On January 29, Harvest International became the first institution to submit a Bitcoin spot ETF application to the Hong Kong Securities and Futures Commission. As early as December 22 last year, the Hong Kong Securities and Futures Commission issued the "Circular on SFC-authorized funds to invest in virtual assets", making it clear that it was prepared to accept applications for recognition of virtual asset spot ETFs.

On the other side of the Pacific in the United States, the development of Bitcoin spot ETFs after they were approved for listing is a good reference for Hong Kong. However, due to Grayscale’s continued selling of Bitcoin, the U.S. Bitcoin spot ETF did not bring stunning performance to the market 19 days after its listing. At this time, does it still make sense for Hong Kong financial companies to enter Bitcoin spot ETFs?

Whether you choose Central or Wall Street, multiple redemption methods may be the biggest advantage

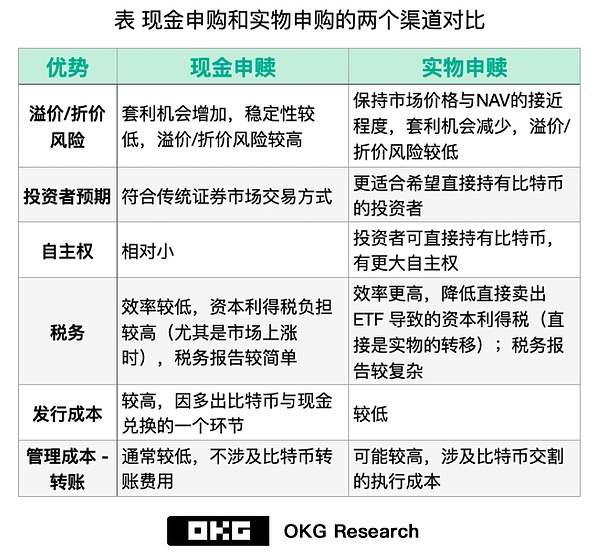

Comparing the two places, Hong Kong is superior to the United States in some rules for virtual asset ETFs. According to the "Circular on Investment in Virtual Assets by Securities Regulatory Commission Authorized Funds" issued by the Hong Kong Securities Regulatory Commission, Bitcoin spot ETFs can be subscribed and redeemed in two ways: physical and cash (hereinafter referred to as "subscription and redemption").

Although various U.S. applicants wrote in their early applications that "the application and redemption methods allow two ways of application and redemption, physical goods and cash." Based on risk considerations, each company ultimately modified the application form to use the less risky "cash" redemption method. Compared to the U.S. Bitcoin spot ETF which is limited to “cash” subscription and redemption methods, according to the current circular disclosed by the Hong Kong Securities Regulatory Commission, it is expected that multiple cash and physical subscription and redemption methods will become the future Bitcoin spot ETF market in Hong Kong. main advantages.

Due to the particularity of Bitcoin virtual assets, adding physical redemption methods brings more challenges to the exchange, custody and transfer of Bitcoin assets. Take subscription as an example. On the premise of ensuring compliance with local compliance requirements, participating traders should first transfer virtual assets to a custody account recognized and licensed by the China Securities Regulatory Commission, including virtual assets Trading platform (VATP) or authorized institution (or its subsidiary),This is mainly to prevent criminals from converting and laundering Bitcoin through physical redemption.

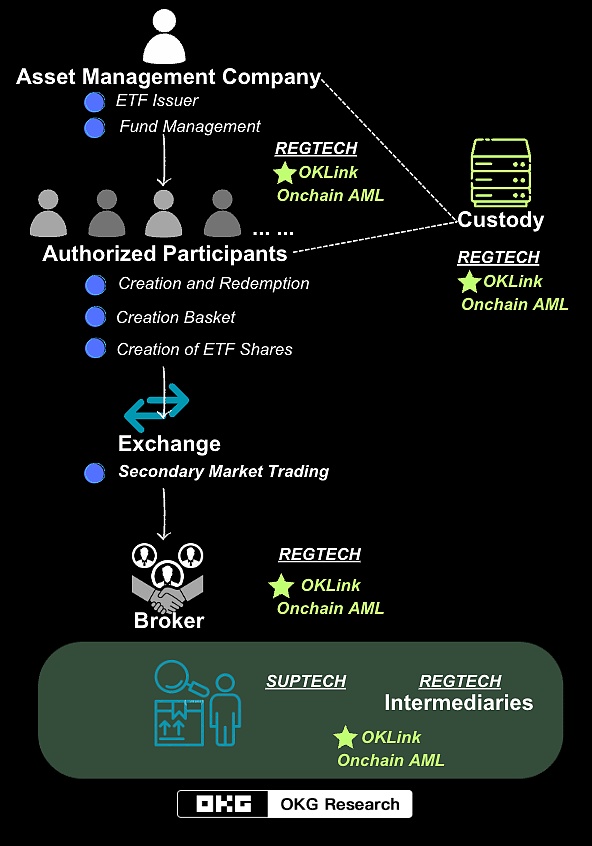

Physical subscription and redemption involves the transfer of assets on the chain, which requires financial institutions and regulatory agencies to adopt a different approach from the traditional market. Compliance method - On-chain compliance. On-chain compliance has some similarities with traditional off-chain compliance, including KYC (Know Your Customer), AML (Anti-Money Laundering) and cross-border compliance. In order to achieve these compliance requirements, it is usually necessary to resort to compliance technology tools. These tools are mainly used to perform asset risk confirmation of on-chain addresses and continuously monitor asset flows for suspicious transactions.

Based on the particularity of blockchain technology, although transactions on the chain address cannot be tampered with, are clear and transparent and can be checked by the public, they are anonymous This makes compliance prohibitive for many organizations. In order to deal with this anonymity, one possible solution is to compare the address with addresses that have been marked as high-risk for sanctions, money laundering, phishing, etc., to determine whether the on-chain address is involved in excessively high-risk transactions. For this reason,Having a rich and comprehensive address tag library has become one of the important criteria for financial institutions and regulatory agencies to select compliance technology tools.

In terms of continuous monitoring of asset flows, when financial institutions select compliance technology tools, in addition to selecting tools with large amounts of data and rich and comprehensive label dimensions In addition to the compliance technology tools of the address tag library, it is also necessary to consider the response speed of compliance technology in continuous risk monitoring. Once compliance technology tools screen out suspicious transactions, OKLink, for example, can perform risk monitoring within milliseconds and quickly perform subsequent operations: determine the risk level and take risk control measures based on that level, such as freezing accounts or rejecting them. Transactions.

The picture takes OKLink Onchain AML as an example, a simple picture of Bitcoin spot ETF from issuance to transaction compliance technology assists

Note : This is a rough flow chart; in terms of compliance technology requirements, it is a more rigorous approach that all "intermediaries" require compliance technology support.

What qualifications does the custodian need for the physical redemption method?

Now Hong Kong has approved futures-based Bitcoin ETFs, and there are currently two listed products, CSOP Bitcoin Futures and Samsung Bitcoin Futures. , its asset size is relatively small, with the AUM of each fund being less than US$100 million. The trustee of both funds is HSBC Institutional Trust Services (Asia) Limited. It is worth mentioning that HSBC is the first bank in Hong Kong to allow customers to buy and sell virtual asset ETFs listed on the Hong Kong Stock Exchange, and it launched a virtual asset investor education center in the middle of last year.

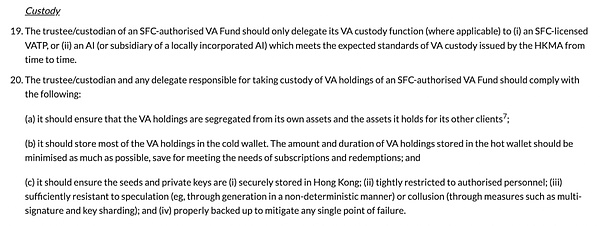

Different from the custody requirements of futures ETFs which only involve cash,The difficulty in custody of spot ETFs is that the custody institution needs to be responsible for Bitcoin custody. Currently, according to the SFC’s “Circular on Securities Regulatory Commission Authorized Funds’ Investment in Virtual Assets”, the trustee/custodian of a virtual asset fund authorized by the SFC can only entrust the virtual asset custody function to a virtual asset manager holding an SFC license. Asset service provider (VATP) or a financial institution or local subsidiary that meets the virtual asset custody standards issued by HKMA.

Excerpt from the picture "Circular on Funds Recognized by the China Securities Regulatory Commission for Investment in Virtual Assets"

In other words, Based on the current development of financial institutions and virtual asset service providers (VASPs) in Hong Kong, financial institutions and licensed VATPs will be responsible for the custody of legal currencies and virtual assets respectively. The mutual cooperation will also become the key to the success of Bitcoin spot ETF.

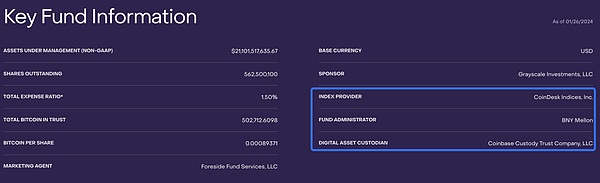

The same is true in the United States. 8 of the 11 ETFs currently approved have chosen Coinbase as the custodian of their virtual assets. Take Grayscale and BlackRock, currently the top two companies in terms of AUM, as examples. Both parties have chosen Coinbase and Bank of New York Mellon as virtual asset custodians and cash custodians respectively, adopting the form of separate dual-institutional custody of virtual assets and legal currency.

