Halving market: You need to know what kind of rhythm represents money, whether it is the trembling of strings by small hands or the dancing of bows, pulling up and down.

Market status: There is only one big pie here. The ideal country of finance is Plato, but people have turned it into Indian flying cakes or even cyberpunk cakes.

ETF effect: "Moshisha" is called "the king of water" because of its good production of high-quality goods. This name is enough to bluff and have enough gimmicks. Even if you know that it is difficult to increase, the price of its raw materials will not be too low. The reason is that it is easy to sell.

Capital entry: The story of a pair of chopsticks has never focused on wrestling. It is important to recognize your own strength, and it is more critical to have insight into what you are facing.

To individual investors: The probability of you encountering aliens is about one in 7 billion, and the success rate of your creation of alien creatures is 50%. You always think that the level of technology limits your imagination, but in fact you don't see it clearly. Investment is a probability game.

With the completion of Bitcoin halving, the "Storm Time" in the crypto world once every four years has officially begun.

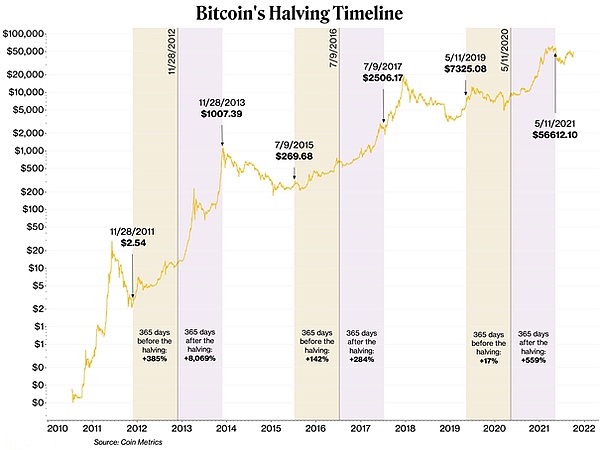

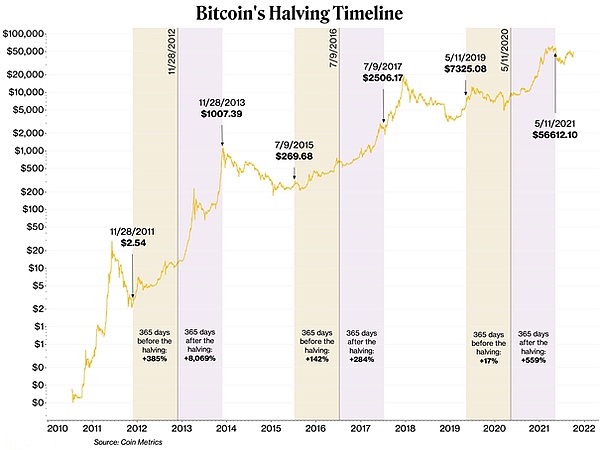

Many people will regard "halving" as an opportunity. Those K-lines that break the top intersect with the time nodes of the halving cycle, and the correlation between the two is strengthened under the support of the logic of supply and demand. As the structure of the Bitcoin market changes, the time node of this halving cycle also carries the support of many external factors. This article will discuss them one by one in depth and find ways for investors to deal with this halving cycle.

Why halving?

First, we need to figure out why Bitcoin needs to be halved.

Halving is the halving of the incentives of the Bitcoin network. In the Bitcoin network, miners need to perform a large number of hash calculations to find a hash value that meets specific conditions in order to package new transactions into blocks and add them to the blockchain. The first transaction in each Bitcoin block will generate Bitcoin, and miners who successfully find the correct hash value will receive Bitcoin rewards.

(Figure 1: Recent Bitcoin Network Blocks and Rewards, Mempool)

Nakamoto hopes to make Bitcoin a scarce resource similar to gold through the halving mechanism, providing a method to allocate currency units to circulation basins without involving the issuance of currency by a centralized authority. The two are similar in mining and supply models. Gold mining requires the consumption of expensive equipment and equipment, high labor costs and transportation costs, and rewards (gold) from gold mines and injection into the market. As the amount of gold mined increases, the difficulty of mining unborn gold has also increased significantly. In the Bitcoin network, miners consume resources (CPU and electricity) to process transactions, receive BTC incentives, and eventually inject them into the secondary market.

