Author: Anthony Pompliano, Founder and CEO of Professional Capital Management; Translated by Shaw Jinse Finance

I spend a lot of time trying to answer the question: "What's going on in the financial markets?" Some believe we're in the midst of a tech-driven economic boom that will last for years, while others believe everything is overvalued and a major market crash is imminent.

It's this passionate disagreement that keeps me interested. The market is ultimately the referee, so it will determine the winners, but I'm always trying to make sure I'm on the right side.

Let's start with one of the negative views on the market. “The forward P/E ratio for the S&P 500 is now at the same level as it was in January 2021,” explained Kevin Gordon of Charles Schwab. “And the effective fed funds rate is now 4.09%… it was only 0.09% in January 2021.” Kevin Gordon believes this is a major red flag. He wrote: "Market valuations are essentially higher than they were in 2021. Investors are counting on AI to drive earnings growth at an unprecedented rate. But we haven't seen that yet, and I don't think we'll see it in the short term. . . Now is the time to be cautious, not greedy."

"But I don't know if people should be as pessimistic about these data as they appear." Kevin Gordon went on to explain: "Expected profit margins for the S&P 500 have been rising sharply and have hit record highs."

![]()

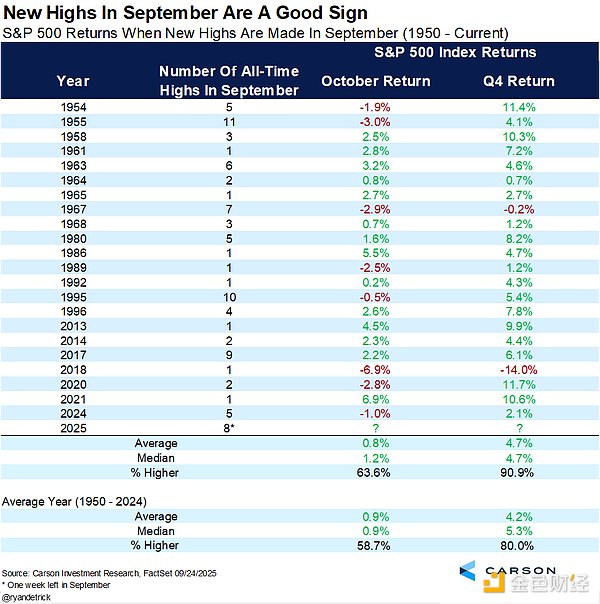

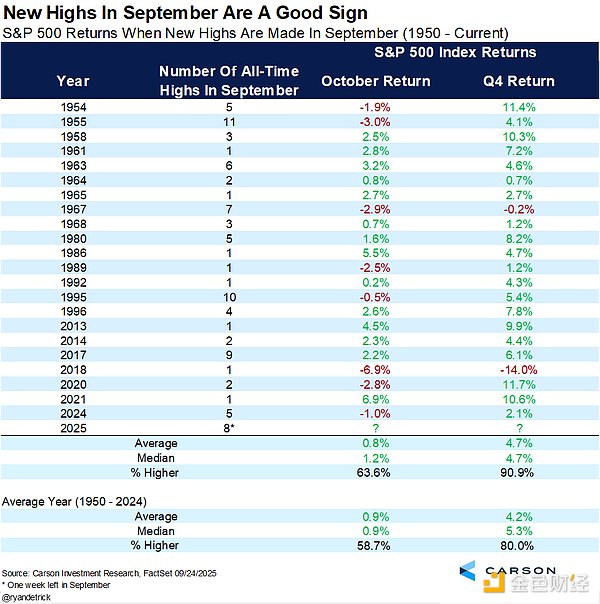

September's record high was driven by sustained market buying. Bloomberg reported: "The S&P 500 has fallen 2% or less for 107 consecutive trading days, the longest such streak in more than a year."

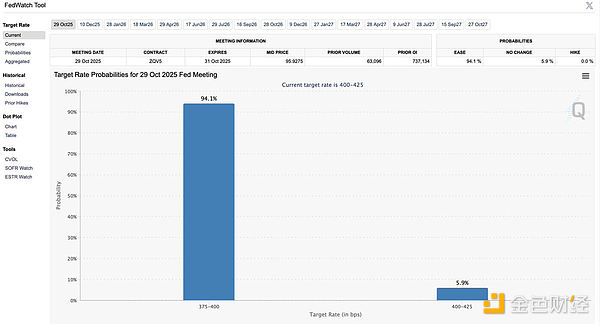

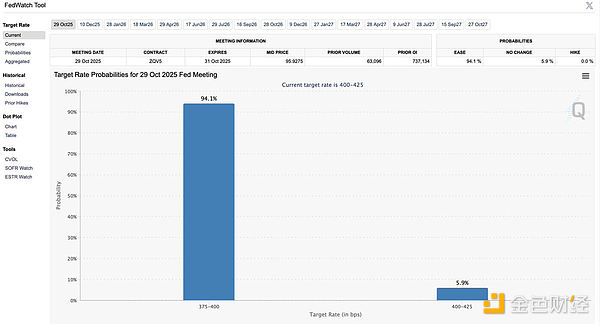

The backdrop for the continued bullish momentum is that the consensus probability of an October rate cut is currently 94%.

A lot of people will look at these economic data and say, “This time is different.” They’ll point to some strange political policies or criticisms of the current administration, but these are just noise.

Ryan Detrick said that the stock market will rise during almost every president’s term, whether they are Republican or Democrat. Don't let politics ruin your portfolio. The structure of stocks is such that they're poised for continued gains over a long period of time. Perhaps most importantly, consumer enthusiasm suggests that bullish sentiment is justified. We saw an upward revision to real GDP for the second quarter, to 3.8%, well above the 3.3% economists had forecast. So, we're seeing consumer spending far exceeding expectations, rising incomes, and declining imports. To me, these are all positive developments. Looking back at the economic data, I understand why some are bearish. But I still think they are wrong. Let's wait and see. Time will tell, and the market will give the final answer.

Weatherly

Weatherly