Author: Jesse Coghlan, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Bankrupt cryptocurrency company Terraform Labs is looking to sell four of its businesses as part of a $4.5 billion deal with U.S. securities regulators that will see it wind down its operations.

Terraform said on July 9 that it was “actively exploring options” to sell its portfolio tracking platform Pulsar Finance, crypto wallet platform Station, code-free decentralized autonomous organization (DAO) management platform Enterprise, and its smart contract automation protocol Warp.

Terraform acquired Pulsar Finance in November 2023, just months after the company filed for Chapter 11 bankruptcy in Delaware in January. The company launched Enterprise a year ago, in November 2022.

It remains actively developing its Warp protocol and Station wallet, with the last updates in February and March.

It added that the sale was intended to “maximize value for its creditors and other stakeholders” and was part of its “broader wind-down of its business under the terms of its settlement with the SEC.”

Last month, Terraform reached a $4.5 billion settlement with the SEC, agreeing to pay nearly $3.6 billion in disgorgement, a $420 million civil penalty and approximately $467 million in prejudgment interest.

Also paying Terraform, its co-founder and former CEO Do Kwon agreed to pay $110 million in disgorgement, $14.3 million in prejudgment interest, and an $80 million civil penalty.

The deal also means Kwon and Terraform are essentially barred from the crypto industry, ending a lawsuit by the U.S. Securities and Exchange Commission (SEC) that accused them of securities violations and fraud in February 2023.

Terraform created a cryptocurrency, Terra Luna Classic (LUNC), which is cross-linked to the U.S. dollar algorithmic stablecoin TerraUSD (UST), now called TerraClassicUSD (USTC), which lost its peg to the U.S. dollar in May 2022.

The way the Terraform ecosystem is designed means that the decoupling caused the prices of USTC and LUNC to fall into an unstoppable death spiral, as the price of one is designed to balance the other. Both are now essentially down 100%.

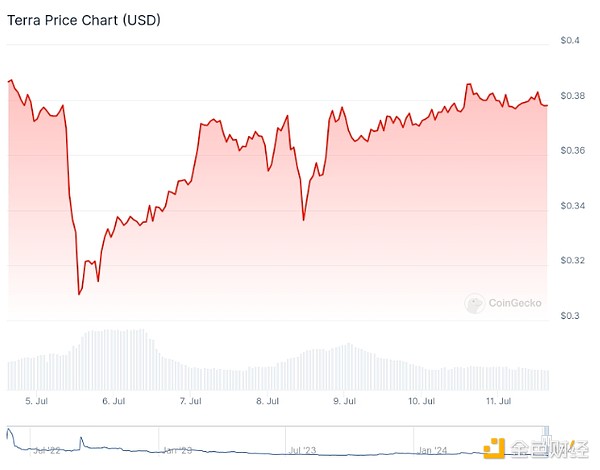

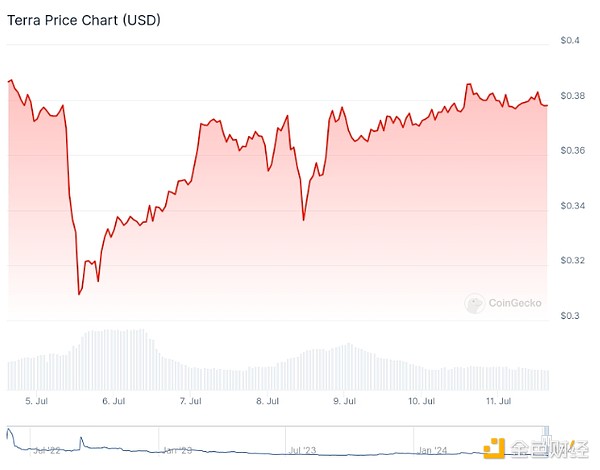

The price of its current token, Terra, was unaffected by the news, falling 3% this week to $0.37 — also down 98% since its peak of $18.87 in May 2022, according to CoinGecko.

LUNA's seven-day price fell slightly. Source: CoinGecko

Terraform invites those interested in buying its business to contact its investment banker, CAVU Securities.

WenJun

WenJun