Author: Deep Wave TechFlow

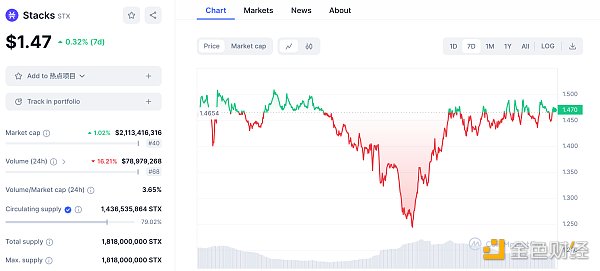

With the passage of Bitcoin spot ETF , the news came true, and the market started a downward path in the short term.

However, with the expectation of halving, projects related to the Bitcoin ecosystem are still the focus of everyone's attention this year. Among them, Bitcoin L2’s leading project Stacks ($STX) has rebounded in the recent week’s market performance.

For those players who are optimistic about STX, the project itself will usher in the Nakamoto upgrade in Q1, and it is expected that with the support, it will be able to sell high and buy low to gradually accumulate funds. Of course it is a good choice;

But price fluctuations are also accompanied by uncertainty in returns. Is there any other way to obtain STX while holding it? Extra revenue?

Don’t forget that the original design goal of Stacks is to bring the possibility of DeFi to BTC.

What most people may not know is that currently holding STX can already form pools, single stakes, liquidity stakes, and even Become the key to interactively win airdrops in the Stacks ecosystem.

But compared to Ethereum and other chains, STX’s pledge-related interactions are not that mainstream.

If you have STX and want to maximize your income, the following will review and explain all possible income strategies. There is always one that suits you.

CEX staking: a convenient choice

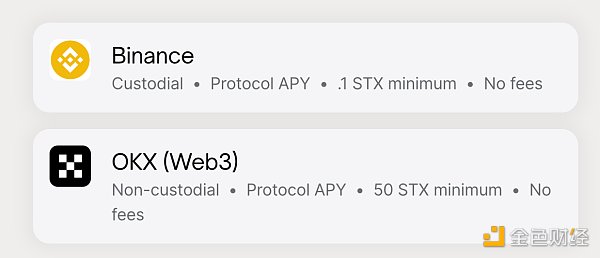

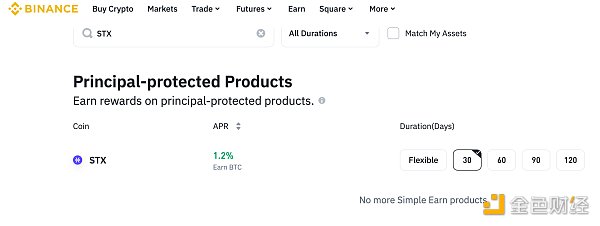

Currently, staking is available directly on Binance and OKX STX options for earning income.

For novices who are not familiar with on-chain operations, or want convenience, it is also a good choice to hand over custody to CEX.

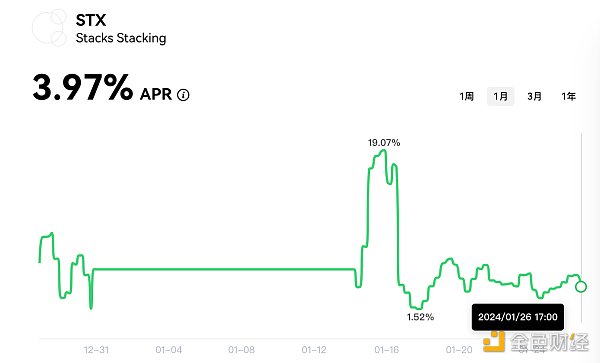

The threshold for two CEXs is not high. The minimum requirement for Binance is 1 STX and OKX is 50; in terms of income, the cut-off At the time of publication, the two pledged STX for 30 days, with estimated APRs of 1.2% and 3.97% respectively.

Separate staking on the chain: the choice of large investors

For the chain For players, STX may be stored more in their own wallets. At the same time, for those who want to deal directly with the Stacks protocol instead of dealing with a delegated staking service provider, staking directly would be a better choice.

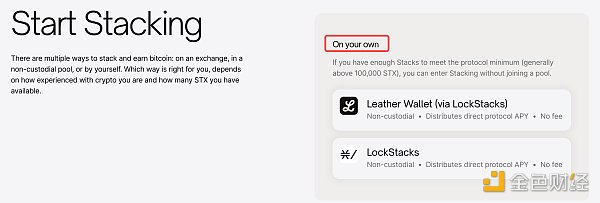

Stacks The official recommended method is Leather Wallet + LockStacks.

The former is a self-hosted wallet that can send and receive STX and BTC, while the latter provides an entrance for users to directly stake STX without having to deal with service providers. .

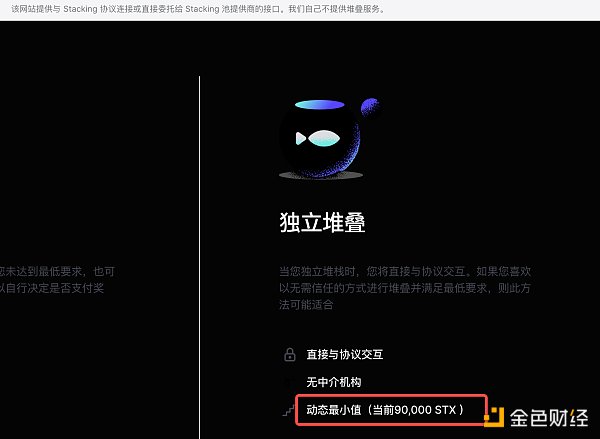

However, the prerequisite for doing this is that you must be a big investor.

It is clearly stated on the LockStacks page that only users holding 90,000 STX are eligible for individual staking; although this threshold will change, it obviously will not Going down there is similar to the basic requirement for Ethereum nodes to pledge 32 ETH.

According to the calculation data given by Twitter user @Mezma00, the APR of this kind of pledge is about 7%.

On-chain entrusted staking: a people-friendly choice

It doesn’t matter if you are not a big investor, Stacks is also It provides a mechanism for entrusted staking, with service providers forming a pool to bring everyone's STX together for staking.

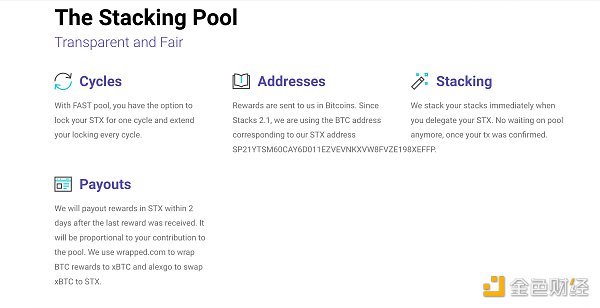

Currently, there are four main service providers that carry out entrusted pledge services. Although they are all non-custodial pledges, their respective requirements and reward methods are different:

< ul class=" list-paddingleft-2">

Xverse Pool: There is a minimum pledge amount requirement (100STX), and rewards are settled in BTC;

Fast Pool: No pledge requirement, rewards are settled in STX;

LockStacks: As mentioned above, you can do both individual pledges and entrusted pledges. There is no pledge amount requirement when entrusting pledge, and the reward will be settled in STX;

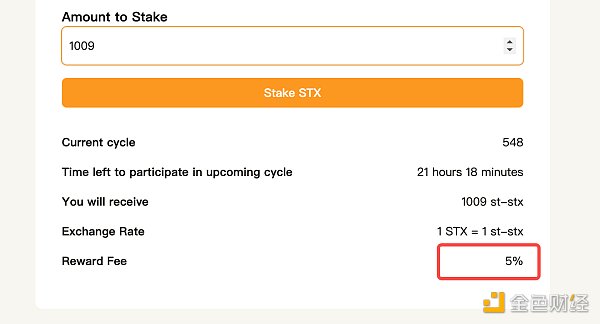

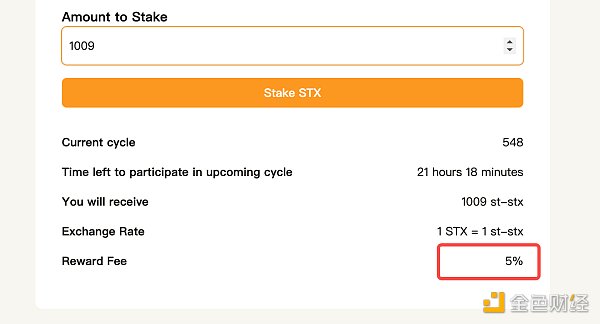

Planbetter: There is a minimum pledge amount requirement (200STX), and a fee will be charged 5% staking fee, rewards will be settled in BTC

Among them, a comprehensive look at several platforms denominated in BTC The APR is around 9%, and the price in STX is around 7%.

However, considering the interface, staking requirements and cost, Fast Pool and LockStacks are more cost-effective.

Liquidity staking: the choice to maximize capital efficiency

Take STX Without staking, liquidity is locked, which means there is also a certain opportunity cost.

In the Ethereum ecosystem next door, this problem has long been understood by liquidity staking players---LST (liquidity staking proxy) will be given after staking. coins, such as stETH), take LST and go to Matryoshka to find more profits.

In the Stacks ecosystem, this method works equally well.

The more mature one is StackingDAO, which focuses on liquidity staking services in the Stack ecosystem.

