Author: Lao Li Mortar

Macro interpretation: The strong performance of the US dollar in early 2025 is still worthy of attention, because Also related to the U.S. dollar-denominated crypto market, we will explore the sustainability of the U.S. dollar’s strength and its impact on the crypto market, hoping to provide valuable reference for everyone.

The U.S. dollar index has shown a significant upward trend since Trump returned to power. This change is not an isolated phenomenon, but the result of the combined action of multiple factors. First, the market is optimistic about Trump’s economic policy expectations after his return. Trump's tax cuts, deregulation and potential stimulus measures are believed to boost U.S. economic growth, thereby increasing the real value of the dollar. In addition, rising inflation expectations also exacerbated the dollar's strength. Trump's policies, including restricting immigration and raising tariffs, may push inflation to rebound further on both the supply and demand sides, thereby increasing the attractiveness of U.S. dollar assets. At the same time, increased policy uncertainty has also prompted investors to flock to the relatively safe haven of the U.S. dollar.

Can the strength of the US dollar continue to face many challenges? There are potential conflicts between Trump's policy goals, such as the balance between inflation, deficits and the economy. Without improvements in productivity or reductions in government spending, the possible rise in inflation from tariffs and tax cuts would contradict low-interest-rate policies. In addition, Trump’s dollar-first policy is also in conflict with isolationism and shrinking trade deficits. The contradiction between these policies means that they cannot be implemented smoothly at the same time, resulting in a discrepancy between strong expectations and weak reality. Once the policy effect differs greatly from market expectations, the dollar's strong position may be shaken.

In addition to the impact of U.S. domestic economic policies, global economic dynamics also have an important impact on the trend of the U.S. dollar. In particular, the performance of the European economy may become a turning point for a stronger dollar. Since the outbreak of the Russia-Ukraine conflict, the European economy has been continuously impacted by unstable energy supply, rising prices and geopolitical risks. If Trump's return can prompt a pause in the Russia-Ukraine conflict, Europe's pressure on energy supply and prices will be relieved, which will help improve long-term capital expenditure levels and investment expectations in Europe's manufacturing industry. Once the European economy shows signs of recovery, funds may flow out of the United States, further weakening the dollar's strength.

In terms of inflation, the base effect of high inflation in the United States may cause inflation to fall first and then rise. Musk's comments about government layoffs and spending cuts have stoked concerns about fiscal contraction, which could become the first factor in curbing inflation. However, the Trump administration may take tough measures to suppress oil prices, as well as regulate oil prices and curb inflation by relaxing regulations on oil and gas drilling. In addition, if the conflict between Russia and Ukraine eases, Russian oil can re-enter the international market, which may also cause oil prices to fall. These factors will have an important impact on the level of inflation in the United States, which will in turn affect the trend of the US dollar.

Next, we analyze the impact of US dollar trends on the crypto market. As a relatively emerging and highly volatile field, the crypto market is extremely sensitive to changes in the global economic environment. A strong performance by the U.S. dollar could have a dual impact on the crypto market. On the one hand, the strength of the U.S. dollar may attract some investors to withdraw funds from the crypto market and instead seek relatively stable U.S. dollar assets. This will cause cryptocurrency prices to fall and market volatility to increase. On the other hand, the strength of the U.S. dollar may also prompt some investors to seek assets to hedge risks, and cryptocurrencies, as a decentralized safe-haven asset, may benefit to a certain extent. In particular, those cryptocurrencies with stable value and low volatility may become the first choice of investors.

In addition, the dynamics of companies such as MicroStrategy also have an important impact on the encryption market. MicroStrategy has announced plans to raise up to $2 billion through the issuance of preferred stock to strengthen its balance sheet and acquire more Bitcoin. This move shows that despite the many uncertainties facing the crypto market, there are still institutional investors who are optimistic about it. MicroStrategy's Bitcoin investment strategy is regarded as a long-term value investment, and its success will have an important impact on confidence in the crypto market. If MicroStrategy can successfully raise funds and continue to accumulate Bitcoin, this will inject new vitality into the crypto market and drive up the price of mainstream cryptocurrencies such as Bitcoin.

The encryption market still faces many challenges. First, the uncertainty of the regulatory environment is an important factor restricting its development. Different countries and regions have different regulatory attitudes towards cryptocurrencies, which may lead to market differentiation. Secondly, the crypto market is highly volatile, and investors need to have a higher risk tolerance. In addition, issues such as technical security and market manipulation may also have a negative impact on the stability of the crypto market.

In general, the strong performance of the US dollar and the volatility of the crypto market are intertwined, forming an important feature of the current financial market. The trend of the US dollar is affected by multiple factors, including domestic economic policies, global economic dynamics, and inflation levels. The encryption market is restricted by multiple factors such as the trend of the US dollar, regulatory environment, and technical security. In the future, investors need to pay close attention to market dynamics and policy changes to flexibly respond to possible risks and opportunities. At the same time, for the encryption market, strengthening supervision, improving technical security, and enhancing market transparency will be important directions to promote its healthy development.

BTCDataAnalysis:

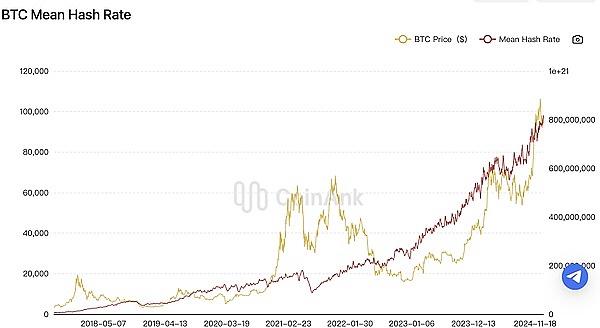

On the 16th anniversary of the birth of Bitcoin, the BTC hash rate (the total computing power of the entire Bitcoin network) reached a record high of 1,000 EH/s, which was almost the network hash rate 12 months ago. twice. Coinank data shows that as of now, the computing power of the entire Bitcoin network is 809.3EH/s.

Data shows that the United States accounts for more than 40% of the Bitcoin network hash rate, among which two mining pools in the United States, Foundry USA and MARA Pool, account for all mining areas More than 38.5% of the block. Foundry USA’s hash rate reportedly grew from 157 EH/s in early 2024 to approximately 280 EH/s in December. Foundry is currently the largest single mining pool by hash rate, controlling approximately 36.5% of the Bitcoin network’s total hash rate.

The Bitcoin hash rate reaches an all-time high, marking a nearly doubling of the Bitcoin network’s total computing power compared to 12 months ago. The growth demonstrates the resilience and expansion of the Bitcoin mining industry. The United States dominates the Bitcoin network hash rate at over 40%, with Foundry USA in particular becoming the largest single mining pool, controlling approximately 36.5% of the Bitcoin network’s total hash rate. This increase in concentration may pose a challenge to the decentralized nature of the Bitcoin network, but it also reflects the United States’ leadership in Bitcoin mining. Currently, the Bitcoin hash rate is 809.3 EH/s. This high hash rate level enhances the security of the Bitcoin network, resists potential attacks, and may have a positive impact on Bitcoin’s price stability.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Hui Xin

Hui Xin Joy

Joy Alex

Alex Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Brian

Brian Joy

Joy