Graphic grayscale GBTC basic information

In terms of VATP, Currently, many companies in Hong Kong are actively applying for relevant licenses. This indicates that there will be multiple VATPs for fund companies to choose from in the future, thereby avoiding the "single point" risk similar to the multiple Bitcoin ETFs in the United States that only choose one custodian institution.

Grayscale is just an example and Hong Kong will not repeat the same mistakes

Since the United States approved the Bitcoin spot ETF, one of the topics that people are most concerned about is the continuous huge selling of Grayscale. However, there is currently no Bitcoin trust as large as Grayscale in the Hong Kong market. Therefore, even if the Bitcoin trust in the Hong Kong market is converted into an ETF and starts redemption operations, it is unlikely that such a large-scale sell-off will occur.

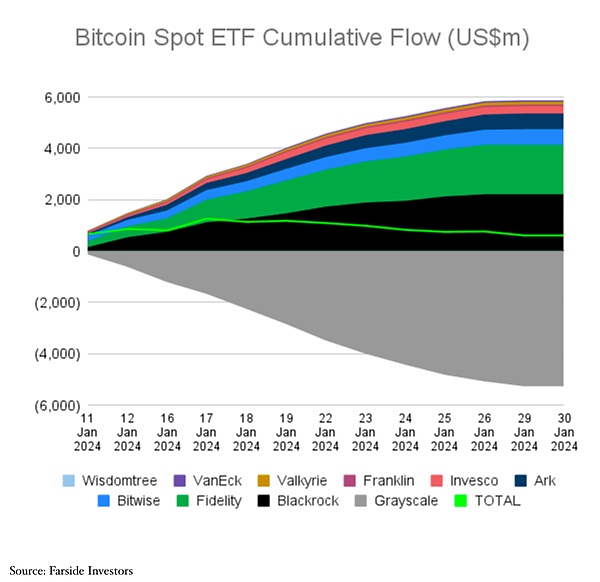

However, even if Grayscale continues to sell off, the overall inflow and outflow of Bitcoin spot ETFs in the United States as of 9 am today (UTC+8) still shows a net According to the statistics of the Ouke Cloud Chain Research Institute, the inflow is approximately US$605 million. Specifically, only Grayscale has continued to outflow, while other funds have shown inflows.

There are two main reasons for Grayscale’s continuous selling: First, compared with other fund companies, Grayscale has the highest management fees. That is to say, if an investor buys IBIT of US$1 million and GBTC of the same size, the management cost is It saved US$13,800; secondly, Grayscale is different from other newly issued Bitcoin spot ETFs in that it operates by converting trusts into ETFs. This allows investors who previously purchased GBTC at a discount to take advantage of the discount and the increase in Bitcoin prices to conduct arbitrage selling without the need to redeem and repurchase.

According to the observations of the Ouke Cloud Chain Research Institute and the data on the OKLink chain, Grayscale started as early as two weeks ago, almost once every working day. Frequency of transferring on-chain assets to Coinbase Prime hot wallet address. And since January 23, 2024, Grayscale’s outflow trend for seven consecutive days has also gradually weakened.

The launch of Bitcoin spot ETF has achieved a close connection between the traditional financial market and the virtual asset market, marking the development of structured finance. The market has opened its doors to the field of virtual assets. According to Technavio estimates, the global structured finance market (Note 1) is expected to grow by approximately US$997.68 billion from 2023 to 2028, with an average annual growth rate of 11.8%.

With the development of compliance and the continuous improvement of market maturity, the launch of Bitcoin spot ETF will mean that Bitcoin will be sold through spot ETF Standardize financial products.

Spot ETFs provide investors with a more convenient and standardized investment method. Not only that,standardized products can enhance the efficient functioning of markets and allow for more effective risk management and investor protection. The mass adoption of compliance assistants that we proposed at the beginning of 2023 is coming to us with a hundred flowers blooming.

Note 1: The global structured finance market covers a variety of complex financial instruments, which are backed by underlying asset pools. feature. Some common structured financial products include: Securitization, Derivatives, Debt Instruments, Structured Derivatives, Financial Engineering Products, etc. Here Bit As a kind of securitization product, currency ETF belongs to the structured financial market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Kikyo

Kikyo Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Catherine

Catherine Bitcoinist

Bitcoinist Ftftx

Ftftx Cointelegraph

Cointelegraph