At the beginning of 2024, a "war" in the digital economy has quietly begun.

In the early morning of January 11, the U.S. Securities and Exchange Commission announced its approval of spot Bitcoin ETFs. However, just half a month ago, Hong Kong on the other side of the ocean had already taken the lead. The official website of the China Securities Regulatory Commission published the "Notice on Funds Involving Virtual Assets Recognized by the China Securities Regulatory Commission" and officially announced that it is ready to accept applications for spot virtual assets ETF. There is no doubt that although there is no smoke, the "virtual assets battle" between Hong Kong and the United States already started.

In fact, virtual asset ETFs are just an "appetizer" for the East and West to compete in the virtual asset market. Now the "battlefield" between them has extended to a new field. , that is: stablecoin.

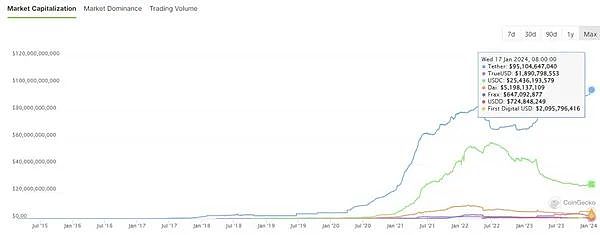

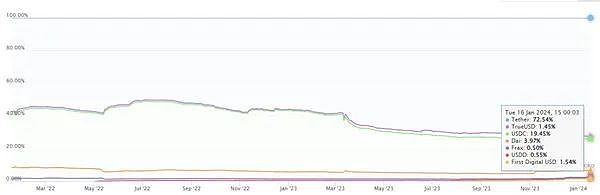

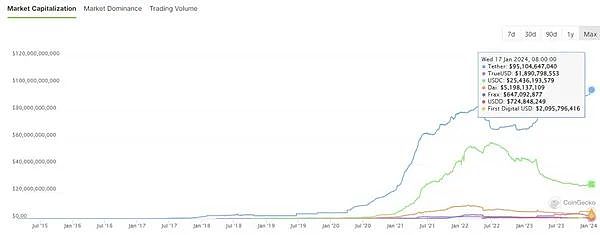

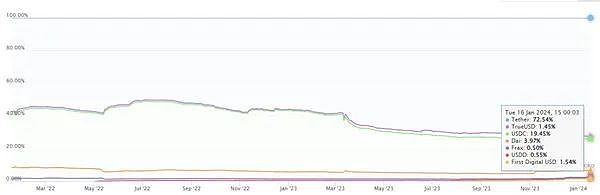

Data overview of the current global stablecoin market

Current stage In the stablecoin market, the top nine stablecoin projects by market capitalization have accounted for more than 95% of the market share, and they are all financial instruments linked to the US dollar. The two “leading” ones are:

(1) Tether issued by Tether (USDT/Tether USD)

(2) Exchange giant Coinbase and Goldman Sachs Group "USD Coin" (USDC/USD Coin) issued by Circle Company.

Data obtained by Koala Finance shows that at the time of writing this article, the global stablecoin market value is approximately US$135 billion, while the stablecoin transaction volume is around US$60 billion. . There are currently five stablecoin "unicorn" projects with a market value of over US$1 billion, namely:

1. Tether: US$95,066,943,726

< p style="text-align: left;">2. USDC: USD 25,452,106,070

3. Dai: USD 5,203,031,829

4. FDUSD: US$2,094,810,984

5. TUSD: US$1,887,941,499

In terms of market share, Tether, Three stablecoins, USDC and DAI, dominate the list, with market shares reaching 72.54%, 19.45%, and 3.97% respectively. The current market share of these three stablecoins has exceeded 95% of the total stablecoin share.

Stablecoins, Hong Kong vs. the United States, the next "virtual asset battlefield"

Last Thursday, Reuters suddenly Disclosure that stablecoin issuer Circle has filed for an IPO confidentially did not disclose the number of shares it plans to sell or the proposed price range of the new IPO filing. The company said it expects the initial public offering to proceed after the U.S. Securities and Exchange Commission completes its review process, subject to market and other conditions.

Coincidentally, Circle CEO Jeremy Allaire made a "sudden" statement on Tuesday, saying that the United States has a "very high chance" of passing stablecoin laws this year, and also pointed out that The regulatory development of the cryptocurrency industry is accelerating around the world, and the United States is more likely than before to approve stable currency laws. He bluntly said, “I think what we will see (the introduction of stable currency laws) is the desire of the U.S. Treasury Department, the Federal Reserve, and both houses of Congress. Of course it is also the wish of both parties.”

On the same day, the Hong Kong Government News Network disclosed that Financial Secretary Paul Chan Mo-po had engaged in two separate projects while attending the World Economic Forum Annual Meeting in Davos, Switzerland. Representatives of financial technology and artificial intelligence companies met. One of them is the world's second largest stablecoin issuer. Although the name of the company has not been disclosed, it is known that the world's second largest stablecoin issuer is likely to be Circle. Chan Mo-po pointed out that since the SAR government announced the policy declaration on the development of virtual assets in Hong Kong the year before last, the market has responded positively, and many digital assets and third-generation Internet companies have settled in Hong Kong. Hong Kong is steadily advancing the development of digital assets and is launching a public consultation on the regulation of stablecoins to formulate an appropriate regulatory framework and promote the responsible and sustainable development of the industry. Stablecoin companies based on legal tender are welcome. Come to Hong Kong to conduct business and provide the society with more innovative and convenient financial service options.

In fact, in order to maintain Hong Kong's status as an international financial center and promote the sustainable and responsible development of Hong Kong's virtual asset ecosystem, the Hong Kong government endorses the issuance of stable coins in a regulatory manner. At the end of last year, the Hong Kong Financial Services and the Treasury Bureau and the Hong Kong Monetary Authority jointly issued a public consultation document to collect opinions on legislative proposals for the supervision of stable currency issuers. It is reported that Tether, the world's largest stablecoin operator by market capitalization, has not yet responded to the stablecoin consultation document, but Circle, the operator of USDC, the world's second largest stablecoin, has expressed support. The meaning behind it is self-evident.

, will become particularly important. Overall, it seems that U.S. regulatory agencies have been adopting a "easy in and strict out" virtual asset supervision model, that is, they do not provide detailed system explanations before market access, but first open the "pockets" and then use their law enforcement powers to Violations and agency penalties. In contrast, Hong Kong regulators have provided a relatively complete access mechanism and a clearer and more transparent regulatory model, which not only outlines a series of requirements for stablecoin issuers, exchanges and wallet service providers, but also It also covers aspects such as risk management, auditing and investor protection, thereby promoting the development of financial technology in Hong Kong and attracting more digital asset transactions.

Summary

Stablecoins are becoming a reality Supplemented by the financial ecosystem, which provides a series of supports such as transportability, continuous settlement, traceability, and cross-border interoperability, the future development of the stablecoin market in Hong Kong and the United States will depend on the regulatory environment, market trends, and technological innovation. and other factors deserve our attention.

System contribution.

Huang Bo

Huang Bo