Author: Ciaran Lyons, CoinTelegraph; Compiler: Baishui, Golden Finance

The average demand for Bitcoin from retail investors has fallen to a five-month low, reaching January levels, but has surged 75% in the following two months.

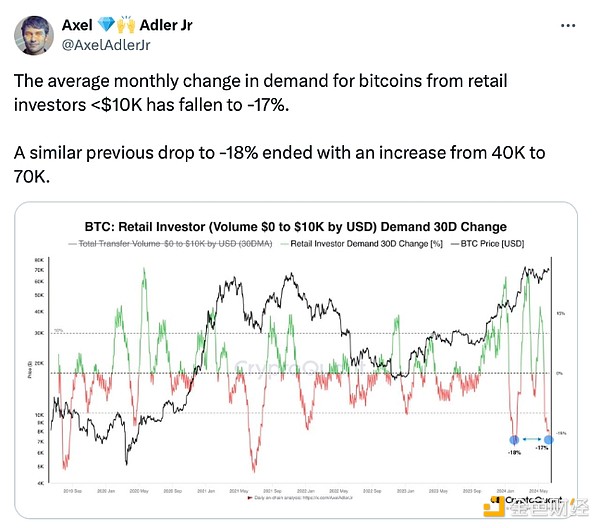

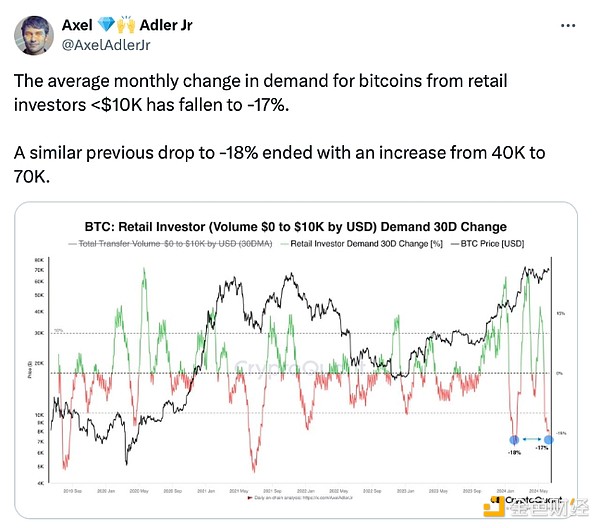

According to data shared to X by CryptoQuant author Axel Adler on June 10, the average monthly change in demand for Bitcoin from retail investors (those transferring up to $10,000) has fallen to -17% over the past 30 days.

Adler added that “there was a similar drop of 18%” in January when Bitcoin rallied from $40,000 to $70,000 — when the price of Bitcoin surged after spot Bitcoin exchange-traded funds (ETFs) were approved in the U.S., hitting an all-time high of $73,679 in mid-March.

“I also noticed that this group of people reacts very quickly to any market changes,” Adler said.

Source: Axel Adler Jr

In May, Adler used the same metric to show that demand fell 31% to -14.50% in the 17 days leading up to May 24. He noted that interest in GameStop and Ether has increased, likely due to the preliminary approval of a spot Ether ETF.

Analysts have previously said that the shift in demand for Bitcoin is due to a variety of factors, including the U.S. Consumer Price Index (CPI), which tracks inflation.

When the CPI falls, assets such as Bitcoin that are considered riskier become more attractive to investors because traditional savings and time deposits offer fewer returns as interest rates fall.

Markus Thielen, chief researcher at 10x Research, noted in May that the CPI would have to fall to 3.3% by June 12, the date the U.S. Bureau of Labor Statistics releases the data, for Bitcoin to hit a new all-time high.

Bitcoin fell below $69,000 on June 11 — the asset’s all-time high in November 2021 — a level that is being closely watched by traders. As of the time of publishing, Bitcoin is trading at $67,350, down 3.19% over the past 24 hours, according to CoinMarketCap.

Bitcoin is currently trading at $67,350. Source: CoinMarketCap

The sudden drop has resulted in the evaporation of $52.87 million worth of Bitcoin long positions in the past day. Open interest remains above the closely watched $35 billion mark, according to CoinGlass.

While traders were hoping for a quick rebound above $70,000 after the price dipped below that level on June 8, Bitcoin has yet to achieve that goal.

Despite the CPI results being released on June 12, futures traders don’t seem to think Bitcoin will bounce back anytime soon, putting $2.14 billion of short positions at risk if it does.

JinseFinance

JinseFinance