Author: SanTi Li, Feng Yu, Naxida; Source: Future brotherAbstract:

< section>

As the Web3 industry continues to mature, the ecological potential of Telegram, an instant messaging software, and the value growth of the project itself are also getting more and more of attention. Telegram is famous for its privacy, convenience and openness, and various projects developed based on TON, such as the TON public chain and derivatives, have also appeared in the internal ecosystem. Including BOT software and embedded projects developed based on the Telegram chat window, these have further enriched the overall value diversity of Telegram. The Ime Messenger version TG, which is different from the one embedded in the window, is more like giving it the wings of Web3, making the entire Telegram easier to use, perfect, optimized and rich. It is also more similar to the operating experience of VX payment. This article will interpret its value from the perspectives of project foundation, team capabilities, feature analysis, valuation analysis, future long-term value, relationship between Telegram and Ton, and doubt points. 1. Basic introduction:

iMe is a multifunctional Web3 version software developed based on Telegram. It can be more quickly understood as a special enhanced version of Telegram's Web3. User accounts can be seamlessly interconnected with Telegram, and content is fully synchronized, but the software needs to be downloaded separately.

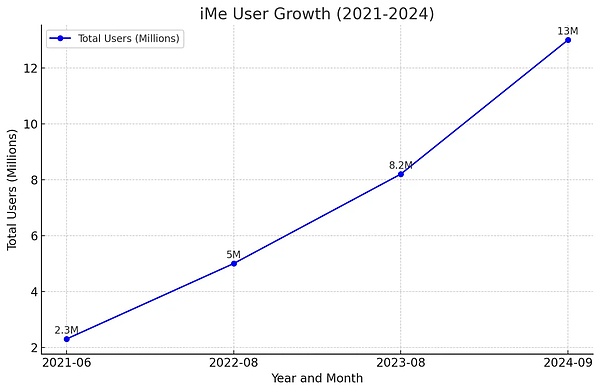

In June 2021, iMe had 2.3 million users, and its daily active users exceeded 200,000. As of September 2024, iME currently has 13 million users. The user growth rate in three years has reached about 565%. Since iME accounts and Telegram accounts are completely interchangeable, TG’s 900 million users can seamlessly use the iMe version of TG software at any time.

< p style="text-align: center;">

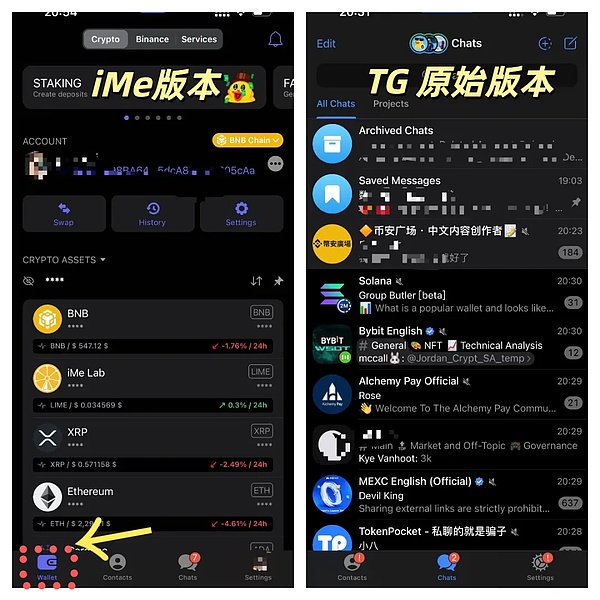

Fig.1. User growth chart of iMe version in 3 yearsPerhaps due to the user versatility between TG and iMe, as shown in Figure 1, the number of iMe users has exceeded A significant increase in the number of 1,000,000 users. At the functional level, the core differences can also be briefly discovered from the comparison of the following set of pictures:

Brief through pictures From the comparison, it can be clearly seen that iMe has added an additionally developed multi-chain Wallet function based on the original version of Telegram, with built-in multi-chain Multichain assets and related Defi, Staking, payment or Binance trading services brought by Binance Pay. Function. This allows users to easily apply Web3 functionality in TG software. (Currently, 18 public chain assets such as BTC, BSC, ETH, SOL, TON, Base, Arb, Matic, TRON, ZKsync, OP, Manta, RON, Celo, Fantom, and Blast are supported) Users can directly send these assets to iMe TG friends' wallet, and can use different assets to interact in group services. For example, airdrops and crypto red packets can be sent in telegram groups through the Cryptobox function. And this development model, iMe has also brought about subsequent software development and TG joining The rich function space can complement and optimize the operational convenience that the original version of TG could not optimize (such as organization, AI functions, voice-to-text functions, real-time translation, etc.)Especially the real-time translation function based on Google Translate and Chatgpt perfectly solves the language dilemma of many Web3 workers. Language translation problems can be solved directly in the Telegram software , greatly increasing communication efficiency. The picture below shows the translation function of the APP version: As we can see in picture 2, it is not currently available in the original version of Telegram conversation Instant translation function, and in the iMe version of telegram, users can already directly use the one-click translation function of the entire group conversation. The PC version has also been updated with a direct one-click translation function, which is very practical for users with language barriers. It can be seen that the iMe enhanced version of TG is more like the Web3 version of the VX ecosystem type. The iMe team’s additional contribution to the entire Telegram has many details, such as operational optimization. Due to space limitations, these are not included here. It is convenient to carry out detailed comparison one by one, and interested readers can experience it in more detail on their own. 2. Token Economics Token Economic Analysis:

The total amount of $LIME is about 1 billion , the circulation rate is about 61%. Since Lime token has entered a period of regular destruction activities in June, the LIME tokens obtained by the project through gas fees and services provided will be frozen and destroyed regularly, so the total amount of tokens will gradually increase. Lower, VC and other early selling pressure has been completely released. At the beginning of 2024, after more than 2 years of deep reshuffle, the FDV project experienced a relatively strong valuation rebound. After the valuation rose from a low of only about 8M to about 120M, it followed the overall market. The market has entered a correction period. As of around September 18, 2024, $Lime’s FDV fluctuates around 37.5M. Token functional analysis:● Participate in various Defi services (Staking) such as staking● ;Gas fees for transactions and operations, gas for friend transfers within Telegram, etc.● Purchase Telegram upgrades and Ime special version services ● New: Users holding 10,000 tokens can get the Ime version of premium membership service for free● AI advanced function selection in research and development● Cryptobox application (similar to the multi-chain version of WeChat group red envelopes and airdrops)● Other functions such as advertising and game servicesToken security audit agency: Certik3. Team analysis:

iMe project team and Telegram team have similar personnel structures, and many of them include top engineering and technical talents from Russia and Ukraine. The total number of people in the Telegram team’s entrepreneurial team is not particularly large, so it also gives iMe a good space to expand and complement each other. Russian development technology enjoys a global reputation, providing strong technical support and product stability for these projects. The team maintains close ties with the Telegram core team, including but not limited to some tokens Possibility of holding, equity negotiation and cooperative research and development. Since some of the information is not publicly announced, it can be treated here as a personal analysis. Due to the high privacy of Telegram type projects, there is not much public resume analysis about the founding team. From personal contact and understanding, the team is strong in technology and products, and the market wants to do well, but it is slightly more sophisticated. A reliable PR agency needs some help to let more people know about the situation. 4. Future long-term value analysis:

For the long-term value of iMe lime Value analysis can be explored from the following perspectives: 1. The relationship between iMe and Telegram:

From the above description and research experience we conducted, iMe and Telegram are more like a deeply bound product relationship, because the core ontology of iMe is Telegram itself, but on this basis, Telegram is equipped with the armor and wings of Web3 that are convenient to use, making the entire TG software architecture look more complete. It is more like the web3 multi-chain version of WeChat with payment functions. Using the iMe version of TG is equivalent to allowing users to use a Telegram with more powerful functions, and the complete account interoperability and synchronization of cloud storage also eliminates the learning threshold for users to use it. Therefore, the long-term valuation of iMe will benefit from the valuation of Telegram as a software ontology. The current valuation of Telegram as a social software was US$30 billion before its listing, but as its popularity continues to rise, its valuation may further increase. As a conservative valuation method, I prefer iMe to use only about 10% of the ontology valuation. (5% of existing customers + 100% of customers who can interoperate with each other at any time + additional functional expansion) 2. The relationship and model difference between iMe and TON:

This is also a point that many people have not understood before. The relationship between iMe and TON is similar to the relationship between Telegram and TON. TON itself is a public chain developed based on the bottom layer of TG, so the valuation model of TON can also be valued according to the traditional public chain valuation and mini-program APP Center methods. Whether in the original version of Telegram or in the iMe version, TON and related project applets are available for normal use. But different from the original TG, iMe’s integrated system has also been added to the main interface It also supports TON chain, making the operation feel more like WeChat or Wallet used in daily life (such as I'm token, TP, etc.). The wallet embedded in the basic TG chat box can still be used normally, but since the wallet embedded in the chat box can easily be confused with daily conversations such as group chats, I prefer this development model that adds functions to the UI. Due to its additional complementarity and independent function development to traditional TG, the additional development space for TON and iMe will also be further increased in the future. 3. Summary of comprehensive future value analysis

As can be seen from the above content, The long-term value of iMe is mainly related to product development, the trend of TG ontology, the optimization and additional development of the ontology, and its own blockchain web3 token application, resulting in a comprehensive and multi-dimensional binding. For its valuation model, it can also be combined with traditional software valuation + public chain L2 valuation + Defi valuation model such as Payment + additional types of valuation sets such as AI + Wallet< /section>Based on various models, 3-5B FDV may not be an overly exaggerated future long-term valuation. It only conservatively obtains 10% of the current TG valuation. The mode can already reach 3B FDV. But it also needs further demonstration of value to be used by applications. If TG further expands, whether the peak of the bull market can reach a valuation of 10B and above will also depend on many comprehensive factors such as the subsequent market, AI functions, payment applications, and whether TG will make further strong purchases. So, I personally believe that the current total valuation of this project of 37.5M is still underestimated. . The reason why the project was seriously underestimated may be the previous incompatibility and unfamiliarity at the marketing level. Due to the overemphasis on social media and the internal community, and the lack of media, there are not many reports on the market that explain the project in depth, so this also leaves room for underestimation. But in the past three years, we have also experienced a long bear market, and we have been able to continuously update and develop to keep pace with the times. This is a quality that a good product and project team should have. And the buried value will be gradually discovered by institutions that are good at making waves, and will get back on track step by step. However, Telegram API failure and the possibility of extreme black swans in the financial field also require readers to make extreme judgments. Including the overall Telegram ecological series team, there is a certain degree of anonymity, and it is not easy to do due diligence, so it is objective and calm. Judging and selecting high-quality projects also tests the researcher's ability. 5. SummaryConclusion:

This article explains Telegram’s Web3 special features The unique features, features, multi-chain configuration of this version of iMe Messenger and its potential to optimize and expand value for the Telegram ecosystem. At the same time, it also explains its token economy and the reasons why it is undervalued. Telegram, as a social and instant messaging ecology that represents privacy and openness, has fully demonstrated its potential and value in the Web3 field. For users who are familiar with WeChat payment, WeChat’s pillar functions: payment, community applications , various entrance functions, and mini program expansion. It also happens to be more similar to the product logic of the iMe version of Telegram. iMe has focused on the development of Telegram’s payment and friend transfers, group applications, additional exchange operations, Ai, etc. Analyzing calmly from another angle, Telegram is beneficial to Web3 It may be precisely this model that is applied. However, due to the lack of explanation content, although there are many ecological users, the number of objective reviews is lacking, which is also one of the reasons for its insufficient valuation. And discovering the value of undervalued projects has become an interesting and meaningful thing. Investment is risky. Even if it is as stable as gold, it will experience huge losses under extreme circumstances. If you want to decline, you must always be in awe of the market and the changing economy. I also hope that everyone can discover more high-quality undervalued projects. (P.S. The inference of valuation is only for analysis and sharing, not a buying recommendation)  JinseFinance

JinseFinance

JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph