Author: Matt Crosby, Bitcoin Magazine; Translator: Deng Tong, Golden Finance

With six-digit Bitcoin prices becoming the norm and higher prices seemingly inevitable, analysis of key on-chain data provides valuable insights into the underlying health of the market. By understanding these indicators, investors can better predict price action and prepare for potential market peaks and even any upcoming pullbacks.

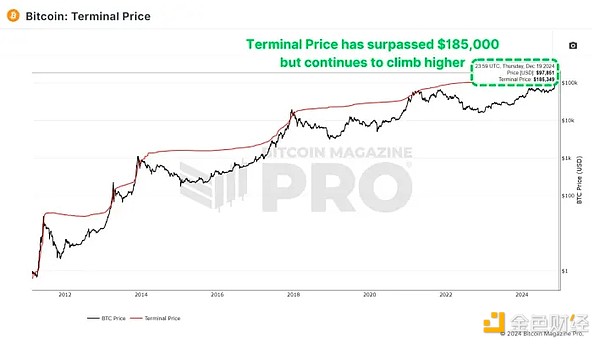

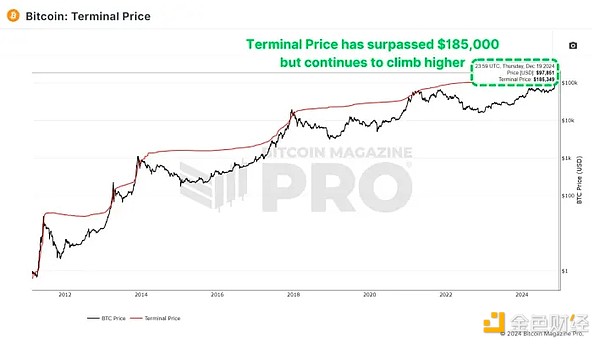

Terminal Price

The terminal price metric combines the number of days of coin destruction (CDD) while taking into account the supply of Bitcoin, and has historically been a reliable indicator for predicting the peak of Bitcoin cycles. The number of days of coin destruction measures the speed of token transfers, taking into account both the holding time and the number of Bitcoins moved.

Figure 1: Bitcoin terminal price has exceeded $185,000.

Currently, the terminal price has exceeded $185,000 and may rise to $200,000 as the cycle progresses. Since Bitcoin has already broken through $100,000, this means that we may still have a few months of positive price action in the future.

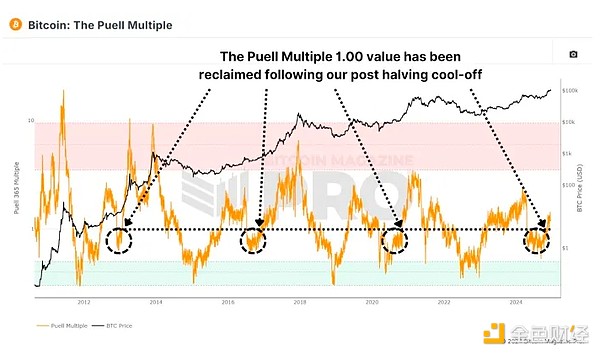

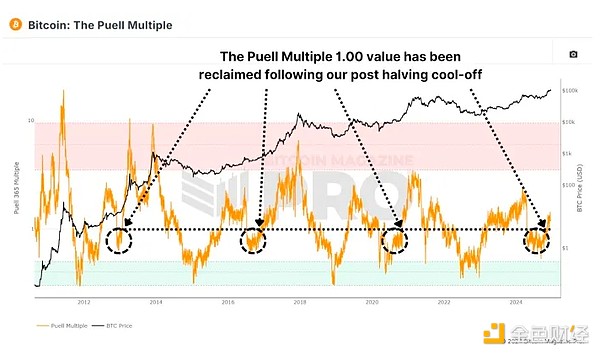

PUELL MULTIPLE

The Puell Multiple assesses the ratio of miners’ daily revenue (in USD) relative to its 365-day moving average. After the halving event, miners’ revenue dropped sharply, leading to a period of consolidation.

Figure 2: The Puell Multiple has climbed above 1.00.

Now, the Puell Multiple has risen back above 1, indicating a return to profitability for miners. Historically, crossing this threshold has indicated a late stage in a bull cycle, typically marked by exponential price gains. Similar patterns have been observed in all previous bull markets.

MVRV Z-Score

The MVRV Z-Score measures market value relative to realized value (the average cost basis of Bitcoin holders). Normalized to a Z-Score to account for the asset's volatility, it is highly accurate in identifying cycle peaks and troughs.

Figure 3: MVRV-Z score is still far below the previous peak.

Currently, Bitcoin's MVRV Z-score is still below the overheated red zone, at around 3.00, indicating that there is still room for growth. Although declining peaks have been a trend in recent cycles, the Z-score suggests that the market is far from reaching a euphoric peak.

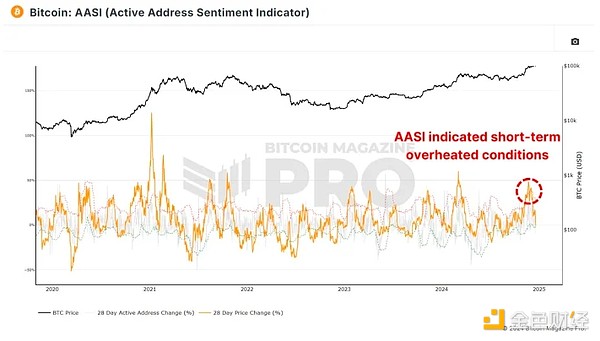

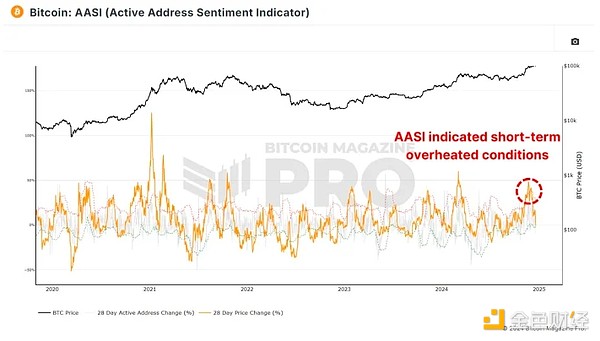

Active Address Sentiment

This indicator tracks the 28-day percentage change in active network addresses and the price change over the same period. When price growth outpaces network activity, it suggests that the market may be overbought in the short term as positive price action may not be sustainable given network utilization.

Figure 4: AASI suggests overheated conditions above $100,000.

Recent data shows that the market has cooled slightly after Bitcoin's rapid climb from $50,000 to $100,000, suggesting that the market is in a healthy period of consolidation. This pause could set the stage for continued long-term growth and does not mean we should be pessimistic about the medium to long term.

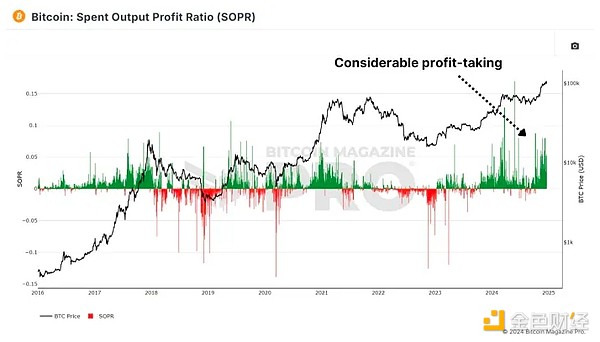

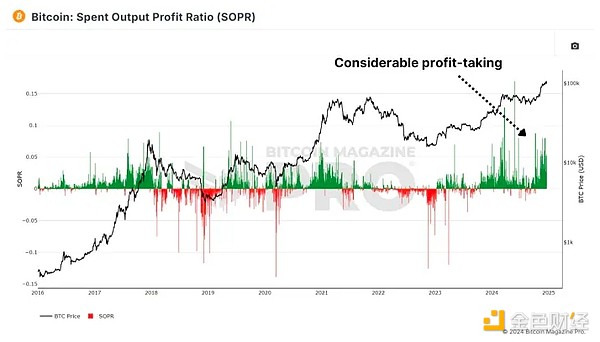

Spent Output Profit Rate

The Spent Output Profit Rate (SOPR) measures realized profits from Bitcoin transactions. Recent data shows an increase in profit-taking, which could indicate that we are entering the late stages of the cycle.

Figure 5: SOPR Massive Profit-Taking Cluster.

One issue to consider is the growing use of Bitcoin ETFs and derivatives. Investors may move from self-custody to ETFs for ease of use and tax benefits, which could impact SOPR value.

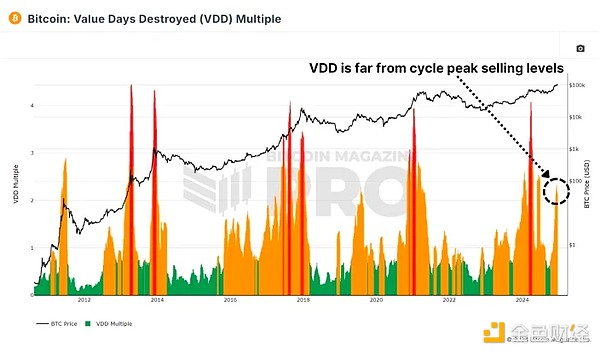

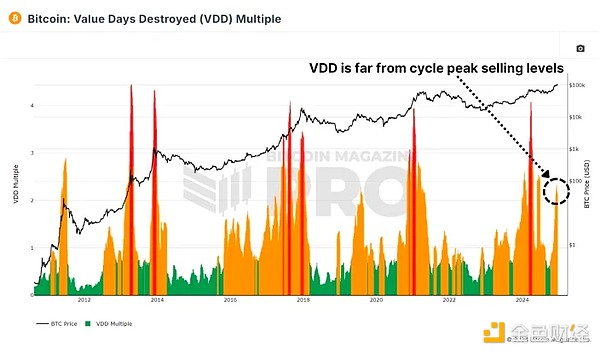

Value Destroyed Days

The Value Destroyed Days (VDD) multiple scales CDD by weighting larger long-term holders. When this indicator enters the overheated red zone, it often signals a major peak in price as the market's largest and most experienced players begin to cash out.

Figure 6: VDD is a little hot, but not too hot.

While Bitcoin's current VDD levels suggest the market is slightly overheated, history suggests that Bitcoin could remain in this range for months before reaching a peak. For example, in 2017, VDD indicated overbought conditions nearly a year before the cycle peaked.

Summary

Taken together, these indicators suggest that Bitcoin is entering the late stages of a bull market. While some indicators suggest a short-term cooling or slight overextension, most suggest considerable upside potential through 2025. Key resistance for this cycle is likely to occur between $150,000 and $200,000, with indicators such as SOPR and VDD providing clearer signals as we approach the peak.

Weatherly

Weatherly