What is Momentum?

Momentum is a native ve(3,3) mode DEX deployed on the Move ecosystem, dedicated to building the core liquidity infrastructure on Sui.

Official X account:@MMTFinance

Financing progress:Currently, US$10 million in financing has been completed, and subsequent rounds will be announced soon.

Powerful lineup behind:

Lead investor:Varys Capital, supported by the Qatari royal family office

Double endorsement: Sui Foundation + Mysten Labs co-founder Adeniyi Abiodun

The investment lineup also includes: Coinbase Ventures, Circle Ventures and other top institutions

Token mechanism:

Protocol token: $MMT

Governance token: $veMMT

ve(3,3) mechanism: How to achieve a win-win situation for all three parties?

ve(3,3) is a mechanism that combines the veToken model with the “(3,3)” cooperative game theory proposed by OlympusDAO. Its goal is to achieve deep incentive alignment between token holders, LPs and protocols.

Momentum ve(3,3) mechanism deconstruction

Lock in exchange for governance rights

Users lock $MMT to obtain the governance token $veMMT. The longer the lock is, the higher the weight:

After locking, the weight of $veMMT will decay linearly and can be extended at any time to maintain governance rights.

Voting determines the direction of incentives

$veMMT holders vote once a week to decide which pools the liquidity incentives are allocated to. Wherever you vote, there will be rewards.

Incentive mechanism activates the governance market

Liquidity providers can attract $veMMT holders to vote for a pool by providing incentives, forming a market-based voting game mechanism.

Revenue distribution mechanism

100% of all transaction fees go to $veMMT holders who actively vote

LP does not directly receive fees unless:

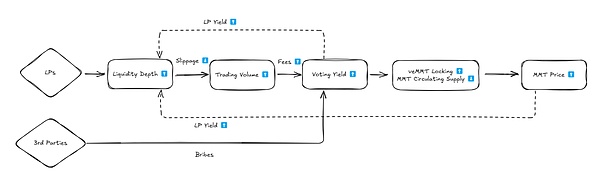

ve(3,3) flywheel: a multilateral game of efficient cooperation

Under the ve(3,3) model, the three parties promote each other to form a flywheel effect of liquidity and returns:

For LP:

Better liquidity → Lower slippage → Higher trading volume → More fees → More veMMT voting → More incentives → Return to liquidity pool

For project parties:

Provide incentives → Attract voting → Get incentives → Improve pool performance → Push tokens up

For veMMT holders:

Vote → Get fees + incentive income → Guide incentives to high-quality pools → Increase $MMT value → Improve your own income

This is a win-win cooperation game for all three parties.

The core logic of ve(3,3)'s token economy

1. Deep liquidity = real price discovery

Sufficient depth is the prerequisite for true price reflection and the basis for DEX to truly compete with CEX.

2. Governance voting + incentives = precise incentives

Do not "sprinkle pepper", only incentivize pools with real needs, which is more efficient and more stable in the use of funds.

3. veToken model = long-term cooperation mechanism

Locking means long-term binding, and the motivations of governors, project parties and LPs are naturally consistent. Sui × Momentum: Co-building a native liquidity engine Sui is one of the most cutting-edge new generation public chains, but it still lacks a DEX engine with native deep liquidity. Momentum is an ideal candidate to fill this gap.

Sui's advantages include:

TPS theoretical value exceeds Solana, and confirmation is faster

Stable architecture and very few downtime

Gas cost is low and predictable

text="">User assets are highly secure

Natively integrated with USDC, no cross-chain bridge risk

Supports DeFi, RWA, BTCFi, GameFi, AI and other asset types

But there are still problems:

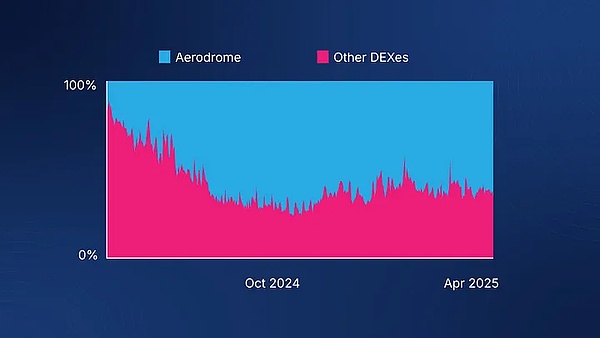

text="">The slippage for large transactions is still ~0.25%, while Aerodrome on Base has achieved ~0.05%

Lack of a ve(3,3) model DEX with governance efficiency

The value of Momentum lies in:

Providing a deep pool

: text="">Support high-frequency trading

Increase protocol TVL and revenue

Support real price discovery

Promote the positive cycle of Sui native asset ecology

Summary in one sentence:

Sui × Momentum = Base × Aerodrome

Current data performance

Momentum has been online for only 5 weeks, and the data has shown explosive potential:

1. TVL exceeds $32 million

2. Cumulative transaction volume exceeds $720 million

text="">Conclusion

Sui needs a native liquidity engine, and Momentum is the project that fills this gap at a critical moment. Looking back at the paths of Base and Aerodrome, it is not difficult to see that the combination of Sui and Momentum is heading towards a future worth looking forward to.

If you are paying attention to the Move ecosystem, or are looking for the next DeFi project worth participating in for the long term,Momentum is worth your in-depth understanding!

Aaron

Aaron

Aaron

Aaron Aaron

Aaron Catherine

Catherine Jasper

Jasper Joy

Joy Hui Xin

Hui Xin Jasper

Jasper Davin

Davin Alex

Alex Catherine

Catherine