Author: Joyce, Vernacular Blockchain

From ICO in 2017 to DeFi Summer in 2020 and NFT in 2021 Big bang, every bull market is driven by a new narrative. If we want to talk about the main narrative of the new round of bull market, the representative inscription boom represented by BRC20 cannot be ignored.

Looking back at the whole year of 2023 from the beginning of 2024, the Bitcoin ecosystem has indeed gone from the historic moment of "spot ETF passing" at the beginning of this year to the BRC20 protocol, Bitcoin NFT, Layer 2, ecological infrastructure, etc. Let a hundred flowers bloom and shine.

01 Bitcoin spot ETF passed

To say that the crypto industry has entered the annals of history in recent years, it is the moment On January 10 this year, the U.S. SEC approved a Bitcoin spot ETF.

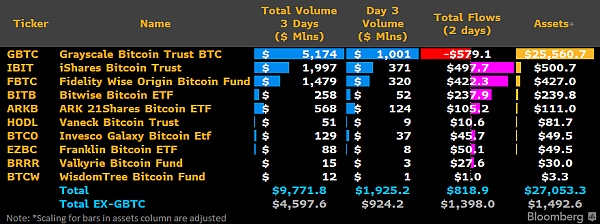

The Bitcoin spot ETF, which has been hotly speculated for several years, has finally settled, ushering in a new era in which Bitcoin is truly integrated with traditional funds. Three days after the Bitcoin ETF was launched, the trading volume was close to 10 billion U.S. dollars, making it one of the best-performing ETFs in history.

A list of relevant data for the 3 days before the launch of the Bitcoin spot ETF, data source: Bloomberg

A list of relevant data for the 3 days before the launch of the Bitcoin spot ETF, data source: Bloomberg

Although with the launch of the Bitcoin spot ETF, the price of Bitcoin fell back from 48,000usdt all the way to 38,000 With long USDT, the market was once full of remarks such as "good things are bad when they are implemented" and "grayscale Bitcoin ETF crashes".However, the net inflow data of ETFs show that the adoption of Bitcoin spot ETF will become the crypto market. It is a major channel for over-the-counter capital injection, and the value effect of this capital channel will become more and more obvious in the future.

Moreover, the passage of the Bitcoin ETF means that Bitcoin is no longer a niche asset in a narrow circle, but like gold has officially integrated into the global capital market and begun to gradually receive Mainstream market recognition, the power of compliance and a large amount of OTC funds may prevent the price of Bitcoin from skyrocketing and plummeting as before.At the same time, the Bitcoin ecosystem and even the entire encryption industry will benefit from this, reducing every The withdrawal of talents and funds from the bear market has allowed the entire industry to develop more healthily.

02 Ordinals protocol detonates a new narrative

In addition to Bitcoin spot ETFs, in the past year The most significant event in the Bitcoin ecosystem is the release of the Ordinals protocol.

The subsequently popular BRC20 protocol and Bitcoin NFT were both built on the Ordinals protocol. It can be said that without the Ordinals protocol developed by Casey Rodarmor, there would be no series of bits driven by the BRC20 protocol. The rise of the underlying ecosystem of the currency.

The Ordinals protocol was released in January 2023 and is an asset issuance protocol based on Bitcoin.

There is no Turing-complete smart contract on Bitcoin. Unlike Ethereum, which can directly issue Tokens or NFTs, Bitcoin’s Segwit and Taproot upgrades allow any data in the Bitcoin block to be stored (less than 4MB) became possible, so Casey, the founder of theOrdinals protocol, numbered the smallest unit of Bitcoin, Satoshi, and wrote pictures, text, audio and even video content into the numbered Satoshi, allowing Bitcoin to issue NFTs. , it is even possible to issue Token.

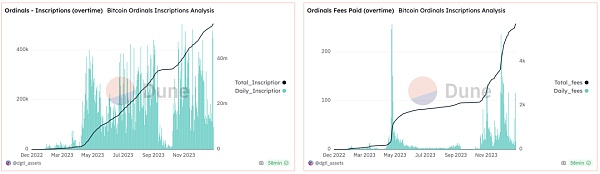

Since the release of the Ordinals protocol in January 2023, so far, the number of inscriptions minted through the Ordinals protocol has exceeded 55 million, and the handling fees created for Bitcoin block generators have exceeded 5,700. BTC. Today, when the output of Bitcoin is getting less and less, the emergence ofOrdinals inscriptions has brought new incentives to Bitcoin block generators whose profits are dwindling. It is undoubtedly beneficial to the security and prosperity of the entire Bitcoin ecosystem. It's a huge benefit.

Ordinals inscription casting quantity and transaction fee trends, data source: Dune @dgtl_aasets

Ordinals inscription casting quantity and transaction fee trends, data source: Dune @dgtl_aasets

Although various new protocols such as Atomicals, Runes, and Pipe have appeared in the Bitcoin ecosystem, , however, the Ordinals protocol, as the leader in this wave of Bitcoin ecological asset issuance, far exceeds other protocols in terms of overall market value and community popularity.

It can be said that the Ordinals protocol triggered this round of Bitcoin ecological craze, or it is not an exaggeration to say that the Ordinals protocol started this round of bull market.

03 BRC20 outbreak

To say that the most out-of-the-box word for the Bitcoin ecosystem in 2023 is "Inscription" is none other than this.

Although the true meaning of "inscription" refers to the NFT or Token minted by the Ordinals protocol, but in this wave of "making inscriptions< "strong>" During the craze, the vast majority of inscriptions refer to Tokens on the BRC20 protocol.

When the Ordinals protocol was born, it mainly focused on issuing NFTs. It was not until two months later that anonymous programmer Domo believed that the Ordinals protocol could not only issue NFTs, but also issue homogeneous tokens: When the inscription is minted according to a unified protocol standard, a homogeneous Token can be generated, and the generated Token is called a BRC20 Token.

From its birth in March last year to the present, BRC20 Token has experienced an explosive stage. The market value of Token in the entire BRC20 track has now exceeded 3.3 billion US dollars. The leading Ordi and Longer Sats have successively After being launched on the top platform, the market value of both quickly climbed to Top 60.

From an unknown Meme to becoming the darling of capital after leaving the circle, this wave of BRC20 is indeed unparalleled.

04 Bitcoin NFT surpasses Ethereum NFT

Bitcoin NFT has actually been around for a long time, but until the Ordinals protocol With the birth of Bitcoin, NFT began to really become popular.

Of course, this degree of “popularity” is relative to Ethereum and other ecological NFTs. The currentBitcoin NFTs are still limited to a small circle and are not as popular as Just like the last round of Ethereum NFT, it attracted a large amount of external funds and talents.

At present, the NFT track is in a relatively deserted state. Since the last round of market bearishness, Ethereum blue-chip NFTs have begun to slump, and prices continue to fall. Until now, the entire The Ethereum NFT track does not have much popularity. Occasionally, there are projects that stir up a little splash, but none of them really ignite the NFT track.

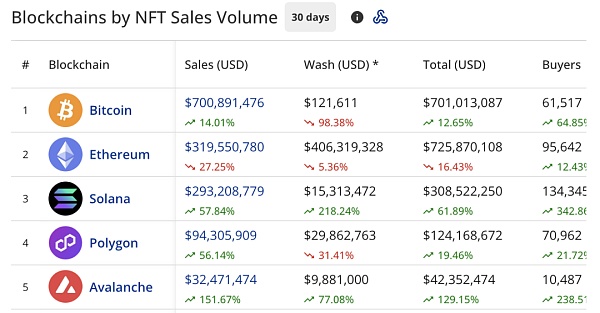

According to Cryptoslam data, the transaction volume of Bitcoin NFT in the past 30 days has far exceeded that of Ethereum and other public chain NFTs. The transaction volume of Bitcoin NFT has even reached more than twice that of Ethereum NFT. . Moreover, Bitcoin ecological NFTs have successively appeared in popular items such as Bitcoin Frogs and Bitmap, which have a strong tendency to impact blue-chip NFTs.

Data source: Cryptoslam.io

Data source: Cryptoslam.io

In just one year, Bitcoin NFT has overtaken Ethereum NFT and reached such a scale. Although it is not as out of the circle as Ethereum NFT in 2021, it is used " "Hot" is not an exaggeration to describe it.

05 ARC20 and other protocols are blooming

Any new thing, there is always Its imperfections are the same for both Ordinals and BRC20 protocols. After the outbreak of the Ordinals protocol, a large number of new protocols quickly emerged in the Bitcoin ecosystem, including Atomics, Runes, PIPE, Stamps, BitVM protocols, etc. Most of them are aimed at improving the Ordinals protocol. The flag shows a lively scene of hundreds of flowers blooming.

