Author: Alex Nardi Source: Shoal Research Translation: Shan Ouba, Golden Finance

Introduction

If the future of finance is digital, then why does using DeFi still feel like dialing up in the 1990s? The dream of a seamless, blockchain-driven financial system is often disrupted by reality - switching wallets, bridging assets, dealing with gas fees, and ensuring cross-chain compatibility. Users face friction at every step, developers are forced to optimize for isolated ecosystems, and capital remains scattered across multiple chains, reducing overall efficiency. The promise of Web3 remains, but its usability issues are preventing it from truly achieving mainstream adoption.

This is where chain abstraction comes in. Just as cloud computing abstracts the complexity of managing physical servers, chain abstraction removes blockchain's biggest user experience barrier, ensuring seamless interaction between chains without users having to manage the underlying complexity. Just as streaming services like Netflix don’t require users to know which cloud provider they’re running on, future Web3 applications will not require users to choose networks or manually bridge assets.

The implications of this transformation are far-reaching. A fully realized chain abstraction model will shift the focus from infrastructure-centric blockchain competition to application-centric user experience. Capital efficiency will be improved, development barriers will be lowered, and decentralized finance (DeFi), gaming, and digital identity solutions will gain huge usability improvements.

This report explores how chain abstraction is reshaping how users and developers interact with Web3, covering the core technical advances that make it possible, the indirect impact of the industry, real-world implementations—including the core role of Particle Networks—and the challenges that may lie ahead.

Core Concepts of Chain Abstraction

The fundamental goal of chain abstraction is to remove the focus on blockchains for users and developers. Chain abstraction simplifies blockchain interactions by creating a unified layer, making them seamless without requiring users to deal with wallet fragmentation, gas fees for multiple tokens, and liquidity silos. Below, we analyze the key components that make this vision a reality.

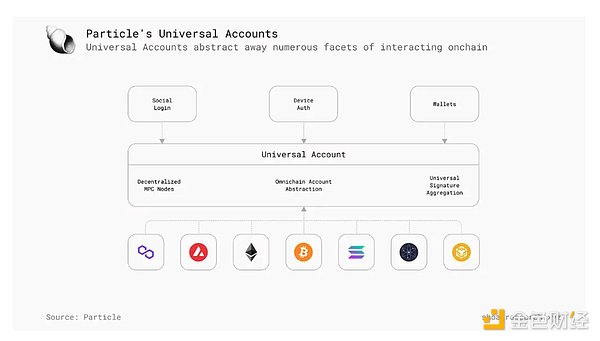

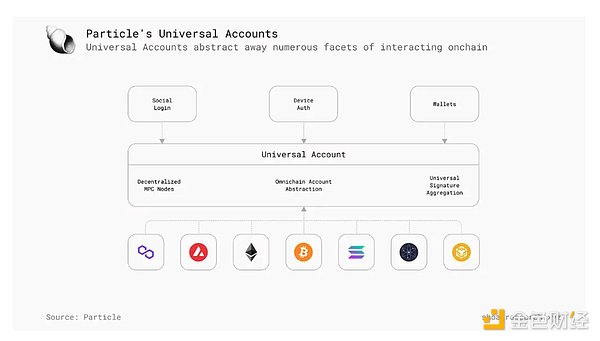

1. Universal Account: Single Balance Across Chains

In the current Web3 ecosystem, users typically need separate accounts for each chain - Ethereum accounts for ERC-20 tokens, Solana accounts for SPL tokens, Bitcoin accounts for BTC, and so on. This fragmented experience forces users to keep track of multiple balances, manage various private keys, and remember where their assets are stored.

Universal Accounts solve this problem by providing a universal address and balance across chains. Users only need to log in once and can transact on different blockchains without switching networks or manually transferring funds.

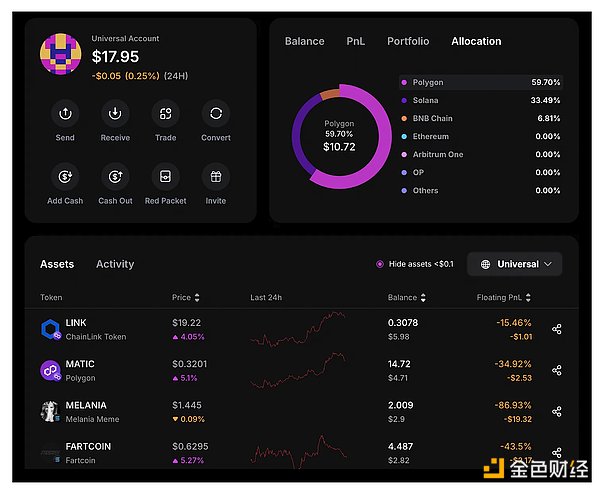

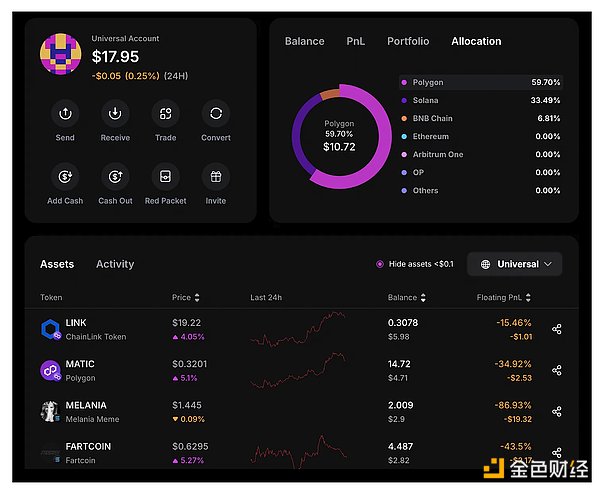

A few months ago, Particle Network released UniversalX - the first chain-agnostic on-chain trading platform - marking the first mainnet implementation of Universal Accounts.

As you can see, despite the funds being stored across multiple chains, the magic of universal accounts is that they appear to be a unified balance. When making a transaction, the system automatically aggregates assets from all chains into a single transaction - no need to manually bridge assets or manage gas fees.

How it works: Universal accounts are powered by ERC-4337-based smart wallets that make on-chain accounts act like programmable smart contracts. These wallets abstract private key management, making multi-chain interactions seamless.

Example operation: Imagine Alice, an ordinary DeFi user. She has ETH on Ethereum, but wants to do yield farming on Avalanche. Instead of manually bridging, paying AVAX's gas fees, and signing multiple approvals, she only needs to interact with a unified interface that optimally routes her assets without requiring her to understand the underlying mechanism.

2) Universal liquidity: eliminating the need for bridging

One of the biggest obstacles facing Web3 at present is liquidity fragmentation. Each blockchain operates its own independent asset pool, and if users want to interact with different ecosystems, they need to manually bridge.

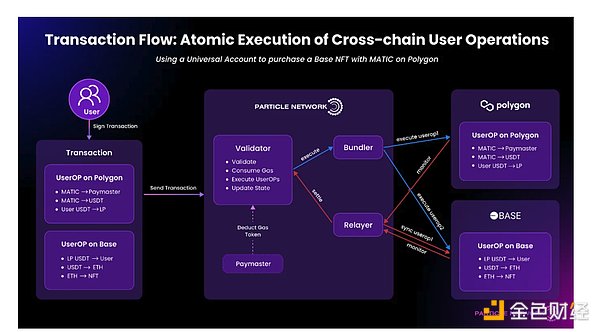

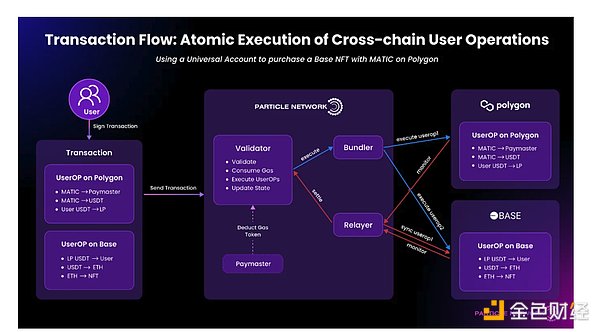

Universal liquidity enables seamless asset flows without manual bridging.

How it works:Universal liquidity does not require users to hold multiple assets on different chains, but instead bundles cross-chain capital into shared liquidity pools that applications can automatically tap into. Think of it as the automation of the bridging process - automatically transferring funds/liquidity from multiple origin chains to meet the conditions of the target transaction (e.g. buying an NFT on Avalanche while holding assets on Base and Polygon).

Real-World Example:

Bob wants to buy an NFT listed on Solana, but all of his funds are on Ethereum and Base.

Rather than manually bridging ETH to Solana, the Universal Liquidity Solution performs the transaction in the background simultaneously with the NFT purchase, eliminating the complexity.

Projects such as Particle Network achieve this by aggregating liquidity across chains through the Bunder node and liquidity provider system (as shown in the figure above), ensuring best execution without user intervention.

3) Universal Gas: Any Token, Any Chain

One of the most common problems in Web3 is gas fees - not only are they costly, but they are also complex to manage. Today, if a user wants to interact with a DeFi application on Polygon, they must first buy MATIC to pay for gas fees, even if they already hold USDC or ETH.

Universal Gas solves this problem by allowing transactions to be paid for with any token.

How it works:

A middleware layer (such as Particle Network's Paymaster) converts gas payments on behalf of users, allowing transactions to be executed with any asset the user holds.

This eliminates the need to acquire gas tokens for a specific chain and greatly improves the user experience.

Real-World Example: User redeems USDC for SOL on a DEX, but only has USDC. Rather than being forced to acquire SOL with gas, they simply approve the transaction and the gas is deducted from their USDC balance.

4) Intent-Based Transactions: The Future of Execution

At the heart of the chain abstraction is the shift to intent-based transactions — users define the outcomes they want, and then solvers compete to execute the trade in the most efficient way.

How it works:Instead of submitting fixed trade orders (e.g., “exchange 1 ETH for 2000 USDC on Uniswap”), users submit high-level intents (e.g., “I want to exchange 1 ETH for USDC at the best price”). The network of solvers finds the best route and executes the trade without the user having to manage the details.

Why this matters:

Reduces trade failures (users don’t have to manually set slippage).

Optimizes execution (solvers compete for the best execution route across chains).

Eliminates network switching (trades can be routed seamlessly across multiple chains).

Real-world example: Vitalik wants to swap ETH for SOL, but instead of manually selecting the best DEX, an intent-based system finds the best path (e.g. swapping ETH to USDC on Ethereum, bridging to Solana, and converting to SOL — all in one seamless transaction).

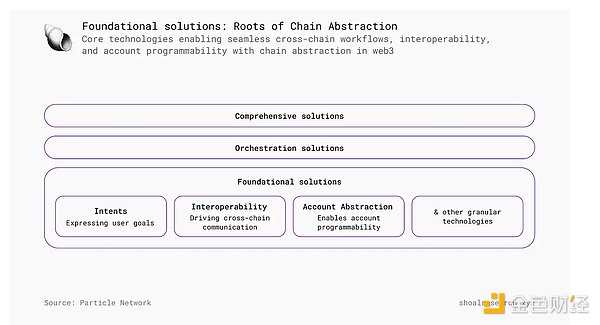

In crypto, intents and chain abstractions are often used interchangeably or in overlapping contexts, but they serve different purposes.

Intents are specifications of what a user wants to achieve, without considering how it will be achieved. For example, a user can state "Exchange 5 ETH for BTC". Intents focus on the outcome, leaving the implementation to intermediaries such as solvers or fillers.

Chain Abstraction (ChA), on the other hand, focuses on hiding the complexity of interacting with multiple blockchains and improving the overall experience for users and developers. It ensures that users and developers do not need to deal with complex details such as bridging assets, managing gas fees, or accessing decentralized liquidity pools.

When intents span multiple chains, they begin to resemble chain abstractions by abstracting away the complexity of execution. For example, a user's intent to exchange tokens between two chains involves interoperability - the cornerstone of chain abstraction. This is where the two concepts overlap, with intent becoming the cornerstone of a comprehensive chain abstraction solution.

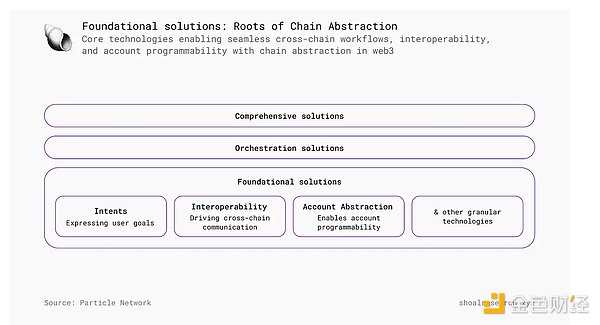

Both intent and chain abstraction play a role in facilitating a smoother multi-chain experience, but their implementation falls into two broad categories: coordinated solutions and comprehensive solutions.

Intent-centric systems look very promising in terms of user experience (UX) but face some key challenges that must be addressed to reach their full potential, such as reliance on centralized servers and solvers, gas and memory pool limitations, lack of gas-free transactions, and scalability bottlenecks.

The Transformative Impact of Chain Abstraction

The evolution of blockchain has been constrained by its user experience (UX) issues. While early adopters have been able to cope with the complexity of multiple wallets, bridging, and gas fees, the next wave of Web3 users will demand a seamless experience similar to Web2 applications. The friction of managing blockchain infrastructure remains a major barrier to adoption. Chain abstraction is not just an incremental improvement, but a fundamental paradigm shift that will impact users, developers, financial institutions, the gaming ecosystem, and even the venture capital market. By eliminating blockchain silos and enabling seamless cross-chain interactions, chain abstraction has the potential to reshape industries and make blockchain technology "invisible" to users while maintaining its decentralized benefits.

Users: A Frictionless Web3 Experience

For the average user, using blockchain-based applications remains a cumbersome process. Performing a simple cross-chain transaction on a decentralized exchange (DEX) requires switching networks, manually approving transactions, paying gas fees in different tokens, and often connecting assets across incompatible ecosystems. These complexities drive users away, forcing them to rely on centralized solutions that offer a smoother experience. Chain abstraction removes these barriers, allowing users to focus on the functionality of the application rather than the mechanics of blockchain infrastructure.

One of the most immediate benefits of chain abstraction is the consolidation of the wallet experience. Instead of having to set up separate wallets for Ethereum, Solana, Avalanche, and Bitcoin, users can interact with all networks through a single universal account. This means that individuals can hold ETH, SOL, AVAX, and BTC in a single wallet interface without having to manage separate key pairs or manually switch networks. Particle Network’s Universal Account is a prime example of this innovation, leveraging an ERC-4337 smart contract wallet to provide a unified experience across chains.

Another game-changer is the seamless flow of assets without the need for network switching. Traditionally, users who want to swap USDC from Ethereum to SOL on Solana need to go through a multi-step process: bridge USDC to Solana, wait for confirmation, and then execute the swap on a Solana-based DEX. With chain abstraction, these steps happen entirely in the background. The system determines the best execution path and completes the swap in a single interaction, optimizing for speed, cost, and efficiency. Solutions like LI.FI’s cross-chain liquidity routing and LayerZero’s messaging layer are already working to create more seamless cross-chain interactions, which chain abstraction protocols can leverage to abstract bridging and provide users with a seamless experience without having to worry about manual bridging.

Another major point of friction is gas fees, which are also abstracted by the universal gas solution. Today, users who want to interact with an Arbitrum-based NFT marketplace must first acquire ETH to pay for gas, even if they already own stablecoins or other assets. Chain abstraction removes this requirement, allowing gas fees to be paid with any token, on any chain. Particle Network’s Universal Gas Paymaster enables users to pay for gas fees with any asset they hold, making blockchain interactions as seamless as credit card transactions.

By abstracting the complexity of blockchains, Web3 applications will eventually offer experiences comparable to Web2 platforms. This shift is critical to mainstream adoption, where users expect financial applications, social platforms, and gaming experiences to function without the technical burden of blockchain mechanisms. Imagine a Web2 social media platform with integrated crypto tipping, where users can send payments across chains without ever seeing a “bridge transaction.” Chain abstraction makes this not only possible, but inevitable.

