Emphasis

① Historically, block rewards are halved This will lead to significant fluctuations in the price of Bitcoin in the year before and after. In the previous three times, the price of Bitcoin has increased significantly. Following a similar pace, Bitcoin will most likely exceed $100,000 by the end of 2024.

② The latest crypto bull market began in 2022/23, and Bitcoin broke through all-time highs a few days ago, but this is obviously not the end. Benefiting from better regulatory clarity, more mature traditional investment products, and the influx of more traditional funds, Bitcoin is becoming an ideal asset class for capital to pursue in the current global inflationary environment.

③ Since the Bitcoin spot ETF was approved, IBIT and others have risen by nearly 40% in 2 months. In this bull market, the leading companies representing the three directions of crypto trading, Bitcoin asset management and Bitcoin mining - Coinbase, MicroStrategy, and Marathon Digital will perform better than Bitcoin itself, and they will bring greater flexibility, Better risk-to-benefit ratio and higher return levels.

The encryption industry has gone through multiple cycles.

Bitcoin experienced a brief surge in 2013, but it really entered the mainstream in 2017. At that time, the term "digital gold" had just gained attention, as macro conditions gradually matured and emerging crypto assets began to flourish.

Since then, the advent of ETH, the emergence of DeFi protocols, the launch of liquidity mining, and the popularity of GameFi and NFT have created several waves of small climaxes. Innovative assets and use cases, coupled with an inflationary external environment, have pushed the crypto market to new heights several times in succession.

Each small cycle brings more attention, users, and capital to the crypto ecosystem, and builds on the progress made previously. Expanded cryptographic possibilities.

The most recent crypto bull run began in 2022/23. A few days ago, the price of Bitcoin announced that it had exceeded its all-time high, but this is obviously not the end. Benefiting from better regulatory clarity and more mature traditional investment products, as well as the influx of more traditional funds, Bitcoin is becoming an ideal asset class for many capitals to chase (or at least start to be willing to allocate more) in the current global inflationary environment.

This article is based on a review and analysis of data from the crypto bull market over the past year, and explores the halving that may follow the market. If you believe Bitcoin prices will continue to reach new highs in 2024, which stocks will benefit the most? How do they perform compared to Bitcoin, and what are their fundamentals and investment logic?

The chart below shows the price of Bitcoin, Bitcoin ETF (represented by BlackRock IBIT), Coinbase, The rise and fall of the five targets of MSTR and Mara (as of the close on March 4):

RockFlow investment research team believes that this bull market represents three directions: encryption trading, Bitcoin asset management and Bitcoin mining. The leading companies - Coinbase, MicroStrategy, Marathon Digital - will perform better than Bitcoin itself, and they will bring greater resilience, better risk-to-benefit ratios, and higher return levels.

The RockFlow team has previously written about the investment potential of three companies, as well as an in-depth analysis of Coinbase. Click on the corresponding article title to read:

Which US stock companies are expected to be winners in the encryption boom?

Coinbase: Exchange, Broker, Crypto Bank or a Faith?

1. The beginning of the crypto bull market in 2023

In 2023, there are 3 major catalysts for Bitcoin.

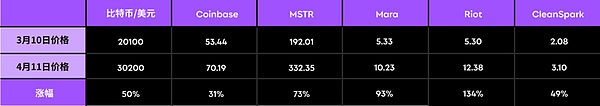

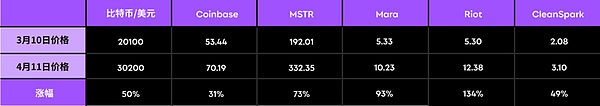

The first catalyst was the banking crisis triggered by the collapse of Silicon Valley Bank on March 10, which raised concerns about Bitcoin as an alternative to traditional finance. interest. On that day, the price of Bitcoin exceeded $20,100. And a month later, on April 11, Bitcoin was trading at $30,200, up 50% since the crisis began.

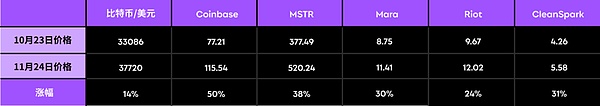

For comparison, crypto-concept stocks such as Coinbase, MSTR, Mara, Riot and CleanSpark rose 31%, 73%, 93%, 134% and 49% respectively. As shown in the following table:

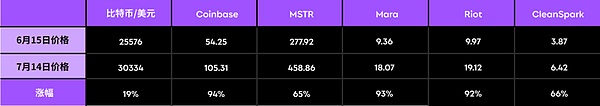

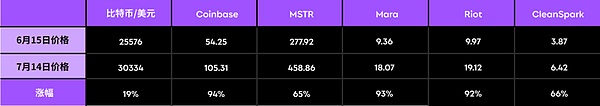

The second catalyst, and the largest Bitcoin catalyst in 2023, is BlackRock's submission of a Bitcoin spot ETF application to the US SEC on June 15, 2023. The news quickly swept the market and was recognized as an olive branch from the traditional financial industry. Spurred by this, the price of Bitcoin rose 19% from $25,500 on June 15 to $30,300 on July 14.

During this period, the stock prices of Coinbase, MSTR, Mara, Riot and CleanSpark increased by 94%, 65%, 93%, 92% and 66%:

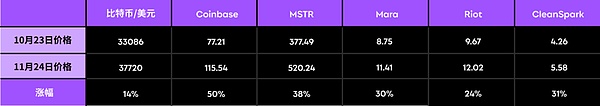

The third catalyst was the appearance of the BlackRock ETF ticker on the DTCC website on October 23, 2023, which sparked speculation that the ETF was expected to be approved. As a result, the price of Bitcoin quickly rose 14% from $33,000 on October 23 to $37,700 on November 24. Meanwhile, shares of Coinbase, MSTR, Mara, Riot and CleanSpark rose 50%, 38%, 30%, 24% and 31% respectively:

The succession of three key events has finally allowed the encryption market to gradually sweep away Clear away the cold winter and haze brought about by the FTX incident. As the price of Bitcoin rises, the crypto bull market has officially arrived.

2. Learning from history, the possible halving market in 2024

< p style="text-align: left;">The approval of the Bitcoin spot ETF is an important time point, but it is obviously not the end. (If you want to know more details about Bitcoin spot ETF, you can click to read: Bitcoin spot ETF is here, one article analyzes the strength of 11 issuing companies and the biggest beneficiaries | RockFlow exclusive) On April 19, 2024, the encryption market will usher in Another big event - Bitcoin's fourth halving, the block reward is expected to drop from 6.25 Bitcoins to 3.125 Bitcoins.

Historically speaking, block reward halving will cause significant fluctuations in Bitcoin prices in the year before and after:

The first Bitcoin halving This occurred on November 28, 2012, when the price of Bitcoin was $12. One year before the halving, Bitcoin was trading at $3, meaning Bitcoin was up 300% during that time. This strong upward trend continues a year after the halving. On November 28, 2013, the Bitcoin price was $1,016, which means that Bitcoin is up 8,367% since the halving and up since the year before the halving. 33767%.

The same trend can be seen in the second halving that took place on July 9, 2016. On that day, Bitcoin was trading at $647, compared to $268 on July 9, 2015, meaning Bitcoin was up 141% during the halving period. Bitcoin price has continued to rise since the halving, reaching $2,491 on July 9, 2017, one year after the halving.

A similar upward trend was still verified in the third halving that occurred on May 11, 2020. At that time, the price of Bitcoin was $8,563, which was higher than 1 It rose 18% from $7,232 a year ago. Bitcoin price has since continued to climb in 2021, reaching over $56,000 on May 11, 2021, up 561% since the halving.

Will this trend continue with the upcoming fourth Bitcoin halving? Probably. On April 19, 2023, the price of Bitcoin was about $29,000, and in early March 2024, it had exceeded $66,000, an increase of more than 127%. According to the previous pace, Bitcoin will most likely exceed $100,000 by the end of 2024.

3. Three US stock targets that surpass the performance of BTC

Currently, the value of assets managed by Bitcoin-based investment products (futures and spot ETFs, etc.) globally has exceeded 1 million Bitcoins (approximately US$64 billion). This highlights the growing interest in crypto portfolios from traditional financial markets.

According to data from K33 Research, more than 83% of 1 million Bitcoins are held by US spot and futures ETFs, followed by investments in Europe and Canada product. As of the close of trading on March 4, they held a combined 1,008,436 Bitcoins, accounting for 5.13% of the circulating supply of Bitcoin.

Take IBIT, a subsidiary of BlackRock, as an example. Its asset management scale has exceeded US$10 billion in just 7 weeks since its launch, and Fidelity’s FBTC fund assets have also exceeded 115,000 Bitcoins (worth $7.5 billion). Comparing traditional ETFs, you can understand their rapid expansion: among the current 3,400 ETFs, only about 150 have assets under management exceeding US$10 billion, and the vast majority of them have been launched for more than 10 years.

These investment tools have greatly shaken the original market structure of Bitcoin. A few years ago, spot exchanges held 20% of the circulating supply of Bitcoin; now, that number has dropped to 11%, and ETFs/ETPs and various other Bitcoin-based derivatives are expanding rapidly.

Different from previous Bitcoins being stored on exchanges as leveraged collateral, this time the entry of traditional asset management products has significantly lowered the threshold for Bitcoin investment (original pension (Gold cannot buy Bitcoin spot, now you can buy ETF)), the purchased Bitcoin will be stored in the hands of the custodian and cannot be pledged or loaned to market makers, so it is difficult to generate liquidity overflow.

If you believe that Bitcoin will have a bull run in 2024, which stocks will benefit the most? How do they perform compared to Bitcoin, and what are their fundamentals and investment logic? Next, the RockFlow investment research team will analyze in detail the investment prospects of leading companies in the three directions of encryption trading, Bitcoin asset management and Bitcoin mining - Coinbase, MSTR, and Mara.

It should also be pointed out that holding crypto stocks Another advantage of non-Bitcoin is that investors face lower risks. Holding Bitcoin directly comes with risks such as hacking, fraud, crypto wallet and exchange malfunctions. A prime example is FTX’s collapse in late 2022, which resulted in customers losing $8.9 billion in crypto assets.

1) Coinbase

Not long ago on February 15 On the same day, Coinbase announced a 2023Q4 financial report that was far better than expected, and its stock price soared nearly 30% in the following weeks. The quarterly report reassured investors that Coinbase's fundamentals are improving thanks to a broad recovery in the crypto market. Driven by the U.S. SEC’s approval of a Bitcoin spot ETF, the rise in Bitcoin prices has strengthened investors’ confidence in the crypto market. Coinbase has become the best bet on the booming crypto economy.

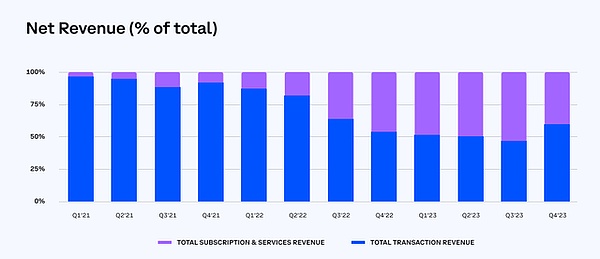

In fact, the expectation that the US SEC will make a positive decision on Bitcoin ETF has already led to a general rise in cryptocurrencies in the fourth quarter of 2023, which also reflects On Coinbase’s surge in trading revenue. Attracted by rising cryptocurrency prices, institutions and retail investors have jumped on the bandwagon, causing Coinbase trading revenue to surge 64% year-over-year in 2023Q4. Institutional trading revenue increased 160% sequentially, while retail client trading revenue increased 79% sequentially.

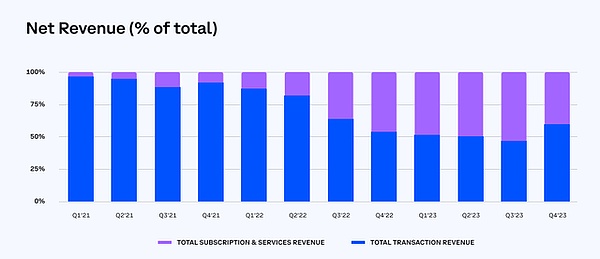

In addition, Coinbase has become more diversified in its revenue since 2022 and worked to reduce its reliance on unpredictable trading revenue. Coinbase's subscription and services revenue has grown significantly (up 78% year-over-year) to reach $1.4 billion in fiscal 2023. These services include blockchain rewards, custody services, interest income from customer loans, and fees from stablecoin issuers.

48% of net revenue will come from non-transaction-related services in fiscal 2023, compared with just 25% in fiscal 2022. This diversification will help reduce the volatility of Coinbase's future revenue and will also lead to a more stable earnings profile.

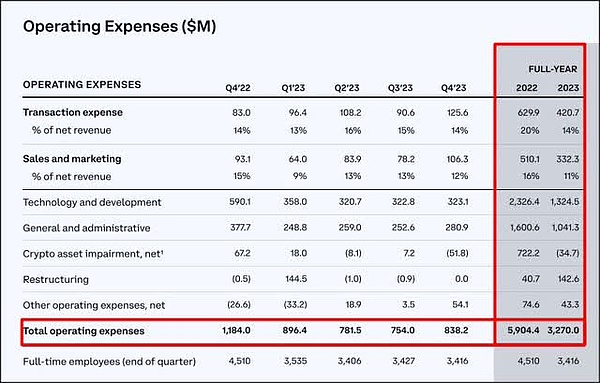

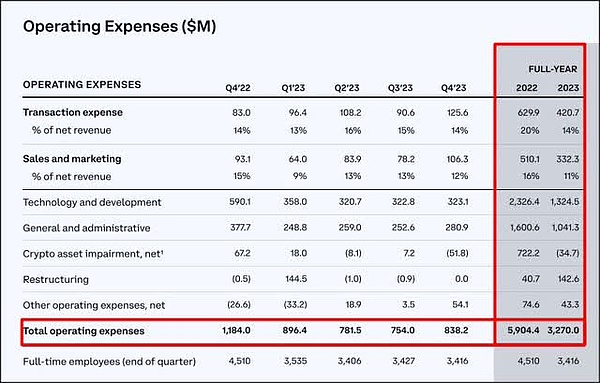

On the other hand, Coinbase's drastic cuts in operating expenses are starting to bear fruit. During the last crypto bear market, Coinbase laid off large numbers of employees and slashed costs. Coinbase today is a much leaner company, with operating expenses already down 45% year-over-year in fiscal 2023.

Currently, Coinbase is already a crypto trading platform with stable profits. The U.S. SEC’s approval of a Bitcoin spot ETF directly stimulated the trading demand for Bitcoin, made a huge contribution to boosting investor sentiment, and further legitimized the entire crypto economy.

However, it should be pointed out that Coinbase is not completely risk-free, and investors need to pay attention to regulatory trends, cyclical fluctuations in the encryption market, and the bankruptcy risks of other trading platforms. The bankruptcy of FTX in 2022 had a very negative impact on investors, and a similar event could again severely damage bullish sentiment in the crypto market.

2) MicroStrategy

MicroStrategy (MSTR) was originally A BI (Business Intelligence) and analytics software service provider. Of course, they are still in the business and have recently branched out into AI. But what is its real value? Nearly 200,000 Bitcoins held.

MSTR chooses to "fix" Bitcoin and hold it for the long term. This is one of the best ways to build a portfolio of volatile assets such as Bitcoin. And this approach is paying huge dividends in the current crypto bull market.

MSTR's move to buy Bitcoin began in August 2020, about three months after the third Bitcoin halving. About a year after the first purchase, MSTR’s Bitcoin holdings jumped to 92,000 coins. The company currently holds 193,000 coins, worth over $13 billion at current prices, with an unrealized profit of $6 billion.

Also because it continues to issue debt to buy Bitcoin, MSTR stock prices and Bitcoin prices have shown a strong correlation since 2020. Historical data shows that MSTR stock price can also effectively amplify Bitcoin price fluctuations. On average, MSTR’s volatility levels are 1.5 times higher than Bitcoin’s price.

Therefore, if you are optimistic about the future performance of Bitcoin, you can consider using MSTR to obtain excess returns beyond the increase in Bitcoin.

However, it should also be pointed out that given that there is still a certain risk of volatility in the price of Bitcoin, MSTR's stock price will also be subject to greater fluctuations. Unexpected global events, including geopolitical tensions or macroeconomic shocks, can impact crypto markets and, in turn, MSTR.

3) Marathon Digital

Due to macroeconomic conditions With Bitcoin prices improving and Bitcoin prices continuing to soar, Bitcoin mining stocks have posted significant returns over the past few months. The RockFlow investment research team believes that Marathon Digital (Mara) is the best target among all Bitcoin mining stocks because its computing power and Bitcoin reserves dwarf its competitors. Mara provides investors with a more resilient trading opportunity, and given that Bitcoin is likely to continue hitting new highs after its halving this year, Mara is also worth looking at.

As a leading Bitcoin mining company, Mara's strategy is to mine and hold Bitcoin as a long-term investment after paying operating costs. Mara currently mines Bitcoin through joint ventures in the United States, as well as in Abu Dhabi and Paraguay. While some of its mines were previously placed in third-party escrow, it is moving away from that model, which has helped it reduce mining costs and improve operational efficiency.

As mentioned above, halving events often have an extremely positive impact on the price of Bitcoin, but the impact on Bitcoin mining stocks is not the same.

Since the block reward will be cut in half, this basically means that their mining costs have doubled. As such, mining stocks are heavily reliant on post-halving Bitcoin price increases to make up for losses from expected production declines. It is also for this reason that mining stock companies with insufficient capital reserves may be unable to survive, while leading companies are more likely to be winner-take-all.

Why are you optimistic about Mara as a mining stock winner? Here’s why:

Mara’s first advantage is its Bitcoin reserves. Currently, Mara has the largest Bitcoin reserves among mining companies, holding 15,741 Bitcoins. By comparison, top rivals Riot and CleanSpark hold 7,648 and 3,573 respectively. In other words, Mara will benefit the most from rising Bitcoin prices.

Mara’s second advantage over its peers is its computing power. The current deployment computing power of Mara is 26.7 EH/s, which is higher than that of Riot and CleanSpark (the latter two’s computing power in January was 12.4 and 10.09 EH/s respectively). Mara expects computing power to grow to 34.7 EH/s by the end of this year; Riot expects computing power to grow to 28.8 EH/s in the fourth quarter; CleanSpark expects computing power to reach 20 EH/s in the first half of the year, having recently completed its Sandersville expansion. 16 EH/s or more. With higher levels of computing power, Mara is more capable of continuing to produce more Bitcoins after the halving.

Mara's third advantage is its cash position. According to January data, Mara has a cash balance of $319 million, surpassing Riot's $290 million and CleanSpark's $173 million. More ammunition clearly supports Mara to explore more growth opportunities, including increasing the acquisition of Bitcoin mining machines that may not survive after the halving, purchasing more mining machines, or purchasing new facilities.

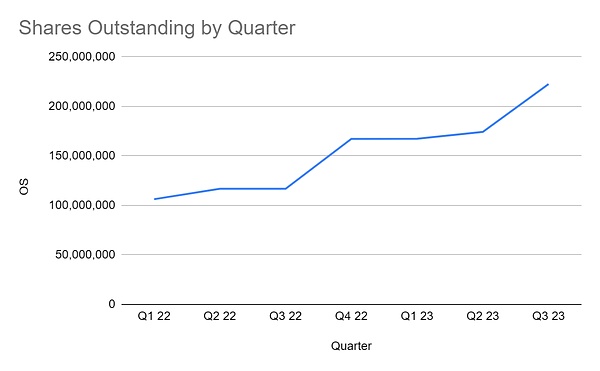

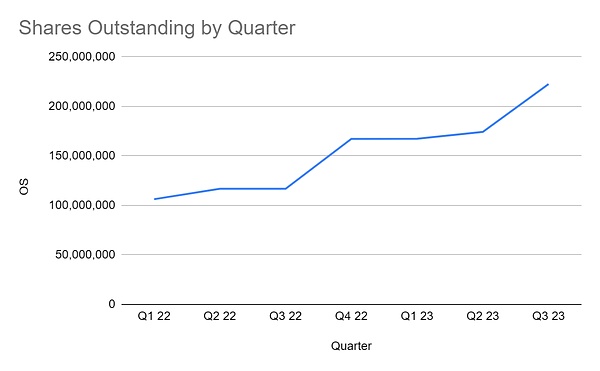

However, Mara itself also has certain risks. The first is the continued issuance of shares, with its outstanding shares increasing from 106.3 million shares in 2022Q1 to 222.6 million shares in 2023Q3, an increase of nearly 110%. This is a negative factor for its share price.

The more significant risk comes from Bitcoin itself. The rise in Mara's stock price is predicated on Bitcoin's continued appreciation. If Bitcoin prices don’t rise dramatically after the halving or fall due to other unforeseen events, Mara will be in trouble.

4. Conclusion

Bitcoin and Bitcoin ETF prices have risen 40% in less than 2 months since dozens of Bitcoin ETFs were approved. In view of the upcoming halving event in April and the historical volatility of the event that has pushed up the price of Bitcoin, the RockFlow investment research team believes that the price of Bitcoin will continue to rise this year.

Coinbase, MSTR and Mara, as very high-quality targets in their respective fields, are excellent alternatives to Bitcoin in this round of market conditions. They will provide investors with Bringing greater resilience, better risk-to-benefit ratio and higher levels of returns.

JinseFinance

JinseFinance