Author: MARCEL PECHMAN; Source: cointelegraph; Compilation: Mars Finance, Daisy

Solana's on-chain and derivatives indicators show no signs of stress, which could pave the way for a rise to $160. The native token of the Solana network has not been able to close above $145 since July 3. This poor performance is partly due to the decline in investor interest in cryptocurrencies, which has caused the industry's total market value to fall by 5% in 9 days. Despite this, SOL still underperformed its competitors between July 3 and July 12, falling 7.8%, while BNB and Ethereum fell 6.5% during the same period. Traders are now worried that SOL's bearish momentum will continue even if the broader cryptocurrency market has reversed. Nonetheless, Solana’s on-chain metrics and SOL’s derivatives suggest that a reversal could be underway, paving the way for a bull run that last topped $160 five weeks ago.

Solana TVL is head to head with the vice-leader BNB Chain

Some Solana SPL tokens have severely underperformed, which explains the reduced demand for SOL. When Solana ecosystem participants lose money, there is less money circulating in their decentralized applications, which negatively impacts demand for SOL. Highlights between July 3 and July 12 include Dogwifhat ( WIF ) falling 24%, Helium (HNT) falling 18%, and Jito (JTO) pulling back 18%.

Overall, SOL remains the fourth-largest cryptocurrency (excluding stablecoins) with a market cap of $65 billion. Competitors Toncoin holds $18.4 billion, Tron holds $12 billion, and Avalanche holds $10.1 billion. In addition, on July 5, Solana's total locked value (TVL) was equal to BNB Chain for the first time, and the gap has been small since then. Solana vs. BNB Chain. Total value locked, USD. Source: DefiLlama According to DefiLlama, BNB Chain will have more than double the TVL of Solana by the end of 2023. The $2 billion gap in favor of BNB Chain has now disappeared, meaning traders are deploying more capital on the Solana network. Solana highlights include liquidity staking Jito, which holds $1.6 billion in deposits, followed by Marinade, which holds $1.1 billion, and Kamino, which also has a TVL of nearly $1.1 billion.

Tron is second with $7.6 billion in TVL, but 72% of that comes from a single decentralized finance (DeFi) app, JustLend. Analysts have strong concerns about this, as 94% of its deposits come from wrapped versions of Bitcoin, which lack hard evidence of reserves. Essentially, Solana is directly competing with BNB Chain for the second position in deposits.

Solana network activity grew in terms of users and volumes

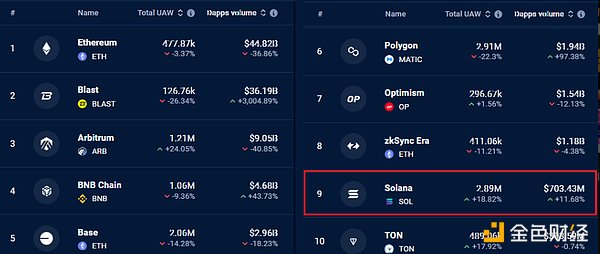

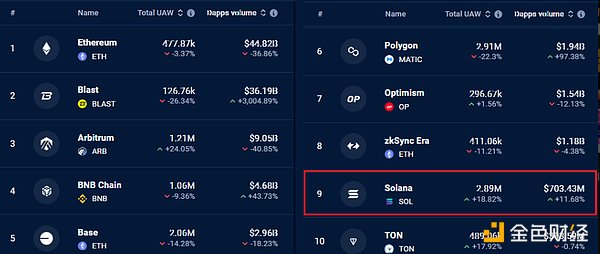

Solana is far from a top contender in terms of decentralized application (DApps) activity, but its metrics have improved over the past seven days while most competitors have faced declines.

Top blockchains by 7-day DApps transaction volume (in USD). Source: DappRadar

Data shows that Ethereum, BNB Chain, and Polygon have all seen a decline in the number of active users, while Solana has grown 19% over the past 7 days. Similarly, Solana DApps transaction volume totaled $703 million in the same period, up 12% from the previous 7 days. Meanwhile, market-leading competitor Ethereum saw a 37% drop in transaction volume.

Related: Cryptocurrency Trading Volume to Exceed $108 Trillion in 2024, Europe Leads

Solana’s decentralized exchange Raydium gathered an impressive 1.71 million active addresses in seven days, an increase of 39%. In comparison, BNB Chain’s leading DApp Move Stake had 198,570 active addresses in the same period.

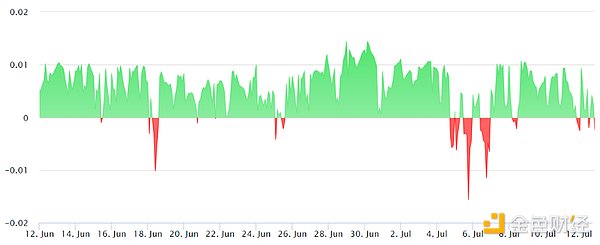

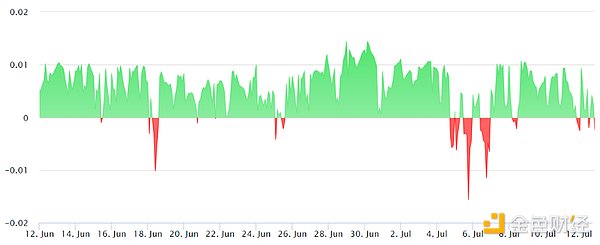

Finally, SOL’s futures market should be analyzed. Perpetual contracts (also known as inverse swaps) contain an embedded interest rate that is recalculated every eight hours. Essentially, negative interest rates indicate that shorts (sellers) are using higher leverage.

SOL perpetual futures 8-hour financing rate. Source: Laevitas.ch

It is worth noting that SOL's eight-hour financing rate turned negative between July 5 and July 6, but the indicator is currently close to zero, indicating a balance of demand between longs (buyers) and shorts. While it is impossible to determine what might cause SOL investors to regain confidence and push its price back to $160, on-chain and derivative indicators do not show any signs of stress.

XingChi

XingChi