Author: flow Source: onchaintimes Translation: Shan Ouba, Golden Finance

Introduction

In early 2024, yield trading on Ethereum took off. This trend stems from the integration of Pendle with EtherFi and other liquid re-staking protocols built on EigenLayer. At the time, yield trading was considered the best way to bet on EigenLayer or EtherFi airdrops, and a strategy to get high APY on ETH, which attracted a large influx of funds. This led to a wave of yield trading on Ethereum, and the market was full of attractive opportunities.

Today, Solana is going through a similar stage of development. Its first yield trading protocol is emerging and integrating with emerging protocols in the Solana ecosystem. Although Solana's yield trading is still in its early stages, the market potential is huge, bringing many new opportunities to DeFi, as well as rich returns to be mined.

This article will explore Yield Trading on Solana, current market opportunities, and how to use this mechanism to tap into emerging protocols in the Solana ecosystem.

Yield Trading Basics

Yield Trading is full of complex terms, so let’s first review its core concepts and how it works.

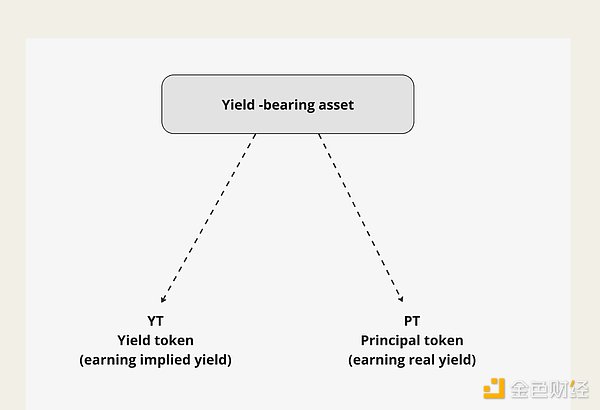

In a nutshell, the Yield Trading Protocol splits a yield asset into two parts - principal (PT) and yield (YT), and mints tokenized assets for each. These tokens can be traded independently and have expiration dates.

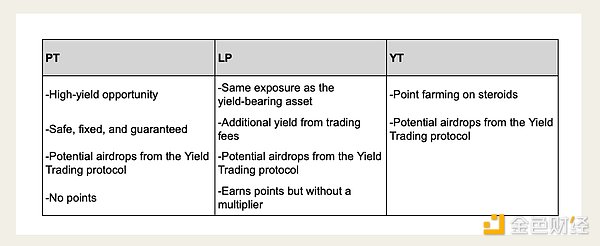

PT (Principal Token)

PT strategy is the simplest and most direct. After purchasing PT on the Yield Trading Protocol, investors can lock in a fixed APY until the fund pool expires.

Although market yields will fluctuate, once PT is purchased at a specific APY, that yield will be locked in. Generally speaking, the higher the fixed APY, the more attractive the PT is.

YT (Yield Token)

Holding YT means giving up real income, but you can get leveraged exposure to implied income (linked to protocol points).

Each YT represents the point income of the entire yield asset. Since the price of YT is much lower than the asset itself, it is essentially a high-leverage point mining method, namely a "point amplifier".

It should be noted that the price and APY of YT and PT are determined by the market, and the sum of the ratios of the two is always 1.

LP (Liquidity Supply)

The operation of the yield trading mechanism requires the market, and the establishment of the market is inseparable from liquidity. Therefore, in addition to YT and PT, users can also provide liquidity by depositing yield assets into the protocol and obtain LP tokens to support the trading of YT and PT.

LP holders not only enjoy the same returns as the yield assets, but also receive transaction fee income and may receive airdrop rewards from the yield trading protocol.

Summary

By splitting the yield assets, yield trading has created a whole new set of DeFi opportunities, sparking great market enthusiasm. As mentioned earlier, this new model drove a trading boom on Ethereum in early 2024, giving rise to the so-called "Pendle Season". Next, let's take a deeper look at the development of this phenomenon.

Ethereum's "Pendle Season"

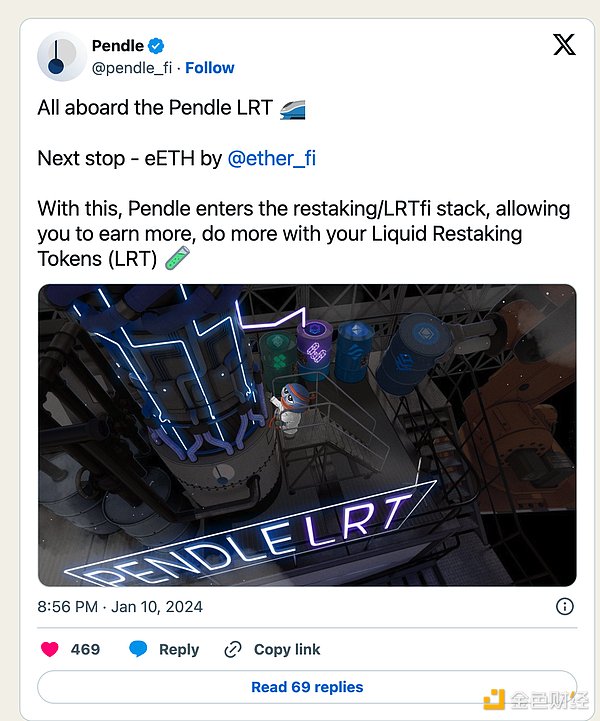

On January 10, 2024, Pendle announced the integration with EtherFi's eETH (liquid re-staking token on EigenLayer).

At that time, Pendle had not yet ushered in a real outbreak. Although it has certain value as a protocol itself, it has low market attention, and the total locked volume (TVL) is only about 220 million US dollars. However, with the launch of this first LRT (Liquid Restaking Token) yield trading integration, the market landscape began to change. It provided investors with a variety of new ways to better earn EigenLayer and EtherFi points (the two most popular projects at the time), or lock in high APY on ETH.

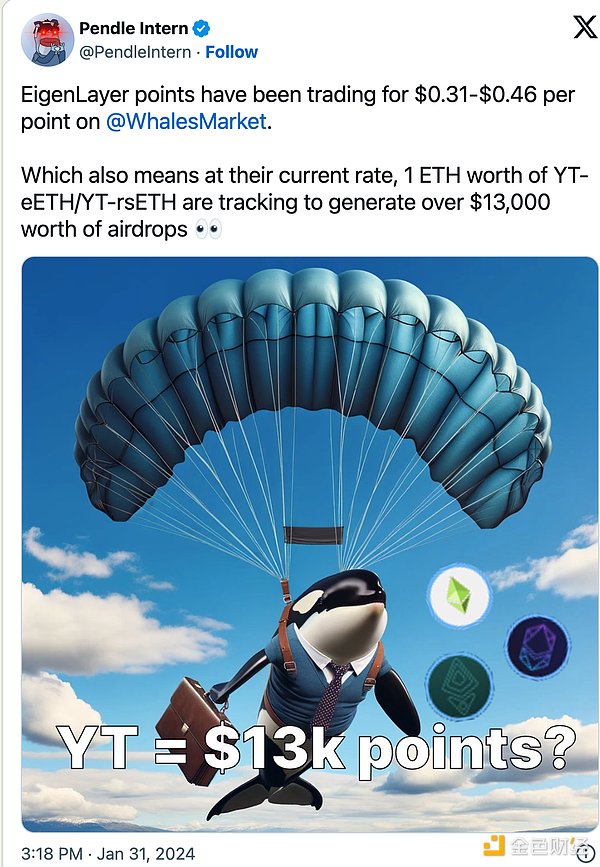

For example, investors who previously held eETH just to accumulate EigenLayer or EtherFi points can now participate in YT-eETH and mine points in a highly leveraged manner, which greatly amplifies the returns and also brings very attractive arbitrage opportunities (Pendle Intern’s tweet at the end of January 2024 mentioned this trend).

At the same time, another popular trading strategy has also become popular: traders buy PT-eETH and amplify the returns through circular lending to obtain super high APY on ETH.

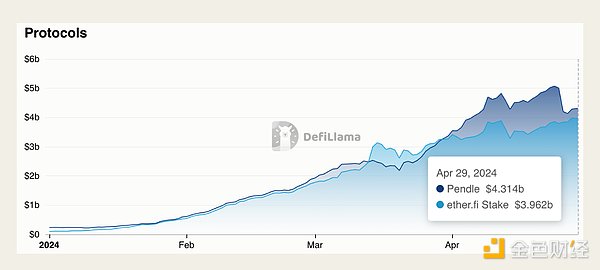

As the market gradually understands these arbitrage opportunities, Pendle's TVL has exploded. In less than 5 months, its TVL soared from US$220 million to approximately US$5 billion. During the same period, EtherFi's TVL also showed similar exponential growth.

Of course, EtherFi is not the only one to benefit from this trend. Several liquid re-staking protocols such as Renzo, Puffer Finance, Kelp DAO and Swell have also emerged, but EtherFi is still the largest and most popular project in the market.

The core conclusion that can be drawn from this wave is that "re-staking + LRTs + yield trading" has become the "golden triangle" of Ethereum DeFi strategy. Whether it is to dig for popular project points or to obtain the highest APY on ETH, the market is actively adopting this strategy. This is also the essence of "Pendle Season".

Will Solana see similar developments?

So why is the experience of "Pendle Season" so important to our understanding of developments on Solana? The reason is that Solana is experiencing similar market structure changes.

Although Solana's re-staking is still in its early stages, it is growing rapidly. Jito recently launched Jito (Re)staking, officially entering the re-staking field; re-staking protocols such as Solayer have also been launched; the first batch of liquid re-staking protocols in the Solana ecosystem have been born one after another; at the same time, the first Solana yield trading protocol has also appeared.

This trend is reproducing the classic combination in the Ethereum ecosystem, namely the linkage effect of EigenLayer, EtherFi and Pendle, but this time, it happens on Solana (the strongest performing L1 blockchain in this market cycle):

• The role of EigenLayer is replaced by Jito (Re)staking or Solayer

• The role of EtherFi is replaced by Kyros or Adrastea

• The role of Pendle is replaced by Exponent or RateX

Not only that, yield trading on Solana also brings more innovative opportunities, whether it is a strategy for SOL or USD, it is worth exploring in depth. Next, we will focus on analyzing the core strategies of two leading yield trading protocols on Solana, Exponent and RateX.

Yield Trading Opportunities on Exponent

Exponent is a fixed-rate and leveraged yield farming protocol on Solana, and its core mechanism is the self-developed yield stripping technology. This mechanism separates the yield of DeFi products from the principal value, forming two tradable assets: principal tokens (PT) and yield tokens (YT). These tokens can be traded on Exponent’s AMM (automated market maker) designed specifically for yield assets, which supports assets with expiration dates. Exponent is one of the best performing yield trading platforms on Solana in terms of user experience and technical transparency.

The core developers of the protocol are from Kamino and Squads, and have received more than $2 million in financing from top investors in the Solana ecosystem, including Robot Ventures, Solana Ventures, and Mechanism Capital.

Currently, Exponent is still in its early stages of development with a total TVL of approximately $8 million, but has shown the potential to become a leader in Solana yield trading. Currently, its platform has only integrated four assets, of which the two most noteworthy are USD* and kySOL.

kySOL and Kyros

Kyros is a Solana native liquid re-staking protocol built on Jito (Re)staking. Although Solana’s restaking narrative is still in its early stages, it has great potential and has demonstrated strong use cases.

Kyros’ first product is kySOL, a liquid restaking token pegged to SOL. Users holding kySOL actually hold JitoSOL indirectly and enjoy all its benefits, including Solana’s staking rewards and MEV rewards. In addition, kySOL also accumulates additional restaking income by providing economic security for the Node Consensus Network (NCN). Currently, kySOL has been used to secure the TipRouter NCN, which processes more than $2.5 billion in tips per year and distributes 0.15% of the revenue to JitoSOL restakers, bringing additional income to kySOL.

Kyros currently has a TVL of approximately $43 million and has not yet launched a token, making it one of the most promising projects in the Solana ecosystem.

On Exponent, users can mine Kyros points with high leverage through YT-kySOL (up to 17.01 times leverage), or lock in 18.66% SOL yield (liquidity exceeds 3.5 million US dollars) through PT-kySOL before June 2025. For investors who hold SOL for a long time, this is an opportunity worth considering.

Current data:

• Liquidity: US$3.6 million

• PT-kySOL yield: 18.66%

• YT implied yield: 18.65%

• Yield leverage: 17.01 times

• Expiration time: June 14, 2025

USD* and Perena

Perena is committed to building the infrastructure for future digital currencies and was founded by Anna Yuan, former head of stablecoin at the Solana Foundation.

Its flagship product, Numéraire, is a Stableswap AMM designed to optimize stablecoin trading, liquidity provision, and capital efficiency. Numéraire reduces idle liquidity in traditional AMM models through composable, scalable pools of funds. It uses a "hub-and-spoke" model to unify liquidity, with all transactions routed through the core "hub" stablecoin USD*.

Similar to Kyros, Perena is still in its early stages with a TVL of approximately $18.7 million and has not yet launched a token, making it another potential mining opportunity worth paying attention to in the Solana ecosystem.

Perena has launched a stablecoin yield vault on Exponent, where PT-USDoffers the highest fixed stablecoin yield on the platform (13.26%). In addition, YT-USD supports Perena points mining with up to 36.76x leverage, which may bring potential airdrop rewards.

Current data:

• Liquidity: US$1.3 million

• PT-USD* Yield: 13.26%

• YT Implied Yield: 13.26%

• Yield Leverage: 36.76x

• Expiration Time: April 30, 2025

It is worth noting that all of these income trading opportunities are likely to accumulate Exponent points (although this has not been confirmed and the points program is not yet online). Therefore, this is not only an opportunity to earn high APY on USD or SOL, but also to mine Perena and Kyros points at the same time and get possible airdrops from Exponent, further increasing the total yield.

Yield Trading Opportunities on RateX

RateX is another yield trading protocol on Solana that provides PT, YT, and LP (liquidity provision) functions. The team won the Solana Renaissance Hackathon and has completed a seed round of financing, with investors including Animoca, Solana Ventures, KuCoin Ventures, etc.

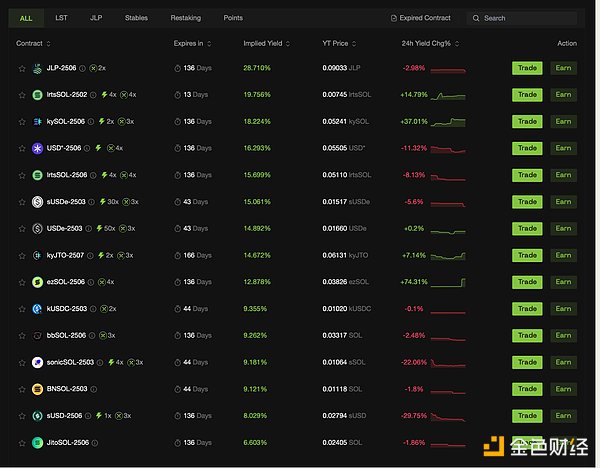

Currently, RateX is the yield trading protocol with the highest TVL on Solana, with a total locked volume of more than 37 million US dollars, and has the widest DeFi integration. However, compared to Exponent, RateX's UI is slightly more complicated and the user experience is more confusing.

RateX offers a variety of yield trading opportunities (as shown below), but in the following sections, we focus only on the most attractive strategies.

kySOL vs. Kyros

On RateX, the kySOL opportunity is similar to that on Exponent, and investors can choose to lock in a fixed APY or mine Kyros points with high leverage. However, the market data is slightly different:

Current data:

• Liquidity: US$630,000

• PT-kySOL yield: 17.20%

• YT implied yield: 18.24%

• Yield leverage: 19.2 times

• Expiration time: June 25, 2025

lrtsSOL (2506) and Adrastea

is a composable protocol designed to simplify advanced DeFi strategies such as Liquid Restaking, making them easier to use on Solana. Adrastea is similar to Kyros, but the difference is that Kyros is built on Jito (Re)staking, while Adrastea is based on Solayer.

Under this system, lrtsSOL is the Liquid Restaking Token (LRT) on Adrastea, representing the user's restaking position in Solayer and receiving additional returns generated by Solayer AVS. As of now, Adrastea's TVL is approximately US$25 million.

On RateX, users can use YT-lrtsSOL to mine points for multiple projects at the same time, including Sonic, Adrastea, and Solayer. In addition, it is possible to lock in a fixed APY of 14.84% until June 2025 through PT-lrtsSOL, which currently has over $6.5 million in liquidity.

Current Data:

• Liquidity: USD 6.5 million

• PT-lrtsSOL Yield: 14.84%

• YT Implied Yield: 15.70%

• Yield Leverage: 19.6x

• Expiration Time: June 25, 2025

USD*

Similar to the USD* opportunity on Exponent, but the market data on RateX is as follows:

Current data:

• Liquidity: US$1.1 million

• PT-USD yield*: 15.39%

• YT implied yield: 16.29%

• Yield leverage: 18.2x

• Expiration time: June 25, 2025

sUSDe and USDe with Ethena

USDe is Ethena’s first US dollar-denominated token and will not accumulate the yield generated by the protocol. sUSDe is a staking version of USDe that retains its value and can earn additional income through funding rates.

Currently, Ethena is very well-known in the DeFi ecosystem, so it will not be introduced in detail here, but on RateX, both USDe and sUSDe offer very attractive yield trading opportunities.

USDe

PT-USDe currently offers an APY of 14.06%, while YT-USDe has an implied yield of 14.88% and comes with a 50x sats points multiplier.

Current data:

• Liquidity: US$832,000

• PT-USDe yield: 14.09%

• YT implied yield: 14.89%

• Yield leverage: 58 times

• Expiration time: March 25, 2025

sUSDe

PT-sUSDe provides a fixed return of 15.1%, while YT-sUSDe The implied yield is 15.95% and comes with a 30x sats points multiplier.

Current data:

• Liquidity: US$1.1 million

• PT-sUSDe yield: 14.25%

• YT implied yield: 15.06%

• Yield leverage: 62.5 times

• Expiration time: March 25, 2025

kyJTO and Kyros

kyJTO is another liquid re-staking token in the Kyros ecosystem and is related to JTO. By holding kyJTO, users can not only gain exposure to JTO, but also earn additional re-staking income by securing TipRouter NCN. PT-kyJTO offers a higher fixed APY for JTO, while YT-kyJTO is similar to YT-kySOL, a high-leverage way to mine Kyros points.

Current data:

• Liquidity: $113,000

• PT-kyJTO Yield: 12.78%

• YT Implied Yield: 13.56%

• Yield Leverage: 18.9x

• Expiration Time: July 25, 2025

Similar to Exponent, these yield trading opportunities may also earn RateX points, and may have different point multipliers depending on the vault. If you are bullish on the development of RateX, then these opportunities are undoubtedly one of the best ways to participate in its future airdrops.

Conclusion

Yield trading on Solana is still in its early stages, but as this report shows, the market opportunity is huge. Not only does it provide a variety of yield strategies for SOL and USD, but it also allows investors to earn potential airdrop rewards by participating in Solana's emerging projects.

If you are a long-term SOL holder, it is recommended to pay attention to PT opportunities on yield trading protocols. The most attractive option at the moment is PT-kySOL on Exponent, which has a fixed APY of up to 18.66%. PT-kySOL on RateX is a close second, with an APY of 17.20%, locked until June 2025. In addition, participating in these yield trading protocols may also receive future airdrop rewards, further increasing your returns.

On the other hand, if you hold a large amount of stablecoins, you can get a stable yield of more than 15% through PT-USD* on Exponent or RateX. This is one of my favorite stablecoin yield trading strategies at the moment. As an emerging protocol, Perena also has great potential and is worth further study.

For airdrop miners, the market now provides a complete "high leverage" strategy that can be used to mine points of emerging projects in the Solana ecosystem such as Perena and Kyros, greatly increasing potential returns.

As this market trend develops, it will be critical to keep a close eye on the TVL growth of Exponent and RateX, which will determine which protocol ultimately dominates the Solana yield trading field. In addition, there will be more novel yield opportunities in the future.

Solana's DeFi and yield trading are ushering in an exciting future. Now is the best time to pay attention to this trend and seize the most asymmetric investment opportunities before it becomes mainstream.

Clement

Clement

Clement

Clement Joy

Joy YouQuan

YouQuan Hui Xin

Hui Xin YouQuan

YouQuan Davin

Davin Joy

Joy Clement

Clement Catherine

Catherine Hui Xin

Hui Xin