Author: Decentralised.Co Source: @Decentralisedco Translation: Shan Ouba, Golden Finance

Earlier this week, FriendTech revoked all permissions to change product fees or features. In short, it is unlikely that there will be any changes to the product in the future. If the network of token holders is able to make changes to the product, there may still be hope. But at the time of writing, this possibility no longer exists.

Part of what makes FriendTech interesting is its ability to make users profitable. A wise man once said that the fastest way to grow a crypto community is to make token holders rich. FriendTech's model makes it possible for everyone to "become" a token and receive part of the revenue. As of the time of writing, the platform has generated nearly $98 million in fees, half of which has gone to users. Sounds promising, right?

Not really. The problems in FriendTech's model began to emerge long before they launched the token. According to @DanielW_Kiwi on @DuneAnalytics, there are some clues.

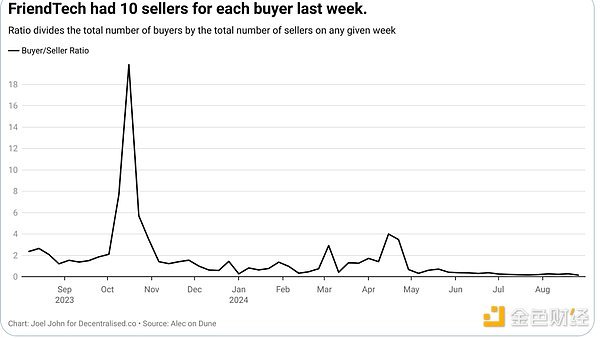

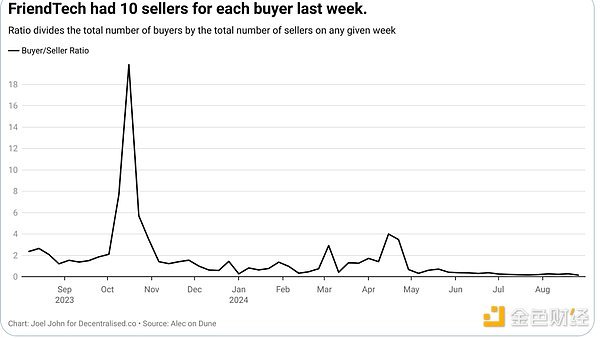

In October 2023, when FriendTech began to enter the mainstream, the ratio of buyers to sellers was 18:1. When there are 18 people buying and only 1 selling, the laws of economics dictate that the price will rise. However, when their token was launched in May 2024, this ratio had dropped to 0.32, or 3 sellers for every buyer. As of last week, the ratio has dropped to 0.14.

It can be said that FriendTech belongs to a type of short-term game without long-term development. For those who hear this term for the first time, a short-term game is a short-term game with financial incentives. Some products even create entire categories, and Pumpdotfun is undoubtedly the first example that comes to mind.

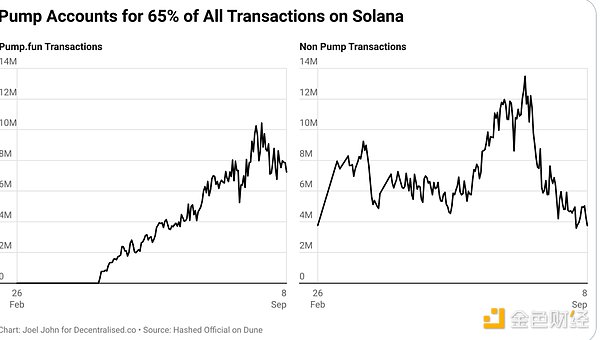

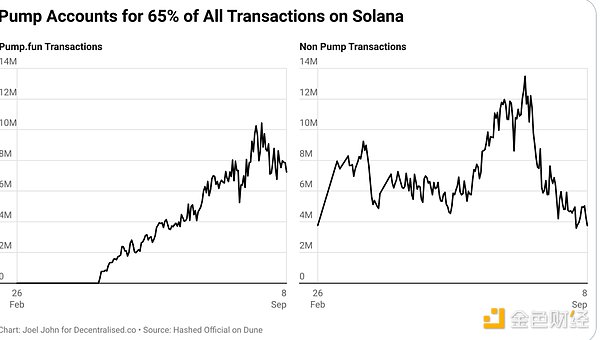

Pumpdotfun can be seen as the Costco of token issuance - cheap, fast and convenient. The product was launched in May this year, and according to @hashed_official, Pump accounts for 65% of all DEX transactions on Solana. In addition, it has generated nearly $100 million in revenue. As of this writing, Pump has issued nearly 2 million tokens.

One of the great things about Pump is that it democratizes token issuance. In the past, you needed to go through a listing process on a centralized exchange, but Pump has proven that using DeFi infrastructure and on-chain liquidity can work just as well.

Of course, this comes with risks. Token issuance is often plagued by “pumping,” where developers withdraw all liquidity, leaving users with tokens that cannot be liquidated. Ethervista takes a different approach by allowing token issuers to receive a portion of the ETH from trading fees, while liquidity providers (LPs) receive ETH.

In 2023, LooksRare took a similar approach, with platform fees rewarded to token holders. However, this story did not end well as wash trading on the platform stopped. Ethervista also requires token issuers to lock up their tokens for at least five days. As of this writing, activity on the platform has cooled off. According to @0xToolman’s Dune data, transaction volume has dropped from 3,300 per hour to around 160. The total amount of ETH on the platform has dropped from 540 ETH to 160 ETH, all in the space of a week.

All this makes one wonder, what are the rules of the short-lived game? Are they just highly financialized Ponzi schemes that appear and die in a short life cycle? Does a sustainable model really exist?

Fundamentally, these platforms do three things:

High-frequency trading - like Pump

The "reason" for trading is often based on feelings. For example, it is impossible to quantify why someone would buy a meme coin on Pump. Volatility is the product itself.

They have short lifespans. When FriendTech’s token was released, its community had already shrunk.

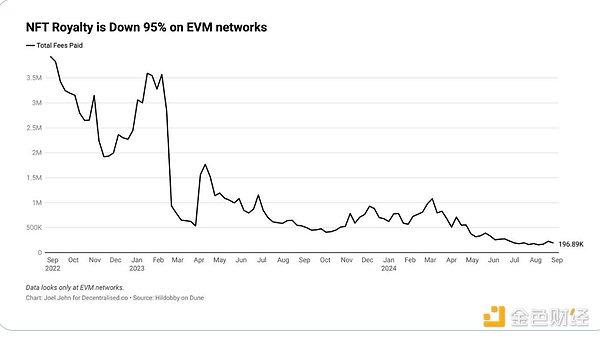

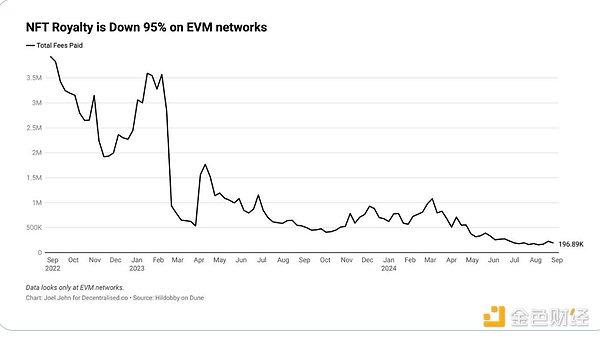

All of this reminds me of the glory days of NFTs. According to @hildobby_ on Dune, the average daily fees generated by NFTs (on the EVM network) dropped nearly 95% from over $3.2 million to $200,000 per day.

The NFT model is interesting in that it provides creators with a way to consistently earn royalties from their work and build meaningful communities. The meme coin season in Q2 2024 was more driven by celebrities talking about their tokens, which often plummeted 90% in a matter of weeks.

Products like Pump and Ethervista simply stripped away the trappings of traditional communities and built highly traded products. In return, they provide fees to creators.

Can this model scale? We’re not sure it’s sustainable yet. But if Pump and Ethervista have shown us anything, it’s that the market has a demand for volatility. As long as the market is willing to pay for the tokens, and accept the associated risks, we’ll continue to see them. Or, like ICOs and NFTs in previous cycles, they’ll fade away as the market becomes more aware of the risks. Only time will tell how short-lived these games really are.

Huang Bo

Huang Bo