Developers: “Eat Less Glass”

The complexity of blockchain development has long been a barrier to widespread innovation. Traditionally, developers have to decide which blockchain ecosystem to build on, requiring them to tailor their applications to that network’s specific architecture, tooling, and constraints. If they later decide they want users from different chains to access their application and tap into liquidity, they’ll need to deploy it again on those chains. This means projects launched on Ethereum can’t simply scale to Solana or Avalanche without significant additional development work, forcing teams to maintain separate codebases and navigate different smart contract languages, consensus mechanisms, and execution environments. Chain abstraction removes these limitations, allowing developers to build once and deploy in one place while bringing in users from any ecosystem (even if users have funds on other chains) without having to redeploy their applications elsewhere, fundamentally changing how applications interact with blockchain infrastructure.

Particle Network’s modular execution layer facilitates this approach by automating cross-chain function calls. For example, a lending protocol launched on Ethereum can automatically enable lending functionality between Optimism, zkSync, and Arbitrum without having to implement them separately.

Liquidity fragmentation has historically forced DeFi projects to launch on multiple blockchains to attract users. Today, decentralized exchanges (DEXs) like Uniswap must deploy independent liquidity pools on Ethereum, Polygon, and Base — all operating in silos, leading to inefficiencies and price discrepancies. Chain abstraction eliminates this problem by aggregating liquidity across all chains, ensuring users always get the best execution, regardless of where the trade originates. LI.FI’s liquidity aggregation protocol and Socket’s Modular Order Flow Auction (MOFA) are already working to unify liquidity across a fragmented ecosystem, ensuring developers can offer deeper, more efficient markets without having to manually deploy to multiple networks.

For developers new to Web3, wallet integration and smart contract deployment have historically been a steep learning curve, requiring understanding of chain-specific architectures, gas optimization, and security best practices. Chain abstraction lowers these barriers by providing developer tools to abstract the complexity of managing different blockchain environments.

In addition, account abstraction significantly improves the developer experience by removing the limitations of traditional externally owned accounts (EOA). With ERC-4337 Smart Wallets, applications can provide programmable, policy-based execution, enabling use cases such as social login, subscription-based payments, and automatic trade execution. This means that developers building subscription-based NFT membership services can allow users to pay for gas with any token they hold, while also setting up recurring payments - features that are not possible with today's standard EOA wallets.

The industry is rapidly accepting Smart Accounts as the new standard for user-friendly programmable wallets. As account abstraction grows in popularity, key developments are accelerating this shift. One of the most exciting releases is Ethereum's upcoming upgrade EIP-7702, which will be launched on Holesky and Sepolia as part of the Pectra hard fork in the coming weeks. This upgrade marks a key moment in Ethereum's journey towards account abstraction, a breakthrough that aims to make the on-chain experience smoother, smarter, and more convenient. Specifically, EIP-7702 enables externally owned accounts (EOAs) to use smart contract account functionality.

The existing AA standard ERC-4337 has a limitation: it requires the creation of new wallets because it is not backwards compatible with EOA.

EIP-7702 is designed to complement ERC-4337 and make account abstraction functionality more accessible to users. It removes this limitation without making deeper changes to the consensus logic of the EVM:

Existing EOAs simply delegate smart contract logic via a delegation indicator.

The convergence of universal smart contract execution, aggregated liquidity, and wallet abstraction means developers can focus on building great applications rather than dealing with blockchain-specific limitations. A new wave of applications will emerge where developers no longer have to decide whether to build on Ethereum or Solana - they can simply build for the entire Web3.

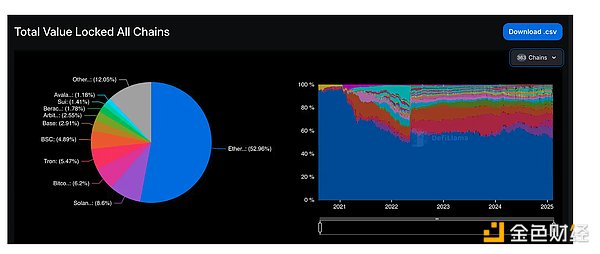

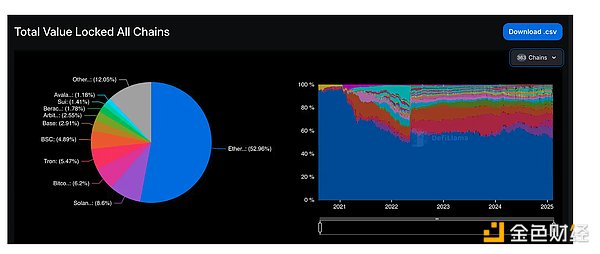

DeFi and Financial Markets: Unleashing Capital Efficiency

Decentralized Finance (DeFi) has revolutionized global financial markets by enabling permissionless lending, trading, and yield generation. However, cross-chain liquidity fragmentation remains a major bottleneck, forcing users and protocols to work in silos, reducing capital efficiency, and leading to inconsistent pricing across networks. Chain abstraction directly addresses these inefficiencies by aggregating liquidity across ecosystems, enabling seamless cross-chain transactions, and optimizing capital flows in ways that were previously impossible.

One of the biggest obstacles facing DeFi today is that liquidity is isolated on different chains, resulting in a fragmented market. Lending protocols like Aave currently require separate instances to be deployed on Ethereum, Avalanche, and Polygon, each with independent liquidity pools. This fragmentation forces users to manually bridge assets to access lending opportunities on different networks, which increases complexity and risk. Particle Network’s universal liquidity layer eliminates this problem by allowing users to borrow from lenders on multiple chains without manually transferring funds. Borrowers are no longer limited to the liquidity of a single chain, but can instead tap into cross-chain lending pools, with execution handled seamlessly in the background.

