Written by: WOO

Background: BTC 73,000 US dollars may be the bottom support price of this round

Bitcoin broke out of the consolidation range of half a year on November 6, breaking through 73,000 US dollars. The reason behind it is closely related to Trump's victory and the start of the interest rate cut cycle.

Trump won the election: Before the election, he promised to publish a number of crypto-friendly political views, including making the United States the global capital of cryptocurrency and firing the current SEC chairman. Although it is uncertain whether he can fulfill his promises after taking office, it is foreseeable that the crypto market has often faced regulatory pressure in the past. This situation will be alleviated after Trump takes office, which is undoubtedly the main factor driving the market upward.

The interest rate cut cycle is open: The interest rate cut means that the United States releases more liquidity to the risk market, which will theoretically drive up the stock market, other countries' fiat currencies and other asset classes, and Bitcoin, which has the highest risk and relatively small market value, can also benefit from this. In November, the interest rate was cut by one code. In terms of traditional finance, the market reacted positively, the S&P closed at a new high, and the bond market rose. The transmission of liquidity often takes time, and 2024 Q4 is leaving the crypto market with the opportunity to take on spillover liquidity.

From the policy side to the capital release, we are currently in the "early bull" period. Since the previous high point of Bitcoin is the bottom of the new round, we can boldly assume that Bitcoin's $73,000 is the support price of this round of bull market.

The support has been confirmed, so how much can the price of Bitcoin reach in this round of bull market? WOO X Research will take you to find out.

BTC and other mainstream asset market value analogy: 110,000 to 220,000 US dollars

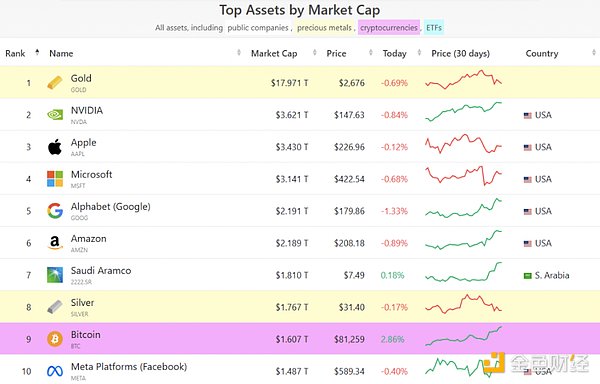

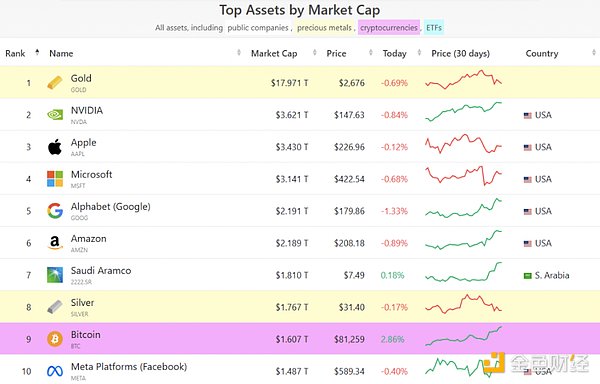

The current market value of Bitcoin is 1.6 trillion US dollars. It surpassed Meta last month and ranked after silver, becoming the ninth largest asset in the world. Since the Bitcoin spot ETF was approved in January this year, Bitcoin is no longer regarded as a niche asset, but has become a mainstream asset. With the help of Trump's election, Bitcoin has become more visible to the public, and its growth potential can be compared with other mainstream assets.

As we all know, Bitcoin is also known as digital gold. The current market value of Bitcoin is about 9% of gold. The following simulates several scenarios to estimate the possible future price of Bitcoin:

If the market value of Bitcoin reaches 25% of gold, which is 4.5 trillion US dollars, the price will reach 227,162 US dollars

If the market value of Bitcoin is the same as NVDIA, the price will reach 183,645 US dollars

If the market value of Bitcoin squeezes out Google and ranks fifth, the price will reach 111,730 US dollars

In terms of market value, Bitcoin is expected to squeeze into the top five assets in the world in this bull market, and the expected top price range is 110,000 to 220,000 US dollars.

Bitcoin escape top indicator: the top is at least 200,000 US dollars

This indicator uses two kinds of data to make judgments:

The usage is:

When the Bitcoin price is lower than the two-year moving average (green line), it is a good time to buy Bitcoin

When the price exceeds five times the two-year moving average (red line), this is a signal to sell Bitcoin

How to interpret this indicator? It means whether the short-term price breaks through/falls below the average price of long-term holders. The low point benchmark is the average price in the past two years. If it is below the green line, it means that it has fallen below the low point in the past two years, which is excessive panic. This is a good long-term buying point.

The red line is five times the average price in the past two years. Once it breaks through, it means that the market is too FOMO, which is often an overheating signal and suitable for selling.

Reviewing the past price performance of Bitcoin, it roughly conforms to this rule. According to the information in the figure below, the price of Bitcoin was about US$75,000 on 11/6, and the price of the red line was US$207,977. In addition, the price of Bitcoin has continued to hit new highs recently, and the price of the red line will also rise. This indicator shows that the peak price of this round is at least $200,000.

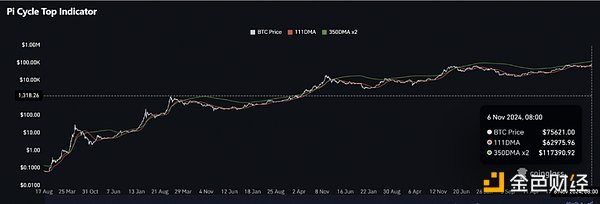

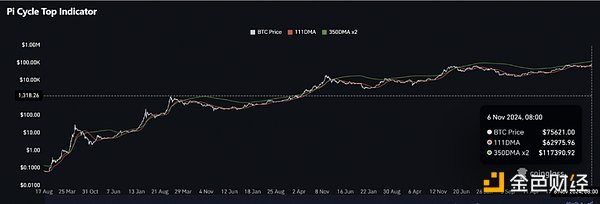

Pi Cycle Top Indicator: Top at least $110,000

This indicator uses two sets of data to determine whether Bitcoin is overheated:

111-day moving average (111DMA, red line)

Two times the 350-day moving average (350DMA x 2, green line)

The method of use is:

When the 111-day moving average is upward and breaks through 350 When the 111DMA (red line) breaks through the 350DMA x 2 (green line), it usually means that the market is overly optimistic and FOMO (fear of missing out) occurs, which is often an overheating signal and suitable for considering selling.

According to the latest chart information, on November 6, 2024, the price of Bitcoin was about $75,621, while the price of 350DMA x 2 was about $117,390. This means that when the price of Bitcoin approaches or exceeds this price, it may be a top signal of this round of market.

Miyuki

Miyuki