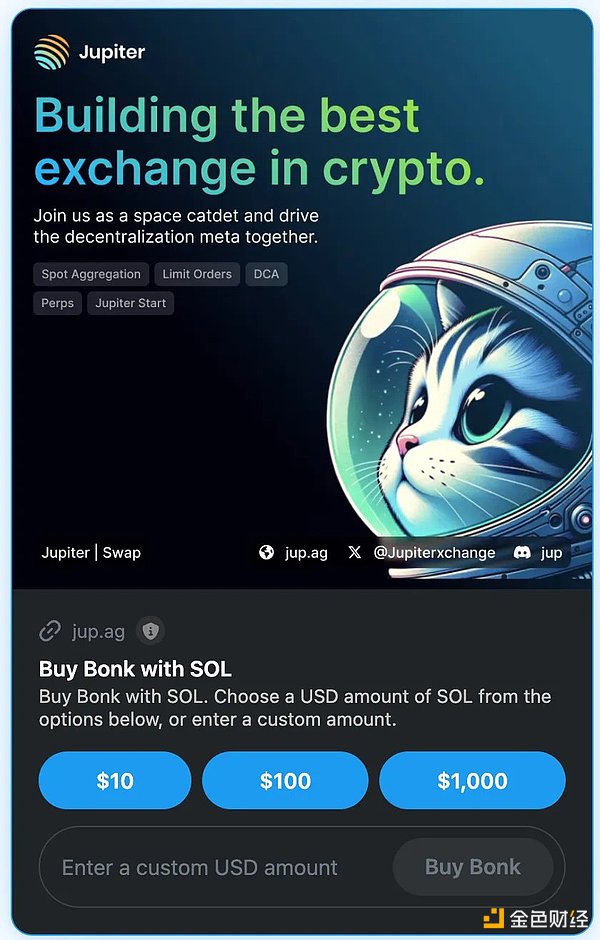

Post and buy coins directly on Twitter.

@JupiterExchange has implemented Blink for buying coins on Twitter, and also supports private message chat interface.

KOL rebates

Increase rebate incentives through Blink to achieve a new creator economy, the shortest purchase path & the strongest dissemination intention.

Paid subscription

Blink puts paid subscriptions in the front, and users no longer need to go to third-party platforms.

NFT minting and bidding

Build a code-free tool that allows anyone to create, mint, bid, and buy NFTs using Blinks on their X Feed.

In addition, Blink also has scenarios such as multi-signature, prediction market, content gating and staking.

SEND

In addition, there is a concept project SEND (@thesendcoin) that has issued tokens and is worth paying attention to. At the time of writing this article, its market value has reached $10 million. SEND demonstrated Blink's various application scenarios through detailed and vivid descriptions, and won the support of Solana founder Toly. Toly pinned the 100 Blink use case tweets summarized by the SEND team on Twitter.

3. Blink analysis, SceneFi preliminary exploration

In my opinion, the flaw of Blink is that although it seems to enrich the interactive scenarios, it still does not lower the user's usage threshold in terms of operation. That is, if you want to experience or use Solana Blinks, you need to enable the relevant functions in your wallet (that is, limited to existing Web3 users) before you can use Blinks on Twitter. From the figure below, we can see the operating logic of Blink.

As a Web3 Builder, how can we improve the Blink protocol? We can learn from FriendTech’s approach and easily create encrypted wallets through Web2 social accounts or payment IDs, thereby deriving the SceneFi track.

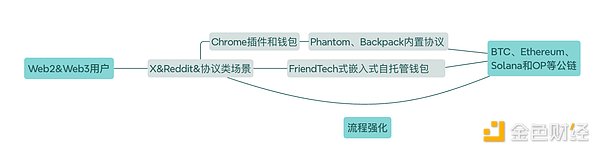

Web2&Web3 users——X&Reddit&protocol scenarios——FriendTech-style embedded self-hosted wallets or Chrome plug-ins and wallets——Phantom, Backpack built-in protocols——BTC, Ethereum, Solana and OP and other public chains

As shown in the figure above, we define SceneFi as a financial infrastructure that provides Web3 payment methods for Web2 scenarios.

First, the SceneFi protocol uses a similar operating method to Web2 to explore potential pan-financial scenarios. Of course, the main focus is on the Web3 scenarios mentioned above. Secondly, the conversion between fiat currency and cryptocurrency is completed by generating FT wallets (embedded self-hosted wallets), and then users are introduced to the public chain ecosystem with a high tolerance for traffic costs (because a large part of SceneFi’s revenue will be provided by the public chain), and then the user’s consumption habits are tracked in the future to strengthen this process.

So why should Web2 scenarios access Web3’s payment methods?

● Because traditional consumption scenarios can combine the high-risk preferences of the Web3 world to provide high-risk premiums for risky events, whether it is investment (NFT), prediction or crowdfunding (coin issuance & event rewards).

● In addition, the user time cost of Web3 is much higher than that of Web2. This basis difference leads to a strong motivation for the financial infrastructure of Web3 to combine good Scenes.Willing to pay the cost of the scene, hoping to continuously siphon Web2 users into Web3 through SceneFi.

SceneFi product concept

Creators or merchants with payment needs select the designated BlockChain as the settlement channel through the SceneFi protocol. Although there is a sense of immediacy of CEX withdrawal, this product tentacles extend to the vast application scenarios of Web2. In the future, we may see that the entire chain has its own SceneFi or Blink protocol.

Fourth, Summary

SceneFi is abstracted from the subdivided tracks of SocialFi, GameFi and CreatFi in the application layer. Judging from the current situation that Web3 cannot expand its circle, most projects may not be good at creating product tonality that Web2 users like, because Web2 products are products that have been precipitated after decades of competition, and decentralized experience is not a rigid demand for most Web2 users but a migration cost. Builder can penetrate the scene from the perspective of payment in the way of Blink, so as to achieve user conversion.

Miyuki

Miyuki

Miyuki

Miyuki Zoey

Zoey Cheng Yuan

Cheng Yuan Clement

Clement CryptoSlate

CryptoSlate The Block

The Block Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph 链向资讯

链向资讯 Cointelegraph

Cointelegraph