Editor's Note:

In 2025, the U.S. Securities and Exchange Commission (SEC) is reviewing 72 cryptocurrency ETF applications, covering Solana, XRP, Litecoin, Dogecoin, and even the newly popular MeMe top stream Trump and Pudgy Penguins. These applications come from top institutions such as Grayscale, Bitwise, and Franklin Templeton, showing unprecedented institutional enthusiasm.

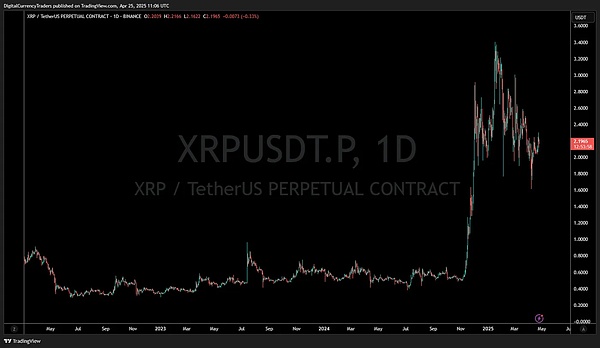

XRP leads with 10 applications, followed by Solana, heralding a potential capital flood. Once approved, these ETFs may reshape the market and open the door to crypto investment for investors without complicated operations.

Here are more details about these alt-Token ETFs:

Do you feel like you may have missed the next wave of the cryptocurrency market?While Bitcoin and Ethereum ETFs have received much attention, another more important story is quietly brewing.

Looking back to the early days of Bitcoin and Ethereum, those who discovered their potential early on were rewarded hugely.

ETF Begins Trading on January 11, 2024

Now, imagine a similar opportunity emerging that has yet to gain mainstream attention.

The "truth" that hasn't been reported on the evening news is this:

In addition to the major players, there are currently more than a dozen other cryptocurrencies with pending ETF applications at the SEC.

These include a diverse range of digital assets from Memes and Layer-1 giants to NFT-related tokens—names you might not have expected.

As of April 2025, the U.S. Securities and Exchange Commission (SEC) is reviewing 72 cryptocurrency-related exchange-traded fund (ETF) applications, covering a variety of digital assets. These applications include major cryptocurrencies such as Solana (SOL), XRP (Ripple), Litecoin (LTC) and Dogecoin (DOGE), as well as emerging tokens such as Sui (SUI), Hedera (HBAR), Avalanche (AVAX), and even theme assets such as Trump Meme and Pudgy Penguins Token (PENGU).

Well-known asset management companies involved in these applications include Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, CoinShares and Franklin Templeton. Notably, XRP leads with over 10 separate ETF applications, while Solana has 5, reflecting strong institutional interest in these assets.

Bloomberg ETF analyst James Seyffart has compiled a detailed list of pending ETF applications, and relevant information can be found in multiple industry reports.

The point is, once these applications are approved, they could bring huge capital inflows.

As we have seen with the Bitcoin and Ethereum ETFs, regulatory approval can open the floodgates for both institutional and retail investment. Those who get in early could reap significant returns.

While you may be bombarded with cryptocurrency news, this particular development remains under the radar for most people.

Don't let FOMO (fear of missing out) on the big names make you ignore other potential profit opportunities.

This is an opportunity to get in before the market gets widespread attention.

Therefore, it is critical to pay attention to these developments now. The list of cryptocurrencies with pending ETF applications represents an area full of potential.

By preparing for these potential approvals, you can get a head start on the expected rush. Here’s a partial list of applications that have been submitted — including some names that might surprise you…

1. Solana (SOL)

Solana follows Ethereum, with VanEck, 21Shares, Bitwise, Grayscale, Canary Capital and even Franklin Templeton all filing applications. This high-performance Layer-1 has attracted institutional attention for its scalability and active ecosystem. A SOL ETF could open the door to mass adoption. 2. XRP (Ripple) Despite regulatory setbacks, XRP has not backed down. Bitwise, Grayscale, WisdomTree, 21Shares, Franklin Templeton, CoinShares, ProShares, Teucrium and Volatility Shares have all submitted ETF applications. This is a significant institutional attention for a token that has gone through hardships.

3. Litecoin (LTC)

Litecoin is often overshadowed by Bitcoin, but it has quietly won respect as a reliable digital asset. Canary Capital, Grayscale and CoinShares have all submitted ETF applications related to LTC. This old cryptocurrency is ushering in new regulatory attention.

4. Dogecoin (DOGE)

Yes, this meme is going mainstream. Bitwise, Grayscale, and Rex Shares have filed applications, and Dogecoin may soon be in the same regulated asset class as Bitcoin. The token that started as a joke may eventually make it into your retirement portfolio.

5. Avalanche (AVAX)

VanEck is optimistic about Avalanche's subnet and scalability and has submitted an ETF proposal. Although it is still in its early stages, AVAX's modular chain design has attracted institutional interest.

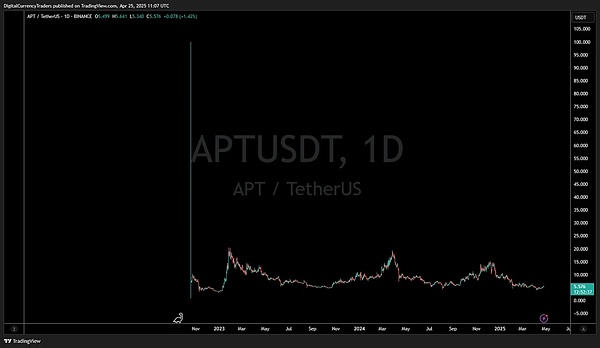

6. Aptos (APT)

This is a more speculative project, but Bitwise has officially submitted an application. Aptos is a Layer-1 derived from the Meta Diem project, with unique advantages, and institutional players are paying attention.

7. Sui (SUI)

Canary Capital submitted an application for SUI, another Diem sister protocol that focuses on Move programming and fast parallel execution. Although still in its early stages, its entry into the ETF application list is impressive. 8. Hedera (HBAR) Hedera continues to gain momentum with its corporate partnerships and unique hashgraph consensus mechanism. Canary Capital filed an ETF application based on HBAR, adding credibility to its long-term vision.

9. Trump Meme (TRUMP)

Submitted by Rex Shares, this is more of a political meme than a monetary asset. But it has officially entered the SEC list. Whether it is satire or serious depends on the market reaction-in any case, it is already in the process.

10. BONK

Rex Shares submitted BONK along with other applications, a Solana-based Meme that continues to grow in grassroots popularity. Seeing it appear in ETF form could mark the beginning of regulated Meme trading.

11. Pudgy Penguins (PENGU)

Attention, NFT enthusiasts! Canary Capital has submitted an ETF application related to PENGU (Pudgy Penguins). This may be one of the first NFT-related tokens to enter ETF consideration.

What does this mean for you? ETFs offer traditional investors exposure to cryptocurrencies without the hassle of dealing with wallets and private keys. If even a few of these applications are approved, it could trigger a massive influx of funds into the underlying assets. The window of opportunity to get in before the ETFs go live may be narrower than most people expect.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Brian

Brian Brian

Brian Hui Xin

Hui Xin Brian

Brian Hui Xin

Hui Xin Joy

Joy Joy

Joy Joy

Joy