Author: Jay Jo Source: Tiger Research Translation: Shan Ouba, Golden Finance

Abstract

JPMorgan Chase issued deposit tokens on the public chain to integrate new technologies into the existing financial order. Circle (USDC issuer) seeks to establish a trust bank to reconstruct a new financial order on the blockchain.

It is worth noting that these two players with different starting points are accepting new technologies and new institutional arrangements respectively, and this approach is blurring the boundaries between them.

However, blurred identities may weaken their original competitive advantages, as has happened in the fintech industry in the past. Therefore, each player needs to clearly recognize their "asymmetric advantages" and find a balance between technology and institutions.

1. Competition in on-chain financial infrastructure

Blockchain technology is becoming the new cornerstone of global financial infrastructure. Traditional financial institutions and crypto-native companies are competing for dominance in the next-generation financial system. JPMorgan Chase's strategy is to integrate blockchain technology into the existing financial system to improve efficiency. Circle is building a new financial infrastructure on the blockchain to provide an alternative to the existing system.

This trend is reminiscent of the past competition between "FinTech centered on traditional finance" and "TechFin centered on big technology companies." However, the current landscape is significantly different.

Competition is not just about simple technological advantages, but also about who will design and operate the future financial ecosystem. Traditional financial institutions are trying to gradually transform within existing regulations and systems. Crypto-native companies are building a new order based on technological efficiency and scalability. This report explores the on-chain finance strategies of JPMorgan Chase and Circle and analyzes the development direction of on-chain financial infrastructure.

2. JPMorgan Chase: Building blockchain on traditional financial architecture

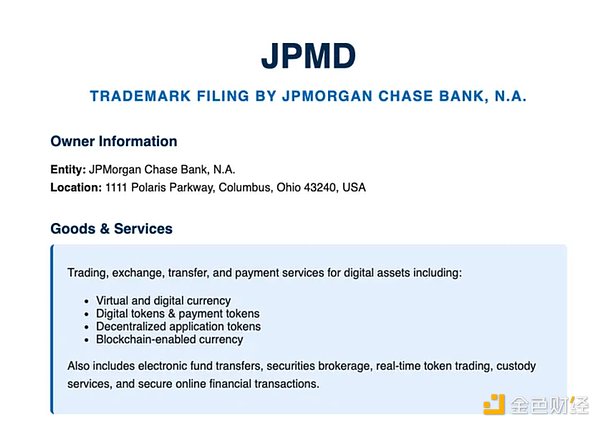

JPMorgan Chase has registered a deposit token trademark called "JPMD", source: JPMD documents

In June 2025, JPMorgan Chase's blockchain subsidiary Kinexys launched a pilot operation of the deposit token (JPMD) on the public chain Base. Previously, JPMorgan Chase only applied blockchain technology in a limited way on private chain infrastructure. This time, it took a completely different path: JPMorgan Chase issued assets and supported trading operations directly on the open network. This marks a major turning point - the first time that traditional financial institutions have directly carried out financial services on the public chain. JPMD combines the characteristics of digital assets and traditional deposits. When a customer deposits US dollars to JPMorgan Chase, the bank records the deposit on its balance sheet and issues an equivalent JPMD on the public chain. This token can circulate freely on the chain while retaining the legal claim to the bank's deposits.

Token holders can redeem them for real dollars at a 1:1 ratio and may enjoy rights such as deposit protection and interest income.

In contrast, current stablecoins tend to concentrate returns in the hands of the issuer, while JPMD differentiates itself by giving users substantial financial rights.

These features not only provide legal compliance stability, but also bring practical convenience to asset managers and investors. For example, assets such as BlackRock's BUIDL fund or Franklin Templeton's on-chain money market fund will achieve 24-hour liquidity if JPMD is used as a redemption medium.

Compared with existing stablecoins, JPMD does not need to be exchanged for fiat currency through traditional withdrawal channels, and can be directly realized instant cash, and provide deposit protection and interest income. This makes JPMD have great application potential in the on-chain asset management ecosystem.

JPMorgan Chase's launch of deposit tokens is a direct response to the new capital flow and income structure formed around stablecoins. For example, Tether generates about $13 billion in revenue each year, and Circle also earns billions of dollars in revenue by managing safe assets such as government bonds.

Although these stablecoin models are different from the traditional "deposit-lending" interest rate spread model, they essentially also reflect a certain "quasi-bank" function, that is, generating income around customer funds.

Of course, this design also has limitations. JPMD is built within the existing financial regulatory framework, so it is difficult to truly achieve the "decentralization" and "openness" of blockchain. Currently, the service targets are limited to institutional clients.

Despite this, JPMD is still seen as a realistic and feasible path to help traditional financial institutions enter the public chain-based financial services field while maintaining regulatory compliance and stability.

It has become a typical representative of the structural connection expansion between traditional finance and the on-chain ecosystem, and has received widespread attention from industry observers.

3. Circle: Building a native financial system on the blockchain

Circle has become an important player in the on-chain financial field through its stablecoin USDC. USDC is anchored to the US dollar at a 1:1 ratio, and Circle uses cash and short-term US Treasury bonds as reserve support. USDC has technical advantages such as low fees and instant settlement, and companies use it as a practical alternative for corporate payments and cross-border remittances.

USDC supports 24-hour real-time fund transfers without the complex processes required by the existing SWIFT network. This capability helps companies overcome the limitations of traditional financial infrastructure.

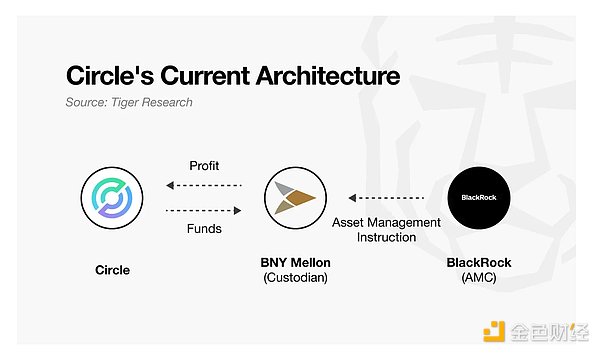

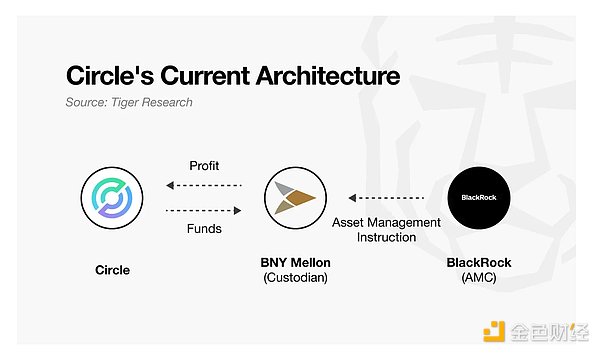

However, Circle's current business structure also faces multiple constraints. For example, USDC's reserves are managed by Bank of New York Mellon and asset operations are managed by BlackRock. This structure hands over core functions to external institutions. Although Circle itself can obtain interest income, its actual control over assets is limited.

In addition, the current revenue model is also highly dependent on the high interest rate environment. In order to achieve long-term sustainable development and diversify revenue sources, Circle urgently needs more independent infrastructure and operational authority.

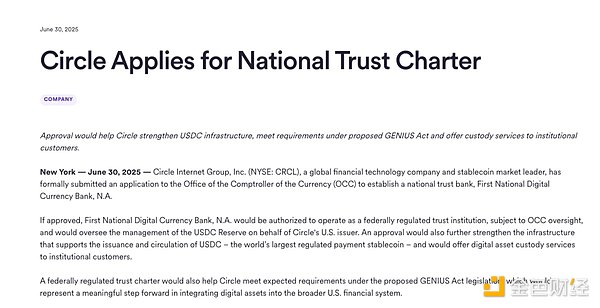

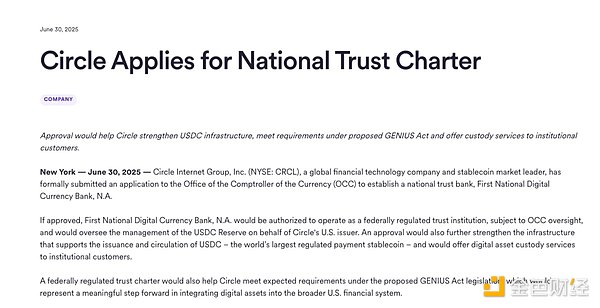

In June 2025, Circle applied to the U.S. Office of the Comptroller of the Currency (OCC) to establish a national trust bank in an attempt to address the above restrictions. This is a strategic choice that goes beyond simple compliance. Industry observers interpreted this as Circle's transformation from a stablecoin issuer to an institutionalized financial entity.

The trust bank identity will enable Circle to directly manage reserve custody and asset operations, which means that stablecoin issuers can strengthen their internal control capabilities and expand their business boundaries within the existing financial system. Circle also hopes to lay the foundation for providing digital asset custody services to institutional investors.

Circle started as a crypto-native company and now adjusts its strategy to achieve sustainable operations within the institutional framework. It actively accepts the rules and roles of the existing financial system, and this transformation is accompanied by trade-offs such as reduced flexibility and heavy regulatory burden.

The business permissions it can obtain in the future will depend on policy changes and regulatory interpretations. Nevertheless, this attempt is still an important milestone, marking an exploration of how on-chain financial architecture can take root in the existing institutional framework.

4. Who will lead on-chain finance?

From traditional financial institutions (such as JPMorgan Chase) to crypto-native companies (such as Circle), various players with different starting points are actively entering the on-chain financial ecosystem. This is quite similar to the pattern of financial technology competition in the past. At that time, technology companies entered the financial field by internalizing core financial functions such as payment and remittance; while financial institutions expanded user touchpoints and improved operational efficiency through digital transformation.

It is important that this competition is not a simple "parallel advancement", but breaking the boundaries between the two sides. A similar phenomenon has reappeared in the current on-chain financial field: Circle applied to establish a trust bank, intending to directly perform core financial functions such as reserve management and custody; JPMorgan Chase issued deposit tokens on the public chain to expand its business to the field of on-chain asset management. Although they started in different directions, they are gradually absorbing each other's strategies and fields, and are looking for a new balance point. This trend brings new possibilities, but also involves risks: if traditional financial institutions are too rigid in the agility and speed of technology companies, they may conflict with the existing risk management system. For example, Deutsche Bank once implemented a "digital first" strategy and invested heavily in IT, but due to conflicts with legacy infrastructure, repeated system failures led to billions of dollars in losses. In turn, crypto-native companies also face another risk: when they over-expand institutional acceptance, they may lose the flexibility and execution capabilities that have always supported their competitiveness.

In the competition of on-chain finance, the final victory will depend on whether one can truly understand and build on one's own foundation and advantages.

Each participant needs to find a way to harmoniously integrate technology and system based on their own "asymmetric advantages". Whether the two can be balanced will determine who will be the winner in the future.

Miyuki

Miyuki