Compared with the Ordinals protocol, the Atomics protocol does not rely on third-party sequencers in terms of asset transaction sorting and is more decentralized. In the early stage, because the Atomics protocol was technically difficult and supported by fewer institutions, it was less popular than Ordinals. However, with the support of Unisats and the rumored support of a major platform, the popularity of Atomics is currently growing significantly.

Runes Protocol was proposed by Casy, the founder of Ordinals Protocol, aiming to solve the efficiency problems of BRC20. However, the current development is still slow and it is not like Ordinals or Atomics protocols form their own ecology. Based on the idea of the Runes protocol, Benny, a programmer in the Bitcoin ecosystem, developed the PIPE protocol, which cleverly combines the advantages of Ordinals and Runes protocols.

Compared with the controversy that the Ordinals protocol has brought a large amount of redundant data to Bitcoin blocks that may be deleted, the Stamps protocol pays more attention to the reliability of data and cannot be permanently removed from the Bitcoin public ledger. remove. So when the Ordinals inscription broke out and brought controversy about the possible removal of data, everyone turned their attention to the Stamps protocol.

But as far as the current situation is concerned, despite the various Bitcoin ecological protocols, the spotlight is still on the Ordinals protocol. Moreover, there is currently no connection between the various protocols in the Bitcoin ecosystem. Most of the different protocols use different wallets and trading markets. In addition, some protocol assets may be destroyed from time to time. For novices, The threshold is not too high.

06 The rise of the Bitcoin smart contract layer

With the outbreak of the Ordinals protocol, the congestion of the Bitcoin main network has intensified , rates continue to rise,As a result, the Bitcoin smart contract layer, which is designed to solve Bitcoin network congestion and reduce handling fees, has also begun to take off.

There are currently many smart contract projects on Bitcoin, but the ones with stronger consensus are Stacks and RSK.

As far as TVL is concerned, RSK’s current TVL is over 100 million, making it the project with the highest TVL in the Bitcoin ecosystem. However, in this wave of Bitcoin ecological take-off, theRSK ecosystem has not seen many eye-catching projects come out, nor has it seen many big moves.

Although the TVL of Stacks is not high, the project itself has many benefits and the ecological development is also good, so it can be called the most anticipated star project in the Bitcoin ecosystem. According to the latest official progress, before the Bitcoin halving, the Nakamoto upgrade is expected to be completed, the performance of the Stacks network will be comprehensively improved, and the BTC-linked stable currency SBTC will be released, which is expected to greatly increase the liquidity of BTC. Moreover, as the first compliant token officially recognized by the SEC, Stacks does have a lot of highlights.

Of course, with the popularity of the Bitcoin ecosystem, many Bitcoin smart contract projects have appeared recently. It remains to be seen whether they can take off.

07 Revival of RGB protocol

The RGB protocol was first proposed in 2016, but there was not much movement until 2023 In April this year, the RGB protocol released version 0.1, marking the official launch of commercial use of the RGB protocol.

The release of this version of the RGB protocol has brought about many major breakthroughs, including the limitations of smart contract development in the original version, integration with the Lightning Network, support for wallets, etc., allowing the RGB protocol to follow suit. This wave of Bitcoin ecological craze has returned to the public’s attention. Especially the integration with the Lightning Network, many people have begun to compare the RGB protocol with Taproot Assets. After all, it can directly take advantage of the security of the Bitcoin main network while taking advantage of the existing channel nodes of the Lightning Network. , it is indeed a good move.

However, as of now, most projects in the RGB ecosystem are still in the development or internal testing stage. How they will perform in the future will have to wait for time to ferment.

08 Lightning Network promotes Bitcoin into the multi-asset era

The release of Lightning Network Taproot Assets, This means that Bitcoin, like Ethereum, has entered the era of multi-asset issuance.

Although protocols such as BRC20 are currently very popular, the Bitcoin network only passively records data. Once issued, the project party has no possibility of withdrawing, destroying, or repurchasing the Token. In other words, although protocols such as BRC20 are fairer for the issuance of Tokens and more beneficial to retail investors, the two sides of the coin are that without the empowerment and operation of a centralized team, it is difficult for a project to truly grow.

Through Taproot Assets, the team can issue and destroy assets, and the subsequent asset transaction process will be directly compatible with the existing more than 14,000 global Lightning Network nodes. Combining the security of the Bitcoin main network with the high-speed and low-fee transaction characteristics of the Lightning Network, it does seem to be a better Bitcoin ecological asset issuance solution.

The Nostra Assets platform announced the introduction of the Taproot Assets function in November 2023. Currently, the platform has 4 types of assets. Although it is not very popular, the entire trading experience is indeed comparable to a centralized one. The payment experience is very smooth.

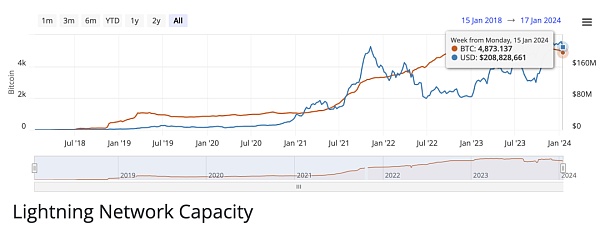

There are currently 14,658 Lightning Network nodes in the world, and more than 4,900 Bitcoins are locked in the Lightning Network. In the bear market of the past two years, the number of Bitcoins in the Lightning Network did not fluctuate sharply with the market. It is a slowly growing trend.

Chart of changes in the number of BTC locked in the Lightning Network since its release, source: bitcoinvisuals

Chart of changes in the number of BTC locked in the Lightning Network since its release, source: bitcoinvisuals

However, judging from the current situation, the Lightning Network is still small in terms of the number of nodes and the number of locked BTC. Currently Most of them are small transactions and are not linked to other assets in the Bitcoin ecosystem.With the prosperity of assets in the Bitcoin ecosystem such as Taproot Assets and RGB Protocol in the future, I believe that the value of the Lightning Network will be brought into greater play.

09 BitVM triggers new hope for Bitcoin smart contracts

Although Bitcoin has been positioned for many years It is "digital gold", but the exploration of Bitcoin's programmability has never stopped.

In October 2023, the BitVM white paper "BitVM: Compute Anything On Bitcoin" was released, proposing a solution to achieve Turing completeness without changing the existing network consensus of Bitcoin, making it possible to It is possible to run complex contracts on the Internet, giving people new hope for the prosperity of Bitcoin smart contracts and ecosystem.

However, for now, BitVM is still just an idea, and actual implementation is expected to be a long way off.

If protocols such as Taproot Assets and RGB + Lightning Network can be implemented quickly and meet expectations, perhaps this will be a faster path to the prosperity of the Bitcoin ecosystem.

10 Other ecological infrastructure is emerging

In addition to these, the Bitcoin ecosystem is poised to explode In 2023, many other potential projects have emerged.

For example, Thorchain, which is deeply involved in cross-chain, provides cross-chain transactions of multi-chain assets including Bitcoin, and Multibit, a new cross-chain star in the Bitcoin ecosystem, provides services from BRC20 to ETH/BNB The network's cross-chain services, including IDO platforms Bounce, Bakery, Turtsat, and Bitcoin ecological stablecoin platform BSSB, are all Bitcoin ecological infrastructure projects that have performed well in this wave.

Of course, as Ethereum and other public chain ecosystems become increasingly mature, there are many reference paths for the rise of Bitcoin ecological projects. Under the enthusiastic market sentiment, It is easier to quickly build consensus and let the market value take off.

However, the rise of inscriptions such as BRC20 has actually attracted more funds and resources to jointly build the underlying infrastructure of Bitcoin.

11 Summary

2023 will be a magnificent year for both the Bitcoin ecosystem and the entire crypto industry. This year is also a year to prepare for the upcoming bull market.

How will the Bitcoin ecosystem develop in 2024? After experiencing the hype of Memes such as BRC20 and Bitcoin NFT, will a large amount of funds and resources really accumulate and enter the ecological infrastructure? Will they copy the path of Ethereum's ecological prosperity, or will it still be a piece of cake after all the excitement?

Perhaps it is most likely the former. After all, under the short-term excitement, we have seen the enthusiasm of developers, communities, and investors for the Bitcoin ecosystem.

In this bull market, the Bitcoin ecosystem will most likely play an indispensable role.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Nulltx

Nulltx Cointelegraph

Cointelegraph