Author: Chaos Labs Source: X, @chaos_labs Translation: Shan Ouba, Golden Finance

In traditional finance, money markets provide short-term lending opportunities, usually for highly liquid, low-risk assets, with the goal of providing the highest possible returns under the premise of safety. In decentralized finance (DeFi), this concept has evolved, mainly referring to the permissionless, decentralized lending of various digital assets, and without specific time limits. These platforms allow users to deposit cryptocurrencies into the protocol and earn returns through the interest paid by borrowers, while borrowers need to provide sufficient collateral as collateral.

The money market uses a dynamic interest rate model to automatically adjust the lending rate based on the liquidity utilization in a specific market or pool of funds. These models ensure that capital is deployed efficiently, while incentivizing borrowers to return assets as soon as possible when liquidity is scarce. A key feature of the interest rate curve is the "knee point", which is when utilization reaches a certain threshold and interest rates begin to rise significantly to control leverage in the system: as utilization increases, interest rates may rise gradually, but will surge sharply after exceeding the inflection point, making borrowing costs significantly higher.

It is important to note that money markets are different from unsecured loans: money markets require borrowers to provide collateral to ensure repayment during the loan period; traditional loans are usually unsecured and rely on credit scores or other forms of guarantees to lend.

Why money markets are key DeFi "Lego" blocks

By allowing users to earn yield on idle assets and release liquidity without selling assets, money markets play a vital role in DeFi's capital efficiency. In the industry, the ability to borrow and lend based on specific tokens is a highly demanded feature that often determines whether a crypto asset is considered a "blue chip" asset.

Money markets allow users to leverage their assets at low cost, high net worth individuals to integrate them into tax planning, and also allow teams with rich funds but insufficient liquidity to use their assets as collateral to borrow and lend to fund projects, while also being able to earn interest from collateralized positions (Curve and Maker are typical examples of this model in the past few years).

In addition, money markets are the basis for other DeFi tools, such as collateralized debt positions (CDPs), yield farming strategies (supporting a variety of pseudo-market neutral strategies), and on-chain margin trading.

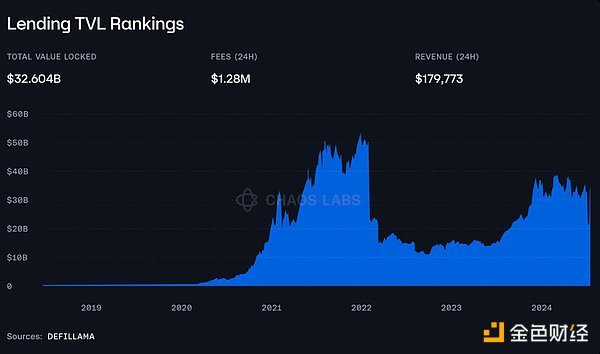

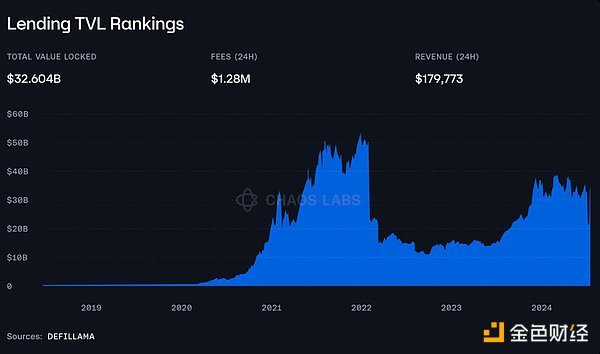

Therefore, money markets are considered one of the most important building blocks in DeFi, namely "financial Lego". In terms of scale, the total locked value (TVL) of lending protocols in the crypto field has exceeded US$32.6 billion, as shown in the figure below.

Design Choices in Crypto Markets: Shared vs. Independent Liquidity Pools

Despite the same basic goals, cryptocurrency markets can have significantly different design choices, especially in terms of liquidity structure. The biggest distinction is between money markets that use a single shared liquidity pool (such as Aave) and markets that implement independent liquidity pools (such as Compound v3). Each model has its pros and cons, influencing factors such as liquidity depth, asset flexibility, and risk management.

Independent Liquidity Pools: Flexibility and Risk Isolation

In the independent liquidity pool model, each market or asset operates in its own liquidity segregation zone. This approach was adopted by Compound v3 and some more extreme platforms such as Rari Capital (although the latter has failed).

The main advantage of independent liquidity pools is their flexibility, and the ability to tailor markets for specific asset classes or user needs. For example, independent pools can support specific asset groups (such as meme coins) or tokens that only contain certain unique risk characteristics or needs. This customization allows independent liquidity systems to meet the needs of specific communities or fields, which may not be able to be achieved within the broader shared liquidity pool framework.

In addition, independent liquidity pools also provide better risk isolation. By partitioning each market, the risks associated with a specific asset are limited to the market in which it is located. If the value of a token drops sharply or fluctuates too much, the potential impact is limited to that market, avoiding the entire protocol.

However, these benefits also come with a price: independent liquidity means fragmentation. For independent markets, the cold start problem needs to be solved repeatedly when each new market is created, because each market can only rely on its own participants and liquidity may not be enough to support significant lending activities.

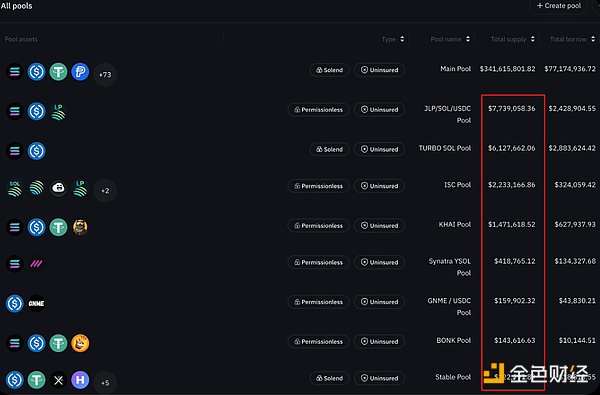

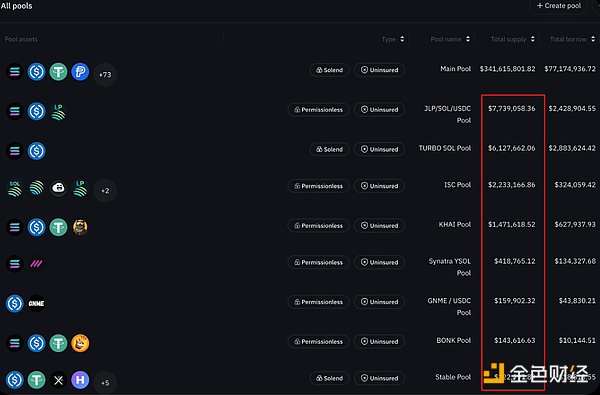

As mentioned earlier, some protocols take the concept of independent lending markets to the extreme, allowing users to create such markets without permission.

In these cases, such as Rari or Solendprotocol, users can create their own permissionless markets, decide on their own asset whitelists, risk parameters (such as loan-to-value ratios LTV and collateralization ratios CR), and manage the corresponding incentive mechanisms.

Shared Liquidity Pools: Deep Liquidity from Day One

On the other hand, a single shared liquidity pool provides ample liquidity support from day one. By combining all assets into a unified pool, the shared liquidity system is able to support large-scale lending activities, even for newly added assets, with fewer liquidity constraints.

For users who provide liquidity, shared pools are also beneficial: a larger liquidity base attracts more borrowers, resulting in higher and more stable returns because these returns are supported by diverse lending demand.

This is the main advantage of the shared liquidity model, and although it only has one core advantage, its importance cannot be underestimated. In all markets, liquidity is of paramount importance, especially in the cryptocurrency space.

However, the main disadvantage of shared liquidity pools is systemic risk. Since all assets are connected to the same liquidity pool, a problem with one asset (such as a sudden depreciation) can trigger a chain reaction of liquidations, which can affect the entire system, especially when bad debts are generated.

Therefore, these pools are less suitable or even completely inappropriate for niche or experimental assets compared to highly liquid, established tokens.

Finally, the governance and risk monitoring of shared liquidity systems are generally more complex, as the impact of any protocol changes can be very significant.

The trend towards hybrid models?

The tradeoffs between independent and shared liquidity pools are significant, and no single approach is perfect. This is why, as the market matures, money markets are increasingly moving toward hybrid models (or at least introducing hybrid features), balancing the liquidity benefits of shared pools with the customization and risk isolation capabilities of independent markets.

Aave’s approach is a perfect example of this trend, having introduced carefully designed independent markets through partnerships with platforms such as LidoFinance and Ether_Fi. The Aave system typically operates with a single shared liquidity pool, providing deep liquidity for major assets. However, Aave recognizes that supporting assets with different risk profiles or use cases requires greater flexibility, and has created markets for specific tokens or partnered projects.

Another key feature that fits this trend is Aave’s eMode, which is designed to handle highly correlated assets to optimize capital efficiency. eMode allows users to unlock higher leverage and borrowing power for assets that are closely priced (and therefore have significantly lower liquidation risk), significantly improving capital efficiency by isolating specific positions.

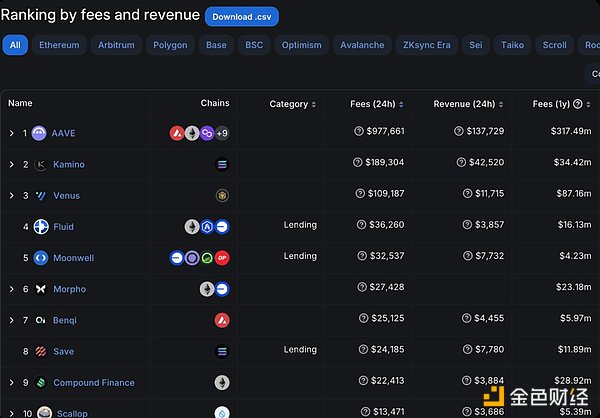

Similarly, protocols like BenqiFinance and VenusProtocol, while traditionally in the shared liquidity category, have also introduced independent pools to meet the needs of specific sub-sectors. For example, these independent markets can focus on niche areas such as GameFi, real world assets (RWAs), or "ecosystem tokens" without affecting the operation of the main pool.

Meanwhile, money markets in independent markets (such as Compound or Solend) typically have a "main pool" that serves as a shared liquidity pool. In the case of Compound, it recently began adding more assets to its most liquid pool, effectively moving closer to a hybrid model.

Business Model of Money Markets

The core business model of cryptocurrency markets revolves around generating revenue through a variety of mechanisms related to lending and collateralized debt positions (CDPs).

1. Interest Rate Differential

• Mechanism: The main source of revenue for money markets is the difference between lending and borrowing rates.

• Process: Users deposit assets into the protocol to earn interest, while borrowers pay interest to obtain liquidity. The protocol profits from the difference between the interest rate charged to borrowers and the interest rate paid to depositors.

• Example: On Aave v3 Ethereum, the current deposit rate for $ETH is 1.99%, while the borrowing rate is 2.67%, resulting in an interest rate difference of 0.68%. Although the difference is small, this income will gradually accumulate as the number of users increases.

2. Liquidation Fees

• Mechanism: When a borrower's collateral falls below the required threshold due to market volatility, the protocol initiates a liquidation process to maintain the solvency of the system. The liquidator obtains part of the borrower's collateral at a discounted price in exchange for paying off part of their debt.

• Revenue Sources: Typically, the protocol will receive a portion of the fees from the liquidation reward. Sometimes, the protocol will also run its own liquidation bot to ensure timely liquidation and obtain additional income.

3. CDP-related fees

• Charging method: The protocol may charge fees for its CDP products, which may be one-time charges, accumulated over time, or a combination of both.

4. Flash loan fees

• Mechanism: Most protocols allow users to perform flash loans and charge a small but very significant fee.

• Function: A flash loan is a loan that must be repaid in the same transaction, allowing users to instantly obtain the capital they need to perform certain operations (such as liquidation).

5. Treasury Revenue

• Operation: Protocols often use their treasury funds to find safe sources of yield, further increasing revenue.

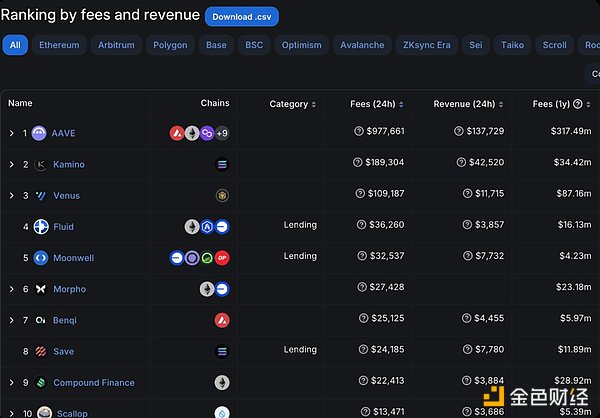

These mechanisms make the lending market one of the most profitable protocols in the crypto space.

These fees are sometimes shared with governance tokens, recovered in the form of incentives or used simply to cover operating expenses.

Risks <> Money Markets

As stated, the business of operating a cryptocurrency money market can be one of the most profitable businesses, but it is also undoubtedly one of the riskiest.

The first obstacle facing new money markets is the cold start problem. This refers to the difficulty of bootstrapping liquidity in a new protocol or market. Early users are reluctant to deposit funds into pools that have not yet reached critical mass due to concerns about low liquidity, reduced lending opportunities, and potential security vulnerabilities. Without sufficient initial deposits, interest rates may be too low to attract lenders, while borrowers may find that they cannot obtain the loan they seek, or face overly volatile interest rates due to changes in liquidity. Protocols often address the cold start problem through liquidity mining incentives, where users are rewarded with native tokens for providing liquidity or borrowing liquidity (the incentives of one party are indirectly reflected on the other, especially when loops are available). However, reliance on such incentives can generate unsustainable emissions if not carefully managed, which is a trade-off that protocols need to consider when designing their launch strategies.

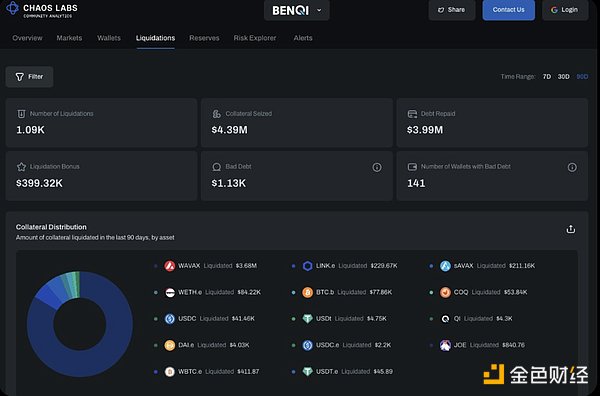

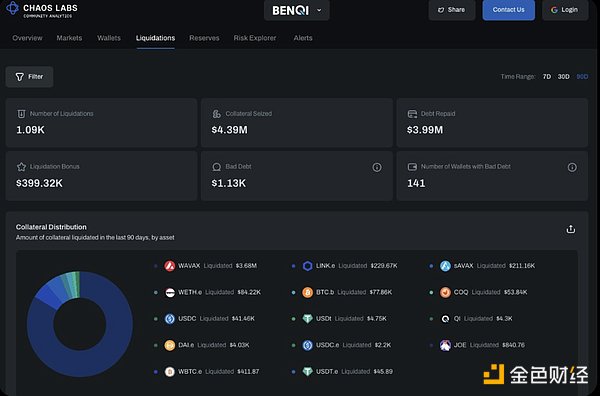

Timely liquidations are another key factor in maintaining the solvency of the protocol. When the value of a borrower's collateral falls below a certain threshold, the protocol must liquidate the position to prevent further losses. This poses two major problems: First, the success of this process depends heavily on the presence of liquidators, either run by the protocol or managed by a third party, who monitor the protocol and execute liquidations quickly.

To achieve these goals, they need to be adequately incentivized through liquidation bonuses, which need to be balanced with the protocol's revenue. Second, the liquidation procedure must be triggered when it is still safe to liquidate the position from an economic point of view: if the value of the seized collateral is too close or the same as the outstanding debt being liquidated, the risk of the position sliding into bad debt territory is higher. In this regard, defining safe and up-to-date risk parameters (LTV, CR, establishing a liquidation buffer between these parameters and the liquidation threshold) and applying a rigorous selection process to whitelist assets available on the platform play a fundamental role.

In addition, to ensure that the protocol runs smoothly, liquidations occur in a timely manner, and that users do not abuse functionality, money markets rely heavily on functional oracles, providing real-time valuations of collateral and indirectly providing the health and liquidity of loan positions.

Oracle manipulation is an important issue of concern, especially for low-liquidity assets or protocols that rely on single-source oracles, where attackers can distort prices to trigger liquidations or borrow at the wrong level of collateral. This has happened many times in the past, most notably Eisenberg's Mango Markets vulnerability. Latency and latency are also critical; during market volatility or network congestion, delayed price updates can lead to inaccurate collateral valuations, causing liquidation delays or pricing errors and resulting in bad debts. To compensate for this, protocols often use a multi-oracle strategy, aggregating data from multiple sources to improve accuracy or setting up backup oracles in case the primary source goes down, and use time-weighted price feeds to filter out sudden changes in asset values due to manipulation or outliers.

Finally, we have security risks: money markets are the primary victim of vulnerabilities after bridges.

The code that handles money markets is extremely complex, and only a few protocols can boast a perfect course, while we have seen many protocols, especially forks of complex lending products, develop multiple vulnerabilities when the original code is edited or mishandled. Protocols mitigate these risks through measures such as bug bounties, regular code audits, and approving changes to the protocol through complex processes. However, no security measure is foolproof, and the possibility of vulnerability exploits remains a constant risk factor that teams need to be careful of.

How are losses handled?

When a protocol suffers a loss, whether it is due to bad debts caused by failed liquidations, or due to unexpected events such as hacks, there is usually a standard clause to allocate the loss. Aave's approach can once again serve as an example. Aave's security module acts as a reserve mechanism to cover potential protocol shortfalls. Users can stake AAVE tokens in the Security Module and earn rewards, but if necessary, their staked tokens may be slashed by up to 30% to cover the deficit. This acts as an insurance layer and has recently been further strengthened with the introduction of stkGHO. These mechanisms essentially introduce a "higher risk, higher reward" position for users and align their interests with those of the protocol as a whole.

Chaos Labs <> Money Markets

Chaos Labs offers a holistic approach to money market clients: a comprehensive solution to optimize and secure their protocols. The most innovative is the Edge Risk Oracles invented by Chaos Labs, which automatically optimizes the protocol's parameter update process, thereby closing the User Experience (UX) and capital efficiency gap between decentralized and centralized financial platforms. With the launch of Edge, Chaos has expanded into the field of oracle provision, leveraging the team's expertise in risk monitoring to provide precise and secure price data feeds and perform real-time anomaly detection to ensure accuracy and reliability. Chaos Labs also conducts mechanism design reviews, asset onboarding management, and parameter recommendations for new and existing assets, ensuring that suitable assets are integrated only after a thorough risk assessment, and providing security optimization of variables such as loan-to-value ratios; Chaos' unique approach is to conduct real-time risk monitoring through detailed dashboards, and design liquidity incentive plans to drive sustainable growth and user participation, solving cold start problems and market competition.

Weatherly

Weatherly