https://dexscreener.com/

Check transaction history

DEX Screener and other tools can list all transaction records, and we can simply view the addresses of all buying and selling operations. If you find frequent operations on the same address (as shown in the picture below), this is also a very suspicious signal.

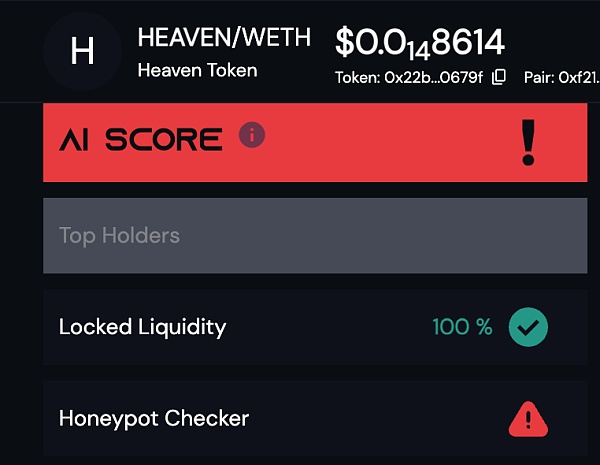

Use Honeypot and token risk monitoring functions

Platforms including DEX Screener and Advantis.AI will provide Honeypot Detection and some basic token risk item detection functions can also assist users in judging investment risks. As shown in the figure, when a user searches for a certain Token,the platform will automatically give the risk level of the Token. Users can judge whether they need to withdraw funds in time based on the risk level.

https://advantis.ai/

Using MetaSleuth to detect Rug Pull

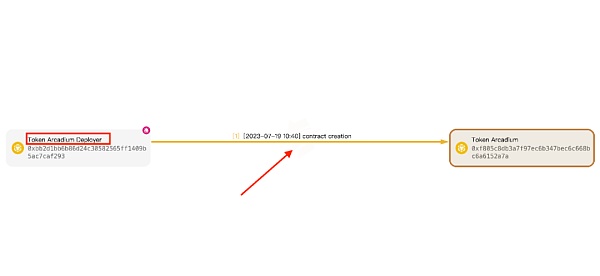

< p style="text-align: left;">Detect the deployer’s funding sourceFor a token, in addition to token In addition to the contract address and transaction pair address of the currency itself, the deployer address is also very important. By observing the financial relationship of this address on the blockchain, we can better assess the risk profile of a project.

To find the deployer address, you can directly enter the contract address of the token in MetaSleuth (https://metasleuth.io) . In the generated fund flow graph, look for the contract creation edge - 'contract creation'. The transaction where this edge is located is the creation transaction of the token contract, and the initiator of the transaction is the deployer. The deployer's funding sources can then be further analyzed.

Example of contract creation relationship

In order to effectively avoid risks, users can pay attention to the following common deployer funding sources, which may bring high-risk situations:< /p>

Funds come from currency mixing services or flash exchange services without KYC (such as Fixedfloat). This is a method chosen by malicious token deployers to avoid being traced to their true identity.

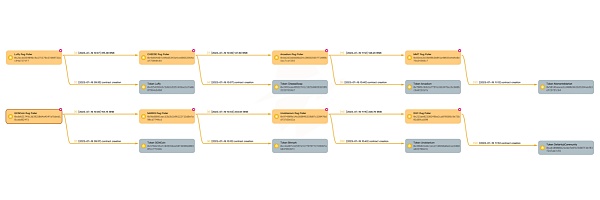

Funds carry other illegal sources. The image below shows a Rug Pull network where all the coins shown have had a Rug Pull occur within a short period of time. The scammers use the profits made after the last Rug Pull to move funds to the next address, which then deploys new tokens and lures new victims.

https://metasleuth.io/result/bsc/0xde621749c3d39250d4a454fafbbeb18cabd824f5?source=64681083-27e7-4b42-a816-db6c0f9869f3

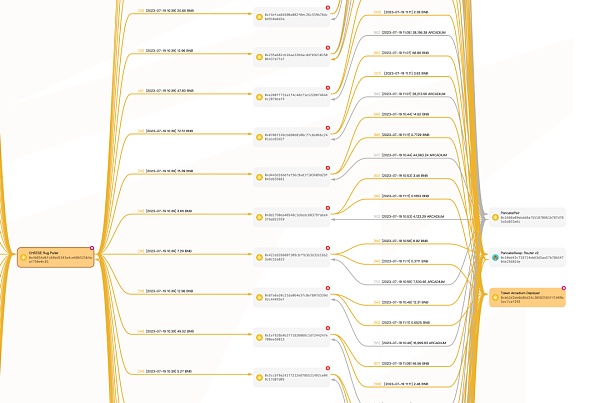

Detect liquidity sources

Fraud project parties are very skilled in creating false liquidity, as shown in the figure below . They dispersed the previously obtained profit funds to many different addresses. These addresses only performed the operation of buying tokens, while there were also some addresses responsible for selling tokens. These falsely constructed liquidity tricks victims into thinking that the token is very popular, but they don’t know that they will be deceived once they invest.

https://metasleuth.io/result/bsc/0x4b854d6fc84bd5343a4ce68652564aaf750e0c65?source=b50ccfcd-f5c9-4d49-8138-1d9c40181aaf

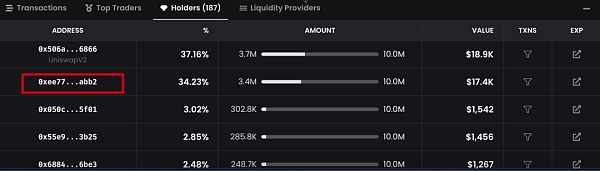

Follow Top Holder

The following figure shows a list of Top Holders of a token, the holdings and liquidity pool of the second-ranked holder Almost equal, which means that the holder has the ability to fully withdraw funds from the pool at any time.

By further tracing the source of funds for this address in MetaSleuth, we can find that this address is the deployer of the token, minting a large number of tokens for itself when the contract was created. This kind of project carries extremely high risks.

Summary

Before investing, users should conduct appropriate due diligence (DYOR), utilizing mature analytical platforms such as Fund tracking platforms such as DEX Screener and MetaSleuth are used to assist investment decisions to avoid risks to the greatest extent. Observing trend charts and verifying transaction volume and checking transaction records are one of the common methods. In addition, tracking the fund source and liquidity source of the deployer through tools such as MetaSleuth is also an effective way to avoid risks. Ensuring the authenticity and reliability of token projects can help cryptocurrency enthusiasts make smarter investment decisions, leading to better returns and reduced risks in the Web3 world.