In December last year, the National Bitcoin Office of El Salvador (ONBTC) issued a statement stating that the Bitcoin bond "Volcano Bond" has been approved by the El Salvador Digital Assets Commission and is expected to be Issuing in the first quarter of 2024, the bond will be issued on the Bitfinex Securities platform.

"The funds raised from the bond issuance will be used to build a city called Bitcoin City. This bond issuance will make El Salvador a new world financial center. ”, in November 2021, Samson Mow, then Chief Strategy Officer of Blockstream, said this at a rally for Bitcoin Bonds in El Salvador.

So what role does Blockstream, the company behind El Salvador’s Bitcoin bonds, play in the world of Bitcoin?

Blockstream involved in "Bitcoin's entire industry chain"

In August 2021, Bitcoin and blockchain infrastructure company Blockstream completed a US$210 million Series B financing and also acquired the Israeli ASIC chip design team Spondoolies. This marks that Blockstream has gradually expanded from its original software-focused business to Bitcoin. Further up the industrial chain.

Prior to this, Blockstream's commercial product line mainly focused on services related to the Bitcoin sidechain "Liquid" ecology and Bitcoin mining, as well as some data types. Business, dedicated to expanding and strengthening the Bitcoin ecosystem.

The product matrix of "Bitcoin Family Bucket"

Blockstream’s early product line was actually mainly Liquid sidechain solutions serving institutions, and later it also got involved in consumer products through the acquisition of the Bitcoin wallet Green Wallet.

At the same time, Blockstream also has several free product lines in the Bitcoin ecosystem that are being continuously maintained and iterated, such as the Bitcoin full-node satellite network Blockstream Satellite, and more. Sign wallet Blockstream Green and Lightning Network client c-lightning, etc.

However, although Blockstream's participation in the research and development of Bitcoin Core is at the forefront of software research and development, the upstream of the entire Bitcoin industry chain also participates in the consensus mining industry, so they also began to announce the development of Bitcoin mining services in early 2020. It launches Bitcoin mining business through cooperation with Norwegian listed companies Aker, Square and BlockFi.

Including the subsequent "Blockstream Energy" service, it aims to help energy producers sell excess electricity to miners, thereby providing power generation projects through Bitcoin mining. Scalable energy demand, increasing power generation efficiency and improving the economics of renewable energy projects around the world, especially in remote areas.

From a specific chip manufacturing perspective, Blockstream also announced the acquisition of the intellectual property rights of Bitcoin mining hardware manufacturer Spondoolies while disclosing its Series B financing. , the core team of Spondoolies will also join Blockstream and focus on ASIC chip design and manufacturing, making up for Blockstream's shortcomings in this area.

In addition, Blockstream has also launched Blockstream Mining Note (BMN), a Bitcoin mining token circulating on Liquid for qualified investors. The mining facility is located in the United States. Georgia and Quebec, Canada.

With the improvement of the layout of the mining sector, Currently, Blockstream covers almost all product matrix dimensions such as Bitcoin development, institutional services, and mining.

Bitcoin side chain "Liquid"

The key core of Blockstream's "Bitcoin Family Bucket" is "Liquid".

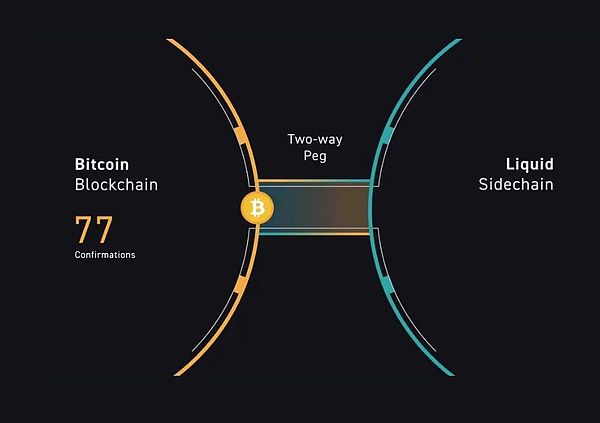

"Liquid" is the Bitcoin side chain on which El Salvador plans to issue Bitcoin bonds mentioned above. It can be simply understood as "Bitcoin-based "Smart contract layer":

It serves as Bitcoin's second-layer network, whichallows the issuance of security tokens and other digital assets and is designed to be used through the Bitcoin network Provide financial products and services and for settlement of financial assets.

The current Bitcoin network ecology can be simply divided into 4 layers of basic structure:

1. Main chain, which is mainly responsible for the value of Bitcoin The system carries the decentralization and security of Bitcoin as well as the value orientation represented by the Bitcoin community;

2. Layer 2, represented by the Lightning Network , the focus is on expanding the payment experience of Bitcoin;

3. Side chain, the smart contract part is mainly placed on the side chain, and the side chain is the most important The function is to add the application of smart contracts to the Bitcoin ecosystem;

4. Cross-chain, almost all other mainstream public chains use cross-chain bridges to connect Bitcoin The currency has introduced its own ecology, and is used to develop Bitcoin-related DeFi projects in its own ecology (especially Ethereum);

And " "Liquid" side chain is also the core of Blockstream's products. Although other products are also interconnected, the Liquid network will be prioritized as the most important product line. "For example, the wallet we develop will eventually be connected to the Liquid network, so the wallet itself The profit model is secondary, the main thing is how to grow the Liquid network."

Blockstream: The "veteran" in the Bitcoin world

In 2014, Ethereum started pre-sales, Mentougou was stolen, and the dispute over the expansion of the Bitcoin community became increasingly fierce. The entire crypto world focused on these major events that had a profound impact on the industry.

At the same time, Blockstream, which was founded less than a few months ago, received US$20 million in Series A financing and clarified the project positioning at that time-expanding Bitcoin Coin protocol layer function (side chain).

The company's lineup is quite luxurious, and its leaders are former HashCash developer Adam Back; early e-cash electronic cash developer and zero-knowledge system founder Hammie Hill , and HashCash and e-cash are both the foundation products of Bitcoin.

In addition, Blockstream also has an all-star development team,including Gregory Maxwell, Jonathan Wilkins, Matt, who will become the leaders of Bitcoin core developers in the future. Corallo and Pieter Wuille; Freicoin project leader Jorge Timon and former NASA engineer Mark Friedenbach, among others.

The "opposition" in the Bitcoin expansion debate

In the debate over Bitcoin expansion, community leaders at that time Gavin Anderson, Bitmain and others were the expansionists, while Blockstream and others, represented by core developer Gregory Maxwell, were the opposition.

The expansionists believe that the network congestion problem must be solved immediately, otherwise as the user population further expands, the payment delay problem will be very obvious and transaction fees will It has soared to a terrifying level, which is unacceptable for Bitcoin, which aspires to be an "electronic cash". Gavin Anderson bluntly stated that "the rise in Bitcoin transaction fees will make the poor stay away from Bitcoin."

The opposition believes that in the long run, the congestion problem can and should be solved through the second-layer network, because capacity expansion can only solve short-term congestion. When the influx of bits There are more and more people using Bitcoin, and Bitcoin, which has already expanded, will have to continue to expand, and there is no end in sight for this approach. Therefore, they advocate keeping the Bitcoin network at 1MB, and at the same time launching a second-layer network outside the Bitcoin network. Segregated Witness and Lightning Network solutions.

This is also the point of conflict between the developers and the miners’ representatives. The two sides do not trust each other:

Developers do not trust miner representatives and believe that mining pools and the large companies that operate mining pools have stolen the miners' voice. Industrial mining has become a centralized business activity, and the existence of "mining tyrants" is destroying The decentralized nature of digital currency;

Miner representatives believe that once the Lightning Network is truly built, the vast majority of transactions will occur on the second-layer network, and The second-layer network will eventually move toward absolute centralization, with central nodes monopolizing transaction channels. The underlying network will become the settlement channel for the central node of the second-layer network. Most people will not be able to use the underlying network in their lifetime, which goes against Satoshi Nakamoto’s original intention of establishing Bitcoin.

In the subsequent New York meeting where the two parties aimed to negotiate, due to various disagreements, Miao Yongquan, who finally attended the meeting on behalf of Bitcoin Core and Blockstream, was turned away. .

The various route disputes and conflict twists and turns that followed will not be repeated. Everyone knows the results. With the Pandora's Box of Bitcoin forked coins such as BCH Being opened, everything becomes irrecoverable.

The controversy between "Bitcoin development" and "corporate organizations"

Blockstream has disclosed financing information three times before, namely a $21 million seed round in November 2014, a $55 million Series A round in February 2016, and the announcement of Digital Garage (DG Lab Fund) in November 2017 ) made an undisclosed strategic investment in Blockstream.

At the same time, it should be clear that Bitcoin Core is an open source project, which is responsible for maintaining and publishing the Bitcoin client software "Bitcoin Core" (including full node verification and Bitcoin wallet) and some related software maintenance and other work.

And a considerable number of the core developers and contributors participating in the Bitcoin Core project are Blockstream employees and are funded by Blockstream Their development work has simultaneously created Blockstream’s dual paradox controversy about “Bitcoin development” and “corporate organization”:

On the one hand, Blockstream The company has gradually gathered a group of the best developers in the Bitcoin community to contribute to the development and maintenance of daily Bitcoin code;

On the other hand, This group of developers is different from the original Bitcoin core developers in the form of direct participation in open source projects - they are directly employed by Blockstream and are salaried company employees;

In addition, Blockstream’s financing and business development itself revolve around Bitcoin products such as second-layer networks, which has begun to make some community members question the independence of Bitcoin core developers. The community’s concerns about this also surfaced:

Core members represented by Blockstream have lost their independence and impartiality in development, threatening to destroy the entire Bitcoin The bottom layer of the currency is in danger of becoming a vassal of the second-layer network. Some people even bluntly said, "Blockstream controls the Bitcoin code."

Daily exchanges with the Ethereum community

" It is impossible to build a truly decentralized financial system based on Ethereum. It can only be achieved through Bitcoin, Lightning Network and Liquid." Blockstream can be regarded as the most influential "KOL organization" in the Bitcoin community, whether it is CEO Adam Back or COO Miao Yongquan, etc., all enjoy criticizing the Ethereum community on a daily basis.

Adam Back once said that Ethereum is similar to a Ponzi scheme when replying to other people's messages, while Buterin believes that Ethereum is rising and the trend of history is not the same. Would be good for (Bitcoin) maximalists.

In the subsequent heated debate between Miao Quanquan and Vitalik, he even raised questions about "mutual harm" between Ethereum and Liquid. "No one will do anything in Ethereum." Build any secure (such as financial) system on the Forex platform. If you want Token, you can issue it on the Liquid network and you can thank me later."

To a certain extent, behind Blockstream is the entire Bitcoin arena - the battle for Bitcoin expansion, the Lightning Network and side chain solutions, and Ethereum The disputes over alternative currency routes, etc., continue to make things more chaotic.

Edmund

Edmund

Edmund

Edmund JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Sanya

Sanya Davin

Davin decrypt

decrypt Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph