Author: Lily Liu, President of Solana Foundation; Translation: Jinse Finance xiaozou

I read the latest report from a16z Crypto last weekend. I learned a lot! I mainly focus on things outside the EVM world, so I am always grateful when I have the opportunity to learn about other innovations in the self-custody world.

But I noticed an implicit EVM bias throughout the report. Here are my observations:

The author divides the world into the EVM world and the non-EVM world, creating a binary relationship between developers who choose not to build in the EVM and the "other" ecosystem.

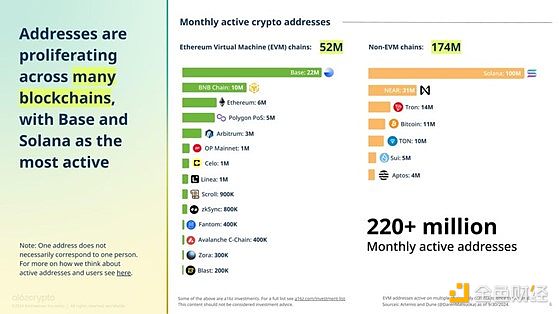

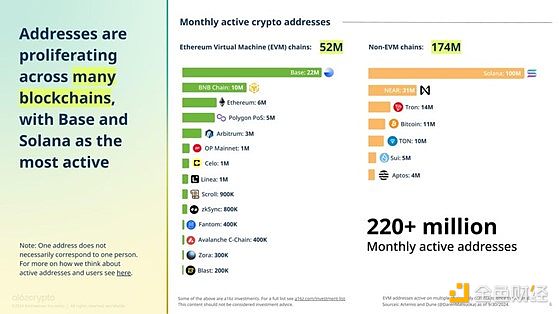

For example, the description of active addresses is misleading. Solana has 100 million monthly active addresses—more than four times Base's 22 million active addresses—but the chart shows that the two numbers are almost equal.

I think a more accurate approach would be to use a bar chart with different colors for the EVM and non-EVM bars.

Also, the chart claims that “Base and Solana” have the most Monthly Active Addresses (MAA), but careful readers will notice that NEAR Protocol has 31 million MAA, surpassing Base. Therefore, the chart title should be corrected to “…Solana and Near as the most active”.

Now let’s look at the choice of metrics. We in the industry often default to using metrics like Active Addresses and Total Value Locked (TVL) as benchmark metrics across ecosystems. However, I think a more meaningful way to measure ecosystem activity, demand, and overall health is to use transaction fees. Transaction fees directly reflect the level of user participation in economic activity, their willingness to pay for transaction execution, and the profitability of validators.

With the introduction of fee markets on Solana, we can now differentiate the economic value of various types of activity within our ecosystem and apply this approach to other activities.

Solana has made significant progress on the transaction fee front. Until December 2023, Solana’s monthly transaction fee market share never exceeded 1.5%. Since April 2024, it has remained above 10%, peaking at 25% in July.

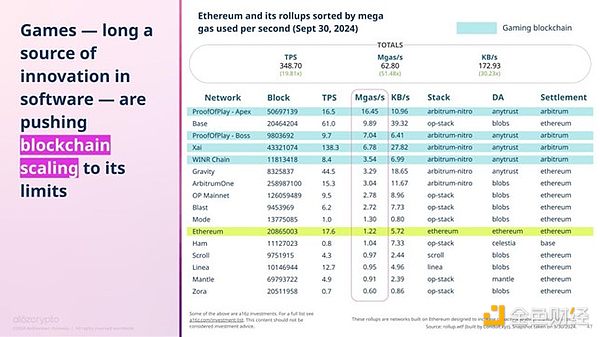

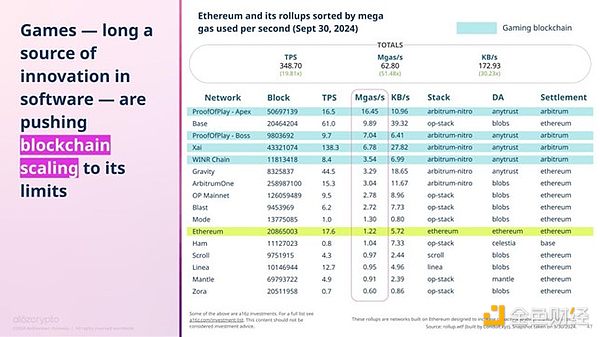

When we incorporate MEV consumption into our measure of “Real Economic Value” (REV), Solana’s gap closes! The chart below, from Blockworks Research, shows the shrinking REV gap between Solana and Ethereum. Here’s another example of an EVM-centric perspective, this time on gaming. Using mgas/s as a metric for evaluating gaming infrastructure excludes Solana and other non-EVM networks, and the comparison is not truly meaningful. This leads to a one-sided view of the broader on-chain gaming ecosystem.

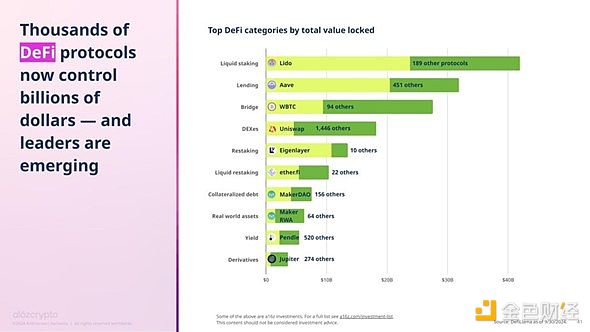

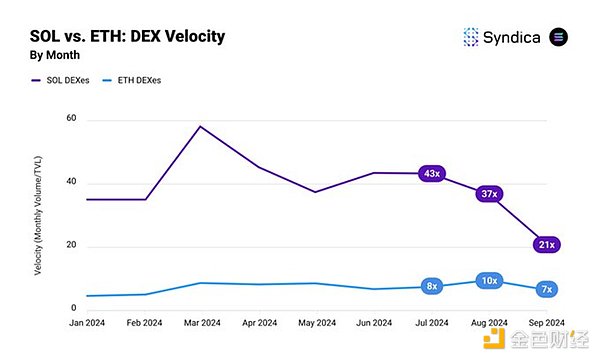

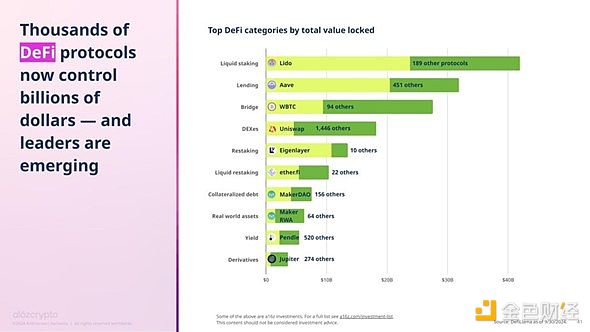

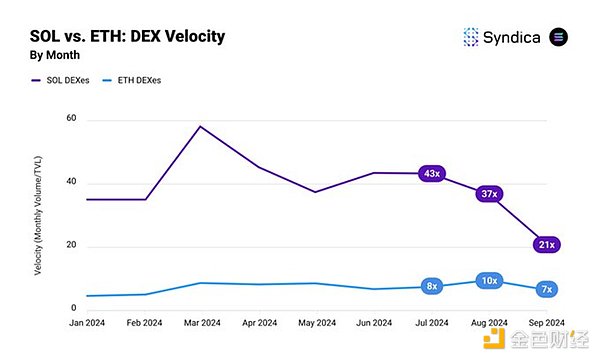

Another example is related to DeFi. TVL is an inadequate metric for measuring DeFi activity, especially in basic categories such as DEXs, derivatives, and bridges, where volume is a more relevant metric. While this report highlights total DEX volume, it only provides information on protocols based on TVL, ignoring key content in terms of activity based on flow.

TVL tends to favor ecosystems with large asset reserves but limited flow, such as Ethereum. Although Solana's TVL is only 10% of Ethereum's, its monthly DEX volume has risen from 50% in 2024, occasionally surpassing Ethereum. To accurately reflect on-chain economic activity, we must focus on the economic value of transactions, not just holding value. In this scenario, more capital-efficient ecosystems will stand out, driven by superior chain performance.

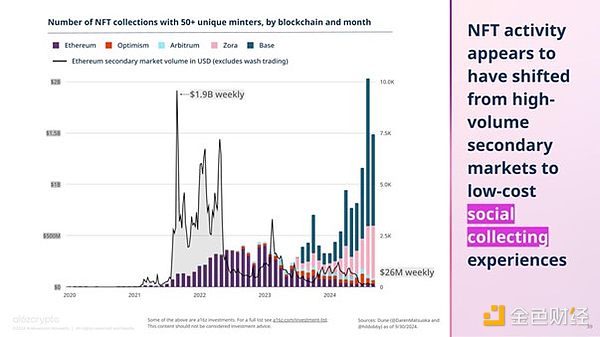

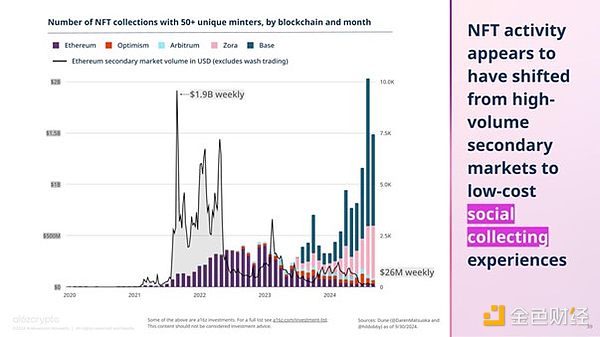

While the metrics across ecosystems are comparable, the report still focuses primarily on Ethereum and EVM L2s. It highlights the implementation of EIP-4844 as a milestone achievement in the industry's fee reduction efforts. Notably, Solana has had similarly low transaction costs since its launch in March 2020. Additionally, in terms of transaction affordability, Solana’s median fees have been consistently lower and more stable than Base. According to nftpulse data, Solana was once again excluded from the NFT comparison, despite ranking first in NFT addresses, second in transaction volume, and fourth in unique collections over the past year.

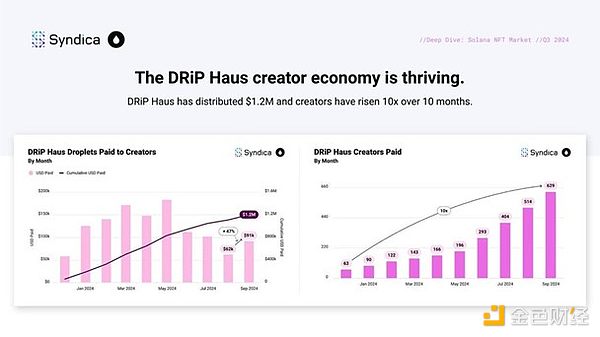

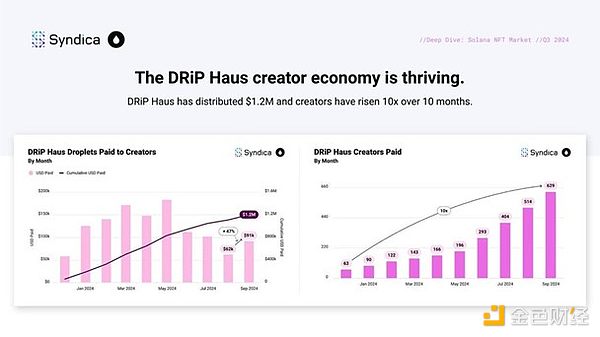

This graph’s point about low transaction costs driving new consumer behavior is perhaps best illustrated by DRiP, which has minted 182 million NFTs since March 2023 at a total cost of just 1,600 SOL (at $150 SOL and $0.001 per NFT), as noted by Top Ledger.

The omission of DePIN is conspicuous. Helium is revolutionizing cellular networks and currently has more than 1 million active hotspots in 182 countries. Hivemapper uses a decentralized network to map the world and has recorded more than 7.5 million kilometers of street data in more than 50 countries. The Render network provides decentralized GPU rendering services, providing critical computing power for industries such as gaming and artificial intelligence.

More importantly, most of these innovations are happening on Solana, not in the EVM ecosystem. So is this why the report doesn’t mention DePIN?

Miyuki

Miyuki