The 10-year-long "Mentougou" Mt.Gox incident is finally coming to an end.

In the early morning of May 28, the Mt.Gox wallet, which had been declared bankrupt for 10 years and had been in cold wallet for 5 years, had abnormal movements. Ten transactions were made to an unknown address, transferring 141,685 bitcoins, which was as high as 9 billion US dollars at the market price. Market sources said that this was a preliminary preparation for the payment of Mt.Gox's debts. Affected by this, the BTC price fell 3% and fell below 68,000 US dollars.

After a long-lasting dispute, the creditors once again approached a satisfactory result, but the market seemed to have ushered in invisible pressure.

01

Mt.Gox Incident Review, Single-handedly Collapsed the Bull Market

If you know a little about the history of encryption, Mt.Gox is definitely famous. It can be said that it once caused one of the biggest Waterloos in the history of Bitcoin and was the terminator of the 13-year bull market.

Mt.Gox is headquartered in Tokyo, Japan. It was built by Jed McCaleb in 2010 and later acquired by French developer and Bitcoin enthusiast Mark Karpeles in 2011, becoming a trading platform focusing on Bitcoin. At that time, Bitcoin was in its infancy and trading platforms were very scarce in the market. The relatively formal and large-scale Mt.Gox was able to develop rapidly.

In 2013, the price of Bitcoin soared from $13 to $1,100. In this unprecedented bull market, Mt.Gox quickly became the world's number one Bitcoin trading platform. At its peak, it occupied 70% of the Bitcoin trading market share.

Such a powerful exchange suddenly announced the suspension of all Bitcoin withdrawals on February 7, 2014. At that time, the platform gave the reason that the currency process needed to be sorted out, so users did not pay much attention. But just 17 days later, the exchange not only suspended all transactions, but even the website could not be opened. Soon, the abnormal behavior caused panic in the market.

A leaked internal company document revealed the bloody facts. Hackers attacked Mt.Gox and stole 744,408 Bitcoins from Mt.Gox customers and another 100,000 Bitcoins owned by the company. The total amount of stolen Bitcoins reached 840,000, which was worth about $450 million at the time. This kind of large-scale attack happened more than once. As early as 2011, Mt. Gox had been stolen by hackers one after another. Before 2011, Mt. Gox had lost up to 80,000 bitcoins. However, due to the rapid rise in the price of bitcoin, the company was able to conceal its true intentions. The theft, which lasted for three years, brought the company to its knees.

On February 28, Mt. Gox filed for bankruptcy in Japan and filed for bankruptcy protection in the United States two weeks later. Under the influence of this incident, the crypto market was shaken. The price of bitcoin fell from $951 to $309, a direct drop of two-thirds. The bitcoin market also encountered a crisis of trust again, and a large number of users embarked on a difficult road to rights protection.

In fact, until now, the market still does not know the cause of the Mentougou hacking incident. There are theories of embezzlement, external intrusion, and internal and external cooperation, but the core problem is that such a huge number of bitcoins has not been discovered yet. Karpeles, then CEO of Mt. Gox, was charged with fraud and embezzlement in early 2015. Before going to jail, he admitted that he had found 200,000 missing bitcoins and stored them in cold wallets, but when he tracked the wallets later, he found that the bitcoins were evenly distributed among 100 people's wallets after a series of operations.

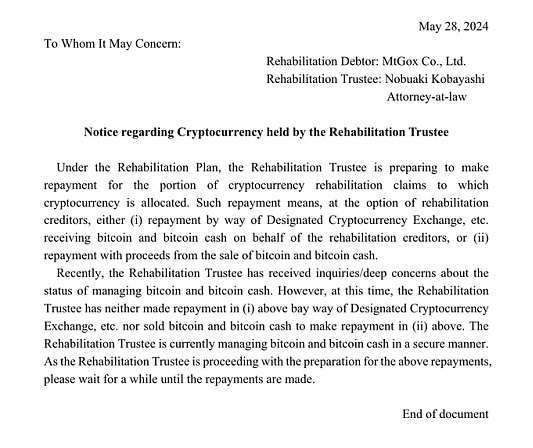

Until 2019, Mt. Gox recovered a total of 141,000 bitcoins. The court ruled that the huge sum of money should be delivered to a trust for safekeeping. The trust manager was Nobuaki Kobayashi, who coordinated the distribution time of creditors. According to the 2019 balance sheet of Mt. Gox, the debtor held about 142,000 BTC, 143,000 BCH and 69 billion yen (about 510 million US dollars at the time).

In 2019, Bitcoin has risen to nearly $10,000, and creditors are more sensitive to the distribution time and plan, and the compensation process was once extended. In 2022, Mt. Gox announced that its Bitcoin repayment procedure had been accepted by the court, and the specific distribution method was subsequently disclosed in 23 years.

This year, a creditor disclosed an email in January, saying that creditors had registered their payment addresses at the beginning of the year, and Mt. Gox will unlock 140,000 Bitcoins in the next two months to pay creditors.

The long-lasting compensation has finally come to an end, which is a good thing, but the market has panicked about this news.

02

Selling pressure of 140,000 BTC? Not so

140,000 bitcoins, at the current price, have reached $9 billion. Does the compensation mean a huge selling pressure? It is precisely because of this news that Bitcoin fell rapidly, falling below $68,000.

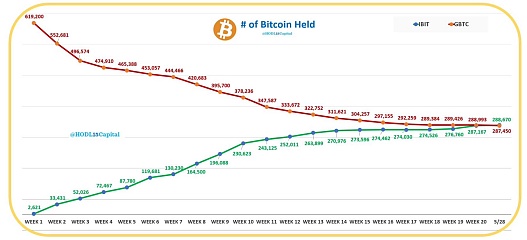

But from a realistic analysis, the possibility of a large-scale decline is minimal. First of all, 140,000 bitcoins seem to be large in scale, but in the current bitcoin market dominated by institutions, it is not completely unabsorbable. Take Grayscale as an example. Since the Bitcoin spot ETF was passed, it has been the largest short seller of Bitcoin. Before April, Grayscale GBTC sold an average of about 7,000 BTC per working day. In January, when the intensive selling was intensive, the daily selling volume even reached 10,000, and it lasted for 2 weeks. So far, Grayscale GBTC has sold a total of 332,000 BTC, with a historical net outflow of $17.746 billion. But the result is obvious, Bitcoin continued to rise from $40,000 to $67,000.

Comparison of Grayscale GBTC and BlackRock IBI Bitcoin holdings, source: IBIT

More importantly, even compensation and selling are not done overnight. According to the Mt.Gox official website announcement in 2023, the repayment plan provided by Mt.Gox to creditors includes basic repayment and proportional repayment. The basic repayment part allows the first 200,000 yen claimed by each creditor to be paid in yen, and the proportional repayment provides creditors with two flexible options, namely "early one-time repayment" or "mid-term repayment and final repayment". Among them, a one-time repayment can only obtain partial compensation. For the part exceeding 200,000 yen, creditors are allowed to choose a mixture of BTC, BCH and yen or pay the full amount in legal currency. Choosing mid-term repayment and final repayment will get more compensation, but it may take several years. In terms of payment methods, it also provides cash and cryptocurrency options.

Overall, Mt.Gox also took into account the danger of concentrated market smashing, adopted a decentralized compensation method, and proposed a coin-to-coin payment option. The former CEO of Mt.Gox also came out to clarify the rumor, saying that Bitcoin would not be sold immediately.

In addition, even if the compensation is concentrated, the amount of selling pressure is much less than the actual total amount. Due to the long-term nature of Mentougou, many creditors had packaged and sold their claims to funds at the beginning, so the bond subjects were mostly institutions. According to last year's data, only 226 claimants had more than 50% of Mt.Gox's claims. Under the current bullish market price, both institutions and retail investors will not easily sell their BTC.

But is there no impact at all? Not necessarily. In the current market with exhausted liquidity, panic can quickly cause prices to fall. The current payment deadline is set at October 31, 2024. Before the payment date, the continuous selling pressure will still exist and bring about a decline in market sentiment, but in the long run, it will not cause the imagined sharp decline.

03

Compared to Mentougou, politics is the key issue

Compared to Mentougou, where "wolves come once every year", perhaps politics is a long-term topic that is more concerned with encryption.

Recently, Biden and Trump have made frequent moves against crypto votes. First, Trump declared that he would ensure that cryptocurrencies were created in the United States and that Assange and the founder of Silk Road would be released. Later, there was news that President Biden's re-election campaign team planned to attract the support of cryptocurrency voters by promoting innovation.

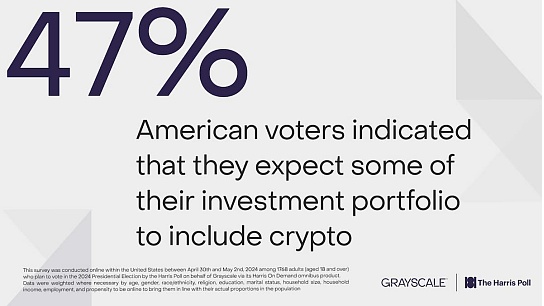

For the narrow party competition, crypto voters may really have a more important position than ever before. According to Grayscale's latest survey of 1,768 adults planning to participate in the general election, voters' attention to Bitcoin has increased significantly (41% vs 34% in November 2023) due to geopolitical tensions, inflation and dollar risks. Nearly a third of voters (32%) said that since the beginning of this year, they would prefer to learn about cryptocurrency investments or actually invest in cryptocurrencies. The survey results show that support for cryptocurrencies does not clearly favor a particular party.

In this push-pull game, cryptocurrency has become the winner behind the scenes. Cathie Wood made it clear in an interview that the Ethereum ETF application was approved because cryptocurrency has become an election issue. The Deputy Secretary of the U.S. Treasury also rarely expressed his views on mixers, saying that mixers are not to be banned, but to increase transparency and find a balance between privacy and national security.

At present, all market institutions are paying attention to the approval progress of the FIT21 Act. If it is passed, it will mean that the United States will further relax its attitude towards crypto regulation. As long as no issuer or related party controls 20% or more of the cryptocurrency, it will be identified as a commodity, thereby lifting the securities restrictions of the SEC, which will also usher in a new era in the crypto field. Lynn Martin, president of the New York Stock Exchange, also said at the Consensus Conference that if the supervision is clearer, the New York Stock Exchange will consider opening up cryptocurrency trading. If this move is realized, the threshold for buying cryptocurrencies will be lowered day by day.

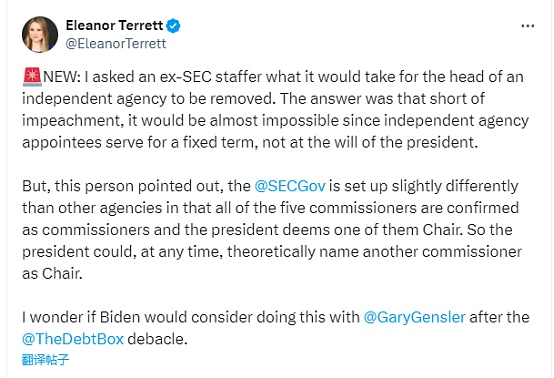

Of course, the always tough SEC Chairman Gary Gensler is very dissatisfied with this. He has not only said in public that there are huge problems with the bill once, but "small arms can't twist thighs" has also happened in reality. Although according to existing information, since the appointees of independent agencies have fixed terms and are not determined by a single president, the SEC Chairman is likely to serve his full term until February 2025, but from the current situation, no matter which party comes to power, the relaxation of US regulation has become a foreseeable fact.

At present, the crypto lobbying agencies are still working hard. Ripple donated another $25 million to the cryptocurrency super PAC Fairshake yesterday, bringing the total donation of the PAC to nearly $100 million before the general election in November this year.

Whether $100 million can influence the current situation is still unclear, but what is quite interesting is that institutions once looked down on enthusiastic retail investors and even maintained a condescending attitude, but in the end, it was the so-called retail investors who gathered together to form a tower, which became a key step in determining the direction of encryption. Isn’t this another form of decentralization victory?

Huang Bo

Huang Bo

Huang Bo

Huang Bo Cheng Yuan

Cheng Yuan Catherine

Catherine Beincrypto

Beincrypto Others

Others The Block

The Block

Others

Others The Crypto Star

The Crypto Star Bitcoinist

Bitcoinist