Similarly, cross-chain trading remains one of the most frustrating experiences for users, as decentralized exchanges (DEXs) still operate in silos. Today, if traders want to convert ETH on Ethereum to SOL on Solana, they need to use a centralized exchange (CEX) like Binance or manually bridge their assets through a third-party protocol, incurring fees and delays. Chain abstraction removes this friction by allowing DEXs to aggregate liquidity across all chains, meaning users can trade assets natively without switching networks. LI.FI, Connext, and Across Protocol are already working on routing cross-chain trades in the background, ensuring users get best execution without having to interact with bridges.

Beyond trading and lending, yield optimization is another major pain point that chain abstraction solves. Today, yield aggregators like Yearn Finance or Beefy Finance must maintain separate strategies for each blockchain, and users need to manually move funds to chase the best returns. With intent-based trading and automatic execution, DeFi users can deposit assets once and solvers will automatically route them to the most profitable opportunities across chains. Particle Network’s universal yield aggregation model aims to achieve this goal, allowing users to earn yield without having to manage chain-specific deployments or bridge assets.

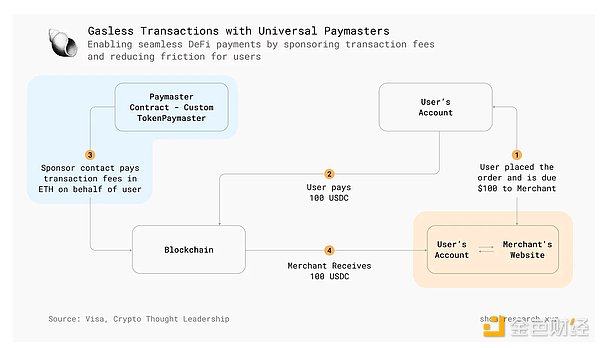

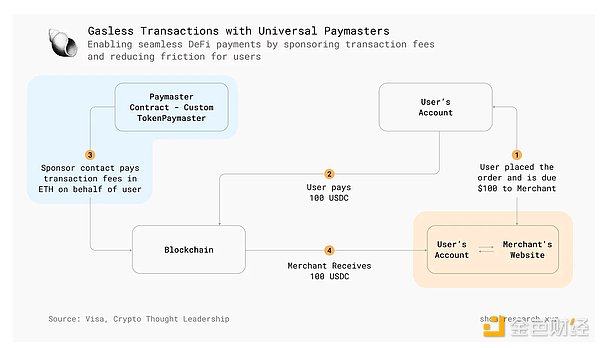

Another challenge in DeFi is that gas fees can create an unpredictable cost structure, making trading expensive and sometimes even unprofitable. When using any asset on-chain, let’s say you want to send an ERC-20 token $X from Ethereum, you must pay for gas in the native currency of that chain (in this case, ETH). Many users abandon transactions because they may not have any liquid native tokens to pay for gas. The Universal Gas Paymaster solution removes this complexity by allowing users to pay transaction fees in any token, making DeFi interactions more seamless. This is especially important for institutional players who need cost predictability before committing large amounts of capital to on-chain strategies. Universal Gas Paymaster is also useful for networks or dApps that plan to implement gasless transactions to support user acquisition. This concept, called Sponsored Transaction Fees, shown in the figure below, is a proven way to support user growth by lowering the barrier to entry for potential users and the cost of conversion.

Chain abstraction not only improves the DeFi experience for individual users, it also makes decentralized finance more attractive to institutions. Many hedge funds, asset managers, and corporate treasuries have been reluctant to allocate capital to DeFi due to the operational complexity of managing assets across multiple chains. With chain abstraction, institutions can interact with DeFi through a unified execution layer, reducing onboarding friction and ensuring that liquidity is always deployed in an optimal manner.

Chain abstraction fundamentally improves the capital efficiency of DeFi by eliminating liquidity fragmentation, optimizing trade execution, and enabling cross-chain lending and yield strategies. This shift ensures that DeFi can compete with traditional financial markets in terms of liquidity depth, execution speed, and user experience, ushering in a new era of frictionless, interoperable financial markets.

Games and Web3 Experience: Multi-Chain Metaverse

From the early days of online multiplayer games to the rise of esports and virtual economies, the gaming industry has been at the forefront of technological innovation. However, blockchain gaming has yet to reach its full potential due to network isolation, with in-game assets, currencies, and economies trapped in specific chains. This lack of interoperability forces players to use complex bridging mechanisms, hindering mainstream adoption. Chain abstraction provides a solution that enables seamless multi-chain gaming experiences, allowing players to interact with blockchain-based assets without having to worry about the underlying network.

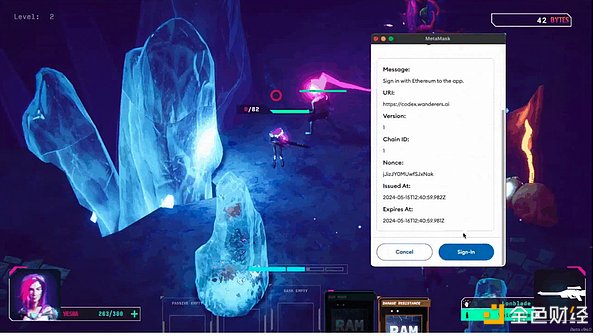

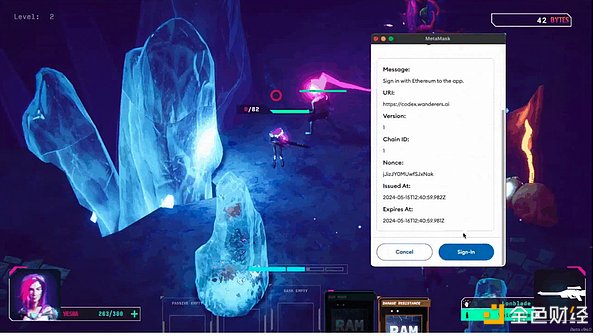

A major limitation of today's Web3 games is that in-game assets (such as NFTs and tokens) are limited to a single chain. If a player acquires an NFT skin in a Solana-based RPG, they cannot easily transfer or sell it on an Ethereum-based marketplace without going through multiple bridging steps. This limits the liquidity and utility of digital assets across different ecosystems. Particle Network’s universal accounts and cross-chain liquidity layer solves this problem, ensuring that NFTs and tokens can be accessed across multiple chains without manual transfers, effectively turning blockchain infrastructure into an invisible backend layer. This will allow players to use NFT avatars acquired on Immutable X in games hosted on Polygon without having to manually migrate assets. Gas fees and transaction approvals are another major friction point for blockchain games. Traditional gamers are accustomed to instant transactions and seamless in-game purchases, while blockchain games often require multiple wallet approvals, network switches, and gas fee payments to perform simple actions.

While most of the limitations associated with transaction approval have been addressed by account abstraction, the chain abstraction protocol is building on that functionality and adding more benefits to provide users with a unified, seamless experience.

With a universal gas solution, gamers will no longer need to hold a chain's native token to pay for transactions. For example, players can use USDC to purchase in-game weapons on an Arbitrum-based NFT marketplace without having to pay gas fees with ETH. This level of abstraction mirrors the one-click purchase experience of traditional online stores, making blockchain games more attractive to mainstream users.

Interoperability is also key for game studios looking to build multi-chain experiences. Today, game developers must choose a single blockchain to build on, locking their user base into that ecosystem. This limits growth potential and forces developers to either maintain multiple versions of their games on different chains or rely on complex bridging solutions. Chain abstraction allows game studios to develop chain-agnostic games, meaning players on Ethereum, Solana, or Avalanche can interact frictionlessly in the same game economy. UniversalX and LayerZero’s messaging layer are already exploring solutions that allow game assets and currencies to flow freely between different blockchain ecosystems, enabling a true multi-chain metaverse.

The impact of chain abstraction on Web3 games is not limited to asset transfers, it also enhances player ownership and monetization models. In traditional games, digital assets are locked in centralized servers and players have no real ownership of in-game items. Blockchain games introduce player-owned economies where assets are verifiably scarce and tradable. However, without chain abstraction, these assets will remain stuck in their original ecosystems, limiting their long-term value. By ensuring cross-chain compatibility of in-game economies, chain abstraction allows players to take their assets wherever they want, reinforcing the idea of true ownership in the digital space. The future of Web3 gaming depends on removing friction and delivering an experience comparable to traditional gaming platforms. Players should be able to log in, transact, and play games without having to think about the blockchain, gas fees, or network switches. Chain abstraction ensures that the blockchain is invisible to end users, allowing game developers to focus on storytelling, gameplay, and community building rather than blockchain infrastructure. By abstracting complexity, Web3 games can rival traditional AAA games, opening the door to mainstream adoption and ushering in a new era of player-driven economies.

Venture Capital: Less Infrastructure Spending, More Consumer dApps

The Web3 ecosystem has seen an influx of venture capital (VC) funding, with investors pouring billions of dollars into blockchain infrastructure, decentralized applications, and digital assets. However, despite growing institutional interest, capital inefficiencies and fragmented liquidity across multiple chains have hampered mass adoption by traditional financial (TradFi) players. Chain abstraction changes this dynamic by removing operational barriers, optimizing capital deployment, and making blockchain-based financial instruments more attractive to institutions.

One of the main obstacles facing institutional investors in Web3 is navigating multi-chain liquidity and asset management. Unlike traditional financial markets, where capital can flow freely between asset classes with minimal friction, blockchain investing is currently fragmented across multiple layer 1 and layer 2 ecosystems. Investment firms looking to deploy capital into on-chain yield opportunities must allocate funds separately across Ethereum, Solana, Avalanche, and other networks, often requiring manual bridging, network-specific custody solutions, and different execution strategies for each ecosystem. Particle Network’s universal liquidity layer solves this problem by allowing institutions to seamlessly deploy capital across chains, ensuring liquidity is always optimally allocated without manual intervention.

Institutional investors also require cost predictability and risk mitigation strategies, both of which are difficult to manage in today’s gas-fee-intensive and execution-uncertain blockchain environment. High volatility in transaction costs, especially on a congested network like Ethereum, makes on-chain finance strategies unpredictable and difficult to scale. Chain abstraction solves this problem by introducing gas abstraction models (such as Universal Gas Paymasters) that allow institutions to execute trades without holding chain-native assets. This means that hedge funds can rebalance DeFi portfolios across multiple chains while paying gas fees in USDC or other stable assets, creating a more predictable and controllable operating environment.

Another major benefit of chain abstraction is enhanced trade execution and settlement of on-chain financial products. Institutional investors looking to enter DeFi have traditionally faced problems with fragmented liquidity, front-running risk, and inefficient execution paths. Today, executing large trades on-chain often results in slippage, price impact, or trade failures due to network congestion. With intent-based trade execution models, such as those pioneered by CoW protocols and LI.FI, institutions can express execution goals (e.g., exchange $10 million of ETH for USDC at the best available price), and then a network of solvers compete to complete that order under the best conditions. This prevents MEV exploitation, reduces execution risk, and ensures institutional-grade trade settlement.

Beyond trade execution, institutional adoption of DeFi lending and staking is limited by the complexity of managing multiple yield sources across different chains. Today, funds seeking to earn liquidity staking rewards on Ethereum (Lido), Solana (Marinade), and Cosmos (Stride) must manually allocate assets, bridge funds, and monitor yield volatility. Chain abstraction enables cross-chain yield aggregation, where liquidity providers can automatically access the highest yield opportunities across multiple networks without having to manually transfer assets. Particle Network’s intent-based execution ensures that capital is automatically deployed where the highest returns are generated, providing institutions with a frictionless experience to maximize yield.

From a regulatory perspective, chain abstraction also reduces the compliance risks associated with cross-chain transactions. Many institutions are reluctant to interact with DeFi due to unclear reporting requirements and the difficulty of tracking on-chain activity across multiple networks. With a unified settlement layer, compliance teams can monitor all blockchain activity through a single interface, making it easier to manage risk exposure, conduct audits, and report transactions in accordance with regulatory requirements.

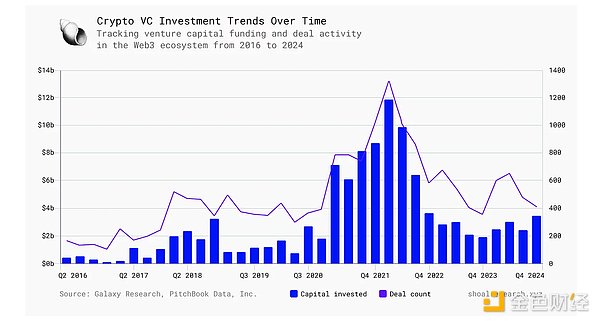

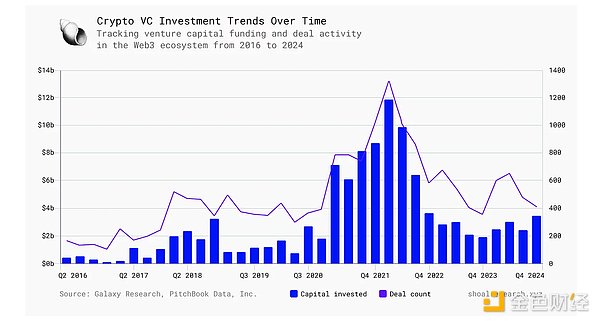

As crypto-native VCs continue to allocate capital to infrastructure projects, chain abstraction is becoming a top investment priority. Crypto VC funding grew 46% quarter-over-quarter in Q4 2024, with a large portion of that funding coming from cross-chain infrastructure projects. Investors are betting that seamless interoperability will be the defining trend in the next phase of Web3 growth, increasing efficiency, capital liquidity, and institutional participation.

Ultimately, chain abstraction transforms blockchain from a set of fragmented ecosystems into a unified, seamless financial infrastructure, making it more attractive to institutional investors, traditional financial players, and hedge funds. By eliminating capital inefficiencies, reducing operational complexity, and optimizing trade execution, chain abstraction positions Web3 as a viable alternative to traditional financial markets—not only for retail users, but also for global financial institutions looking to deploy capital in the digital economy.

Challenges and Considerations

While chain abstraction has the potential to transform blockchain infrastructure by consolidating liquidity, increasing transaction efficiency, and improving overall system availability, its widespread adoption also presents some key challenges. The transition to a fully abstracted blockchain ecosystem presents challenges in terms of security, decentralization, solver network dynamics, regulatory compliance, and long-term economic sustainability. Effectively addressing these issues is critical to ensuring that chain abstraction solutions maintain their trustless, permissionless, and scalable characteristics while preserving the fundamental principles of blockchain technology.

Security Risks and MEV Exploits

One of the most critical challenges facing chain abstraction is security. Today, bridges are one of the most vulnerable components in the blockchain ecosystem, with losses from bridge hacks exceeding $2.5 billion in the past two years. As chain abstraction inherently relies on cross-chain execution and liquidity routing, security risks associated with bridges and interoperability solutions remain a major concern.

The introduction of intent-based trading and solver networks also introduces new attack surfaces. While solvers compete to complete transactions under the best conditions, malicious solvers may attempt to manipulate pricing, preempt user intent, or extract MEV (maximum extractable value) at the expense of users. In traditional blockchains, the exploitation of MEV leads to severe inefficiencies, including sandwich attacks, priority gas auctions, and transaction slippage. If solver networks are not designed properly, they may become centralized rent-seeking entities, extracting excessive value and harming users instead of benefiting them.

To mitigate these risks, cryptographic mechanisms such as private memory pools, zero-knowledge proofs, and fair order sorting must be implemented in solver networks. For example, the batch auction model of the CoW protocol minimizes MEV by executing transactions in a way that reduces adversarial trading strategies. Similarly, Particle Network's cross-chain execution framework employs cryptographic proofs to ensure that solvers operate transparently and cannot manipulate order flow.

Decentralization Tradeoff

Another major consideration for chain abstraction is the potential centralization of the execution network. Currently, many cross-chain execution systems rely on a small set of relayers, validators, or sequencers to facilitate transaction settlement. If too few entities control the infrastructure required for cross-chain execution, chain abstraction risks becoming a permissioned, gated ecosystem rather than a truly decentralized protocol.

For example, LayerZero, one of the most widely adopted cross-chain messaging protocols, relies on a “relay and oracle” system where trusted entities pass messages between chains. While this ensures efficiency, it also introduces potential centralization risks. Optimistic execution models, where transactions are executed on-chain and subsequently verified, offer a potential solution. EigenLayer’s shared security model and Babylon’s Bitcoin secure verification are promising developments that can spread trust across a larger network of validators, reducing reliance on any single entity.

The balance between efficiency and decentralization has long been a point of debate. While centralized solvers and execution networks can improve speed and reliability, they also introduce points of failure and governance risks. Open, permissionless solver networks must be designed to prioritize censorship resistance while maintaining high execution efficiency.

Regulatory and compliance uncertainty

Since chain abstraction enables large-scale cross-chain execution, regulators may introduce new oversight measures to ensure compliance with AML (anti-money laundering) and KYC (know your customer) requirements. Financial regulators may view intent-based transactions and solver-driven execution models as opaque financial instruments, especially if users interact with multiple chains through a single execution layer without clear judicial oversight.

The main regulatory concern is liability for cross-chain execution failures. If a user submits an intent and the solver fails to execute it correctly, who should be held responsible for the lost funds? Unlike centralized exchanges (CEXs), where regulations require protection of failed trades, decentralized solver networks exist in a gray area without a clear legal framework. Additionally, as capital flows frictionlessly between chains, regulators may seek to enforce cross-border transaction tracking, which could impact the privacy-first nature of blockchain transactions.

Protocols that implement compliance-friendly solutions, such as zero-knowledge compliance proofs or opt-in regulatory frameworks, may win favor with institutional investors while retaining the core ethos of decentralization. Polygon’s AggLayer is exploring solutions that allow institutions to interact with DeFi in a compliance-compliant manner, demonstrating how chain abstraction may need to balance privacy, transparency, and regulatory oversight.

Economic viability and long-term sustainability

The sustainability of chain abstraction models is another key factor. Many chain abstraction solutions rely on intent-based execution networks, where solvers compete to execute trades. However, the economic incentives that drive solver participation must be carefully designed to ensure long-term sustainability.

If solvers are not sufficiently rewarded for executing transactions, network participation may decline, reducing execution quality and efficiency. Conversely, if the solver network is over-incentivized, they may charge excessive fees, leading to inefficiency and rent-seeking behavior, similar to Ethereum's MEV crisis. A carefully calibrated fee mechanism (such as dynamic solver rewards adjusted to execution demand) can help maintain a competitive and sustainable ecosystem.

In addition, the costs of running cross-chain infrastructure must be incorporated into the long-term incentive model. Running secure, decentralized execution nodes requires a lot of resources, and the network must ensure that the revenue generated by transaction execution exceeds the operating costs. The introduction of modular blockchains and shared security models (such as Celestia's data availability layer) can reduce the overhead required to maintain the solver network and ensure its long-term viability.

The Road Ahead: Addressing Challenges to Unleash the Full Potential of Chain Abstraction

Despite these challenges, the industry is moving quickly to mitigate risk and ensure chain abstraction remains decentralized, secure, and economically sustainable. Innovative projects are already implementing cryptographic safeguards, open solver networks, and compliance solutions to strike the right balance between efficiency and trustlessness.

As with any paradigm shift, the path to full adoption will require constant iteration, security improvements, and thoughtful economic design. If the industry can successfully address these issues, chain abstraction has the potential to be one of the most transformative innovations in Web3, creating a future where users, developers, and institutions can seamlessly interact with blockchains — without having to think about the underlying complexities.

The Future of Web3 Is Unclear

The blockchain industry is at a critical juncture. While decentralized technologies have unlocked permissionless finance, digital ownership, and new economic models, they remain mired in complexity. The need to bridge assets, switch networks, manage multiple wallets, and understand gas fees has fragmented Web3, slowing mainstream adoption. Chain abstraction changes this paradigm by making blockchain infrastructure invisible, allowing users to seamlessly interact across chains without having to know which network they are on.

Just as cloud computing abstracts away server management, chain abstraction eliminates blockchain silos, ensuring that applications, not chains, become the focal point of the user experience. As this technology matures, Web3 will no longer be a space dominated by protocol-specific barriers, but a unified ecosystem where users, developers, and institutions can interact effortlessly. Universal accounts, seamless liquidity routing, intent-based transactions, and gas abstraction will ensure that the complexity of blockchains is hidden beneath an intuitive, frictionless layer—unlocking the next era of mass adoption.

From an investment perspective, venture capital is already poised for this shift, with billions of dollars flowing into cross-chain infrastructure, modular execution layers, and liquidity aggregation protocols. Institutional players are eyeing the potential of a unified financial market where capital moves on-chain just as efficiently as it does in traditional markets. Meanwhile, games, social platforms, and DeFi protocols are preparing for a world where users no longer have to think about which chain they’re interacting with — they just interact with the application.

If chain abstraction solutions like Particle Network succeed, the concept of “using a blockchain” will become obsolete. Just as today’s internet users don’t need to know if their favorite website is hosted on AWS or Google Cloud, future Web3 users won’t need to care if they’re interacting on Ethereum, Solana, or Avalanche. Blockchains will fade into the background, leaving only the applications, financial instruments, and digital experiences that users want.

Chain abstraction isn’t just about reducing friction, it’s about creating a seamless user experience. While some argue that it abstracts risk by limiting users’ ability to assess individual chains, that’s not entirely true. Most users don’t want to analyze the risk of each chain — they just want to use applications efficiently.

For those who wish, chain abstraction remains a UX feature, not a limitation. Users can still do their due diligence and maintain control if they wish.

The only question now is: who will lead this transition? The race to full chain abstraction is on, and the projects that solve these challenges first will determine the future of Web3.

Miyuki

Miyuki