Author: Chang Jiashuai Source: Wall Street News

Keith Gill, the retail investor leader who led the meme stock movement three years ago, has returned with unabated momentum. He recently showed off his huge GameStop (GME) delivery orders worth hundreds of millions of dollars on social media, calling on retail investors to buy. A new meme stock hype frenzy seems to be brewing.

But the bad news is that his trading activities have attracted the attention of Massachusetts securities regulators.

A spokesperson for the office of Massachusetts Secretary of State Bill Galvin told the media that the securities department is investigating Gill's behavior and the investigation is still ongoing.

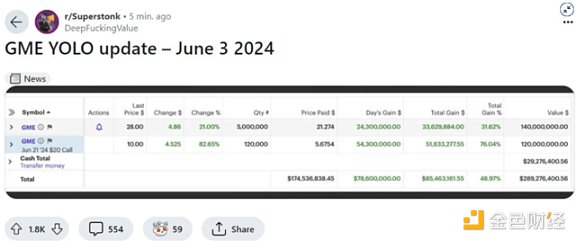

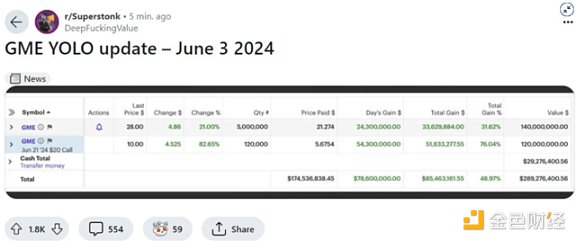

On Sunday, Gill posted a transaction screenshot on Reddit, showing that he held 5 million GME shares worth $115.7 million, as well as 120,000 call options expiring on June 21 with an exercise price of $20 and a total value of $65.7 million.

On Monday, GME shares closed up 20%. During the session, Gill posted an account screenshot showing that he had more than $29.2 million in cash. As of the opening of Monday, Gill's GME position was worth more than $386 million. On Monday evening, he shared another screenshot on Reddit, showing that he had not sold a single share.

The U.S. Securities and Exchange Commission (SEC) has reportedly been reviewing call options related to GME at the time of Gill's social media posts, and it is currently unclear whether the SEC is specifically reviewing Gill.

In addition to regulators, there have been reports that Morgan Stanley's brokerage E-Trade is considering banning Gill from using their platform for trading.

Gill himself has not responded to these inquiries.

After the meme stock craze in 2021, Massachusetts regulators fined Gill's former company, MassMutual, $4 million, accusing MassMutual of failing to properly supervise Gill. Until the end of January 2021, Gill served as the company's director of financial health education.

Amid multiple negative factors, GME US stocks fell by more than 5% overnight and rose by about 2% during after-hours trading.

Wilfred

Wilfred