Author: Terry, Plain Language Blockchain

Who is the liquidity cornerstone and innovation hotbed of the on-chain crypto market?

Most people would probably say it is DeFi. Yes, as the cornerstone of the on-chain liquidity market, it not only provides a low-friction transaction and real native income environment for existing funds, but also becomes the main channel for introducing incremental funds such as RWA and underlying high-quality assets. For the entire crypto market, it is an indispensable positive factor.

However, since 2023, in the face of the successive hype of other concepts, DeFi as an overall narrative has gradually declined, especially in the context of the market plunge, it often leads the decline sharply, so fewer and fewer people mention it, becoming a forgotten narrative in the rotation of the crypto world.

However, it is worth noting that three years have passed, and the DeFi narrative has begun to show some new changes worthy of attention. Whether it is the new actions of old giants such as Aave and Compound, or the development of emerging DeFi ecosystems such as Solana, there are some quite interesting variables.

01 The DeFi narrative that has never recovered

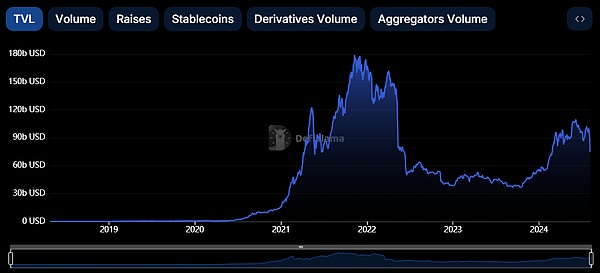

Although the "DeFi Summer" in 2020 occupies a very deep memory in the experience of crypto players, if we look back strictly from the perspective of the timeline, we will find that the prosperity of the entire DeFi market only lasted about a year and a half, and the performance of data such as TVL is the most intuitive.

According to DefiLlama data,In November 2021, the overall DeFi lock-up volume in the crypto market reached a historical high of about US$180 billion, and then fluctuated/declined all the way, and experienced the Terra/Luna, Three Arrows Capital, and FTX/Alameda crises in 2022, and liquidity was continuously drained, and finally hit a stage low in October 2023.

As of the time of writing, the total TVL of the entire DeFi track has fallen back to about US$85 billion (as of August 13), which is only 47% of the historical high at the end of 2021,and this huge gap is not only reflected in the numbers, but also in the ecological development of DeFi projects and user confidence.

For example, many DeFi projects that once attracted much attention have had to scale down their business due to the withdrawal of funds and the lack of market confidence. Some projects have even stopped operating directly:

On September 20, 2023, the DeFi yield aggregator Gro Protocol announced the cessation of operations and the dissolution of Gro DAO;

On September 21, 2023, the cross-chain DeFi lending aggregator Fuji Finance announced the closure of the protocol and the cessation of operations;

On December 15, 2023, the DeFi protocol SafeMoon formally filed for bankruptcy under Chapter VII of the U.S. Bankruptcy Code;

On January 30, 2024, the fixed-rate lending protocol Yield Protocol reminded users to close their positions in the protocol, and official support would end on January 31;

On July 20, 2024, the decentralized derivatives trading platform Rollup.Finance announced that it would cease operations and its infrastructure would be After September 21, 2024, the system will be completely shut down, and users will have one month to close their positions and withdraw funds.

It should be noted that the above are only relatively well-known DeFi protocols that have been reported in the newspapers. In fact, according to incomplete statistics, the number of projects that have chosen to stop operating in the crypto industry has accelerated sharply since the second half of 2023, and the entire track has even experienced a "shutdown wave". Many projects seemed to fall into trouble overnight and could not continue to maintain normal operations.

For the DeFi protocols that are still persisting, the token price performance in the secondary market is also very sluggish. The irony is that even in the same period, the trend of Bitcoin and even Ethereum, which have always been regarded as "Beta" returns, is much better than the overall performance of DeFi Token, which was once regarded as "Alpha":

If we use November 2021 (BTC: $68,999) as an important reference point for analysis, we can clearly see that the current price of Bitcoin is about $60,000, which is about 86% of the high at that time; the price of Ethereum is about $2,670, which is about 55% of the high at that time (ETH: 4,800).

But the performance of the DeFi field can almost be described as horrible, almost suffering an ankle chop-according to Binance's DeFi contract index data, the current price is about 630, which is only less than 20% of the high point in November 2021 (3,400)!

Although such a comparison may not be rigorous enough, it also indirectly proves a fact that cannot be ignored:As the entire market continues to recover and even BTC hits a new high, the DeFi field has failed to keep up with the overall pace of the market, nor has it been able to further attract capital inflows. Investors' enthusiasm for the DeFi field has obviously cooled down, and they are no longer as keen to participate in and invest in DeFi projects as in the past.

This also sounded the alarm for the future development of the DeFi field.

02 Self-rescue and expansion of OG DeFi

However, from the perspective of the DeFi track, there are some quite interesting variables happening recently, especially the actions of the top blue-chip projects such as Aave and Comound.

1) MakerDAO: RWA and stablecoins work together

MKR is, to some extent, one of the most resilient old DeFi projects. Maker and MakerDAO have also been seeking continuous evolution."Maker Endgame" is one of the boldest moves taken by the DeFi protocol, especially in the field of RWA.

As of August 2024, according to Makerburn data, the total assets of MakerDAO's RWA portfolio have reached approximately US$2.1 billion.

Source: Makerburn.com

Source: Makerburn.com

The total supply of DAI has also re-reached the $5 billion mark since November last year. In addition, in May, MakerDAO also proposed plans to launch stablecoins and governance tokens with new token symbols to replace DAI and MKR.

Among them, NewStable (NST) will be an upgraded version of DAI, still focusing on maintaining a stable peg to the US dollar, with RWA as a reserve asset. Dai holders can choose whether to upgrade to NST.

PureDai aims to achieve an idealized DAI - using highly decentralized oracles, only accepting extremely decentralized and well-verified collateral (such as ETH, STETH), and PureDai will launch a borrowing platform to maximize the supply of PureDai.

2) Aave: Update the security module and repurchase tokens

On July 25, ACI, the governance representative of the Aave official team, initiated a proposal for Aave's new economic model, proposing to launch a "purchase and distribution" plan to purchase AAVE assets in the secondary market from protocol revenues and enrich the ecosystem reserves to reward major users of the ecosystem.

At the same time, the Atokens security module is activated through a new security module, the GHO borrowing rate discount is canceled, and the Anti-GHO generation and destruction mechanism is introduced, thereby enhancing the consistency of interests between AAVE pledgers and GHO borrowers. In addition, it is also recommended to upgrade the current AAVE security module to a new "pledge module".

To put it bluntly, because Aave's security module has repeatedly encountered problems in bad debt processing efficiency, such as the 2.7 million CRV bad debts generated in the previous CRV hunting war, it will lead to the temporary issuance of AAVE Tokens for auction to cover the debt deficit.

Therefore, the biggest change in the new security module is to upgrade to a "staking module", which blocks the hole for additional issuance from the supply side; at the same time, because the protocol income will be used to purchase AAVE assets from the secondary market and allocate them to the ecosystem reserve, this has also found a long-term demand side for AAVE in the secondary market, and the two-pronged approach has increased the appreciation potential of AAVE from both the supply and demand dimensions.

3) Compound: Whales seize control, blessing or curse is hard to tell

On July 29, Compound went through a fierce voting contest, and finally passed Proposal No. 289 with a subtle advantage of 682,191 votes to 633,636 votes, deciding to allocate 5% of the Compound protocol reserve funds (499,000 COMP Tokens worth approximately $24 million) to the "Golden Boys" yield protocol to generate income over the next year.

At first glance, this seems to be a pretty good decision, after all, it is equivalent to giving COMP, which was originally a pure governance token, a new income attribute. However, when we delve deeper into the "Golden Boys", we will find the clues - the leader behind it is the whale Humpy who once successfully controlled Balancer through similar governance attacks.

I won’t go into detail about Humpy’s previous success story, but in essence, this time Humpy once again hoarded a large number of tokens, and then used his voting rights to deposit $24 million directly from the Compound vault into the goldCOMP vault under his control. From a process point of view, this may be a legal operation, but it is undeniable that this behavior has caused unquestionable damage to decentralized governance.

However, Compound also released a proposal yesterday, proposing the concept of "Proposal Guardian", which aims to prevent malicious voting through a multi-signature mechanism-the guardian will initially consist of 4/8 multi-signatures of Compound DAO community members, who can veto proposals that have passed a majority vote and are awaiting execution when the protocol faces governance risks.

In addition, Uniswap and Curve are relatively slow in action. Curve recently encountered a large-scale token liquidation crisis of its founder again, and the $140 million CRV barrier lake, which has always been like a sword of Damocles hanging over its head, was finally detonated in this crisis, causing great shock and anxiety in the market.

03 Summary

In fact, the prosperity of most DeFi projects in 2020 and the difficulties they encountered in 2021 were doomed from the beginning-rich liquidity incentives are unsustainable. For this reason, the new product directions or token empowerment attempts of the current DeFi blue chips are a microcosm of self-salvation starting from different channels.

It is worth noting that although the recent market shock has led to large-scale liquidations in the DeFi field - the Ethereum DeFi protocol set a record for liquidations on August 5, with a liquidation amount of more than 350 million US dollars, but there was no panic stampede, which also indirectly shows that DeFi's own stress resistance is constantly increasing, and the overall trend is a coexistence of adjustment and exploration.

In any case, as the liquidity cornerstone and innovation hotbed of the crypto market, after the bubble is cleared, those valuable DeFi projects that have not died and continue to innovate are expected to stand out, re-attract the attention of funds and users, breed a new narrative, and usher in their own breakthrough.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Ledgerinsights

Ledgerinsights Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph