Written by: Glendon, Techub News

Since Bitcoin fell below the $90,000 mark on February 25, the cryptocurrency market has plummeted across the board, and the market has been like sitting on a slide, going down all the way. In the early hours of today, Bitcoin once fell to around $82,200, hitting a new low since November 12, 2024; Ethereum also fell to around $2,100, erasing all gains since August 2024.

According to Coinglass data, as of writing, the total amount of liquidation in the past 24 hours exceeded $772 million, of which Bitcoin and Ethereum accounted for 60% and 17% respectively, and a large number of altcoin long positions were also collectively liquidated in these two days.

As market sentiment continues to be in a state of "extreme panic", despite the large decline in Bitcoin and Ethereum, there is still no sign of stopping the decline. So the question is, what caused this round of plunge in the cryptocurrency market?

Based on a variety of factors and analysis, the author believes that this market plunge may be a "panic stampede" phenomenon under the resonance of multiple negative factors.

Macroeconomic factors of policy

At the macro level, we can combine the uncertainty impact of Trump's recent policies, the bubble in the US stock market, and the failure of the Fed's interest rate cut expectations.

First, although Trump has publicly expressed his support for Bitcoin as a "strategic reserve asset", he has not actively promoted the formulation of relevant cryptocurrency policies since taking office. But in fact, long before Trump took office, the market had been pushed to the top by various optimistic expectations of investors. As Trump continues to promote tariff plans (such as imposing tariffs on imported goods from Mexico and Canada), some analysts pointed out that this has aroused people's concerns about the trade war, which has led to a rise in risk aversion, resulting in investors choosing to sell high-risk assets such as Bitcoin. In addition, the review process of state-level Bitcoin-related bills in the United States has also begun to be blocked. At present, more than 30 states in the United States have proposed bills involving strategic Bitcoin reserves and digital asset investments, but some state governments have rejected the relevant proposals. The most influential one is the South Dakota legislature's seemingly postponed but actually killed the "Bill to Allow State Governments to Invest in Bitcoin". During the same period, the strategic Bitcoin reserve bills proposed by Montana and Wyoming were also rejected.

This series of events also exposed the differences between the Trump administration and state-level policies. Investors suddenly found that the passage of the Bitcoin bill did not seem to be as smooth as they imagined. When expectations were dashed again and again, it would undoubtedly weaken the market's confidence in the Trump administration's "Crypto-friendly" commitment to a certain extent.

On the other hand, the US stock bubble and the Fed's interest rate cuts have also had an impact on the cryptocurrency market.

According to China Business News, as of February 26, US stocks have been sold off for four consecutive days, and popular star technology stocks have dived from high positions, with cumulative declines ranging from 10% to 35%. Some analysts pointed out that this selling sentiment for highly valued technology stocks is also gradually spreading to the cryptocurrency field. Investors are worried about the bursting of the US stock bubble and their risk appetite is rapidly reduced, resulting in funds withdrawing from high-volatility assets such as Bitcoin and Ethereum. At the same time, the Federal Reserve has been slow to cut interest rates. In a high-interest environment, the attractiveness of the U.S. dollar as a global reserve currency has been enhanced, which has caused some funds to flow back from risky assets such as cryptocurrencies to U.S. dollar assets.

Cryptocurrency market is plagued by "negative buffs"

The cryptocurrency market has been plagued by internal and external troubles recently, and it is full of "negative buffs".

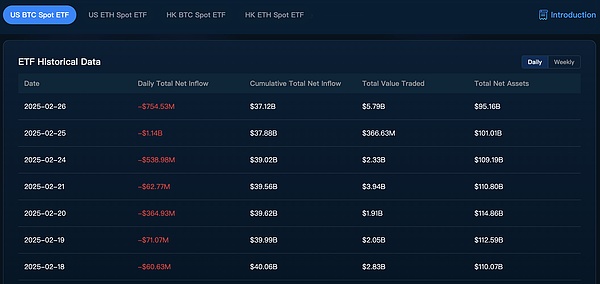

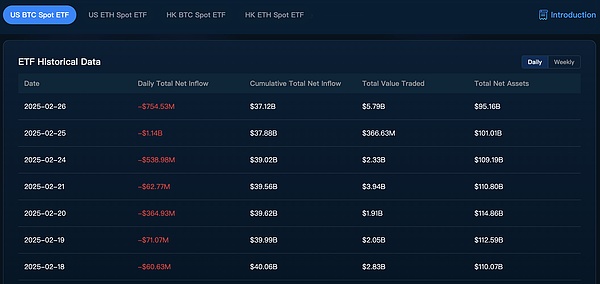

Since February this year, Bitcoin spot ETFs have experienced a serious "bleeding effect". As an important inflow channel for institutional funds, its capital flow data is also one of the key indicators affecting market confidence. However, throughout February, Bitcoin spot ETF funds were almost net outflows, including large net outflows of over US$100 million.

According to iChaingo data, from February 18 to 26, Eastern Time, the US Bitcoin spot ETF experienced a net outflow for seven consecutive days. On February 25, the net outflow was as high as $1.14 billion, setting a record for the largest single-day net outflow since its launch, which inevitably reflects the pessimistic expectations of institutional investors on short-term price trends.

