Author: Zixi.eth Source: X, @Zixi41620514

I have held ETH/SOL for 3 years. The market will not deceive people. In a year and a half, users voted with their feet. In summary:

The overall funds and developers of Ethereum are still>solana;

The users of Ethereum mainnet have migrated to L2, but L1 still has weak capture of L2 value, and the number of Solana users is far greater than that of Ethereum L1;

The assets priced by Ethereum in this cycle are less than those priced by Sol;

The direction of Ethereum's Ecosytem is crooked.

In the past, our criteria for judging public chains were basically: 1. TVL of funds; 2. Number of developers; 3. Users; 4. Ecosystem; (5. Is there a banker). We will continue to analyze the current Ethereum (L1+L2) and Solana ecosystems from these five perspectives.

1. From the perspective of the amount of funds

The Ethereum mainnet far outperforms Solana. The trend has not changed in the past three years. Since 2021, Ethereum TVL has been 50%-60%. Although Ethereum TVL Dominance has declined recently, including Base/Arbitrum's TVL, the overall Dominance is still at 60%, which is the same level as the big bull market in 2021. But it is worth noting that Solana TVL has now grown to 8%, a significant increase compared to 1%-3% in 2021.

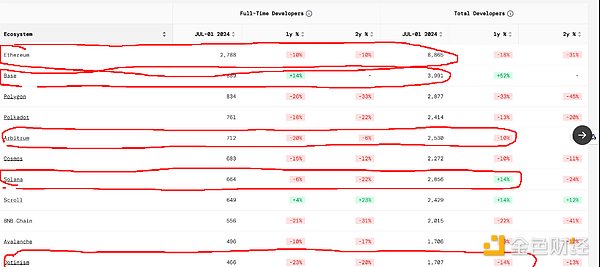

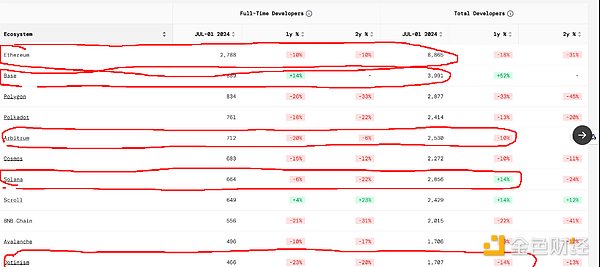

2. From the perspective of developers

The total number of Ethereum ecosystem developers is still far ahead. The number of Ethereum mainnet developers has declined in the past year, and some may gradually migrate to L2, such as Base. In 22-23, Ethereum builders regarded "halal" as the supreme honor, and Ethereum investors regarded halal as the core of their investment. During that time, I listened to the project party talk about various zk changes every day. It was painful, but I have to admit that ZK is gradually landing.

But in the past year, I have personally felt the rise of Solana ecosystem developers. I feel this particularly strongly from the breakpoint of 2049 this year. It has been a long time since I have seen a large public chain that can organize ecosystem activities so well. In addition, the Solana Foundation continues to hold hackerhouses, and many teams around me have turned to Solana, which can be verified by the data that the number of Solana devs has increased by 20% in one year.

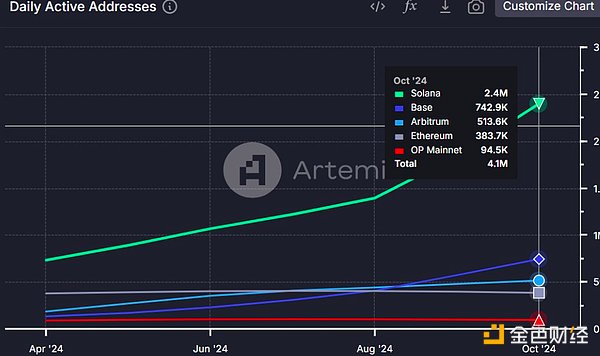

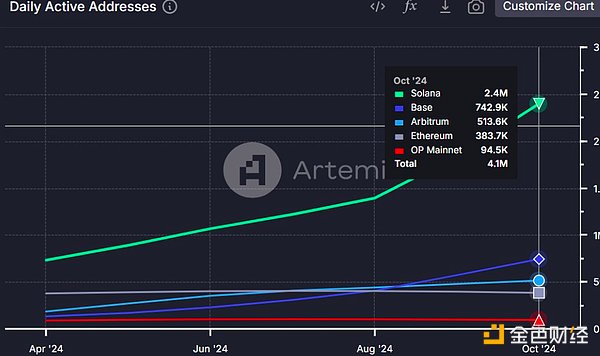

3. Users

Solana is far ahead. Solana's daily activity (58%) is greater than that of Ethereum and L2 combined (42%), and Solana's transaction volume (84%) far exceeds that of the Ethereum system (16%). However, the core asset transaction volume is still deposited on Ethereum and L2. This is consistent with Solana's current ecological positioning as a launch platform for the coin. In addition, you can focus on Base, which is rising very fast.

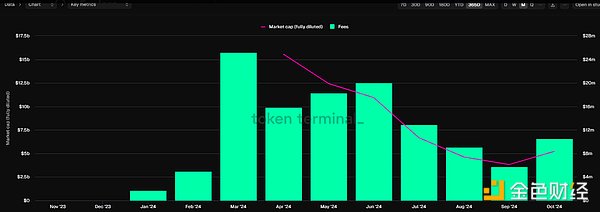

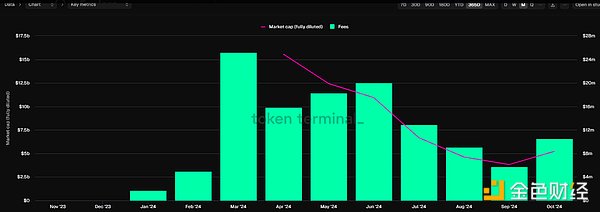

4. Ecological coin asset pricing

The pricing of coin assets is actually the result of the good or bad development of the public chain ecology. In 2020-21, Ethereum relied on the two ecosystems of DeFi/NFT to make all DeFi assets and NFT assets priced in E. People would say that DeFi TVL is thousands or tens of thousands of E, and the price of NFT is several E. Regardless of the actual buying or the virtual psychological pricing, the currency standard will be used as the final pricing standard, although these coins will eventually be sold in a round-trip manner:)

Looking back at GameFi on BSC in 21, users also used BNB to price ecological assets, which led to a surge in BNB during the gamefi period.

The most correct thing Solana has done recently is that @pumpdotfun has been using the three-disk theory of issuing new local dogs and the myth of making a fortune for a very small number of users to attract a large number of buyers to the entire market. Over time, users will form a model of pricing local dog assets with SOL. BTW, http://pump.fun is the third most perfect product I have seen in the past three years (the first and second will be mentioned later).

5. Has the Ethereum ecosystem developed poorly in the past two or three years?

On the contrary, I think it has developed very well. In the past three years, I think the top 1/2 products that are the most perfect are @ethena_labs and @Polymarket. Ethena sold the funding rate arbitrage that only a very few people could do in the past to decentralized retail investors, and the agreement earned 100 million US dollars in 251 days. It is a win-win for the project party/investors/users, but the design of the token utility is indeed problematic.

Polymarket put the prediction market on the chain, using blockchain to circumvent the payment and regulatory issues of the traditional prediction market, and seized the opportunity of the election. Now media platforms around the world refer to Polymarket's election data to view polls.

Ethena has brought real benefits to users with financial management needs. Polymarket has solved the practical problems of the web2 prediction market with blockchain and successfully broke through the circle. Ethena and Polymarket have continued to write new successes for the Ethereum ecosystem, but what have they brought to the price of Ethereum? It is difficult for the two successful big brothers Ethena and Polymarket to replicate the glory of using Ethereum to price the ecosystem during the period of DeFi/NFT.

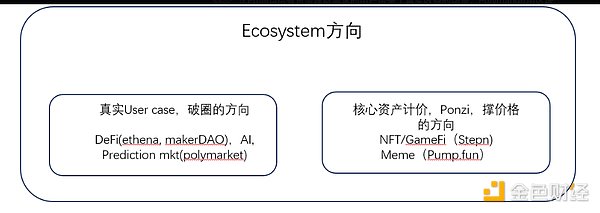

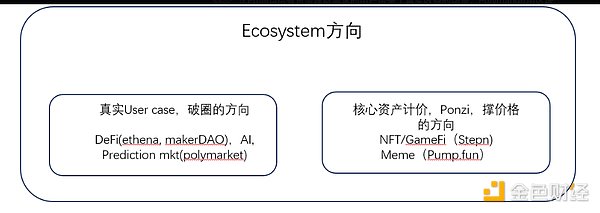

6. Future Outlook of Ecosystem

I think the future ecology should be viewed from two aspects. On the one hand, there are real use cases, such as @ethena_labs and @Polymarket that need Ethereum, and there should be more and more PayFi on Solana. This is the real development direction of blockchain. At the same time, split-plate projects similar to @pumpdotfun are also needed to boost the price of core assets. Both are indispensable.

Wilfred

Wilfred