After this halving, the block reward will change from 6.25 BTC to 3.125 BTC. The impact on miners' income needs to be explored from different stages. For example, after the first halving, the number of bitcoins miners received was reduced from 50 to 25. Subsequently, the price of Bitcoin rose from a few dollars to hundreds of dollars, and the income of miners rose sharply. The sharp rise in prices compensated for the impact of halving. The emergence of the 2024 inscription provides an additional source of income for Bitcoin miners.

In addition, the Bitcoin network has a built-in difficulty adjustment mechanism, which will respond to changes in network computing power (hash rate) by dynamically adjusting the mining difficulty to maintain the miners' income level. The difficulty adjustment mechanism uses 2016 blocks (about two weeks) as an adjustment cycle, and adjusts according to the actual block time of the previous cycle. If it is less than two weeks, the difficulty will be increased (up to 4 times), and if it is more than two weeks, the difficulty will be reduced (up to 75%).

(Figure 2: Hash rate & mining difficulty, Mempool)

Combining the past few halvings with the development of the mining industry and the ecology of the Bitcoin network, Bitcoin has formed a closed value loop. Bitcoin halving, BTC price rises, miners' competition escalates, mining technology and hardware requirements increase, hash rate rises, Bitcoin network difficulty increases, miners' costs increase, block efficiency improves, and Bitcoin network value increases. Throughout the process, good money drives out bad money, efficient miners replace less efficient miners, and the Bitcoin network ecology develops.

The essence of the halving mechanism is to encourage miners to maintain the long-term value of the Bitcoin network and the overall security of the network. On the one hand, Bitcoin's halving mechanism can control inflation and realize the value storage of its tokens through scarcity enhancement; on the other hand, with the reduction of mining rewards, miners will rely more on transaction fees as a source of income, thereby promoting the activity and efficiency of the entire network transaction and ensuring the security and anti-attack capabilities of the network, thereby enhancing the value of the Bitcoin network.

ThinkingWhat is the truth about the "halving market"?

In the information we receive, we subtly ignore the hidden "necessary conditions".

Combined with the nature of Bitcoin's halving, halving drives the market, and the necessary condition that most people tend to ignore is consensus. This is an explanation that conforms to the attributes of currency. Consensus determines the scope of circulation. As circulation increases, prices also increase.

(Figure 3: Bitcoin halving timeline, Coin Metrics)

The more people who agree with the value of Bitcoin, the more users there are, the more people who participate in circulation, the more liquidity there is, and the price trend rises. This is the normal market logic. The price of Bitcoin and consensus should be positively correlated. Looking at the past Bitcoin price trends, there are several times that the peak prices do not conform to the horizontal parabolic trend. There are external factors that affect the Bitcoin market.

2013: Mt.Gox has a large number of suspicious transactions. Two robot accounts, Markus and Wiley, executed large-scale Bitcoin buy orders, and the price rose sharply.

2017: From October 1 to December 16, 2017, the price of Bitcoin rose from $4,403.74 to a high of $19,497.4. During this period, USDT was issued 28 times, with a total of 705 million additional issuances

2024: On March 12, the net inflow of Bitcoin ETF exceeded $1 billion, and then the price of Bitcoin broke $73,000, setting a record high.

Is Bitcoin's status shaken?

Analysts at JPMorgan Chase once said that Ethereum will surpass Bitcoin in 2024. He believes that the Cancun upgrade will enhance Ethereum's competitiveness, and at the same time, favorable factors such as Bitcoin halving and ETF have already acted on Bitcoin's price, and its stamina is insufficient.

Many people believe that, apart from Bitcoin's safe-haven properties, Ethereum's smart contracts and DApps can create more growth opportunities. In addition, the rise of blockchain networks such as BNB and SOL has brought diversified financial products and services to the crypto world, which is undoubtedly more attractive to investors seeking diversified portfolios and higher potential returns.

In the past, Bitcoin was more seen as a means of storing value; today, the Bitcoin network is no longer limited to being a medium of exchange for currency, but has been given new functions such as NFT and tokenization.

From the perspective of on-chain value, after the Cancun upgrade, L2 has achieved initial results in gas fees, throughput, etc., but the optimization of Ethereum's own gas fees is not obvious enough. Moreover, Ethereum developers need to consider the pressure brought by the increase in on-chain activities, and a lot of development is still needed to achieve the final form of Rollup expansion.

In 2024, the innovation of the Bitcoin network Ordinals and BRC-20 token standards marked a major breakthrough for Bitcoin. The Ordinals protocol allows the recording of arbitrary data on the Bitcoin blockchain, the deployment, minting and transfer of alternative tokens on the chain, and the creation of digital artworks or NFTs. For the Bitcoin ecosystem, this is undoubtedly a breakthrough from 0 to 1, making DeFi possible on the Bitcoin network.

From the perspective of price performance, the Cancun upgrade and Ethereum ETF would have become new narratives for its breakthrough highs. Who would have thought that Cheng Yaojin would come out halfway, and the periodic craze of Meme made market funds rush to the SOL ecosystem. The postponement of the Ethereum ETF resolution also aggravated the market's bearish sentiment. As of April 19, the price of Ethereum has retreated by more than 24% from its highest point before the upgrade.

On the other hand, Bitcoin's price reached a record high of $73,798 in mid-March, accounting for nearly 55% of the market value of the cryptocurrency market, the highest level since April 2021.

(Figure 4: Cryptocurrency Price & Share, CMC)

In addition, Bitcoin is the product of Satoshi Nakamoto's reflection on the 2008 financial crisis. He hopes to build an orderly, fair, and public interest-oriented decentralized financial system to cope with the limitations and crises of the traditional financial system. And now, the situation of "the chancellor is on the verge of a second round of bailouts for the banking industry" is playing out. The Japanese yen, Indian rupiah, Korean won and other monetary systems are facing severe tests under the pressure of a strong US dollar index and short selling by international capital, and the yen exchange rate has fallen to a 34-year low. The United States itself will also face the choice of breaking its wrist, the credit of the US dollar system will collapse, the hard currency attributes of the currency will weaken, and the US dollar will no longer be "US dollars".

Investors need to focus on the negative situation when there is a widespread liquidity tightening in the market.

Pressure on asset liquidation: Tight liquidity means increased credit difficulty and increased default risk. Liquidity reserves need to be increased by liquidating assets, which may lead to the sale of Bitcoin.

Market panic pressure: Liquidity tightening will be accompanied by increased economic uncertainty and market panic, and investors will tend to adopt relatively conservative investment strategies.

Hidden dangers of market depth: Liquidity itself is extremely important for market operations. When liquidity tightens, the market's ability to absorb large transactions decreases, that is, the market depth decreases, and small transactions may cause large price fluctuations.

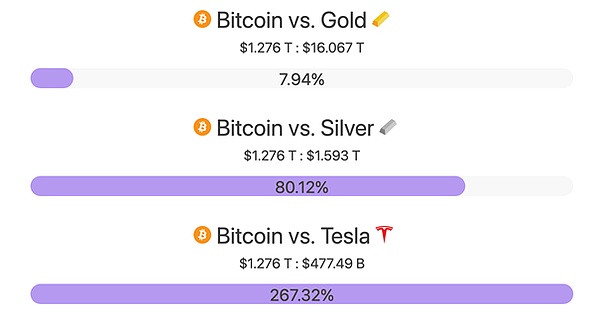

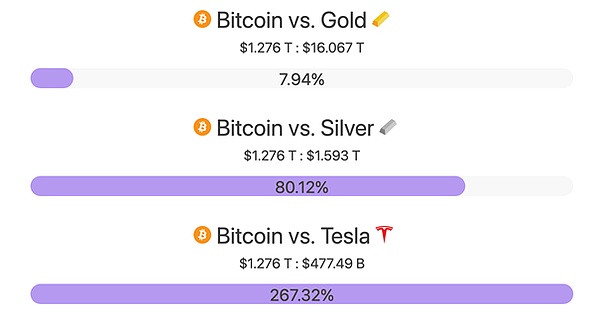

PayPal co-founder Peter Thiel once said in public: "Central banks are bankrupt, and we are at the end of the legal currency system. Bitcoin is the ultimate substitute for the entire traditional financial system." At present, Bitcoin's market capitalization ranks 10th in the global asset ranking. Its huge consensus base and its importance in the financial market are self-evident.

(Figure 5: Comparison of market value of Bitcoin with gold, silver and Tesla, 8marketcap)

Why ETFs hold back the halving

In recent years, the connection between the crypto world and the traditional financial market has become increasingly close. For example, the Bitcoin ETF has been approved, and financial institutions such as Grayscale and BlackRock have provided innovative investment products for investors in the traditional financial market by holding Bitcoin.

JMP Securities, a well-known investment institution on Wall Street, once released a research report saying that it is expected that in the next three years, spot ETFs tracking Bitcoin (BTC) may have an inflow of up to $220 billion. They believe that the flow of funds will continue to grow significantly, and regulatory approval is only the beginning of a "longer capital allocation process."

Since 2024, Bitcoin ETFs have accumulated assets of up to about $56 billion.

But the situation has changed recently. Bitcoin ETF has experienced net outflows for 5 consecutive days, with a total outflow of more than 319 million US dollars.

Inflation has not been controlled, and government bonds have become risky assets, which has greatly affected investors' confidence in the market. Bitcoin prices have also fluctuated greatly, falling by more than 10,000 US dollars from their historical highs not long ago. I have to sigh that the ups and downs are all due to ETFs.

(Figure 6: Recent Bitcoin Prices, Investing)

The emergence of Bitcoin ETFs has changed market dynamics. Bitcoin ETFs allow investors to invest in Bitcoin indirectly through traditional investment channels. Investors need to pay more attention when considering the impact of halving.

1. Bitcoin ETFs have increased liquidity and attracted a large number of institutional investors and funds, which will have an impact on Bitcoin prices before and after halving.

2. Bitcoin ETFs increase the demand for Bitcoin and reduce the supply in circulation, which can easily affect investors' accurate judgment of market expectations for the halving cycle. Investors need to distinguish between the halving expectations and the actual situation after the halving. Affected by Bitcoin ETFs, the market may have reflected expectations before the halving, resulting in price adjustments after the halving.

3. The behavior of long-term holders during the halving period has a significant impact on the balance of market supply and demand. If long-term holders choose to sell Bitcoin after the halving, it will increase the supply in the market, thereby putting pressure on prices. The flow of funds in ETFs may affect the decision-making of long-term holders, further affecting the balance of market supply and demand.

Whales at the helm, halving becomes a reshuffle?

According to a report by Glassnode, there are currently about 2.317 million liquid Bitcoins, accounting for only 11.7% of the total circulation. The entry of traditional financial institutions has undoubtedly accelerated the pace of the Bitcoin market's transition to institutional dominance.

The entry of institutions into the Bitcoin market brings more stringent investment processes and risk management measures, which will improve the liquidity and depth of the market and catalyze the mature development of the crypto market. Moreover, with the participation of institutional investors, more perfect requirements will inevitably be put forward for the regulatory framework to protect the interests of investors, reduce the speculation of the market, and further promote the healthy development of the market.

In addition, the due diligence and compliance operations of institutional investors will help improve the transparency and efficiency of the market. As more regulated financial activities enter the cryptocurrency market, the irrational prosperity and bubble risks of the Bitcoin market will be reduced. How regulators, market participants and financial institutions cooperate becomes the key.

For ordinary investors, the institutionalization of the Bitcoin market is like a filter. On the one hand, the entry of traditional financial institutions will bring a more stable market environment and more investment products. On the other hand, the entry of more traditional institutions means intensified competition and higher investment thresholds.

Especially in the face of the halving cycle, there is a possibility of short-term fluctuations in the price of Bitcoin. Institutions may use fluctuations to execute short-term transactions or make profits through strategies such as selling high and buying low. Ordinary investors need to evaluate their investment strategies more carefully and seek professional financial advice, otherwise they will only be eliminated.

To individual investors

In the investment market, everyone has a 50% chance of turning over.

Insights into historical data, macroeconomics, market dynamics and other factors will help you increase your chances of winning.

But it is more important to remember that the impact of wrong investment perspectives and mentality on the probability of winning is multiplied.

If you want to gain wealth, you first need to understand wealth, and then learn to forget wealth.

JinseFinance

JinseFinance