With the rapid growth of digital assets and the continuous innovation of blockchain technology, the financial market landscape is undergoing profound changes. In October 2024, TBAC's latest report deeply explored the impact of digital assets, especially tokenization and blockchain technology on the U.S. Treasury market, and analyzed its potential benefits, risks and future development trends.

1. Growth trend of digital assets

The report pointed out that although the market size of digital assets is still small compared to traditional financial assets, the growth rate is amazing. As of 2024, the total cryptocurrency market value reached 238.5 billion US dollars, of which Bitcoin's market value was 136.4 billion US dollars and stablecoins' market value was 16.6 billion US dollars. Stablecoins have become the focus of attention due to their "stable value" and important role in the decentralized finance (DeFi) ecosystem.

II. Key uses of stablecoins in the digital asset market include:

1. Providing cross-chain transaction liquidity.

2. Serving as the main collateral in DeFi.

3. Providing an unregulated "deposit" function on cryptocurrency exchanges.

III. Tokenization

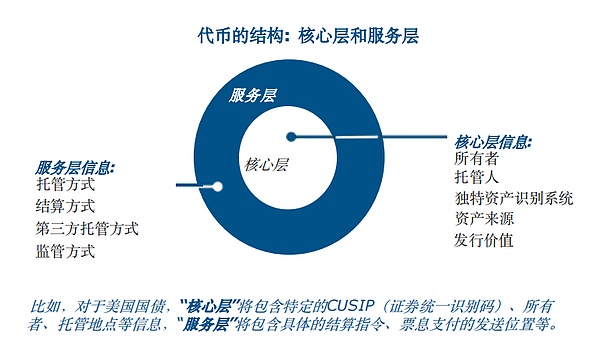

Tokenization is the process of representing assets in digital form and running them on a blockchain or distributed ledger. It includes a core layer and a service layer. Tokenized assets have the following features and advantages:

− Core layer and service layer:Tokenized assets integrate a "core layer" containing asset information and ownership information and a "service layer" that manages transfer and settlement rules.

− Smart contracts: Automated transactions are achieved through smart contracts, automatically executing the transfer of assets and rights when preset conditions are met.

− Atomic settlement: By ensuring that all parts of the transaction are completed at the same time, the settlement process is simplified, the risk of settlement failure is reduced, and reliability is improved.

− Composability: Different tokenized assets can be combined to create more complex new financial products to provide highly customized asset management and transfer solutions.

− Fractional ownership: Tokenized assets can be divided into smaller, more accessible shares.

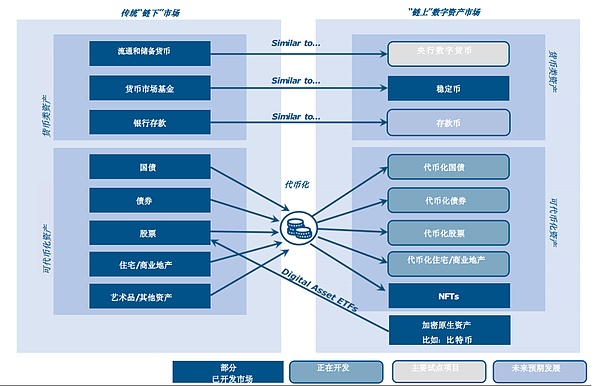

Fourth, the similarities between the digital asset ecosystem and the existing financial market

Five. Tokenized Treasury Market

In the U.S. Treasury market, tokenized private and public projects include:

- Tokenized Treasury Funds:For example, BlackRock’s BUIDL Fund and Franklin Templeton’s On-Chain Money Market Fund.

- Tokenized Treasury bond repurchase project: JPMorgan Chase's Onyx platform uses tokenization to achieve intraday repurchase.

- Pilot projects: Including cooperation between DTCC and the Bank for International Settlements (BIS) and other institutions to explore tokenized settlement methods.

Sixth, the potential benefits and risks of treasury bond tokenization

Benefits:

1. Improved settlement and clearing: Tokenized treasury bonds support a simpler "atomic settlement", and all transaction parts involving treasury bonds can be settled at the same time, reducing the risk of settlement failure.

2. Optimize collateral management:Smart contracts programmed directly into tokenized Treasuries enable more efficient collateral management, including automatic execution of collateral transfers when preset conditions are met.

3. Improve transparency and accountability:Immutable ledgers can provide greater transparency, reduce the opacity of market operations, and provide real-time trading activities for regulators, issuers, and investors.

4. Combinability and innovation:Tokenized assets provide a foundation for financial innovation and promote the development of new derivatives and structured products. Attract more small retail investors and emerging market investors.

5. Increase liquidity:Tokenization may create new investment and trading strategies through seamless integration and programmable logic; tokenized Treasuries can be traded 24/7 on blockchain networks, although doing so may have a two-way impact.

Potential risks:

1. Technical and security issues:The high cost of distributed ledger technology and cybersecurity threats may hinder its promotion.

2. Regulatory and legal uncertainty:Cross-border legal differences and the unregulated nature of stablecoins bring uncertainty to the market.

3. Possible risks of market expansion:

− Contagion risk

− Complexity and interconnectedness

− Bank/payment disintermediation

− “Basis risk”

− Market manipulation and high volatility caused by 24/7 trading

VII. Framework elements and regulatory requirements of the tokenized treasury bond market

Framework elements:

1. Trust and interoperability:A unified or highly collaborative ledger system is required to eliminate the “islands” in the current financial system.

2. Technology selection:Traditional public blockchains may not be suitable for the treasury market due to complex consensus mechanisms and security issues; permissioned chains or private chains managed by trusted institutions are needed.

3. Core and service layer design:The core layer records asset information, such as ownership and custodians; the service layer manages transaction settlement and coupon payments.

4. Customer asset protection:Asset security and operational transparency are ensured through smart contracts.

Regulatory elements:

1. Legal and compliance:Clarify the legal status of tokenized assets and resolve the problem of inconsistent cross-regional supervision.

2. Financial stability:Establish rules to address liquidity risks and asset mismatches under market pressure.

3. Transparency requirements:Improve transaction transparency and protect investor rights through a regulatory framework.

4. Stablecoin regulation:Promote stablecoins to hold high-quality collateral, such as short-term government bonds, and be supervised by regulators.

Conclusion:

Although the overall market size of digital assets is still small compared to traditional financial assets such as stocks or bonds, people's interest in digital assets has grown significantly over the past decade.

1. The growth of digital assets has so far created negligible incremental demand for Treasuries:

− This has so far been primarily driven by the increased use and popularity of stablecoins.

− Institutional use of “high volatility” Bitcoin and cryptocurrencies could lead to increased hedging demand for Treasuries in the future.

2. Advances in DLT and blockchain hold promise for building new financial market infrastructures that improve operational and economic efficiency through a “unified ledger.”

− There are multiple projects and pilots underway by private and public sector players to leverage blockchain technology in the traditional financial market ecosystem, notably those by DTCC and the Bank for International Settlements.

− Central banks and tokenized dollars (CBDCs) may be needed to play a key role in future tokenized payments and settlement infrastructure.

3. The legal and regulatory environment needs to evolve as tokenization of traditional assets advances.

4. Operational, legal, and technical risks need to be carefully considered when making design choices around technical infrastructure and tokenization.

− Research projects should include the design, nature, and concerns of treasury tokenization, the introduction of sovereign CBDCs, technical and financial architecture choices, and financial stability considerations.

5. At present, financial stability risks remain low given the relatively small size of the tokenized asset market; however, strong growth in tokenized assets could lead to elevated financial instability risks.

Tokenization technology provides financial markets, especially the treasury market, with the possibility of optimizing settlement, improving transparency and promoting innovation. However, its rapid growth also brings challenges in terms of technology and financial stability. To realize its potential, it is necessary to gradually promote the large-scale application of tokenization under the leadership of a trusted central authority through rigorous technology development, legal framework and regulatory measures.

Alex

Alex

Alex

Alex Joy

Joy Brian

Brian Alex

Alex Joy

Joy Edmund

Edmund Joy

Joy Alex

Alex Alex

Alex Joy

Joy