In contrast, although the situation of Ethereum spot ETF is better than Bitcoin, it also experienced a net outflow for five consecutive days from February 20 to 26. However, the negative factors facing Ethereum are not limited to this.

In fact, Ethereum has long been trapped in the expansion dilemma and is difficult to extricate itself, which is also the main reason for its relatively low price in the past two months. Ethereum plans to alleviate the expansion problem through the Pectra upgrade, but the upgrade process is not smooth. According to CoinDesk, the Ethereum Pectra upgrade was activated on the Holesky test network but ultimately failed to be confirmed. As of now, Ethereum officials have not announced the reason why the test network failed to complete.

In addition, Solana, which was once in the limelight with Meme coins, has also suffered multiple blows recently. Under the successive destruction of Trump's Meme coin TRUMP and the Meme coin LIBRA promoted by the Argentine president, the potential value of the Meme coin market has been severely reduced, and a large number of investors have lost interest in Meme coins. There are even many analysts who believe that the Meme coin craze is coming to an end. Because of this, the Meme coin market that Solana relies on has also entered a state of sluggishness.

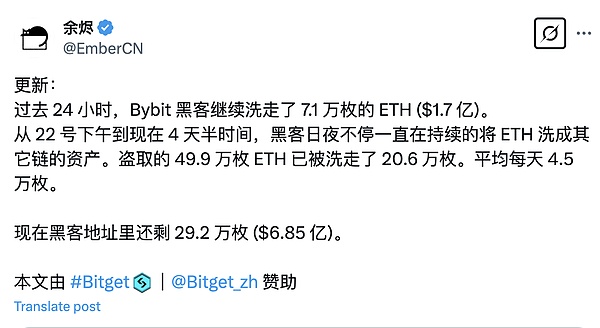

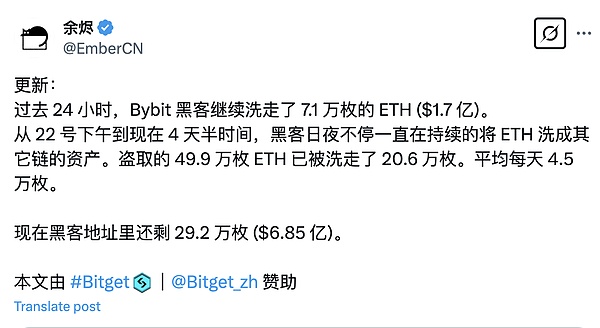

What is even more worrying is that Solana is about to usher in the largest-scale SOL token unlocking "storm". According to Cointelegraph, Solana will unlock more than 11.2 million SOL tokens (worth about $2 billion) on March 1, which will undoubtedly make SOL's market "worse". Crypto analyst Artchick.eth analyzed that "over 15 million SOL (about $2.5 billion) are expected to enter the circulation market in the next three months." Affected by this, SOL once fell to around $130, setting a new low since September 18, 2024. Frequent hacking incidents In the late night of February 21, the cryptocurrency trading platform Bybit was hacked, and more than 400,000 Ethereum and stETH (total asset value of more than $1.5 billion) were stolen, becoming the largest theft in the history of the currency circle. At the same time, it also questioned the security of cryptocurrency and triggered panic selling by a large number of investors. Although Bybit has tried to minimize the negative impact, the huge amount of Ethereum stolen by hackers has undoubtedly become a "mine" that affects the market.

As of writing, according to X user Yu Jin monitoring, in the past 24 hours, the address marked as the Bybit hacker has laundered about 71,000 Ethereum (worth about $170 million). So far, the amount of Ethereum laundered has reached about 206,000, but the hacker address still holds 292,000 Ethereum (worth about $685 million). Previously, Yu Jin had said that hackers expect to be able to convert all the remaining ETH into other assets (such as BTC, DAI, etc.) within half a month.

In addition to Bybit, the stablecoin payment platform Infini was also hacked on February 24, and nearly $50 million in crypto assets were stolen. Although the amount of stolen money is far less than the former, the successive hacking incidents have not only hit investors' confidence, but also caused a direct impact on the market.

To sum up, this round of decline is not only the market's own demand adjustment, but also the market's comprehensive response to the withdrawal of institutional funds, macroeconomic policy and economic impact, hacking incidents and bubble bursting. The author believes that, in essence, the continued rise of cryptocurrencies such as Bitcoin since the end of 2024 has accumulated a lot of profit-taking, but since the beginning of February, the price of Bitcoin has continued to fluctuate in the range of 90,000 to 100,000 US dollars, failing to break through the resistance level, coupled with the lack of major positive support, so even if there is no major negative factor, the selling of these profit-taking will also put great pressure on the market price.

However, although the current market has been hit by multiple factors, it is still too early for us to assert that the "bull market is over".

Yu Jianing, co-chairman of the Blockchain Committee of the China Communications Industry Association, said in an interview with Beijing Business Daily that "the current decline is likely to be a technical adjustment rather than a long-term trend reversal." The author believes that in the short term, we need to be wary of the risk of further bottoming out caused by the sell-off crisis, but in the medium and long term, the market may lay the foundation for a new cycle after clearing. In addition, if the Trump administration proposes cryptocurrency-related policies and the US state strategic Bitcoin bill is passed, it will inevitably bring unpredictable developments to the entire cryptocurrency market.

Weiliang

Weiliang