Author: Brayden Lindrea, CoinTelegraph; Compiler: Deng Tong, Golden Finance

The business intelligence services and Bitcoin purchasing company (formerly known as MicroStrategy) is seeking to raise another $2 billion through 0% senior convertible bonds to purchase more Bitcoin.

Strategy said in a statement on February 18 that the first bond buyers will have the option to purchase up to $300 million worth of additional bonds, which will be available within five business days of issuance.

The company added that it intends to use the net proceeds from the offering to purchase more Bitcoin and as working capital.

Senior convertible notes are debt securities that can be converted into equity at a later date. They are senior to common stock because the holders have priority in the event of bankruptcy or liquidation.

Senior convertible notes have been one of the main tools used by Strategy to execute its 21/21 plan - which aims to raise $42 billion in capital over the next three years, splitting equity and fixed-income securities - to buy more Bitcoin.

The plan was orchestrated by Michael Saylor, Strategy's executive chairman and co-founder.

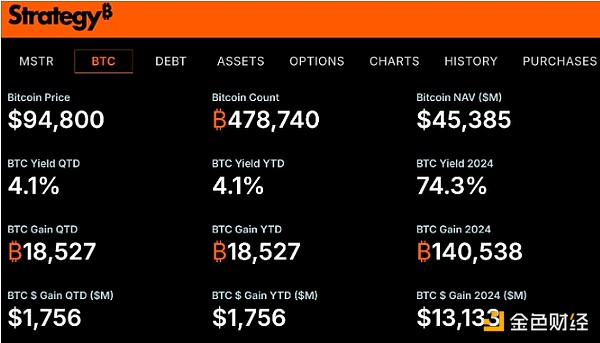

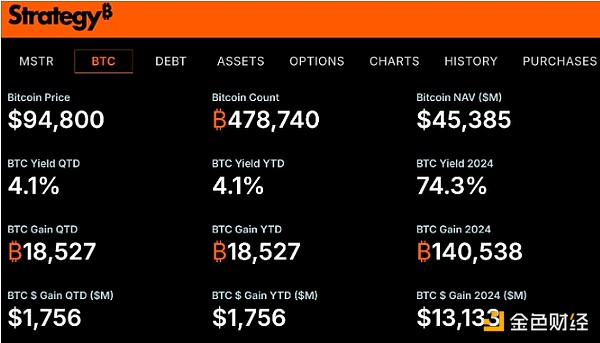

The firm has completed more than half of its $42 billion capital plan since it was announced on Oct. 30 — purchasing nearly 200,000 bitcoins since then, bringing its total reserves to 478,740 bitcoins and making it the world’s largest corporate bitcoin holder.

Key bitcoin indicators displayed on Strategy’s new website. Source: Strategy

Strategy said the proposed notes would mature on March 1, 2030, unless repurchased, redeemed or converted earlier, and are “subject to market and other conditions.”

Strategy’s (MSTR) shares did not see a major move on the news. MSTR closed down just over 1% on Feb. 18 and was flat in after-hours trading, according to Google Finance data.

However, Strategy shares are up 372% over the past 12 months, making it one of the best performers in the U.S. stock market over the past year.

Despite its purchases of Bitcoin and its rally in its price, Strategy reported a net loss of $670.8 million in the fourth quarter.

Catherine

Catherine