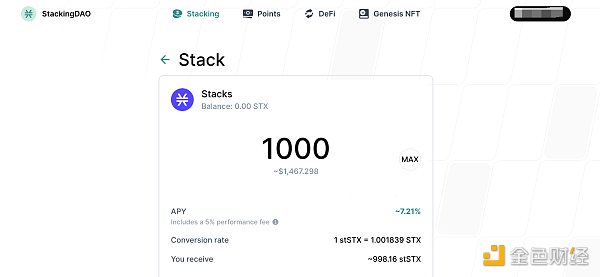

As shown in the figure below, you can deposit STX and swap out stSTX, and enjoy an APY of about 7.21%. However, it should be noted that you still need a wallet that supports depositing STX and BTC, such as the Leather Wallet mentioned above.

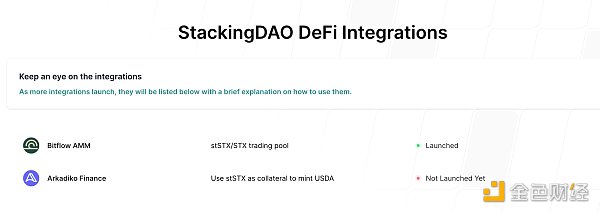

After staking to get stSTX, StackingDAO also provided related DeFi functions. For example, the Bitflow AMM project in its ecosystem has been launched, and users can use stSTX/STX trading pairs to swap/form pools/use LP certificates to earn interest, which are common DeFi gameplays.

In addition, there is a stablecoin project called Arkadiko that is not yet online, which allows the use of stSTX to mint the stablecoin USDA, similar to Lybra Finance and Prisma gameplay.

Interaction in the testnet stage: the choice of airdrop

The same flow In terms of nature staking, there are two projects in the Stacks ecosystem that are easily overlooked, but may generate future airdrop profits - Papaya and LISA.

First let’s look at Papaya.

This project also provides liquidity staking services, but currently it does not receive much attention on Twitter, so it has certain potential.

Papaya's v1 test network is currently online. Users can access its platform to perform liquid staking of STX, and will also receive stSTX, and liquid staking The reward is 5%.

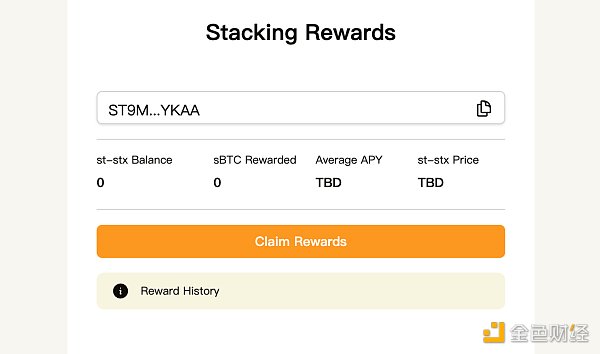

At the same time, on top of this income, Papaya also provides additional BTC income. After staking STX for a period of time, you will also receive sBTC rewards, and the value of this token corresponds to BTC at a ratio of 1:1. However, since the test network has just been launched, the current APY is unknown.

The author speculates that sBTC can also be used as nesting dolls in other projects in the ecosystem to generate revenue, but the gameplay and acceptance remain to be seen.

In addition, it is clearly written in the official documentation of the project that participants can obtain liquidity mining rewards by staking sBTC or STX to Papaya , after which they will also receive PAPA tokens. The amount of PAPA tokens an individual receives is proportional to the liquidity they provide.

However, PAPA tokens do not specify a clear TGE time, so it may be possible to win PAPA tokens through interactions at the current testnet stage.

Another liquidity staking project that deserves more attention is LISA.

Currently, LISA’s official website is still in the conceptual stage, and specific liquidity staking services and test networks are under construction. But the reason why it is expected to be even more popular is that LISA officials have made it clear that the team behind the project comes from ALEX Lab, a powerful builder of the Bitcoin ecosystem.

The official Twitter exchanges between the two are frequent, and LISA’s official website page also has a slogan about ALEX’s participation in the construction.

Considering that the latter has rich resources and sufficient gameplay experience from establishing Bitcoin’s first oracle to launching Launchpad, and at the same time, before the ALEX token It also has very good market performance;

If the team gets involved in the field of liquidity staking, it can be expected that it will also vigorously carry out marketing and promotion, and LISA, as a bridgehead project, will naturally It will also benefit from this, further increasing expectations that there may be an airdrop of LISA tokens.

However, since LISA’s liquidity staking has not been officially launched yet, it is recommended that players go to LISA’s website to register via email first, and pay attention to the subsequent progress and performance of the project. .

Generally speaking, Stacks has stuck its position in the wave of Bitcoin ecological explosion, and related ecological projects are blooming more and more. It gives players of different sizes, experience and preferences options to obtain different benefits.

Under the expectation of a bull market, project construction, ecological development and player participation achieve mutual success. Sometimes an inadvertent interaction may lead to unimagined benefits.

Use an early attitude, find a position to maximize profits, and welcome the next opportunity.

Xu Lin

Xu Lin

Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Joy

Joy Others

Others Bitcoinist

Bitcoinist Others

Others Coindesk

Coindesk Cointelegraph

Cointelegraph