Author: Xiyou, ChainCatcher

On July 24, ChainCatcher reported that dYdX, the leader in decentralized derivatives trading, was planning to sell dYdX V3 trading software.

But within less than an hour after the news was spread, the dYdX V3 website (dydx.exchange) was attacked by hackers. The hackers first took over the website and implanted links to fake phishing websites. Once users authorized information, their assets or information might be stolen.

As soon as the news of the plan to sell V3 was exposed, its domain name was hacked, and the community speculated whether this was a pure coincidence or a long-planned action.

The sale and security crisis of dYdX triggered a series of chain reactions, and users and investors showed obvious concerns. The price of DYDX tokens fell rapidly in response to the news, from $1.45 to a low of $1.23, with a daily drop of more than 15%. At the time of publication, the price of the coin fluctuated at $1.27.

Why sell V3? Is the dYdX team going to cash out and leave? Why did the hacker choose this time point to attack? Can DYDX tokens still be held? A series of questions filled the community chat page.

Intention to sell dYdX V3, not related to dYdX Chain

Bloomberg reported that dYdX is in talks with potential buyers to sell part of its derivatives trading software (dYdX V3). It is reported that Wintermute Trading and Selini Capital are among the potential buyers of dYdX V3 software, and the specific amount has not been disclosed.

As the leading derivatives company in the DeFi space, the rumor of dYdX selling V3 has attracted widespread attention from the crypto community. Most community users are more concerned about whether the V3 being sold is just the trading software or whether the entire dYdX brand is being sold as a package. Is the dYdX team going to withdraw completely? You should know that the V4 version dYdX Chain launched last year is managed by the DAO community? What impact does this incident have on the overall ecosystem of dYdX? What impact will it have on the price of DYDX?

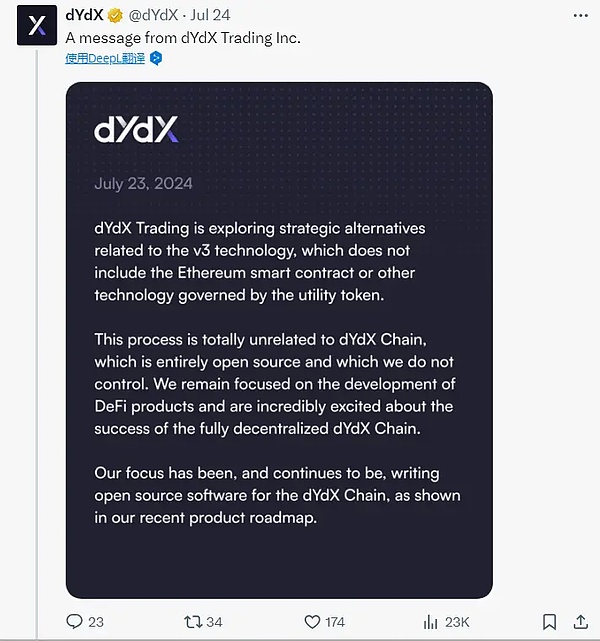

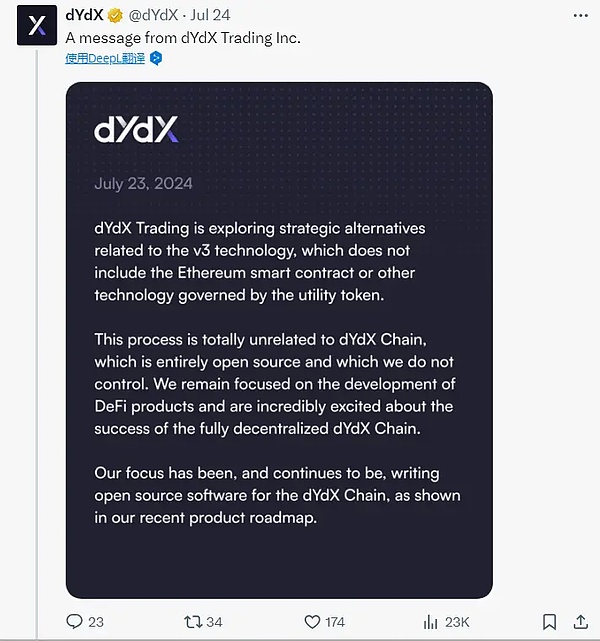

In response to the news of the sale of V3, dYdX officials responded on social media that dYdX Trading is exploring strategic alternatives related to V3 technology, which does not include Ethereum smart contracts or other technologies managed by DYDX tokens, and this process has nothing to do with dYdX Chain, which is the focus of future development.

It added that the dYdX V3 exchange is a trading engine supported by the operating entity dYdX Trading. All funds and settlements on V3 occur on smart contracts governed by DYDX token holders, and V3's transaction fees also belong to dYdX Trading.

With the launch of dYdX Chain in V4, all dYdX transactions will eventually be migrated to the chain, and all transaction fees paid on the chain will belong to validators and DYDX stakers.

It also emphasized that the dYdX Chain code is open source and fully decentralized, which is more in line with the development concept of DeFi products, and the focus will be on building products around dYdX Chain in the future.

Regarding the official statement of dYdX, community user Bobo summarized to ChainCatcher that it seems that the rumor that dYdX sold V3 is true, but it is only the V3 trading software that is sold, which has little impact on dYdX Chain, and dYdX Chain’s main business focus is also dYdX Chain, and the price of DYDX is also directly related to the handling fee income of dYdX Chain.

User @atg1688 also said that dYdX only sold V3 trading software, which is owned by the organization dYdX Trading, and dYdX Chain is operated by dYdX Foundation, so the impact is not great.

The long-warned V3domain name vulnerability was finally hacked

However, less than an hour after dYdX V3 was exposed to be negotiating a sale, the V3 domain name was found to have been attacked by hackers.

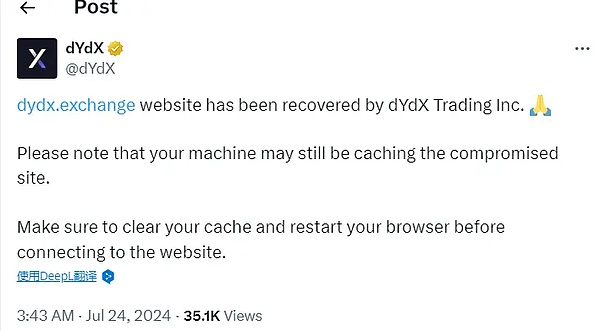

On July 24, dYdX officially issued a reminder that the dYdX v3 website domain name (dYdX.exchange) has been hacked. Please do not visit the website or click on any links, but dYdX v4 has not been affected.

The hacker successfully hacked into the domain name by exploiting the vulnerability and tampered with the DNS record of the domain name, causing users to be redirected to malicious websites when visiting dYdX V3. Users encountered phishing attacks when visiting malicious websites, and some users' private keys and assets are likely to be stolen.

Fortunately, in this hacker attack, only the network domain name became the target of the attack, and the underlying smart contract was not attacked. The user funds on the dYdX platform were not affected. The dYdX V3 domain name vulnerability has been fixed and the website has resumed normal operation. dYdX stated that dYdX Chain, dydx.trade website and V3 protocol were not attacked.

However, community users are not satisfied with the dYdX vulnerability handling.

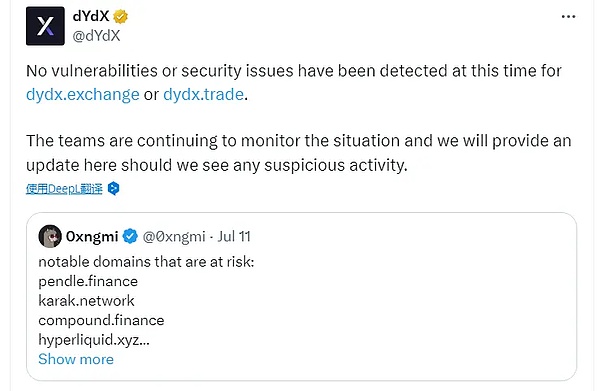

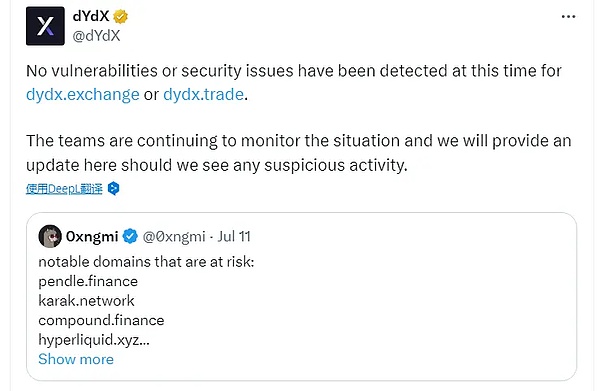

Because as early as July 11, some users had already reminded that the dYdX domain name had the same vulnerability as protocols such as Compound and Celer. However, after the official dYdX reply that no vulnerabilities or security issues had been found, there was no follow-up, and no relevant countermeasures were deployed in advance.

Therefore, some users regard this hacker attack as a warning to dYdX for its negligence.

However, the timing of the hacker's attack on the dYdX V3 domain name coincided with the perfect coincidence when the news of the V3 sale was revealed, which made community users wonder whether it was premeditated.

Some users said that when dYdX V3 was hacked during the negotiation of the software sale, dYdX had to deal with a security crisis and a potential business transaction, which was a two-birds-with-one-stone move.

Is dYdX selling V3 to "cash out" or for ecological development?

Compared to this security attack, users are even more puzzled by dYdX's sale of V3. According to dYdX's original plan, after the V4 version of dYdX Chain went online last year, all transactions would be fully transitioned to V4, and V3 would be slowly abandoned, but now dYdX's disposal of V3 is an attempt to sell it.

In the DeFi field, overall buying and selling transactions of projects are rare because most projects use open source software, which means that others can use, modify, and rebuild it without having to buy it.

A DeFi OG player lamented to ChainCatcher that he had been in the DeFi industry for so long and had seen platforms shut down, sell coins and run away. dYdX was the first person to directly sell the trading platform.

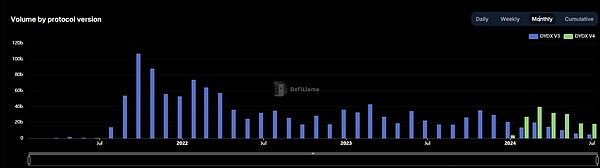

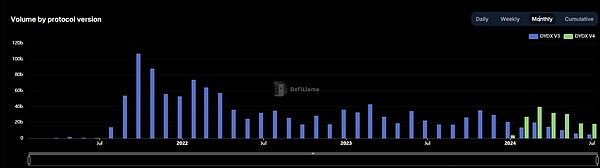

Although dYdX V3 is an old version of the product, the platform's trading data performance is still impressive. According to DeFiLlama data, the V3 platform is expected to generate approximately $18.67 million in revenue this year.

In its report in March last year, VanEck estimated that the V3 platform generated $137 million in fees in 2022.

DeFiance Capital also publicly stated last year that although the dYdX V3 product had basically no new trading pairs and features launched in more than a year, its market share still exceeded 50%.

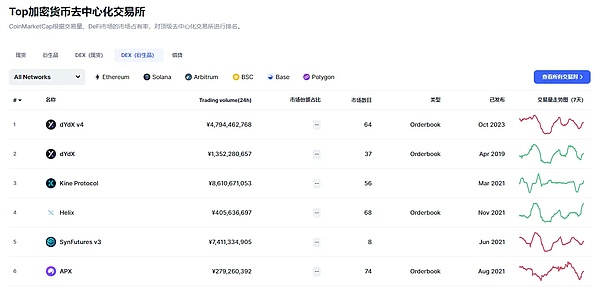

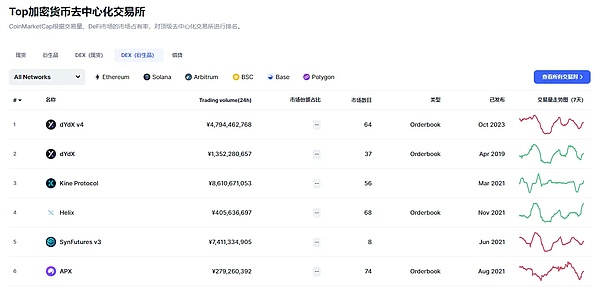

According to DeFiLlama data, dYdX V3 still has an average of $1.5 billion in weekly derivatives trading volume, and the weekly trading volume on V4 dYdX Chain is about $5 billion.

According to the analysis of crypto risk company Gauntlet, the V3 platform is still attractive to traders because some tokens on the V3 platform have higher liquidity and traders face less slippage in large transactions.

According to the analysis of crypto risk company Gauntlet, the V3 platform is still attractive to traders because some tokens on the V3 platform have higher liquidity and traders face less slippage in large transactions.

User Bobo also mentioned to ChainCatcher that he still uses V3 the most, and rarely uses V4, because the asset trading volume and liquidity of this version seem to be very low.

From this point of view, dYdX V3 is still a continuous cash cow. It is reported that the business transactions of this V3 sale will reach hundreds of millions of dollars.

Since its launch on the Ethereum network in 2017, under the liquidity mining incentive policy during the DeFi Summer period, the business has grown wildly, and the dYdX product has also undergone countless major changes. The product has been upgraded from the initial V1 to today's V5 version. After escaping Ethereum, dYdXChain was launched and became the king.

However, the business development of dYdX is very different from the trend of DYDX coin price. The price of DYDX coin has plummeted since the high of $27 in 2021, and the lowest point has fallen to around $1.005 many times. Now it fluctuates around $1.25, and the coin price has shrunk by 95% compared with the high point.

Although after the launch of V4 dYdX Chain, all on-chain transaction fee income belongs to DYDX token stakers, etc., giving more empowerment, it has no impact on the price of the coin.

There are two main views on dYdX's sale of V3. One is the negative view that the project party wants to cash out, and the other is the positive view that the funds obtained by the project party from this sale are beneficial to the overall development of dYdX.

Bobo said that if dYdX invests its sale funds into the dYdX ecosystem, it will undoubtedly be a good thing.

He explained that as a fast-growing DeFi company, dYdX needs a lot of funds to support its technology research and development and market expansion. The sale of the V3 platform can raise a lot of funds for it, help it focus its energy and resources, and enhance its overall competitiveness.

In the long run, the sale of the V3 platform may also have a positive impact on the value of the DYDX token. By obtaining a large amount of funds, dYdX can further improve its technology and services, enhance its market competitiveness, and thus enhance the long-term value of the DYDX token.

He also reminded that currently, regarding the sale of dYdX V3, the official has not stated whether the funds obtained after the sale will be pocketed by the team itself or used for other purposes.

JinseFinance

JinseFinance