Article source: ZHEV, Dose of DeFi; Translation: Golden Finance xiaozou

Transaction fees are necessary to support even the most basic activities on the blockchain, as they enable users' transactions to be granted validity and included in blocks. The main purpose of these fees is to inhibit "spamming"; it is also part of the subsidy paid to validators to build/validate blocks. In a sense, these network fees are similar to rent; users pay to obtain a limited commodity per unit of time. In this case, the commodity is "block space", which, as the name suggests, refers to the space on the block.

We evaluated block space on the two largest smart contract blockchains - Ethereum and Solana. As we dug deeper, we learned that the fee market - organically designed within the protocol and from the bottom up - enables validators to exploit their access to block space.

Solana’s fee market is optimized for high performance and is designed to avoid the problems that arise on Ethereum. However, while the Solana market may ultimately perform better than the Ethereum market, it still needs to go through a similar MEV transformation as its peers (validators begin to exploit their privileged position). Solana does not have to go the Proposer-Builder Separation (PBS) route chosen by Ethereum, but it needs to take a comprehensive approach to stabilize its fee market in the long term.

1. Blockspace Valuation ABC

Before we go into detail, let’s first understand how the value of blockspace is roughly determined.

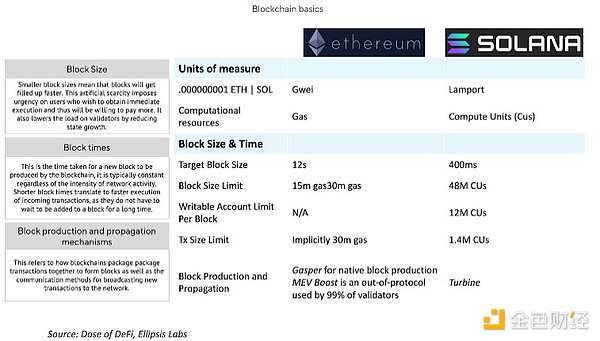

This involves both technical and social aspects (essentially, entities that collectively trust the blockchain assign its value). On a technical level, blockchains can adjust block size, block time, block production, and propagation mechanisms. See the figure below for a more detailed description and comparison of Ethereum’s approach and Solana’s approach.

The social dimension refers to the coordination between blockchain stakeholders to achieve the technical and financial goals of the blockchain. It can also be seen as the social status of the chain, which is subjective but an important metric. Social pressure is undoubtedly influential, and setting a specific culture for solving problems is also influential - both Solana and Ethereum have established such a culture. An example of recent discussions around the social dimension is the ongoing debate over whether to increase Ethereum's gas limit and issuance per epoch, as well as the recent closure of the Jito memory pool on Solana.

Now, let's move on to a more detailed review and comparison of the fee markets of Ethereum and Solana.

2. Overview of Ethereum's Fee Market

Ethereum's popularity is mainly due to its execution environment: the Ethereum Virtual Machine (EVM) that supports smart contracts. Another reason is that Ethereum’s permissionless nature has generated a wide variety of innovative applications over multiple cycles (the ICO boom of 2017-2018, the DeFi summer of 2020, and the NFT mania of 2021-2022). These applications run continuously, creating value that is transferred to validators because they provide block space for these activities.

Soon after the surge in economic activity on Ethereum, miners (in the first few years of the transition to PoS) began to explore how to use their position as block proposers to insert their own transactions when arbitrage opportunities arise.

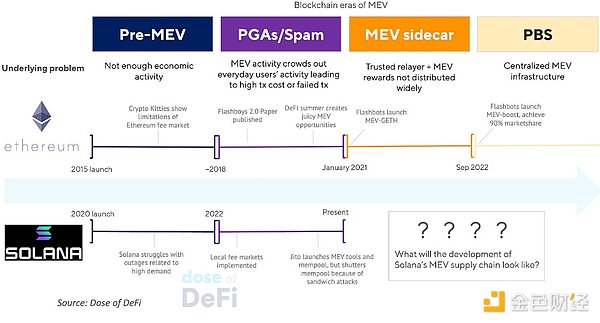

Phil Daian was the first to document this activity (which we now call MEV) in his seminal 2019 article Flash Boys 2.0. At the time, the Ethereum fee market only allowed higher gas prices as a way to incentivize the inclusion of transactions. These priority gas auctions (PGAs) clogged the Ethereum network and drove up gas prices until the launch of Flashbots (co-founded by Daian). This created a market for miners, who were paid to include transactions through searchers (on-chain arbitrage traders). Ethereum researchers subsequently realized that MEV extraction could be a more powerful incentive than in-protocol fees.

The biggest change to the Ethereum fee market may be EIP-1559, which creates a base fee (determined dynamically per epoch, to inhibit "spamming", burned) and a priority fee (used to show urgency or specify preference, and paid to block proposers to include transactions). It is important to note that the "priority fee" is functionally different from the "tip". The former ensures that the transaction is included and passed through the underlying chain; the latter ensures that it is sorted at the same time as it is included and passed through the fee market.

The Ethereum approach has been constantly evolving, vigorously decentralizing the centralized MEV industry on a social level, and on a technical level MEV is now a key part of the technology roadmap.

3. Sonala Fee Market: Mechanism

Solana adopts a completely different blockchain architecture, especially in terms of scalability.

Some of Solana's notable innovations include:

· No universal memory pool: In Solana, transactions are forwarded directly from the initial client to the current leader responsible for generating blocks, eliminating the need for a memory pool. This theoretically reduces the delay associated with transaction confirmation, but this is not always the case in practice because of "jitter", which is about the variation in processing time experienced by different validators when processing transactions or blocks.

· State isolation: It is an expansion innovation for its no memory pool, which enables transactions on its dApp to be more independent of each other. This approach is similar to the principle of "adding lanes to ease traffic congestion"; on Solana, different types of transactions have specific "paths" that they must follow from the user to the leader in order to be added to the block.

· Parallel execution: Solana has the ability to process non-overlapping transactions in parallel within the same block. This is due to two factors: On Solana, block production is (roughly) sequential, as leaders are expected to add transactions to blocks as soon as they receive them. Slot-leader roles are deterministic, as they are scheduled in a queue in advance, and leaders are also responsible for producing four consecutive blocks.

The above two factors, combined with Solana's state isolation, make it possible to "multithread" transactions. In this case, the current epoch leader will schedule multiple transaction packages for confirmation in the same way and at roughly the same time (under the condition that transactions in the same thread do not change the same state).

4. Solana Fee Market: Lower Price Does Not Equal Better

Solana's network fees are generally low (although they have risen with recent demand). Compared to Ethereum, Solana has a static base fee measured in lamports for each signature. Its priority fee is then measured in microlamports per computational unit requested.

This means that while fees scale with the complexity and demand of the EVM, the SVM only scales its priority fee with simple demand. It is important to note that pricing a commodity whose demand fluctuates wildly but whose supply is determined in a static manner is not optimal.

5. Solana Fee Market: The Inevitability of MEV

The social consensus about Solana is that its low fees are its unique advantage over other blockchains. This practice invites “spamming,” so there have been calls for higher fees or dynamic base fees for times of high activity (similar to EIP-1559).

To date, Solana’s approach has been to implement a localized fee market in response to increasing demand. Because states are isolated, it is cumbersome for the network to identify “hotspots,” or states that are experiencing a surge in demand. This hotspot approach enables the blockchain to algorithmically price target transaction fees above average compared to other states with less demand. This approach — similar to the role of block builders on Ethereum — is accomplished by a scheduler, which helps place transactions in consecutive blocks based on priority fees.

As part of the local fee market deployment, Solana built an in-protocol scheduler that locally schedules pending transactions based on a first-in, first-out algorithm. Transactions flow continuously to slot leaders, who sort them based on the tips provided.

The algorithm also requires slot leaders to share the shreds they are building with some of the nodes they are associated with (based on the nodes' stake). However, as mentioned earlier, this process is disrupted by jitter. Specifically, scheduler jitter (caused by Solana's random assignment of input transactions to execution threads) and network jitter (due to P2P relay delays for input transactions and shreds).

These "jitters" cause uncertainty in the order of transactions on Solana, which makes block space auctions economically viable. So, in other words, as long as jitter exists, validators have an economic incentive to insert or reorder transactions. For users, this means MEV leakage, and for validators, it means MEV profit.

6. Solana vs. Ethereum

A quick look at MEV-Ethereum: On Ethereum pre-Flashbots, MEV activity squeezed out regular blockchain activity, driving up gas prices for all users through PGA. On Solana, fees don’t spike because it doesn’t have a shared state and global minimum price like Ethereum, but it’s very difficult for regular users on Solana to transact during periods of heightened activity. Flashbots released MEV-GETH to handle PGA, creating an alternative way for MEV value to be auctioned outside of the in-protocol fee mechanism. In the case of Solana, Jito launched a similar product for validators, giving validators access to a pseudo memory pool and a custom scheduler that will sort transactions in the most profitable way. Jito’s memory pool is attractive to users, ensuring that users have the right to trade first (i.e., extract their MEV).

While popular, the Jito mempool shut down last month under social pressure. This was likely for similar reasons to why over 20% of Ethereum transactions run through private mempools: users were fed up with being stuck in the middle. Now, spamming is back in the spotlight as the only mechanism on Solana to (probabilistically) guarantee execution of time-sensitive transactions. The lack of an effective bidding mechanism for block space leads to uncertainty during periods of high demand.

Since transactions on Solana now flow directly to slot leaders and the priority model has been broken, topology and, by extension, latency are the most important considerations for users of time-sensitive transactions.

A user’s topology in the network can be understood as their “distance” from the leader and is determined by their stake weight and/or the stake weight of the node they are associated with. Therefore, rational agents will seek to connect to nodes that already control a large amount of stake, leading to centralization.

Due to the short-term impact of spamming, Solana is now very crowded and is effectively unusable for less savvy users due to transaction failures. Solving the long-term impact (centralization of network stake) becomes more important.

7. A more structured market?

Solana’s original design philosophy was based on removing user friction and allowing the validator network to meet demand in any way possible. What Solana ignores is that markets perform best when they have basic certainty about how they work. Fee markets provide a way to be universally inclusive by requiring users to pay more fees, shifting the problem from a topological perspective to an incentive perspective.

While transforming the user experience, embracing a fee market — especially one related to MEV — is the best path forward for Solana and its users. Arguably, providing a cost-intensive path to inclusion while maintaining chain integrity is far better than having no path at all.

In fact, on-chain activity is almost always time-sensitive, especially when agents seek to extract value at little to no economic cost. Deterministic execution at a high price is better than probabilistic execution at a low price.

Professionalization of the fee market enables bargaining and auctions over block space to take place at a higher layer away from consensus and execution. As a result, validators can perform their duties without worrying about optimizing for the best accumulation of block space value.

8. Solana is about to stage a MEV transformation

Solana is in a chain-wide discussion on how its fee market should be restructured (Ethereum has been thinking about this problem for years, but still hasn't figured it out).

Solana has not yet completed the necessary MEV transformation. Although the recent increase in on-chain activity has attracted MEV participants such as Jito and Ellipsis to start building MEV infrastructure, major validators have not yet made up their minds to start running their own Solana MEV strategies. This is in stark contrast to all major staking providers running MEV boost on Ethereum. The Solana validator community is not as hostile as Ethereum's validator community, and friendly negotiations have begun about not extracting MEV to prioritize the end-user experience.

This situation will not last; the social level cannot monitor behavior forever. Blockchains must function in a hostile environment composed of self-interested actors. Solana may fare better than Ethereum because it can solve some of the MEV issues without being constrained by Ethereum’s heavy decentralization. However, it must work through some thorny issues, such as should all staked SOL earn MEV rewards through MEVboost like Ethereum does?

Several congestion-minimizing mechanisms are already being explored to address Solana’s congestion issues. These include a dynamic fee structure, an upcoming native scheduler spec update, stake-based limits, and other optimizations at the application level. Everything is moving fast. Jito’s CEO recently said that “a small group of operators/seekers [are] sandwiching private mempools [and] front-running.”

MEV is a sign of economic growth and is therefore inevitable. In fact, even Bitcoin—whose simplicity is often hailed as its greatest feature—is beginning to undergo a reinvention as Ordinals and economic activity take off. Choosing to ignore solutions because of negative externalities (such as Jito’s example) does not eliminate externalities, it only leads to market disharmony.

The social layer is an effective tool to stop predatory behavior, but it can only last for a short time. Ethereum is experiencing the shortcomings of the social layer with the rise of timing games, a strategy where block proposers deliberately delay block publication to maximize MEV acquisition. This weakens the security of the chain, but makes economic sense from a validator perspective. Shame may work temporarily, but protocol research is the only long-term solution.

It is too early to say what Solana’s MEV supply chain will look like in a few years. But one thing we can be sure of right now is that most of the value will be pocketed by those larger validators.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Clement

Clement 链向资讯

链向资讯