Author: Min|TechFlow

Following the March 12th and May 19th crashes, the cryptocurrency world has another anniversary of a major market crash—October 11th.

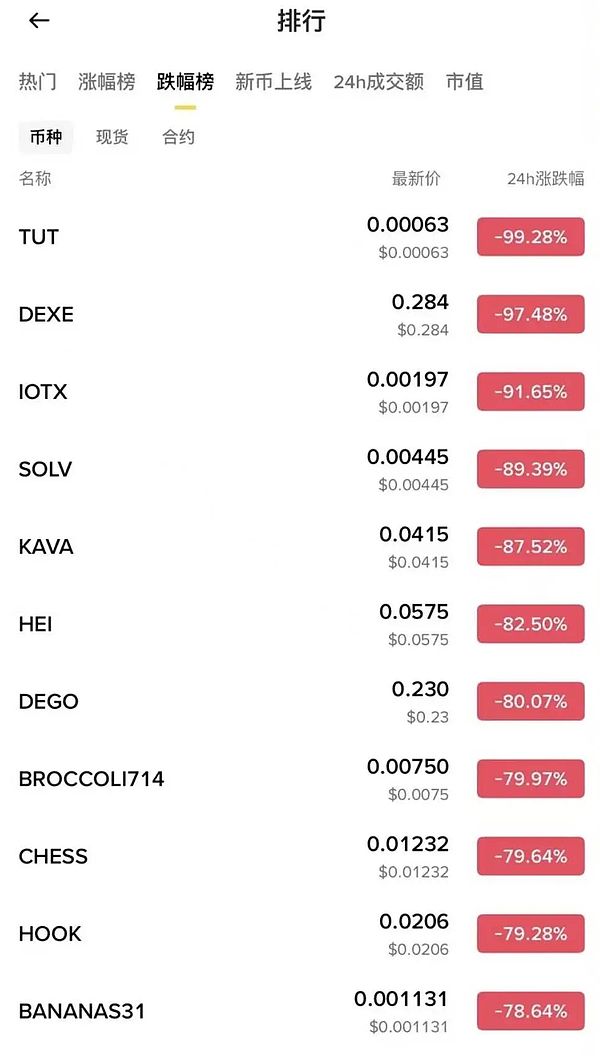

Bitcoin briefly fell below $110,000, the USDE decoupled, and altcoins plummeted. The prices of many projects plummeted to zero in a matter of minutes. Yes, they really did.

Coinglass data showed that as of 9:00 on the 11th, the 24-hour liquidation amount reached US$19.2 billion, the number of liquidations reached 1.64 million, and the largest single liquidation order exceeded US$200 million. However, this data may only be the tip of the iceberg. According to relevant practitioners, the actual liquidation data is far higher than the public. "Binance's liquidation data should be far higher than Hyperliquid and Bybit." According to Coinglass data, Binance's liquidation data is currently only one-fifth of Hyperliquid's. Crypto data analyst MLM (@mlmabc) believes that the actual market liquidation data is around US$30-40 billion. In the past, we comforted ourselves with the belief that the market was now a different place, more mature, and would never again experience a volatile market like the March 12th crash. However, reality has once again slapped us in the face. On the surface, this was a sudden black swan shock, but the real cause of the market collapse may have been the long-accumulated leverage boom and structural flaws in the market-making system. The trigger for this plunge was Trump. That day, he abruptly announced a new round of tariffs on Chinese goods. The Sino-US trade friction escalated sharply, putting global risk assets under pressure. Risk aversion surged, sending capital fleeing to the US dollar and US Treasuries. Cryptocurrencies, representative of risky assets, bore the brunt of the sell-off. This became the first straw that broke the market's back. However, tariffs alone cannot explain the sudden collapse of the entire crypto market. The real key lies in the market's false prosperity, which was built on high leverage. Over the past few months, Bitcoin and other mainstream assets have repeatedly reached new highs, but much of the capital behind this is not long-term capital, but leveraged funds accumulated through contracts, lending, and liquidity mining. When negative news hit, these highly leveraged long positions were the first to be hit. Once the support level was broken, forced liquidations were triggered one after another, and the selling pressure intensified, causing the market to fall into a chain reaction of "longs killing longs." Perhaps the most striking example is the US Depository and Clearing (USDE). Since the official introduction of the 12% subsidy policy, a large number of users have engaged in revolving loans for arbitrage. This mechanism was extremely attractive during the bull market, attracting a large amount of capital in a short period of time and becoming a key engine driving market prosperity. However, on October 11th, when the impact of tariffs triggered a sell-off, the USDE significantly decoupled from its peg, briefly falling below $0.66, becoming a landmark event in this plunge. Even more fatal was the complete failure of the market-making mechanism during this plunge. Greeks.live staff member Bugsbunny analyzed that currently, active market makers (AMs) have limited funds and tend to focus their primary liquidity resources on Tier 0 and Tier 1 projects, such as BTC and ETH. For mid- and long-tail altcoins, they only provide a small amount of support. After the collapse of Jump, market liquidity became even more dependent on these AMs. However, they lacked comprehensive tail risk hedging mechanisms and could only cover daily market fluctuations. In extreme market conditions, their funds were insufficient to provide a bottom line. When Trump's tariff announcement triggered market panic, AMs were forced to prioritize the safety of large projects, withdrawing funds originally allocated to smaller altcoins. As a result, the altcoin market was completely deprived of counterparties, leaving no one to cover the selling pressure, and prices plummeted in a near-free fall. Tokens like IOTX plummeted to near zero, a stark reflection of the liquidity depletion. In fact, with the surge of new projects this year, active market makers have long been overwhelmed with funds, and the market lacks sufficient derivatives to hedge tail risks. This latest sell-off has only completely exposed the issue. Furthermore, Bugsbunny believes that what's even more devastating is that this crash occurred on Friday night (early Saturday morning in the Asian session). Market makers in both Europe and Asia have clearly defined working hours. If this had occurred during the weekday trading session, liquidity would likely have been restored long ago. "But today just happened to be Friday. It all just happened to be a coincidence." It's both a danger and an opportunity, bringing joy to some and sorrow to others. On October 10, before Trump's announcement, an early Bitcoin investor continued to increase his short positions in BTC and ETH on Hyperliquid, bringing his total position to over $1.1 billion. After the sharp drop, he made a killing. Some people also took advantage of the situation and used the decoupling of USDE, BNSOL, and WBETH to arbitrage… Overall, the October 11th crash was not caused by a single factor, but rather the conspiracies of three forces: the policy impact of a macro-black swan, the structural fragility of leverage amidst prosperity, and the collapse of market makers’ liquidity protection. This morning, seeing the widespread grief on my WeChat Moments, I felt doubly the cruelty and ruthlessness of the market. The crypto market has never been a smooth highway; it's more like a sea dotted with hidden reefs. The prosperity of a bull market is often shrouded in the illusion of leverage, while black swans always lurk around the corner, poised to strike at any moment. For retail investors, the most important thing isn't the constant pursuit of huge profits, but survival. As long as you survive, you have the opportunity to start a new journey in the next cycle. Once your entire position is liquidated in extreme market conditions, you may never get back to the table. I repeat: survival is everything.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Clement

Clement Clement

Clement decrypt

decrypt Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph