Solana’s meme coin ecosystem is experiencing an untimely infighting, with two giants — Pump.fun and Raydium — declaring war on each other. In just 48 hours, we’ve seen Raydium announce LaunchLab, its own token launch platform, followed shortly after by Pump.fun launching PumpSwap, a native decentralized exchange (DEX) that completely excludes Raydium from its ecosystem.

What makes this power struggle particularly fascinating is its timing—it’s erupting just as the once-booming meme coin market is showing clear signs of weakness. Since its January peak, Solana network revenue has plummeted 95%, while daily DEX trading volume has fallen by more than 93%.

In today’s post, we take a deep dive into this high-stakes showdown, exploring how the partnership that once propelled Solana to new heights has turned into a battle for survival, and what this means for the future of Solana’s decentralized exchange.

The Collapse of a Partnership

Since the beginning of 2024, Pump.fun and Raydium have operated in perfect tandem. Pump.fun democratizes token creation, allowing anyone to issue Meme Coins for pennies through its Bonding Curve system.

When these tokens reach the magical $69,000 market cap threshold, they “graduate” to Raydium (Solana’s premier DEX), where they can be freely traded on the wider market.

It’s a perfect arrangement that works extremely well for both parties.

The Story Behind the Numbers

According to Blockworks Research, Pump.fun tokens accounted for 41% of Raydium’s exchange fee revenue over the past month. Some even put that number as high as 43.5%.

What’s at stake? A revenue stream worth tens of millions of dollars per month and control over the future of the Solana Meme Coin.

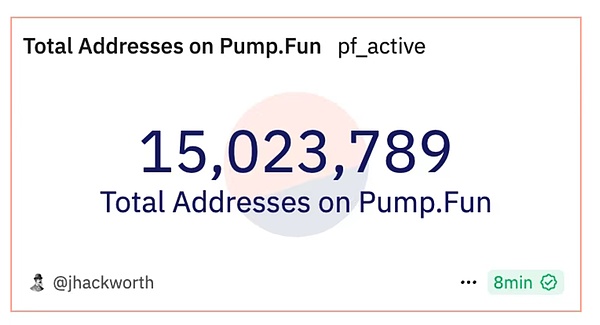

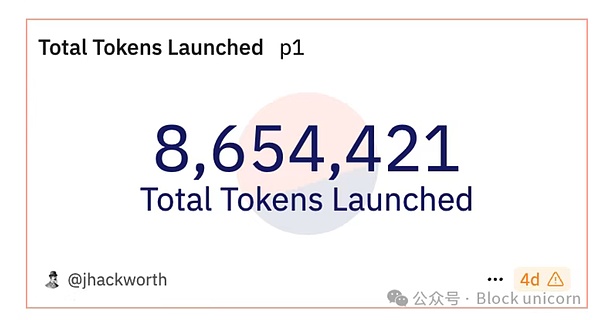

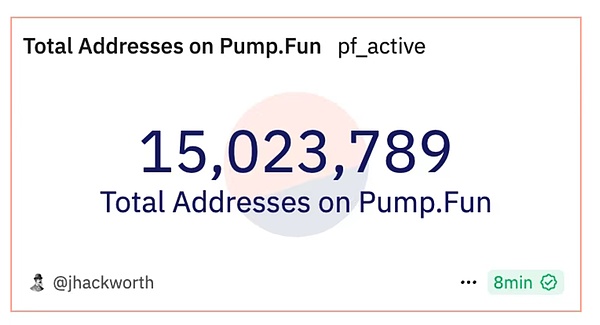

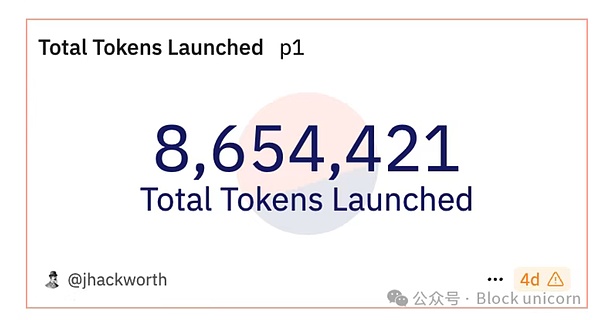

With Pump.fun facilitating over 8.65 million token launches and attracting 15 million addresses, Raydium has reaped the rewards - earning over $80 million in transaction fees from Meme Coin activity alone.

But there are friction points in this system. Each token’s “graduation” required:

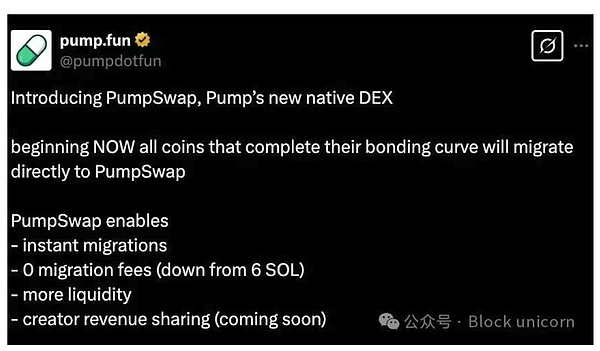

a migration fee of 6 SOL (~$800 at current prices)

a time-consuming migration process that could take hours

complexity that confused new users and undermined the token’s momentum

the result? Only a tiny fraction of the tokens created on Pump.fun graduated to Raydium.

These pain points created opportunities for disruption—something both sides are now actively exploiting.

The Current Conflict

In a dramatic 48 hours, long-simmering tensions completely transformed the Solana ecosystem.

On March 18, Raydium announced LaunchLab — its own permissionless token launch platform designed to compete directly with Pump.fun. This was not without purpose; it was previously reported that Pump.fun was considering launching its own native DEX.

LaunchLab introduced several features that improved the Pump.fun model.

The message was clear: Raydium was no longer satisfied with just collecting trading fees — it wanted Pump.fun’s market share.

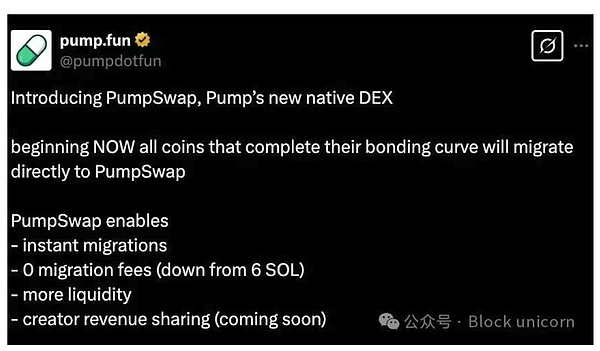

Pump.fun responded quickly. On March 20, it launched PumpSwap — a native DEX, effectively ending its reliance on Raydium.

The market immediately recognized the significance of the move. Within five minutes of PumpSwap’s announcement, Raydium’s RAY token plunged 7.6%, extending losses to nearly 9% on the day.

What started as a rumor when Pump.fun was first spotted testing AMM functionality in February has now exploded into a full-blown DeFi war. Both platforms are vying for the same creators, the same traders, and most importantly, the same fee revenue.

Meme Coin Market Context

This power struggle comes at an inopportune time for the Solana meme coin ecosystem. Two contenders may be vying for a rapidly shrinking pie.

Since the peak of January’s frenzy, the meme coin market on Solana has experienced a dramatic reversal of fortune. Consider these sobering statistics:

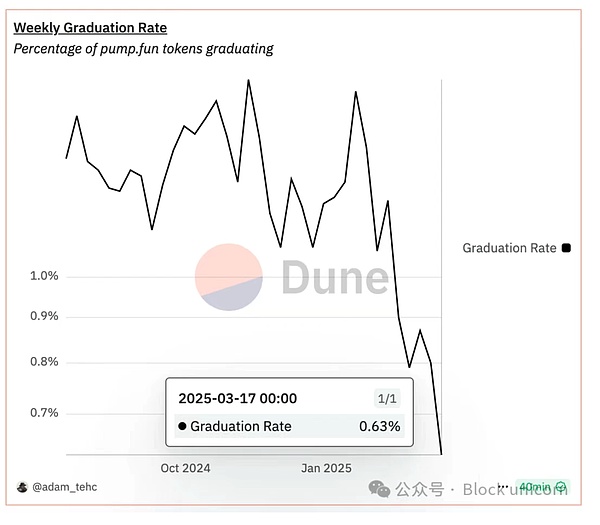

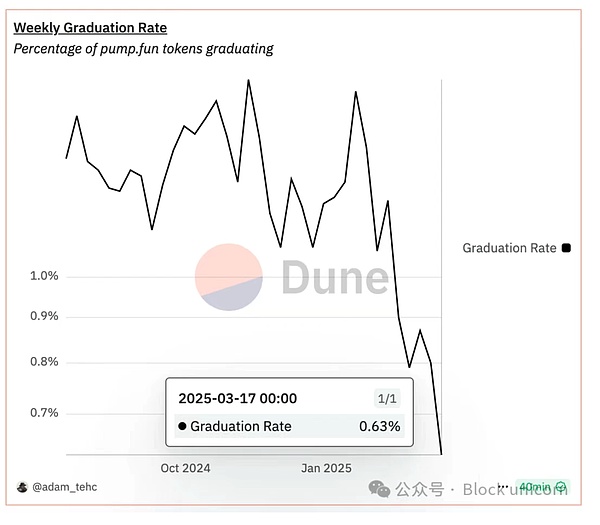

Even token graduations from Pump.fun to Raydium have dried up.

“Fewer and fewer tokens are reaching the threshold. At peak times, the average number of active wallets in 30 minutes was around 6-7,000. Now it’s down 30-40%,” said Bambino, the institution’s founder and developer, at X.

The weekly graduation rate continues to decline — from a high of 1.67% in November to the current 0.63%.

What caused this dramatic slowdown? Several factors are at work.

Remember those high-profile political meme coin scams?

Investment firm Bernstein has predicted a shift in market liquidity away from “useless meme coins” and toward DeFi, gaming, and NFTs.

It will be interesting to see if Pump.fun and Raydium are fighting for the last few passengers on a sinking ship — or if their innovations can reignite interest in meme coins.

Who Has the Edge?

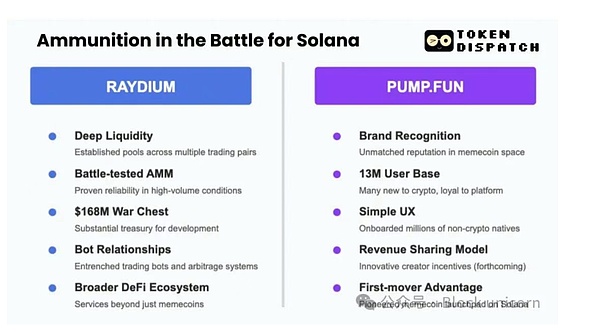

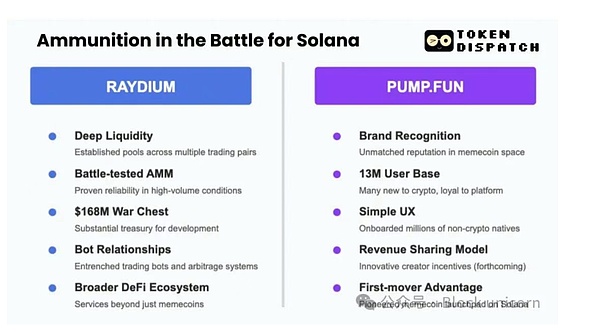

As this DEX war unfolds, both contenders bring important but different strategic advantages to the battlefield.

This creates an interesting competitive dynamic.

Raydium has the technical infrastructure and liquidity depth, but needs to attract creators. Pump.fun has creators and brands, but needs to build liquidity on its new exchange.

The key battleground may be creator incentives. PumpSwap’s upcoming “creator revenue share” feature may fundamentally change the Meme coin landscape.

Arif Kazi, head of business development at Sonic SVM, wrote on X: "Earlier, Meme coin creators had to sell to make a profit. Now, they earn a yield on each transaction, which may drive the development of long-term projects rather than quick hype."

This innovation solves a core problem in the Meme coin ecosystem - the incentive for creators to pump and sell. By tying creator success to sustainable trading volume rather than initial price increases, PumpSwap may foster more lasting projects.

However, DeFi history shows that these wars can quickly become destructive. If two platforms engage in a race to the bottom on fees or attract liquidity through aggressive incentive plans, they may create unsustainable economic models that harm the interests of both parties.

Impact on Solana

The conflict between Pump.fun and Raydium is more than a simple business dispute — it represents a pivotal moment in the evolution of the Solana ecosystem.

While the meme coin craze has faded somewhat for now, its role in hammering out Solana’s infrastructure remains a bright spot.

Messari research analyst Matthew Nay points out that “Solana was able to handle nearly $40 billion in volume in a single day without crashing. That’s the equivalent of 10% of Nasdaq’s volume in a regular 24-hour trading session.”

This massive stress test has accelerated Solana’s maturation.

If the meme coin craze fades, where will Solana’s DeFi ecosystem focus next?

A few potential paths are emerging.

DeFi Renaissance: Former Ethereum maximalist and current Solana advocate Kain Warwick believes that traditional DeFi applications may eventually cross the chasm and enter mainstream adoption. "DeFi is clearly the direction. Decentralized lending protocols like Aave may see widespread adoption."

DePIN (Decentralized Physical Infrastructure): Nay highlighted projects like Helium and HiveMapper as "excellent leaders" bringing real-world practicality to blockchain.

Games: With infrastructure improvements brought about by Meme Coin traffic, Solana is now better equipped to support gaming applications.

Evolved Meme Coins: While classic animal-themed meme coins are fading, Nay sees potential for a new generation of meme coins with real utility. For example, creator tokens that support new influencers and give investors a share of future YouTube revenue — not just “a random animal picture.”

However, Solana’s current economics pose a challenge to DeFi growth. Multicoin Capital’s Tushar Jain explained that high inflation and staking yields “set a high barrier to entry for people to participate in DeFi.” When users can earn risk-free returns through staking, they have less incentive to use DeFi protocols unless they offer significantly higher yields.

Our Take

As the dust settles on this week’s dramatic announcements, we’re witnessing a commercial competition that could reshape Solana’s entire DeFi landscape.

In the short term, both platforms face key execution challenges. PumpSwap must build sufficient liquidity without Raydium’s existing liquidity pool and implement its promised revenue-sharing model for creators. At the same time, LaunchLab needs to attract creators away from Pump.fun’s ecosystem and take advantage of Raydium’s existing liquidity.

Beyond the tactical maneuvers, this conflict represents the natural evolution of a maturing ecosystem. Pump.fun and Raydium’s relationship flourished during the speculative phase of cryptocurrencies, but their divergent interests became irreconcilable as the market contracted.

The battle comes as the meme coin market faces exhaustion, with the number of token graduations plummeting and trading volumes collapsing. While they are vying for control of the meme coin market, it will be interesting to see if this market is still important enough to be worth fighting for.

The most valuable outcome of this conflict may be how it accelerates Solana’s evolution beyond a meme coin, and how competition drives innovation. For example, PumpSwap’s creator revenue share model could change token economics by tying creator success to sustainable trading rather than pump and dump cycles.

This moment echoes a similar shift we’ve seen in the cryptocurrency space — from ICOs to DeFi Summer to the NFT boom. Each wave of speculation eventually gave way to more sustainable use cases. Perhaps Pump.fun’s war with Raydium marks the end of an era of pure speculation and the beginning of a utility-focused phase of development on Solana.

For users and creators, this competition should result in better tools, lower fees, and more aligned incentives — provided the platforms don’t destroy each other through unsustainable economic models. One wild card is whether Pump.fun’s tokens can potentially dramatically shift the balance of power through strategic airdrops and token economics incentives.

Ultimately, this conflict represents a process of creative destruction. While tensions rise and token prices fall, the entire ecosystem will benefit from the innovation driven by this competition.

Weatherly

Weatherly