How to find 10x or 100x Meme coins? Biteye Lao Leek shared three ideas last week. Today, Lao Leek will teach you how to use Meme coin tools to capture valuable tokens from a practical perspective!

Hand-in-hand teaching, nanny-level step-by-step breakdown, I believe you will definitely gain something from reading it. ?

In addition, Biteye has compiled 40 super practical Meme coin tools, covering on-chain monitoring and tools.

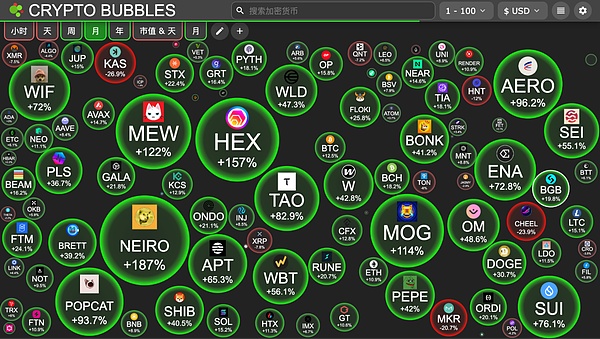

As shown in the figure, many of the large bubbles with the highest monthly statistical growth are Meme coins.

Without saying too much, there are two main ways to find valuable Meme coins: 1. Active search 2. Passive search

01 Active search

Features: This method is suitable for people with more free time, because you need to watch the chain for a long time, mainly to discover new Meme coins.

Specific steps:

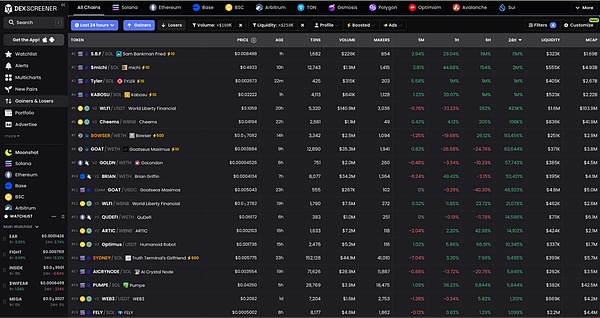

1. Find chains with active fund dog transactions. First open Dexscreener (this is a free and very easy-to-use tool), select Gainers & Losers in the left column, and observe which chains the top 20 tokens with the highest increase in the past 24 hours are on. Then count which chain has the most tokens in the top 20. For example, in the figure below, the chain with the most tokens with the highest increase is Solana.

Observe the most active chains of the top 20 tokens with the highest growth in the past 24 hours through Dexscreener

2. After selecting the chain, click New Pairs on the left column and select the most active chain found earlier, such as Solana. Observe the top 10 tokens, and you can understand the current hot narrative through the token name, Twitter and website.

3. The next step is to filter. Still on the New Pairs page, we have to set some conditions:

Liquidity > 10k

Age < 48H

4. Based on the screening results, we select the top 10 tokens, and then continue to filter based on the project’s Twitter, Telegram, and holders:

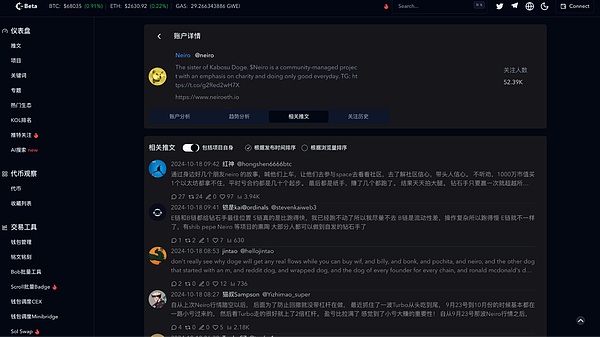

On Twitter, look at KOL attention and fan growth. It is recommended to use Cryptohunt.

On Telegram, look at the community situation and judge based on chat and activity.

On-chain holders can be viewed in the Solscan browser, because we are filtering new coins between 1000-2000, which will be more stable.

Learn about the relevant tokens’ Twitter KOL attention, related tweets, trend analysis, etc. through Cryptohunt

5. Add favorites in Dexscreener, keep an eye on the tokens, and set price alerts, such as price support or breakthrough positions.

6. Choose the right trading tool. The more popular and convenient one is TG bot, such as Pepeboost. For the evaluation and comparison of TG trading robots, please read the Biteye article: How can a newbie attack a local dog? The most detailed comparison of Solana trading bots

02Passive search

Features: This method consumes less time and does not require long-term chain monitoring, but it requires regular time to find smart wallets.

Specific steps:

1. Choose a recent hot Meme coin, such as $Goat, open the Top Traders corresponding to $Goat in Dexscreener, and look for the insider wallet, which is a wallet with low investment but high return.

Take the wallet with the highest profit in Top Traders as an example. This wallet does not display the purchase cost.

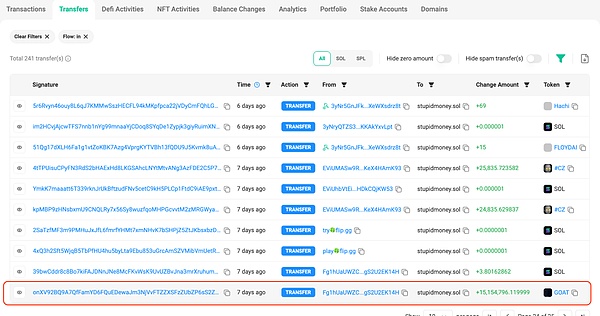

2. Analyze the wallet: If the purchase cost is not displayed in Dexscreener, then these coins are transferred. You can find the initial purchase wallet. This process can be done using a block browser (such as Solscan) or a professional address tracking tool (such as Coinstats). It can help you view the address portfolio and quickly find transactions of related tokens.

Through the Solscan block browser, we can observe the interaction of the address and find that the Goat token is transferred from another address

3. In-depth analysis of the wallet: observe the income of other tokens in the address.

Through Coinstats, we analyze the portfolio of the wallet address. Most of these are temporary wallets with no other heavily invested assets

4. Monitor the wallet: Use Cielo to monitor the address so that you can buy at the right position later.

03 Summary

1. Choose active or passive methods according to your own situation, and of course you can use them together.

2. While trading in the short term, you should also have long-term positions (for example, the leading Meme coin). This is because the probability of loss in short-term trading is very high, and you need to have a stable, long-term position with a good narrative to hedge the risk of short-term PVP trading.

3. You can increase your position if you are profitable, and stop loss in time if you are losing money.

4. Finally and most importantly, don’t fall in love with the coin you bought! (Blood and tears lesson)

Brian

Brian

Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Joy

Joy Alex

Alex Brian

Brian Alex

Alex Joy

Joy Brian

Brian Joy

Joy