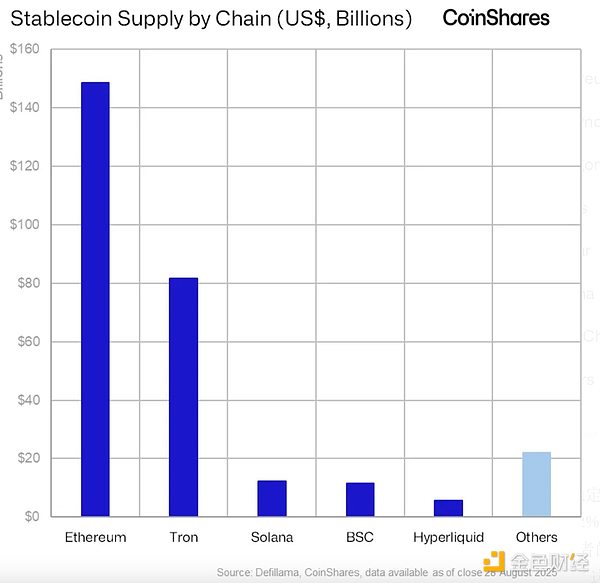

Since the beginning of May, Ethereum and the broader market have undergone significant changes. On May 9th, just after the Pectra upgrade, the initial catalyst emerged, and ETH began to rally and outperform other currencies. The upgrade itself did not suddenly change ETH's fundamental value. ETH's performance had been persistent for quite some time, with market sentiment being very negative. Furthermore, from a positional perspective, ETH was on the short side of many hedges or directly shorted on perpetual futures exchanges. As shown in the chart, many people were trapped and had their positions liquidated during the week of the upgrade implementation. That week alone, Binance liquidated approximately $400 million in short positions. The events that followed were momentous: the United States drafted, voted on, and passed the GENIUS Act. The GENIUS Act's significance for Ethereum lies in its clear regulatory approval for US banks and financial institutions to issue payment stablecoins and custody digital assets. While the act does not directly authorize tokenized deposits or mandate a blockchain-based ledger, it lays the groundwork for future innovation and could open the door to the future tokenization of large-scale government debt and money market funds on-chain.

It's worth noting that Bitcoin's dominance is declining: down 5% over the past month, we're seeing this kind of "stagnation" in Bitcoin's price action, while at the same time, some altcoins are rising. It's difficult to predict how long this will last, but the signals above clearly indicate that we're still in this rotation, and importantly, it's limited to a few cryptocurrencies, not all of them.

Solana's Positioning Looks Constructive

By the way, from a technical perspective, Solana looks quite attractive. The U.S. Securities and Exchange Commission (SEC) has set a final deadline for spot ETFs in mid-October, with potential approval, and the market appears to be starting to factor this in. Solana has been trading in a wide range since January 2025, and this broad consolidation has kept its positioning clear during the decision window. Under the hood, multiple client upgrades have improved transaction throughput and efficiency. Validators are currently voting on the implementation of the new consensus client, alpenglow, which is expected to significantly improve finality (among other improvements) and slightly reduce validator operating costs by lowering voting fees. Compared to some other assets that have seen significant gains in recent months, its risk-reward ratio appears more attractive. Funds showed no enthusiasm, RSI has room to rise, and the technical setup is relatively clean. Source: Velo

Joy

Joy