On June 17, 2024, Tether, the world's largest cryptocurrency company, announced the official launch of Alloy by Tether, a revolutionary anchored asset backed by Tether Gold. Alloy by Tether was developed by Moon Gold NA, S.A. de C.V. and Moon Gold El Salvador, S.A. de C.V., both of which are authorized to issue under El Salvador law.

1. Aiying briefly introduces this project

1.Token Overview

aUSD₮: A US dollar-denominated collateral stablecoin that combines the properties of fiat currency and gold-backed tokens, with each aUSD₮ worth $1.

Collateral Assets: Tether Gold Token (XAUt), representing ownership of one ounce of gold.

Participants:

Tether AbT: A licensed entity that manages smart contracts and custody services.

Users: Customers who have completed KYC verification and use XAUt as collateral.

Liquidators: KYC-verified individuals or companies that are allowed to purchase XAUt locked in smart contracts at a discounted price.

2. Issuers

These tokens are issued by Moon Gold El Salvador and Moon Gold NA.

Moon Gold El Salvador, S.A. de C.V.: Registered in the Commercial Registry of El Salvador, with its office address at Edificio Torre Futura, oficina 6, nivel 11, entre 87 y 89 avenida norte, Colonia Escalón, San Salvador, El Salvador.

Moon Gold NA, S.A. de C.V.: Also registered in the Commercial Registry of El Salvador, with the same address as Moon Gold El Salvador.

3. Token Collateral

aUSD₮ is a stablecoin backed by the Tether Gold token (XAUt).

Tether Gold (XAUt): Each token represents ownership of one ounce of fine gold, meeting the London Bullion Market Association (LBMA) "London Good Delivery" standard.

These gold reserves are provided by TG Commodities Limited and are held by the custodian on behalf of Tether Gold token holders.

Users can search for specific gold bars associated with each on-chain address on TG Commodities Limited's "Find Website".

4. Token Features

Collateral: Users can use XAUt as collateral to mint aUSD₮ tokens.

Price Oracle: Used to track the value of XAUt and determine the minting and liquidation points of aUSD₮.

Liquidation: If the value of the collateral drops below the liquidation point, XAUt may be purchased by the liquidator to repay aUSD₮.

5. Technology and Standards

Smart Contract: ERC-20 standard smart contract based on the Ethereum blockchain.

Technology stack: includes a three-layer architecture of local blockchain, tokenization system and business entity.

6. Tax system

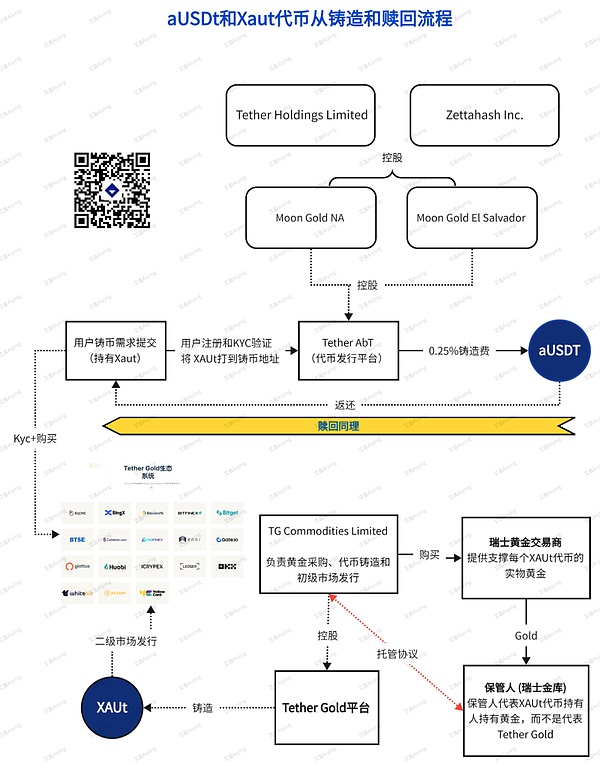

Below is a flowchart of aUSDt and Xaut tokens from minting to redemption:

II. Overview of El Salvador’s Digital Act (Stablecoin)

1.From the white paper, we learned thatboth companies are authorized under El Salvador’s Digital Asset Issuance Law.

Pursuant to Article 22 of the Law, this document (Related Information Document, RID) has been submitted to the El Salvador National Digital Asset Commission (CNAD) as part of Tether AbT’s application for registration as a stablecoin issuer.

Tether AbT has successfully obtained the authorization of a stablecoin issuer in accordance with Article 5 of the Stablecoin Public Offering Regulations.

According to El Salvador's Digital Asset Issuance Law, it aims to regulate the issuance and management of digital assets to ensure investor protection and market transparency. Article 22: In accordance with Article 22 of the law, all digital assets to be issued must submit relevant information documents (RID) to the El Salvador National Digital Asset Commission (CNAD) for review and filing.

2. Relevant Information Documents (RID):

Submission Content: The relevant information documents include detailed information on the token issuance, such as the token's function, purpose, issuance method, risk warning, etc.

Purpose of submission: Ensure that regulators have a comprehensive understanding of token issuance and ensure the transparency and legality of the issuance process.

3. El Salvador National Digital Asset Commission (CNAD):

Institutional functions: CNAD is responsible for reviewing and supervising all digital assets issued in El Salvador to ensure that they comply with relevant laws and regulations.

Audit process: CNAD reviews the relevant information documents (RID) submitted by Tether AbT to assess its legality and compliance.

4. Regulations on the Public Issuance of Stablecoins

Regulations Background: The regulations specify the issuance requirements and standards for stablecoins to ensure that they can be legally circulated in the market as a digital asset with stable value. Article 5: According to Article 5 of the Regulations on the Public Issuance of Stablecoins, stablecoin issuers must meet the following conditions:

Provide a detailed description of the token and a functional description.

Prove the value stability of the token, such as pegging to legal currency or physical assets (such as gold).

Provide adequate risk disclosure and investor protection measures.

Ensure the transparency of token issuance and management.

But here Aiying would like to remind you: Although the AbT token has been registered in the public registry of CNAD, this does not mean an endorsement of the quality of the token or the solvency of Tether AbT. Potential customers need to carefully review all information contained in this document about the token and related risks.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Miyuki

Miyuki Huang Bo

Huang Bo Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Nulltx

Nulltx Ftftx

Ftftx Nulltx

Nulltx