Author: Climber, Golden Finance

With the passage of the Bitcoin spot ETF, the hype surrounding Bitcoin in the market has come to an end. The price of BTC has also dropped from around US$49,000 to US$41,000, and community topic discussions and investment trends have gradually turned to the Ethereum ecology and concept.

Previously, the BTC ecosystem experienced a surge, but Ethereum, known as the "King of Ten Thousand Chains", did not rise much, especially the growth of L2 track currencies was generally lower than expected. However, the price of Ethereum has recently risen above US$2,700, hitting a new high since June 2022. Related concept sectors such as L2, LSD, ReStaking, modularization, etc. have also experienced significant increases.

The market generally believes that after Bitcoin, the Ethereum spot ETF will also be passed, and the upcoming Cancun upgrade is also a big plus. In the future, projects surrounding the Ethereum concept will become the focus of investment.

So, is now the most appropriate time for investors to enter the market? After crossing the bull and bear market, what other leading projects and new generation potential projects are there in the current Ethereum ecosystem? What are the popular and highly discussed projects surrounding the concept of Ethereum?

1. Two major positive expectations: Cancun upgrade and Ethereum spot ETF

1. What is Cancun upgrade?

On January 17, the Dencun hard fork of the Goerli test network was officially completed, followed by the Sepolia and Holesky test networks. Once Dencun is running smoothly on all three testnets, activation on the Ethereum mainnet will be scheduled.

What exactly is Cancun Upgrade? And why does it need to undergo three testnet inspections before the Ethereum mainnet is deployed online?

The Ethereum Cancun upgrade (also known as the "Cancun-Denebu" upgrade) is the result of Ethereum's joint efforts to enhance its infrastructure and resolve unresolved issues after the Shanghai upgrade.

The Ethereum Cancun upgrade is committed to introducing the concept of Proto-danksharding to improve the scalability, security and efficiency of the Ethereum network. Danksharding refers to the final phase of the Ethereum 2.0 ("quiet" phase) upgrade, which is dedicated to enhancing data management and transaction processing.

The Ethereum Cancun upgrade was originally planned for October 2023, but has now been postponed to the first half of this year.

The Cancun upgrade is based on four Ethereum Improvement Proposals (EIPs): EIP-4844, EIP-1153, EIP-4788 and EIP-6780. The goal of the Cancun upgrade is to increase the network’s transactions per second (TPS), aiming to boost performance to 100,000+ TPS, in line with the “Surge” phase of the Ethereum roadmap.

The Ethereum Cancun upgrade will bring a series of benefits, including increased transaction processing speed, reduced transaction costs, optimized data, and improved cross-chain communication. The upgrade also aims to simplify data processing and improve overall network efficiency by introducing the concept of transactions carrying blobs.

Looking back at the Shanghai upgrade on April 12, 2023, Ethereum has risen significantly. One month before the upgrade, the price of ETH was US$1,368 on March 7, but after the expected hype, it rose to a stage high of US$2,141.54 around the upgrade date, an increase of approximately 56.54%.

2. Ethereum spot ETF

The previous increase in BTC price brought about by the adoption of the Bitcoin spot ETF is obvious to all, and the following focus on Ethereum spot The adoption process of ETF has entered the scope of market discussion.

BlackRock CEO Fink said that he saw the value of launching an Ethereum ETF; Matrixport said that Ethereum will perform better than Bitcoin in the future.

But whether and when the Ethereum spot ETF will be passed has become the focus of discussion.

Previously, the U.S. SEC has sued multiple crypto exchanges for listing crypto assets that are considered securities, including other L1 tokens such as SOL, NEAR, and ATOM. But none of these enforcement actions have listed Ethereum as a potential security.

On January 13, JPMorgan Chase strategist Nikolaos Panigirtzoglou said in an interview with The Block that if the U.S. Securities and Exchange Commission (SEC) wants to approve the spot Ethereum ETF in May, it will need to classify Ethereum. For commodities (similar to Bitcoin) rather than securities. But this is far from certain, and it believes there is no more than a 50% chance that the SEC will classify Ethereum as a commodity before May.

However, the analyst also said that the SEC had approved an Ethereum ETF holding commodity futures contracts in October last year, providing clear information that Ethereum is considered a non-security.

According to information disclosed on the SEC’s official website, the final approval deadline for the Ethereum spot ETF is May 23.

2. Ethereum concept projects worthy of attention

Many encryption research institutions generally believe that the Cancun upgrade is the most important benefit for Ethereum in 2024. The renewed prosperity of Ethereum will also promote the prosperity of the L2 ecosystem and bring about the popularity of LSD, ReStaking, modularization and other tracks.

1. L2

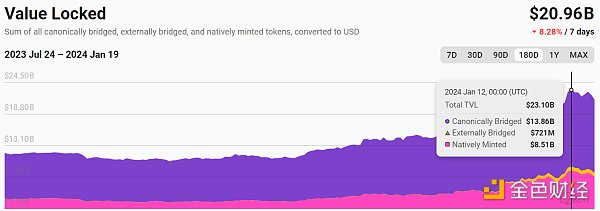

On January 12, according to L2BEAT data, the total lock-up volume (TVL) of Ethereum Layer 2 exceeded 23 billion US dollars, a record All time high.

At present, the competition on the L2 track is fierce, and new and old public chain projects have their own advantages and disadvantages. For investors, while they are already familiar with an old public chain, they should also pay close attention to the trends of new forces.

In general, the L2 projects worthy of attention are:

Polygon (MATIC):

Polygon network uses Plasma technology to process off-chain transactions and then record them on the Ethereum chain to achieve high transaction throughput. In theory, Polygon can process 65,536 transactions per second on a single sidechain with near-zero fees.

Some well-known projects such as Aavegotchi, Decentral Games, Easyfi, Neon District, Polymarket, and SushiSwap, etc., are using Polygon as the infrastructure.

Arbitrum (ARB):

Arbitrum is a second-layer blockchain for Ethereum that uses optimistic rollups scaling technology. The Arbitrum blockchain uses rollups to merge multiple transactions into one to reduce on-chain transaction costs and increase scalability.

As a result, Arbitrum is able to achieve throughput of up to 40,000 transactions per second at significantly lower miner fees than on the Ethereum mainnet.

Optimism (OP):

Optimism is the first Ethereum L2 to develop an Optimistic Rollup solution compatible with the Ethereum Virtual Machine (EVM) .

Optimism is parallel to Ethereum and can process transactions on a large scale while inheriting the security of Ethereum. Its main feature is to reduce transaction costs on the Ethereum chain. Optimism provides Ethereum developers the opportunity to use all the tools available on Ethereum without making changes.

The development team stated that the mining fees traders need to pay will be 10 times lower. Additionally, Optimism leverages Optimism rollups to solve the problem of fraud and invalid state transitions.

Immutable X (IMX):

Immutable X is a layer 2 extension solution dedicated to solving NFT and web3 games ;, currently deployed on Ethereum, using IMX, it is possible to trade NFTs in a safe and carbon-neutral way without any consumption.

IMX’s ZK-rollup technology STARK proof, developed by Starkware, combines hundreds of off-chain NFT transaction pairs and generates a cryptographic validity proof to ensure the validity of the transaction. Additionally, IMX encapsulates this ZK-rollup extension solution in a set of powerful REST APIs, allowing developers to easily build their NFT applications.

SKALE (SKL):

The SKALE network aims to reduce transaction fees and enable network participants by introducing the scalable Web3 sidechain SKALE chain Has high throughput. By creating a scalable sidechain that is EVM-compatible and interoperable with Ethereum, SKALE solves technical problems and improves the performance of any application.

MetisDAO (METIS):

MetisDAO announced that it is building "the first-ever hybrid Rollup, combining optimistic Rollup architecture with zero-knowledge proofs" .” Additionally, Metis plans to become the first Layer 2 network to decentralize its orderers, eliminating the single point of failure risk posed by a single orderer by launching a first-of-its-kind orderer pool.

Cartesi (CTSI):

Cartesi is an application-specific Rollup protocol with virtual machines running Linux distributions for DApps Developers create a richer, broader design space.

Cartesi Rollups provide a modular scaling solution that can be deployed as L2, L3 or sovereign Rollups while maintaining strong base layer security guarantees.

2. LSD, ReStaking

Since the upgrade in Shanghai last year, the concept of liquid staking has become more and more popular, and with the upcoming upgrade in Cancun , this related concept still cannot be ignored.

Lido Finance (LDO):

Lido DAO is a staking solutions provider serving Ethereum 2.0, Terra, Solana and Kusama . Users staking with Lido are able to maintain control and liquidity of their staked tokens. LDO is the project’s native token.

Rocket Pool(RPL):

Rocket Pool is an Ethereum 2.0 staking pool. The protocol aims to reduce the capital and hardware requirements for staking on Ethereum 2.0 and enhance Ethereum’s decentralization and security. To achieve this goal, Rocket Pool allows users to make trustless pledges to the node operator network.

Ankr Staking(ANKR):

Ankr Earn makes staking, Liquidity staking and other income earning opportunities. Ankr has created the most scalable and decentralized staking infrastructure solution designed to solve the capital inefficiencies of proof-of-stake networks and similar blockchain consensus mechanisms.

Pendle(PENDLE):

Pendle is a revenue trading protocol that divides revenue-producing assets into principals The deposit and income section allows users to earn regular or current income. PENDLE is a utility token used for liquidity incentives, governance, and fee value accumulation.

EigenLayer:

EigenLayer is a middleware protocol based on Ethereum, which introduces the concept of re-pledge, allowing Ethereum nodes can re-stake their staked ETH or LSD tokens into other protocols or services that require security and trust, thereby gaining dual benefits and governance rights.

At the same time, the utility of the Ethereum consensus layer can also be transferred to various middleware, data availability layers, side chains and other protocols, allowing them to enjoy Ethereum-level security at a lower cost.

3. Modularity

Some people believe that the encryption industry will increasingly see that Ethereum is becoming a modular area in the future. Blockchain. That said, Ethereum increasingly relies on external execution layers and external data availability layers to drive its underlying performance.

Celestia(TIA):

Celestia will be The technology stack of the blockchain network is modular and decouples the consensus layer and execution layer. As the consensus layer itself, it will only be responsible for transaction ordering and data availability verification, and specific transaction execution will be distributed to other links to Celestia. On top of the execution layer network (such as Celo).

Injective (INJ):

Injective is a blockchain layer built using CosmosSDK that can implement security and security on multiple blockchain networks. Fast and interoperable transactions. Injective is specifically designed to address the limitations of popular smart contract platforms and is optimized for decentralized applications (DApps) in the decentralized finance space. It supports all financial primitives, creating a comprehensive ecosystem that provides a variety of financial products and services.

Manta (MANTA):

Manta Network is a gateway for modular ZK applications that leverages modular blockchain and zkEVM to build L2 intelligence A new paradigm for contract platforms.

Manta Pacific solves availability issues with a modular infrastructure design that allows modular DA and zkEVM to be seamlessly integrated to continuously enhance the user experience over time.

Mantle (MNT):

Mantle Network is the L2 technology stack used to extend Ethereum and is the first core product of the Mantle ecosystem . Mantle Network is committed to compatibility with the Ethereum Virtual Machine. Mantle Network’s modular architecture separates transaction execution, data availability and transaction finality into multiple modules that can be individually upgraded and adopt the latest innovations.

Dymension:

Dymension is a sovereign Rollup built on Cosmos, designed to use Dymension Chain (settlement layer), RDK (RollApp Development Kit ) and IRC (Inter-Rollup Communication) make the development of RollApp (RollApp with a focus on custom applications) easy.

Summary

Since the last bull market, Ethereum’s performance has been mediocre, but all parties in the market are still very optimistic about it. This year is undoubtedly the most certain stage of the rise of the Ethereum concept in the recent cycle. At this time, the layout of related concepts has greater potential for high returns.

The crypto market has always been more enthusiastic about new trends, so investors can try to pay attention to the newly born Ethereum concept projects in this cycle, which may contain the next hundred-fold coin.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Finbold

Finbold Finbold

Finbold Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph