Author: Stacy Muur Translator: Shan Ouba, Jinse Finance

For most of the past year, Hyperliquid dominated the market—but now its market share has plummeted to just 20%, with new challengers vying for market share. This article will provide an in-depth analysis of the four major decentralized exchanges (DEXs) for perpetual contracts.

In 2025, the decentralized perpetual contract (perp DEX) market experienced explosive growth. In October 2025, the monthly trading volume of perpetual contract DEXs surpassed $1.2 trillion for the first time, attracting widespread attention from retail traders, institutional investors, and venture capitalists.

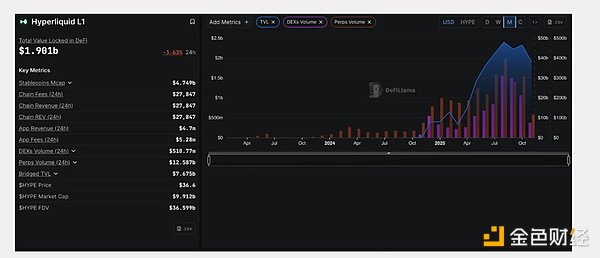

For most of the past year, Hyperliquid has held absolute dominance, with its on-chain perpetual contract transaction volume peaking at 71% in May. However, by November, with new challengers entering the market, its market share had plummeted to just 20%: Lighter: 27.7% Aster: 19.3% EdgeX: 14.6% Thus, in this rapidly iterating ecosystem, four leading platforms have emerged and are vying for industry dominance: Hyperliquid – The veteran king of on-chain perpetual contracts; Aster – A rocket-like platform with astonishing trading volume but constant controversy; Lighter – A disruptor with zero fees and zero proof of knowledge; EdgeX – A low-key, pragmatic dark horse that caters to institutional needs. This in-depth investigation will cut through the fog of market hype and analyze each platform's technical architecture, core data, points of contention, and long-term feasibility. Part 1: Hyperliquid – The Undisputed King Why Hyperliquid Dominates Hyperliquid has established itself as the industry-leading decentralized perpetual contract exchange, peaking at over 71% market share. While competitors have briefly grabbed headlines with explosive growth in trading volume, Hyperliquid remains a structural pillar of the decentralized perpetual contract exchange ecosystem.

Technical Foundation

Hyperliquid's dominance stems from a revolutionary architectural decision: building a Layer 1 blockchain specifically designed for derivatives trading. The platform's HyperBFT consensus mechanism achieves sub-second order finality, with a transaction throughput (TPS) of 200,000 transactions per second, comparable to, and often surpassing, centralized exchanges.

Verifying the Authenticity of Open Interest

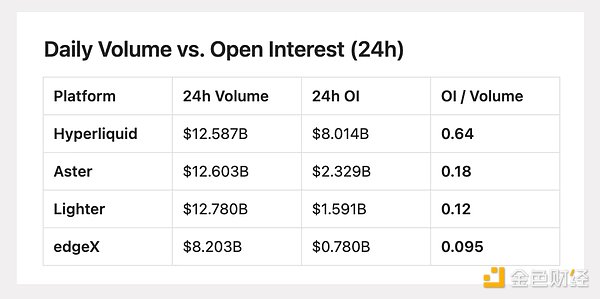

Competitors often publish eye-catching 24-hour trading volume data, but the true indicator reflecting actual capital deployment is open interest (OI) – the total value of outstanding perpetual contracts.

Trading volume reflects activity, while open interest reflects capital commitment.

Trading volume reflects activity, while open interest reflects capital commitment.

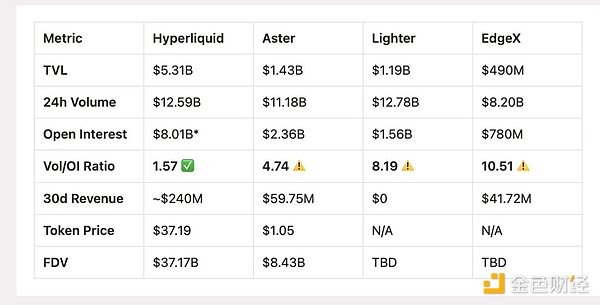

According to 21Shares data, in September 2025: Aster accounted for approximately 70% of the total trading volume. Hyperliquid temporarily declined to approximately 10%. However, this dominance is only reflected in trading volume, which is the most easily distorted indicator through incentives, rebates, frequent trading by market makers, or wash trading. Latest 24-hour open interest data shows: Hyperliquid: $8.014 billion Aster: $2.329 billion Lighter: $1.591 billion EdgeX: $780.41 million Total open interest across the four major platforms: $12.714 billion Hyperliquid's share: approximately 63% This means that among major perpetual contract trading platforms, Hyperliquid holds nearly two-thirds of the open interest, exceeding the combined total of Aster, Lighter, and EdgeX. 24-hour open interest market share: Hyperliquid: 63.0% Aster: 18.3% Lighter: 12.5% EdgeX: 6.1% This metric reflects the amount of capital traders are willing to hold overnight, rather than simply the flow of funds for incentives or frequent trading.

Key Ratio Analysis

Hyperliquid: The open interest/volume ratio is high (approximately 0.64), indicating that a large volume of trading activity translates into active, sustained open interest.

Aster and Lighter: The ratios are low (approximately 0.18 and 0.12 respectively), showing high turnover but relatively low actual open interest, which is typically characteristic of incentive-driven trading rather than sustainable liquidity.

Aster and Lighter: The ratios are low (approximately 0.18 and 0.12 respectively), indicating high trading turnover but low actual open interest, which is typically characteristic of incentive-driven trading rather than sustainable liquidity.

Overview Summary

24-Hour Trading Volume: Reflects Short-Term Activity

24-Hour Open Interest: Reflects the Size of Risk-Taking Funds

24-Hour Open Interest / Trading Volume Ratio: Reflects the Authenticity of Trading (Not Incentive-Driven)

From all metrics based on open interest, Hyperliquid is the structural leader:

Largest Open Interest

Highest Percentage of Committed Funds

DefiLlama Delisting Incident

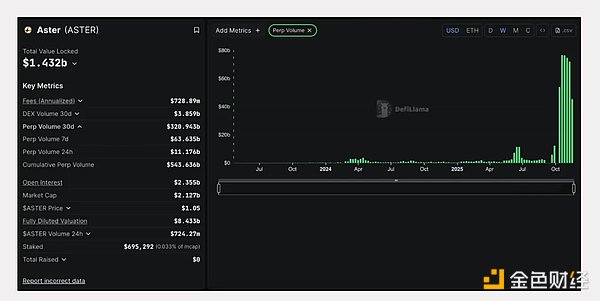

On October 5, 2025, DefiLlama, the most trusted data platform in the cryptocurrency field, discovered that Aster's trading volume almost perfectly matched Binance's trading volume—with a correlation of 1:1—and subsequently delisted Aster's data.

Trading volumes on real exchanges fluctuate naturally; a perfect match can only mean one thing: data fraud.

Trading volumes on real exchanges fluctuate naturally; a perfect match can only mean one thing: data manipulation.

Key Evidence: Aster's trading volume pattern is completely consistent with Binance (all trading pairs including Ripple and Ethereum). Aster refuses to provide trading data to verify the authenticity of the transactions. 96% of ASTER tokens are controlled by only 6 wallets. The trading volume/open interest ratio is over 58 (a healthy level should be below 3). ASTER tokens subsequently plummeted 10%, from $2.42 to approximately $1.05 currently. Aster's Explanation: CEO Leonard claimed that the correlation was merely due to airdrop arbitrageurs hedging on Binance. But if true, why refuse to provide data proof? Weeks later, Aster was relisted, but DefiLlama warned that it remained a black box, making data verification impossible. Actual Value: To be fair, Aster possesses some real features: 1001x leverage, hidden orders, multi-chain support (BNB, Ethereum, Solana), and interest-bearing collateral. It is building Aster Chain based on zero-knowledge proof technology for privacy. However, excellent technology cannot compensate for the flaws in the data. Conclusion: The evidence is conclusive: Complete relevance to Binance = Wash trading Refusal to be transparent = Concealing problems 96% of tokens concentrated in 6 wallets = Centralized control DefiLlama delisting = Completely destroyed reputation Aster gained enormous value by leveraging Changpeng Zhao's (CZ) popularity and fake trading volume, but failed to build genuine infrastructure. While it may survive due to Binance's support, its reputation has suffered permanent damage. For traders: High risk. You are betting on Changpeng Zhao's (CZ) narrative, not real growth. Set strict stop-loss orders. For investors: Avoid. Too many red flags; better options exist (such as Hyperliquid). Part Three: Lighter – Promising Technology, Questionable Data Technological Advantages Lighter is different. Founded by former Citadel engineers and backed by Peter Thiel, a16z, and Lightspeed (in a $68 million Series B funding round valued at $1.5 billion), it uses zero-knowledge proofs to cryptographically verify every transaction. As a Layer 2 (L2) network of Ethereum, Lighter inherits Ethereum's security through escape channels—users can recover their funds via smart contracts in the event of a platform failure. Application chain-type L1 networks do not offer this level of security. Launched on October 2, 2025, within weeks its Total Value Locked (TVL) exceeded $1.1 billion, daily trading volume reached $7-8 billion, and it had over 56,000 users. Zero Fees = Aggressive Strategy Lighter charges 0% fees to both order placers and takers, truly zero fees. This renders all competitors uncompetitive against fee-sensitive traders. Its strategy is simple: seize market share through an unsustainable economic model, build user loyalty, and then realize profits.

October 11th Test

Ten days after the mainnet launch, the largest liquidation event in the cryptocurrency space occurred, with $19 billion in holdings being liquidated.

Highlight: The system withstood 5 hours of market turmoil, and the Liquidity Provider Pool (LLP) continued to provide liquidity while competitors withdrew.

Highlight: The system withstood 5 hours of market chaos, and the Liquidity Provider Pool (LLP) continued to provide liquidity while competitors withdrew.

Constraints: The database crashed after 5 hours, and the platform was offline for 4 hours.

Issue: Liquidity Provider Pools (LLPs) incurred losses, while Hyperliquid's HLP and EdgeX's eLP both achieved profits.

Founder Vlad Novakovski stated that they originally planned to upgrade the database on Sunday, but Friday's market volatility caused the old system to crash ahead of schedule.

Founder Vlad Novakovski stated that they originally planned to upgrade the database on Sunday, but Friday's market volatility caused the old system to crash prematurely.

Trading Volume Issue

Data clearly shows the existence of points mining behavior:

24-hour trading volume: $12.78 billion

Open interest: $1.591 billion

Trading volume / open interest ratio: 8.03

Health level = below 3, above 5 = suspicious, 8.03 = extremely abnormal.

Comparison Reference: Hyperliquid: 1.57 (Natural Trading) EdgeX: 2.7 (Moderate Level) Aster: 5.4 (Worrying) Lighter: 8.03 (Mining Behavior) For every $1 of capital deployed by a trader, $8 of trading volume is generated – frequent closing of positions to mine tokens, rather than holding real positions.

30-day data confirms: The ratio of $294 billion in trading volume vs. $47 billion in cumulative open interest = 6.25 is still far above reasonable levels.

Airdrop Questions

Lighter's points program is extremely attractive. Points will be redeemed for LITER tokens during the token generation event (TGE, Q4 2025 / Q1 2026). The over-the-counter (OTC) market prices for points are $5-$100+. The potential airdrop value could be as high as tens of thousands of dollars, so an explosive trading volume is logical.

Key Question: What will happen after TGE? Will users remain or will trading volume collapse?

Conclusion: Advantages: Top-tier technology (zero-knowledge proof verification effective) Zero fees = a true competitive advantage Inherited Ethereum security Top-tier team and funding support Concerns: 8.03 trading volume / open interest ratio = high volume mining activity Left;">Liquidity Provider Pool (LLP) Losses During Stress Testing4 Hours Offline Raise Trust Questions

User Retention After Airdrop Unverified

Key Differences from Aster: No Allegations of Wash Trading, Not Delisted by DefiLlama. The High Rate Reflects Aggressive but Temporary Incentives, Not Systemic Fraud.

Summary

Lighter Possesses World-Class Technology, but Its Data Metrics Are Worrying. Can It Convert Miners into Real Users? Technically Feasible, But Historical Experience Suggests It's Probably Not.

For Miners: A Good Opportunity Before TGE.

A Good Opportunity Before TGE.

User Retention After Airdrop Is Unverified

Key Differences from Aster: No Allegations of Wash Trading, Not Delisted by DefiLlama. The High Rate Reflects Aggressive but Temporary Incentives, Not Systemic Fraud.

Summary

Lighter Possesses World-Class Technology, But Its Data Metrics Are Worrying. Can it convert miners into real users? Technically feasible, but historical experience suggests it's unlikely to be.For Miners: A Good Opportunity Before T For investors: Observe whether the trading volume can be sustained 2-3 months after TGE. Probability: 40% probability of becoming a top-three platform, 60% probability of becoming a technically excellent but lacking real users points mining project. Part Four: EdgeX – Institutional-Grade Professional Platform Amber Group Advantages EdgeX's operating model is unique. Originating from the Amber Group incubator (managing $5 billion in assets), it brings together professionals from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. This is not about crypto natives learning financial knowledge, but rather traditional financial professionals bringing institutional-grade expertise to decentralized finance. Amber's market-making DNA is directly reflected in EdgeX: strong liquidity, narrow bid-ask spreads, and trade execution quality comparable to centralized exchanges. Launched in September 2024, the platform's core objective is to provide CEX-level performance without sacrificing its self-custody advantages. Built on StarkEx (StarkWare's proven zero-knowledge proof engine), EdgeX can process 200,000 orders per second with latency below 10 milliseconds, comparable to Binance's speed. EdgeX has lower commission rates than Hyperliquid. EdgeX is superior to Hyperliquid in all aspects of commission rates: Commission Comparison: EdgeX Take-Order Fee: 0.038% vs Hyperliquid: 0.045% EdgeX Limit-Order Fee: 0.012% vs Hyperliquid: 0.015% For traders with a monthly trading volume of $10 million, this could save $7,000-$10,000 annually compared to Hyperliquid. In addition, EdgeX offers better liquidity for retail orders (below $6 million) – narrower spreads and lower slippage than its competitors. Real Revenue, Healthy Metrics Unlike Lighter's zero-fee model or Aster's questionable data, EdgeX generates real, sustainable revenue: Current Key Metrics: Total Value Locked (TVL): $489.7 million 24-Hour Trading Volume: $8.2 billion Open Interest: $780 million 30-Day Revenue: $41.72 million (147% increase from Q2) Annualized Revenue: $509 million (second only to...) Hyperliquid)

Trading Volume / Open Interest Ratio: 10.51 (Seemingly Worrying, But Requires In-Depth Analysis)

At first glance, a ratio of 10.51 seems extremely bad, but the context is crucial: EdgeX launched an aggressive points program to generate liquidity in its early days. As the platform matured, this ratio has steadily improved.

More importantly, EdgeX has consistently maintained healthy revenue levels—proving the presence of genuine traders, not just mining users.

Trading Volume / Open Interest Ratio: 10.51 (Seemingly Worrying, But Requires In-Depth Analysis)

October Stress Test Performance

EdgeX performed exceptionally well during the October 11 crash ($19 billion in positions were liquidated):

Zero failures (Lighter offline for 4 hours)

eLP pool remained profitable (Lighter's LLPs were at a loss)

TGE's timing is late: Expected to launch in the fourth quarter of 2025, later than its competitors, it missed the initial airdrop hype.

Conclusion

EdgeX is the choice of professionals – solid excellence instead of hype.

Advantages: Institutional Background (Liquidity provided by Amber Group) Real Revenue (US$509 million annualized) Best Pool Returns (57% annualized yield, profitable during market crash) Lower Fees than Hyperliquid Data Compliance (No wash trading scandals) Multi-chain Flexibility + Best Mobile App Smaller Market Share (5.5% of open interest) Trading Volume / Open interest ratio 10.51 (improving but still high)

No unique differentiating features

Unable to compete with zero-commission platforms

Suitable for

Asian traders seeking localized support

Institutional users valuing Amber Group's liquidity

Conservative traders prioritizing mature risk management

Mobile-first traders

Liquidity provider investors seeking stable returns

Summary

(Data estimated based on existing data)

Trading Volume / Open Interest Ratio Analysis

Industry Standard: Healthy Ratio ≤ 3

Platform Overview

Hyperliquid - Mature Leader

62% Market Share with Stable Data

Annualized Revenue of $2.9 Billion, with an Active Buyback Program

Community-Driven Model, Strong Performance Record

Strengths: Market Dominance, Sustainable Economic Model

Rating: A+

Aster - High growth, high controversy. Binance Smart Chain has strong ecosystem integration capabilities and is supported by Changpeng Zhao (CZ). In October 2025, it faced data challenges from DefiLlama. Multi-chain strategy promotes application adoption. Advantages: Ecosystem support, wide retail investor coverage. Areas to watch: Data transparency issues. Rating: C+. Lighter - Technology Pioneer. Zero-fee model, advanced zero-knowledge proof verification technology. Top-tier funding (Teale, Andreessen Horowitz, Lightspeed Venture Partners). TGE is expected to launch in Q1 2026, performance data is limited. Advantages: Technological innovation, Ethereum Layer 2 network security. Areas to watch: Business model sustainability, user retention after airdrop. Rating: Not yet completed (performance pending token generation event). EdgeX - Institutional Focus. Backed by Amber Group, professional-grade trading execution capabilities. Annualized revenue of $509 million, stable fund performance. Asian market strategy, mobile-first deployment. Advantages: Institutional credibility, steady growth. Points to note: Small market share, competitive positioning. Rating: B. Investment considerations: Trading platform selection. Hyperliquid - deepest liquidity, proven reliability. Lighter - Zero fees, suitable for high-frequency traders. EdgeX - Fees lower than Hyperliquid, excellent mobile experience. Aster - Multi-chain flexibility, Binance Smart Chain ecosystem integration advantages. Token Investment Timeline. HYPE - Listed for trading, current price $37.19. ASTER - Current trading price $1.05, need to monitor updates. LITER - Token Generation Event (TGE) expected in Q1 2026, post-launch data needs evaluation. EGX - Token Generation Event (TGE) is expected in Q4 2025; initial performance needs to be evaluated. Key Findings: Market Maturity: The perpetual contract decentralized exchange industry has shown clear differentiation, with Hyperliquid establishing its dominance through sustainable data and community consensus. Growth Strategies: Platforms target different user groups—Hyperliquid (professional traders), Aster (retail/Asian market), Lighter (tech-oriented users), and EdgeX (institutional users). Key Metrics Focus: Compared to simple trading volume, the trading volume/open interest ratio and revenue generation capability better reflect a platform's true performance. Future Outlook: The performance of Lighter and EdgeX after their token generation events will play a crucial role in their long-term competitive positioning. Aster's future depends on its ability to resolve transparency issues and maintain ecosystem support.

Zoey

Zoey

Zoey

Zoey cryptopotato

cryptopotato Bitcoinist

Bitcoinist South China Morning Post

South China Morning Post Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph