Author: Marcel Pechman, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Solana is trading above $180 again after struggling to retake the level it held for nearly 3 months. In the past month, Bitcoin has risen 16.3% to $183, and at the same time, Bitcoin has risen from its all-time high to within $1,000, but does Solana's data support SOL to higher levels?

Total capitalization of altcoins (left) versus SOL/USD (right). Source: Tradingview

On-chain and derivatives indicators suggest that Solana’s bull run may have just begun, with the potential for further gains to $200 or even higher. Data shows that the Solana network’s total locked value (TVL) has steadily increased, with the amount of collateral in smart contracts hitting a 2-year high.

Solana Network Total Value Locked, SOL. Source: DefiLlama

On October 26, deposits on the Solana network reached 42.5 million SOL, the highest level since September 2022. Major contributors include Jupiter, which has seen a 13% increase in reserves over the past 30 days, Raydium, which has increased by 18%, and Sanctum, which has increased by 17% over the same period.

Solana Ranks Second Among Decentralized Applications

Solana has now surpassed BNB Chain to become the second largest network in terms of liquidity TVL, but still lags behind Ethereum. This gap has been narrowing in recent years. An example of Solana's recent growth is the SOL liquidity staking service launched by Binance, which is currently ranked tenth in the Solana ecosystem, indicating greater growth potential.

In comparison, Ethereum's TVL has increased by 2% over the past 30 days, while BNB Chain has fallen by 5%. It’s worth noting that focusing solely on deposit numbers can be misleading, as many decentralized applications (DApps), including games, collectibles, Web3 infrastructure, social networks, and marketplaces, do not require a large deposit base.

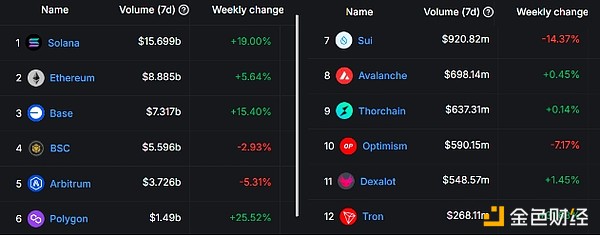

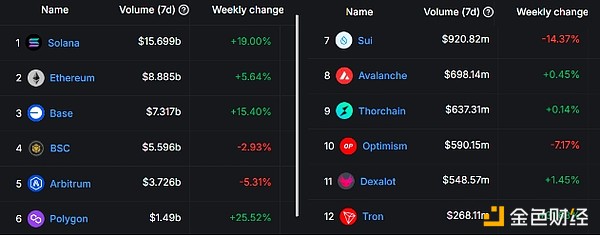

Blockchains ranked by 7-day DEX volume (USD). Source: DefiLlama

Solana recently surpassed Ethereum to take the lead in decentralized exchange (DEX) volume, maintaining that position with a 19% increase over the past 7 days. By comparison, Ethereum activity surged 6%, while BNB Chain fell 3%. Overall, Ethereum’s Layer-2 ecosystem capacity grew 5% over the same period, making Solana the clear winner.

Notable contributors in the Solana ecosystem include Raydium, up 20%; Lifinity, up 49%; and Phoenix, which increased activity 34% in just seven days. A large portion of Solana’s increased traffic can be attributed to the memecoin sector, raising questions about the sustainability of this growth.

For example, Moo Deng (MOODENG) surged 178% over the past week, Goatseus Maximus (GOAT) rose 71%, and Nosana (NOS) rose 70%. While it’s impossible to predict how long memecoin rallies will last, history shows that only a few are able to retain value over the long term. Notable exceptions include Shiba Inu (SHIB), Pepe (PEPE), and Dogwifhat (WIF).

Low leverage usage leaves room for price growth

In addition to on-chain indicators, the lack of excessive leverage in gold futures suggests that the rally to $182 on December 29 is just the initial stage of a broader bull cycle.

Average 8-hour funding rate for SOL perpetual contracts. Source: laevitas.ch

The current funding rate of 0.01% indicates that long positions (buyers) are paying for leverage, which equates to approximately 0.9% per month. During periods of high demand from retail buyers, this rate can exceed 2.1% per month; therefore, current levels are considered neutral. Combined with positive on-chain indicators, this data suggests healthy SOL spot buying activity, leaving room for potential gains to $200 and beyond.

Kikyo

Kikyo