Author: BitpushNews

Affected by the favorable policy expectations of Trump's inauguration, investors' confidence has increased greatly, and the prices of assets such as cryptocurrencies, stocks and gold continued to rise on Friday.

After the volatility in early trading, the U.S. stock market stabilized and closed with strong momentum. As of the close, the S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite Index rose by 0.35%, 0.97% and 0.16% respectively.

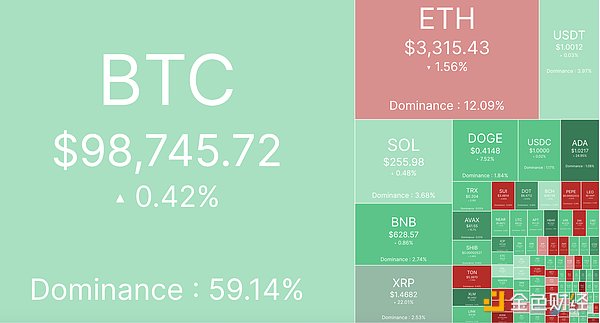

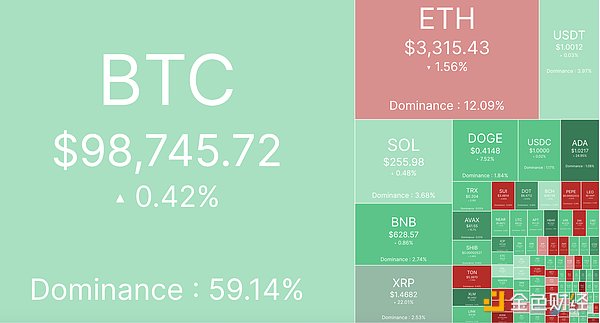

The price of Bitcoin continued to rise, reaching a high of $99,880 on the day, and the bulls were in high spirits, entering the sprint stage of $100,000.

Old altcoins generally rose, Solana hit $260 for the first time, a record high, XRP rose 20%, and Cardano (ADA) rose 23.5%.

The Meme sector fell, among which Goatseus Maximus (GOAT) fell 18%, Peanut the Squirrel (PNUT) fell 17.5%, and Act I: The AI Prophecy (ACT) fell 15.5%.

The current overall market value of cryptocurrency is 3.3 trillion US dollars, and Bitcoin's share is 59.4%.

The six-digit mark represents a "market psychological barrier"

In an interview with CNBC, Federico Brokate, head of 21Shares' U.S. business, said that the six-digit mark represents a "market psychological barrier" and is also a price target that investors have been paying attention to since the last cryptocurrency bull run.

He also pointed out that the BTC price rose quickly by 3-5% last week when it reached the $90,000 mark and the trading volume was large enough. This situation may happen again when the BTC price reaches $100,000.

Looking back at historical data, BTC hovered between $6,000 and $9,000 in 2017 and soared to around $16,000 after Thanksgiving.

Brokate said: "If this barrier is not completely broken by Thanksgiving, we expect prices to fall by 15-20% - this pullback will test the $80,000 support level and eliminate participants with high leverage and low conviction."

Reaching $100,000 or even more

Several analysts believe that Bitcoin prices are expected to break through the $100,000 mark on weekends when institutional investors are closed, and the "panic buying" sentiment of retail investors may further push the market higher.

BCA Research Chief Strategist Dhaval Joshi said there is no need to panic yet, and the market is "a long way from entering the next crypto winter."

He said in the report: "Despite Bitcoin's election-driven rally, its 260-day complexity indicator has not yet reached the 1.2 level, indicating a low risk of a crypto winter. Therefore, while we should expect a short-term pullback, Bitcoin's structural uptrend is intact, with the ultimate target of over $200,000."

Analysts say that to understand the value of Bitcoin, it needs to be compared to gold. Both assets are considered "non-confiscable" assets, which can provide some protection in the face of inflation, the collapse of the banking system or government expropriation. As global wealth grows, the value of the network effects of gold and Bitcoin will also increase, and Dhaval said that "Bitcoin has much more room to rise than gold."

Some analysts use technical analysis tools, such as Elliott Wave Theory, to predict Bitcoin's price trend.

According to their analysis, Bitcoin may experience a five-wave upward cycle, with the initial target price of the third wave at about $85,000. If it enters the fifth wave extension, the price may reach $127,000.

Ledn Chief Investment Officer John Glover said in a report: "If we do experience an extension of the third/fifth wave, this could take us all the way up to $127,000 (green line in the figure below) before completion. But this is not a number I am sure of, but it is a common target in the case of wave extension."

John Glover said he still expects "BTC to follow the orange line in the chart, and if the trend is confirmed, the ultimate fifth wave target will be much higher ($160,000 to $180,000). And if it falls to $75,000/$80,000, it should be a suitable area to cover positions."

Brian

Brian