Author: Climber, Jinse Finance

On June 24, the crypto market fell again, with BTC falling below $63,000 and SOL falling to around $125. Although the top currencies have not yet fallen to the level of April this year, the decline of many blue-chip altcoins has already caught up with the initial bull market last year. Many investors said that their earnings for more than half a year have been lost in the past few weeks, and they may have to "wear a yellow robe" again.

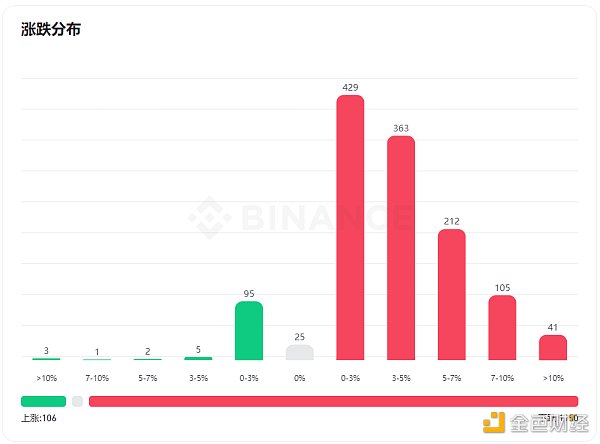

As of the time of writing, the number of spot currencies on the Binance platform alone has fallen to 1,150, while the number of rising is only 106, accounting for less than 10%.

It is normal for the crypto market to surge and plummet, but in the past, the conventional operation was that BTC rose and the altcoins took advantage of it, but now, as long as BTC fell slightly, the altcoins would be beaten wildly. Recently, the altcoins have been falling continuously, and there are many negative factors behind it.

1. Bitcoin spot ETFs have a large outflow and a decrease in inflows

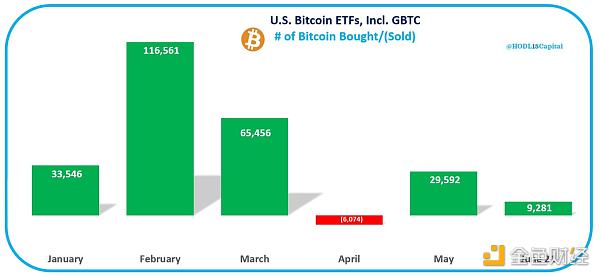

On June 23, according to HODL15Capital monitoring, the US Bitcoin spot ETF sold 7,690 BTC in the past week (week 24).

On June 21, the US Bitcoin spot ETF had outflows for five consecutive days, and the total outflow in the past week exceeded US$900 million. Grayscale GBTC and Fidelity FBTC are the largest buyers, and only BlackRock IBIT is buying.

As shown in the above figure, there was a significant inflow of Bitcoin in January, February and March, corresponding to the gratifying rise in the crypto market. In April, there was no negative inflow, and the currency circle fell sharply during the same period. Although there was an inflow in May and June, the flow dropped sharply and the inflow trend slowed down significantly.

Similarly, the 10x Research report pointed out that there was a large outflow of Bitcoin spot ETF (an average of $660 million outflow in 5 days), because the overall net outflow of various fields (stablecoins, futures leverage, ETFs, etc.) was $2.4 billion, which was the third week of net flow decline since the launch of the ETF in January 2024.

2. Massive token unlocking and selling pressure

According to Token Unlocks data, starting from June 24, the mainstream crypto projects on the entire network will unlock a total of $188 million worth of tokens in the next 7 days.

Previously, from June 10 to 16, tokens worth $363.79 million were unlocked, and a week after May 26, tokens such as OP, DYDX, and SUI will usher in a one-time large-scale unlocking, with a total release value of about $380 million.

And 10x Research said in its market analysis report that the sharp drop in the price of altcoins was due to the market's difficulty in digesting the huge token unlocking of a series of projects, totaling $483 million, including Aptos (US$97 million), IMX (US$51 million), STRK (US$75 million), etc.

Early investors and venture capital institutions seem to be under pressure to cash out, causing the overall market to fall and dragging down the price of Bitcoin.

In addition, Bitcoin miners have begun selling their Bitcoin inventory. Since June, Bitcoin miners have sold more than 30,000 BTC (about $2 billion), the fastest pace in more than a year, mainly due to the tightening of miners' profit margins caused by halving.

3. Investors actively sell and FUD sentiment spreads

On June 23, Bank of America reported that investors withdrew $300 million from the gold market, $400 million from the cryptocurrency market, and $15.8 billion from cash last week.

On June 19, the German government wallet sold about 6,500 BTC. The crypto wallet has held nearly 50,000 BTC since February 2024. These funds were seized from the pirated movie website operator Movie2k and currently still hold 43,359 BTC, worth $2.83 billion.

At the same time, Santiment data indicated that during Bitcoin's sideways trading at the $65,000 mark, "persistent FUD" circulated widely on social media platform X, mainly due to traders' constant bearishness. In addition, its weighted sentiment index (an indicator that measures the amount of Bitcoin mentions on X and compares the proportion of positive and negative comments) has been negative since May 23.

4. Macro level: unclear regulation, policy pressure

On June 21, the U.S. SEC's judge in the Kraken case hinted at rejecting the motion to dismiss. The judge hinted that the exchange's motion would be rejected, pointing out that crypto assets may be sold as securities on its platform. On the same day, a California judge ruled that the case of Ripple CEO suspected of securities fraud would continue to be heard, and dismissed four other class action claims.

On June 20, the U.S. Commodity Futures Trading Commission (CFTC) began investigating the cryptocurrency business of Chicago-based trading company Jump Crypto, including its trading and investment activities.

In addition, the crypto market is also facing the potential impact of the US presidential election. Although there have been reports that Biden may "soften" his attitude towards cryptocurrencies, his rival Trump has clearly stated that he is crypto-friendly, so it is not ruled out that Biden will increase the risk of suppressing the crypto market during the campaign.

5. Binance's new coins perform poorly

Recently, the community has questioned Binance's listing and the poor performance of new coins after listing. At the same time, it also questioned that the price of VC coins is too high and the bubble is obvious, which has a negative impact on the long-term development of the entire industry.

According to HC-Capital, among the new tokens listed on Binance in 2024, the tokens that have fallen by more than 80% from their historical highs are: $AEVO, $PORTAL, $STRK, $SAGA, $DYM; the tokens that have fallen by more than 70% are: $AXL, $MANTA, $OMNI, $PYTH, $PIXEL, $TNSR, $ALT; the tokens that have fallen by more than 60% are: $AI, $BOME, $WIF, $XAI, $JUP, $METIS, $REZ, $ETHFI; Tokens with a drop of more than 50% are: $TAO, $ENA, $BB.

In addition, on June 20, Binance appealed against a $4.4 million fine imposed by Canada, and the verdict is pending. The fine was imposed for failure to comply with anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

Recently, Binance executives were detained and held by the Nigerian government, and the Nigerian High Court also dismissed the detention lawsuit of Binance executives.

6. Reduced income levels for project parties and miners

On June 24, the media reported that Ethereum network Gas fell to its lowest level since 2020, and Bitcoin miners' income hit an all-time low.

Recently, Ethereum network Gas fell to its lowest level since 2020. Gas prices have caused Ethereum's consumption rate to drop to its lowest level in 12 months. According to data from ultrasound.money, Ethereum is currently experiencing slight inflation due to its low consumption rate, with a seven-day average supply growth rate of 0.56%/year.

In addition, after the current round of Bitcoin block reward halving, the income earned by Bitcoin miners in TH/s (7-day MA) has hit a record low in the past two months. In addition to the halving, another possible reason for the decline in miners' income is the small number of new wallets entering the Bitcoin ecosystem, which is currently at its lowest level since 2018 (7-day MA).

Summary

The recent continuous plunge in the crypto market has caused investors to doubt this round of bull market, believing that it has encountered a false bull market. However, many blue-chip altcoins are gradually falling to the initial level of the bull market in October and November last year, and some have even fallen to a deep bear position.

There are many internal and external factors behind the decline in the market, and the investment method of carving a boat to seek a sword seems to no longer be applicable to the new stage of the currency circle. Every time this happens, Buffett's famous saying is confirmed: It is true that companies with high moats are worth investing in, but don't forget that there are ferocious crocodiles, pirates and sharks guarding them.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance Nell

Nell Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist