Author: Lawyer Guo Zhihao

1. Shanghai Taxation Documents Correct understanding of virtual currency taxation

On January 5, 2024, the Shanghai Taxation Bureau issued the "Personal Income Tax on Business Income and The article "Common Misunderstandings on Classified Income" points out that individuals who buy and sell virtual currencies online need to pay personal income tax.

This has also triggered heated discussions in the currency circle, such as: "Virtual currency is finally going to start collecting taxes!", "Virtual currency taxation may be Facing high late payment fees", "Our country can only tax legal income, and the state recognizes virtual currencies!", "The currency circle will be glorious again!" and so on.

However, after carefully reviewing the original text, Lawyer Guo found that people in the currency circle would indeed take advantage of hot spots, even if the hot spots were not from the currency circle at all. To lead it to yourself.

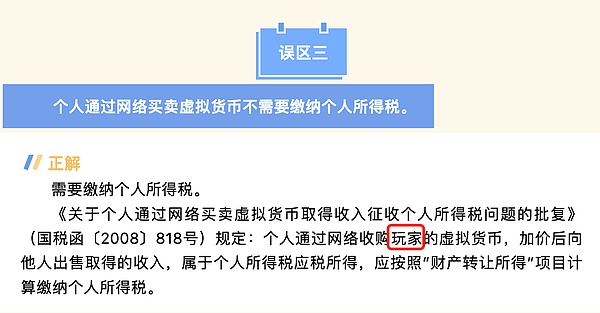

"Common Misunderstandings about Personal Income Tax Business Income and Classified Income" The original text contains a total of four common misunderstandings, among which the one about virtual currency is Misunderstanding 3. The original text can Look at the picture below:

Although on the surface it seems that we are really going to start taxing virtual currencies. However, let’s focus on this: the regulation quoted here is an approval in 2008! Why is it said that the currency circle will become a hot topic? Can the 2008 approval explain the birth of Bitcoin in 2009?

Although domestic Bitcoin and online game currency are collectively referred to as "virtual currencies" at the official level, in fact virtual currencies based on blockchain technology Currency is different in terms of underlying logic, purpose of issuance, value expression, social role, legal attributes, and public perception. Moreover, the international definition of virtual currencies based on blockchain technology and ordinary game currencies are not the same.

Secondly, looking at the definition of the subject in the original text of the 2008 "Approval", it is also "an individual acquires players' virtual currency through the Internet." The key point is " "Player", according to the context, it can also be seen that the virtual currency here is the definition of game currency.

Finally, this article from Shanghai Taxation is just a tweet to remind you of very common "common misunderstandings". It is not an official document. If we really want to tax virtual currencies, it won’t be such a joke, right? The editor who posted this article must have never expected that it would become a hot topic in the currency circle, and the number of clicks would increase dramatically~

2. Domestic Taxing virtual currencies is not far away

Although Lawyer Guo just analyzed that Shanghai Taxation wants to tax virtual currencies, it is just a hot topic in the currency circle. An own incident. But it can also reflect the currency circle’s strong reaction to the tax issue. Because once taxed, it not only means paying a large amount of tax (usually considered to be 20%), but it also means that virtual currency will be officially recognized by the country.

Why do you say that? You may not know that when it comes to taxation, the United States and other Western countries will not consider whether it is legal income. Even for drug smuggling and trafficking, taxes must be paid first. After all, capitalist governments basically rely entirely on taxation for financial expenditures.

However, unlike the United States and other Western countries, my country’s current mainstream views and practices, both theoretically and practically, all agree that “taxable income should be legal. sex". Translated, it means that illegal income is not under the control of the tax bureau. Therefore, once virtual currencies are taxed, it means that at least the tax authorities have recognized the legality of virtual currencies.

Return to the topic. Why is it said that domestic taxation of virtual currencies is not far away?

In fact, as early as a few days after the release of the "9·24 Notice" in 2021, staff from the State Administration of Taxation discussed with Attorney Guo the issue of virtual currencies. Feasibility of starting taxation. Then in October, "China Tax", a magazine under the State Administration of Taxation, published an article titled "Preventing Tax Risks Brought by Virtual Currencies" to test the reactions of all levels of society.

Following this, beginning in early 2022, tax authorities in some regions began to conduct personal income tax audits against large players in the currency circle. Until 2023, people are still being audited by the tax authorities.

In addition, whether it is the "Notice on Preventing Bitcoin Risks" issued by five ministries and commissions, or the "Announcement on Preventing Token Issuance Financing Risks" issued by seven ministries and commissions , or the "Notice on Further Preventing and Handling the Risks of Speculation in Virtual Currency Transactions" issued by ten ministries and commissions, all only deny the legal currency attributes of virtual currencies, and do not deny the property or commodity attributes of virtual currencies, let alone directly define them as illegal property.

So, theoretically speaking, as long as the general direction of the country is certain, virtual currencies will be taxed at any time. And in the context of countries around the world gradually recognizing the legality of virtual currencies and the severe fiscal tightening in various places, I believe that this day will not be too far away.

JinseFinance

JinseFinance

JinseFinance

JinseFinance 铭文老幺

铭文老幺 JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Ftftx

Ftftx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph