Source: Mankiw Blockchain Law

Since the People’s Bank of China launched the digital renminbi pilot test at the end of 2019, after four years of technological exploration and development, Digital RMB has gradually been applied and implemented in all fields and links of economic and social life, and is favored for its legal compliance, convenience, traceability and security.

However, innovation is often accompanied by risks. With the promotion and popularization of digital renminbi, some criminals are also eyeing this emerging thing. They take advantage of the concealment, controllable anonymity and other characteristics of digital RMB transactions to commit fraud crimes or transfer fraudulent funds... constantly challenging the bottom line of the law.

Recently, the Yangpu District People’s Court of Shanghai (hereinafter referred to as the Yangpu District People’s Court) concluded Shanghai’s first case of using digital renminbi to “run points”.

01Case Replay

At the end of May 2023, Wang came to the local At a bank ATM in Yangpu District of the city, in just two hours, digital currency accounts registered with more than 10 different mobile phone numbers were used to withdraw 30 cash through the ATM digital renminbi exchange function, with an amount as high as 123,000 yuan, which was almost as much as 123,000 yuan. All cash stored in the machine was emptied.

The number of accounts that clearly "exceeded the standard", the number of exchanges that were too frequent, and the large amounts of cash withdrawals in a short period of time immediately aroused the vigilance of bank staff, who immediately reported the case, thus uncovering a case of using digital RMB accounts for Overseas telecommunications network fraud, gambling and other upstream criminals split up and transferred stolen money to "run score" gang criminal cases.

It turns out that with the rapid development of digital renminbi, in order to adapt to new changes in payment methods, the bank actively carried out digital renminbi docking and upgrading of smart devices, and added a new digital renminbi ATM exchange function. You need "mobile phone number + verification code + payment password" to exchange and withdraw cash from the ATM.

Since May 2, 2023, Xiao has made illegal profits by taking advantage of the characteristics of the four types of digital RMB accounts, which are not real-name and can be opened with mobile phone verification. As well as the ATM exchange and cash withdrawal function, he recruited Kan, Wang Jia, Wang, Chen, Yang and others to form a "scoring fleet", knowing that it was the proceeds of other people's crimes and using the money in the digital RMB account (four categories) provided by the previous company. Withdraw money and earn "handling fees" from it.

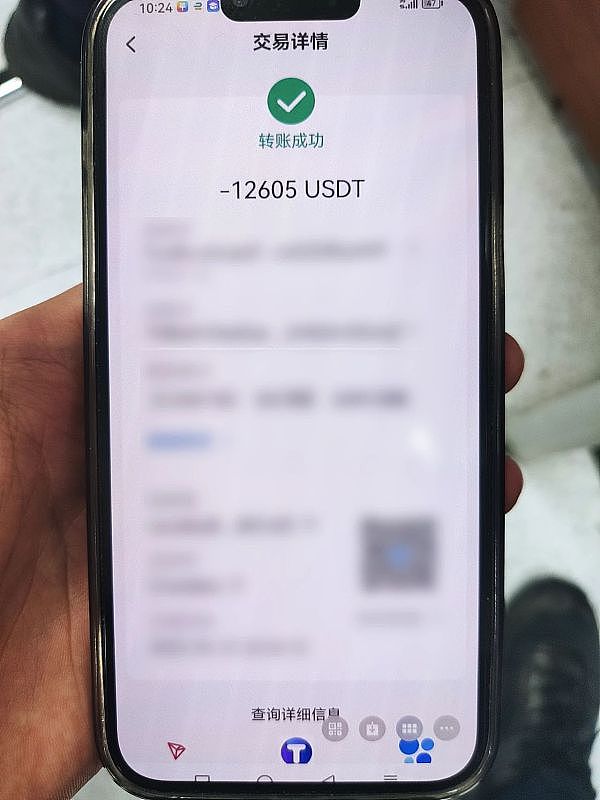

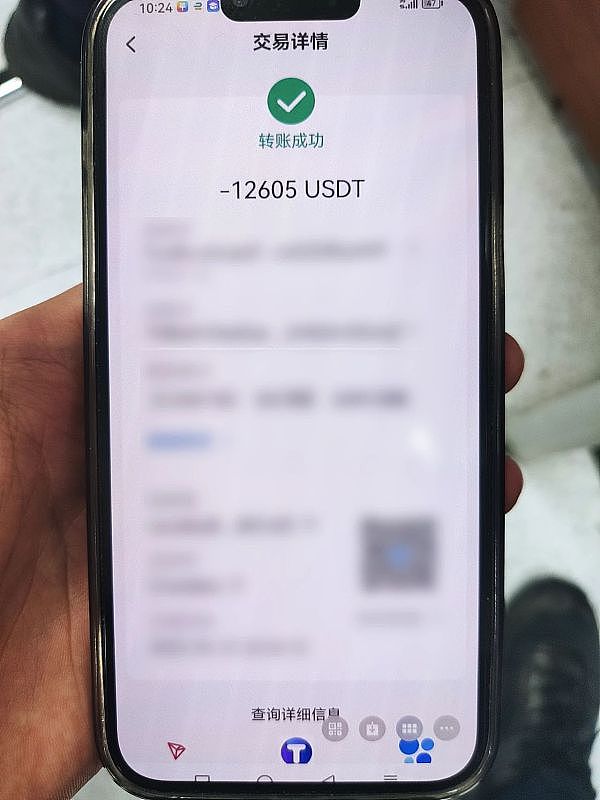

As the person in charge of the "scoring team", Xiao communicated with the owner to determine the amount of cash that needed to be withdrawn, and then Kan and others purchased and exchanged the virtual currency from the virtual currency dealers Gong and Huang, and transferred the money to them. The virtual currency obtained is paid to the designated account of the host. After receiving it, the host sent the corresponding digital RMB account and password to Xiao, who forwarded it to "driver" Wang and others. The "driver" used the above-mentioned digital RMB account and password to go to a bank branch to withdraw cash through an ATM machine. Then transfer it to the designated bank account.

With a few operations, illegal funds were “laundered” through digital renminbi and virtual currency transactions.

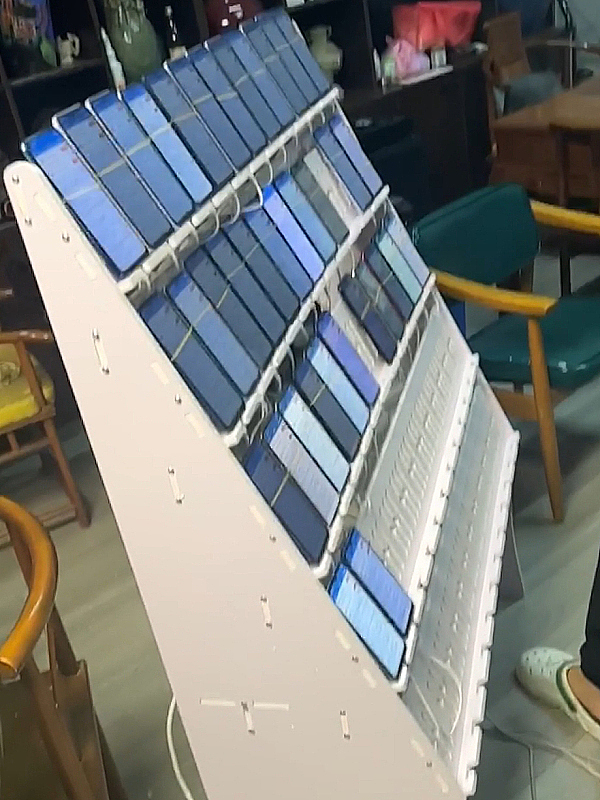

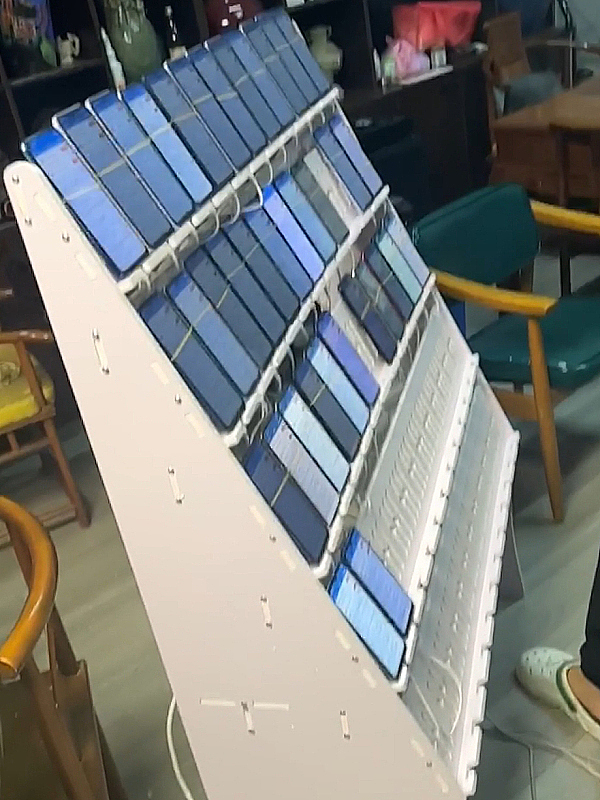

The picture shows the mobile phone used to commit the crime

In the meantime, in order to earn more "Handling fee", Xiao also purchased multiple mobile phone numbers and more than 30 mobile phones from others, registered multiple digital RMB accounts (four categories) and provided them to his family for receiving money, and through the same method as above, he entered digital RMB Withdraw money from the account.

After judicial audit, between May and June 2023, Xiao led the "running team" to withdraw more than 10 million yuan from more than 900 digital RMB accounts, of which more than 800,000 yuan were victims of telecommunications network fraud Transfer money.

02Court Judgment

The Yangpu District People’s Court held after hearing:

The actions of the defendants Xiao, Kan, Wang Jia, Wang, Chen, Yang, Feng and Xu constituted the crime of covering up and concealing criminal proceeds. The eight people were sentenced to fixed-term imprisonment of seven months to Sentences ranging from four years to six months, and fines ranging from 5,000 yuan to 45,000 yuan; the actions of defendants Gong and Huang constituted the crime of assisting information network criminal activities, and they were sentenced to fixed-term imprisonment respectively. Sentenced to one year and four months in prison and fined 10,000 yuan.

Huang Bo

Huang Bo